| I'm Chris Anstey, an economics editor in Boston, and today we're looking at China's enduring commitment to using the dollar. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - Ahead of Federal Reserve Chair Jerome Powell's remarks on Thursday, several US central bank officials fretted over just how far they can cut interest rates.

- China's economy likely gained momentum last month, with early indicators pointing to a rebound after the government began rolling out stimulus measures.

- China and Brazil's increasing economic links are creating unease in Washington.

Just weeks after China's President Xi Jinping signed off on a BRICS communique that included a call for reducing use of the dollar, his finance ministry was marketing sovereign bonds denominated in — wait for it — US dollars. Actions speak louder than words, as the old saying goes. For all the de-dollarization fervor, Beijing is demonstrating that it remains dedicated, or at least resigned, to continuing to use greenbacks in international finance. China's government has no real dollar-funding need itself, so one of the main motivations is to offer benchmarks for Chinese banks and corporations to price their own bonds off of. Dollar-denominated securities are appealing to Chinese borrowers because they can access a broader pool of investors than at home. Some Chinese investors also like dollar investments to park their funds offshore. High rates and a run of defaults cast a shadow over the Chinese dollar debt market for a time, and the government held off on sovereign issuance in 2022 and 2023. In September, when Beijing for the first time in three years sold its first new sovereign bonds in euros — popular lately with Asian corporate issuers — the question was whether dollars would also resume. This year's dollar sale came with a twist: the securities were sold in Saudi Arabia, not Hong Kong as was done in the past. Which also tells a story. First, it demonstrates China's increasing connections with the Middle Eastern oil giant, which is building its own international financial hub in capital city Riyadh.  An under-construction office building in front of the KAFD World Trade Center, left, and the Riyad Bank Tower in the King Abdullah Financial District in Riyadh, Saudi Arabia in January 2023. Photographer: Jeremy Suyker/Bloomberg Fans of de-dollarization have for years awaited a move by oil exporters to shift their pricing of crude to Chinese yuan, at least when it's shipped to China. But dreams of a petro-yuan always ran into a key challenge: what would Saudi Arabia and others do with the Chinese currency? China itself maintains capital controls, which makes it awkward for any investor interested in liquidity. This week's China dollar bond sale suggests a solution: keep on pricing the oil in dollars, and build out an offshore dollar bond market in Riyadh, with China's help. Whatever the longer-term intentions, investors loved the deal: bids were some 20 times the $2 billion of bonds on offer and they were sold for a razor thin margin over similar-maturity Treasuries. - Japanese Prime Minister Shigeru Ishiba's government is planning ¥30,000 ($192) cash handouts to help low-income households cope with higher prices.

- Chancellor Rachel Reeves said the UK will introduce legislation next year to pool £1.3 trillion ($1.7 trillion) of pension savings into a series of "megafunds."

- Here's a look at the Chinese officials who'll be tasked with handling escalating trade tensions and tariffs under a Trump presidency.

- Global oil markets face a surplus of more than 1 million barrels a day next year as Chinese demand continues to falter, the International Energy Agency said.

- France is enlisting the help of external economists to improve fiscal forecasting after errors during the previous government undermined efforts to rein in the deficit.

- Australia's run of hiring gains slowed while the unemployment rate held steady.

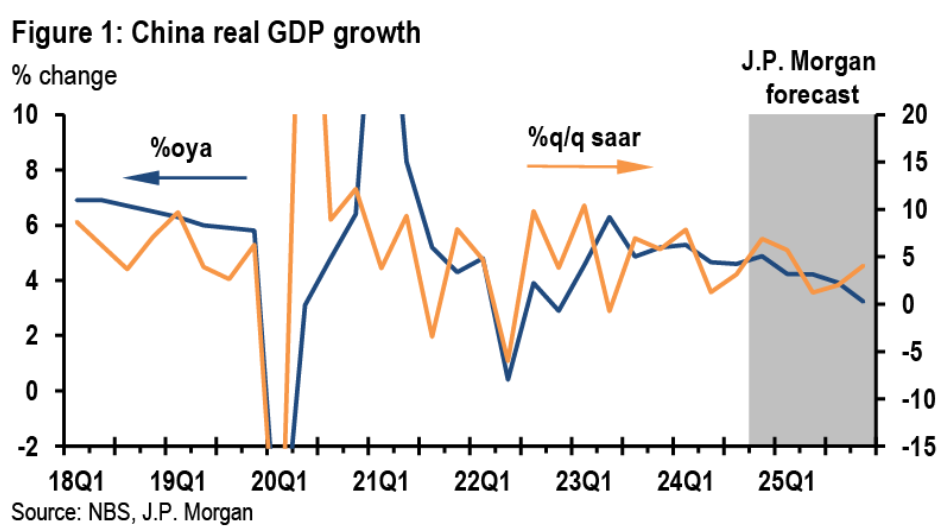

While some observers still see a potential trade US-China deal after Donald Trump takes office, JPMorgan Chase economists are convinced enough about steep tariff increases that they've lowered Chinese economic growth projections. "We now assume a jump of US average effective tariff on China imports from ~20% to 60%," JPMorgan economists led by Haibin Zhu wrote in a note after the US election result. Assuming the new levies become effective in the second quarter of 2025, the team now sees growth next year at 3.9%, against 4.6% previously. US tariff hikes will likely impose a three-part hit to China, with the direct blow to exports just one component. Exports account for about 20% of jobs, so there would be a drag on GDP from domestic incomes, JPMorgan says. Finally, there would be a blow to business confidence. While fiscal and monetary easing will be stepped up, and currency depreciation can help, that all "will still be insufficient to fully offset the negative impact." |

No comments:

Post a Comment