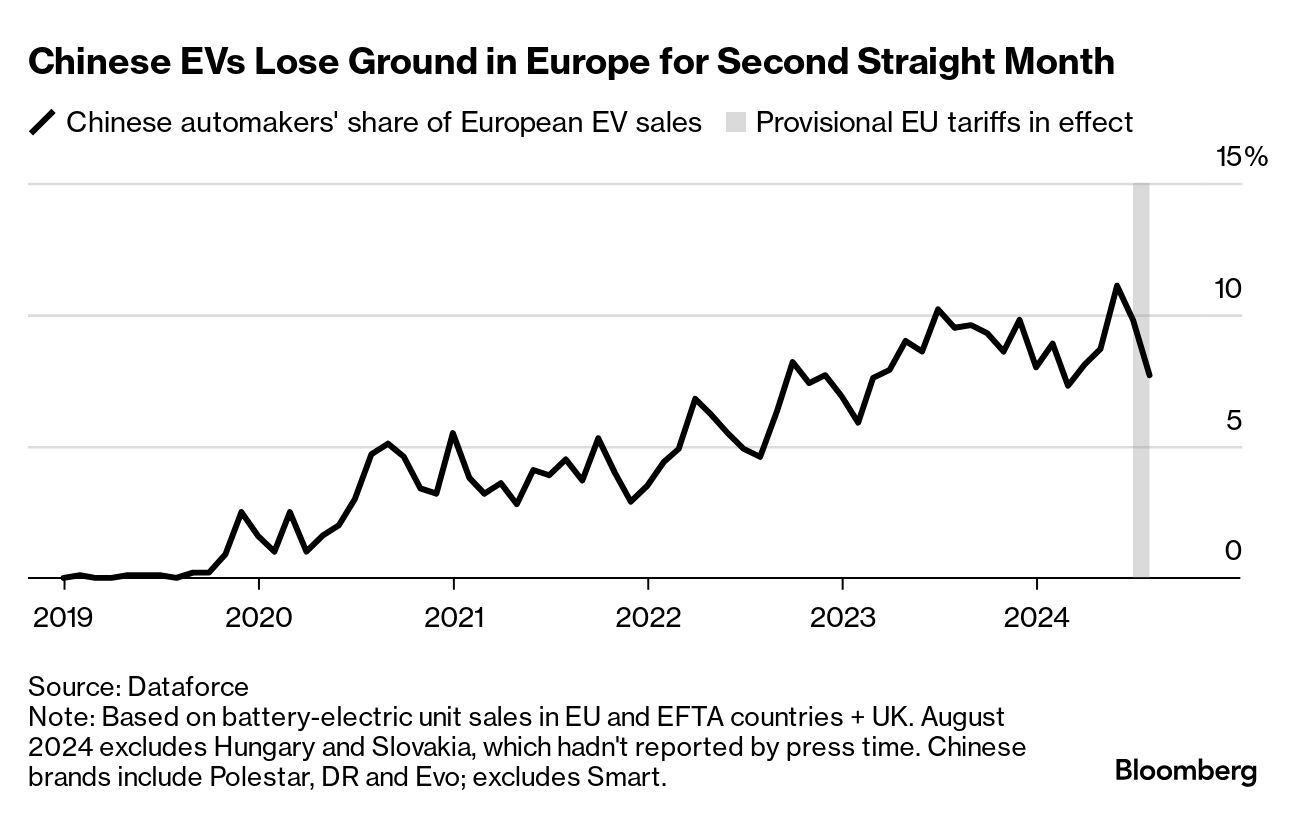

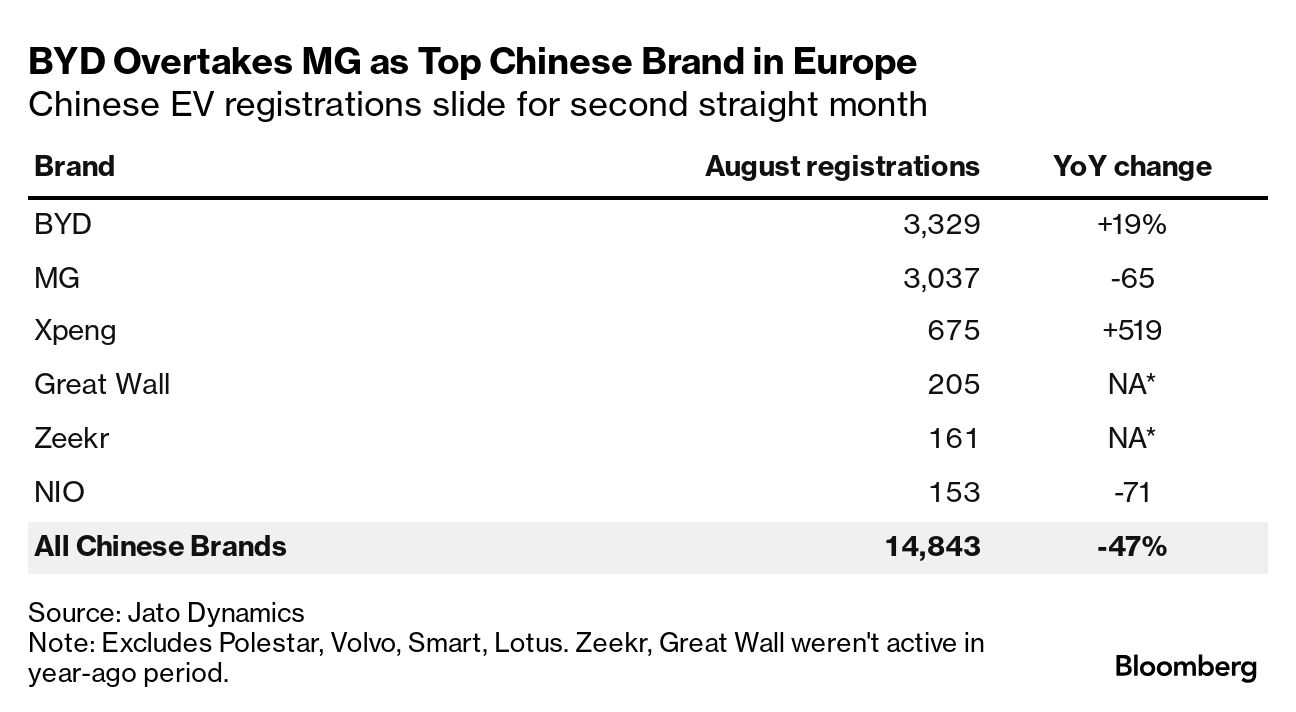

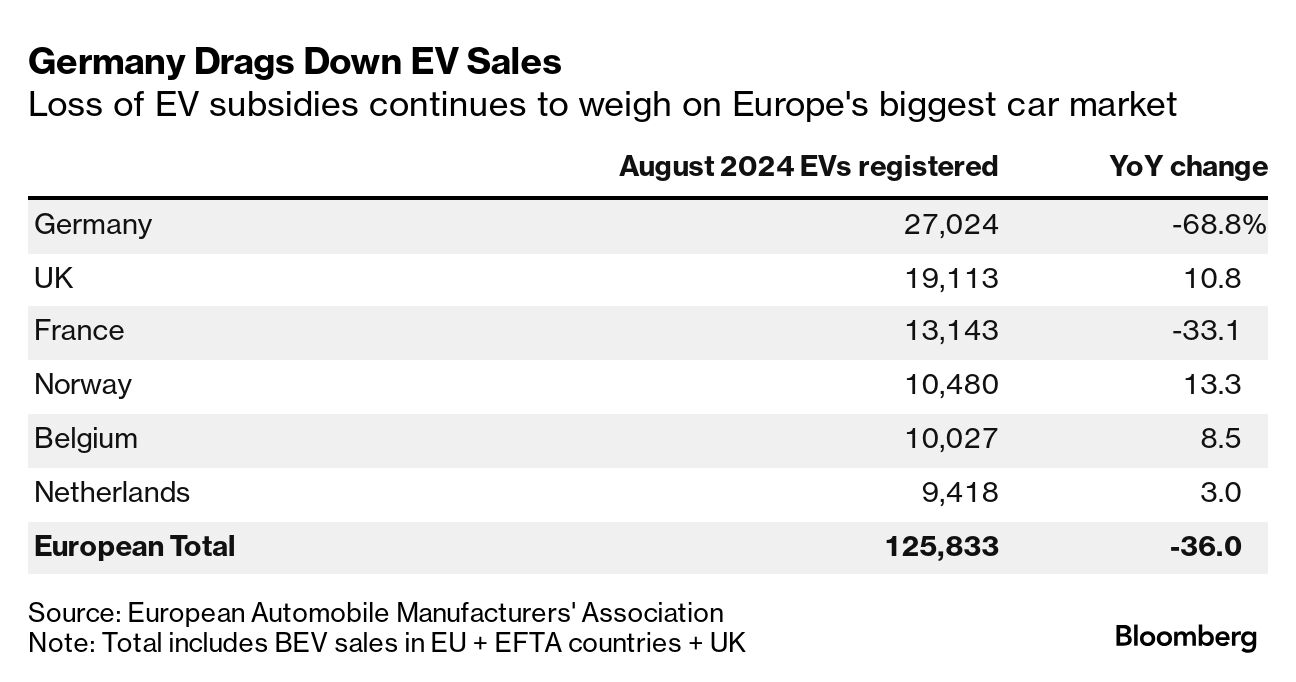

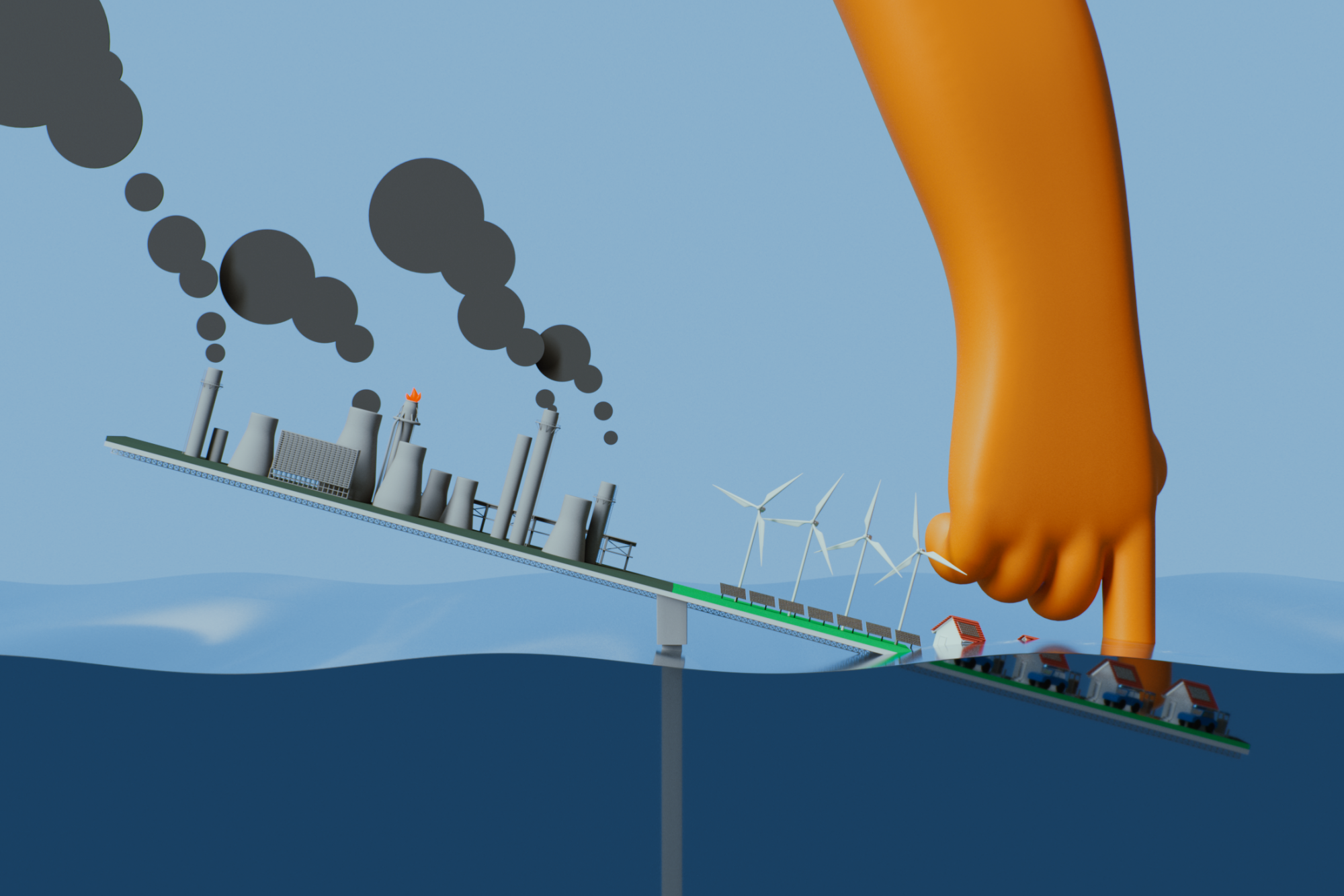

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Read today's featured story in full online here. Chinese manufacturers sold the fewest electric cars in 18 months to customers across Europe, with registrations falling by almost half in August from a year earlier. The 48% drop led to the second straight month of declining share for Chinese brands, based on figures from researcher Dataforce. MG, the British brand owned by SAIC, lost its top spot in the region to Chinese rival BYD, according to Jato Dynamics. Uncertainty tied to provisional European Union tariffs on Chinese EV imports can partly explain MG's 65% tumble in August, said Felipe Munoz, a senior analyst at Jato. He said the automaker has been putting more emphasis on mild hybrids and plug-in hybrids, rather than fully electric cars. MG has had the most success of any Chinese carmaker in Europe, leveraging its name recognition to rebuild the brand over the past decade, while making a pivot to EVs. But its state-owned parent SAIC was hit with added EU levies of 38% on its EVs in July, the highest assessment of all. BYD, the Chinese heavyweight that's a relative newcomer to the European market, continued to make strides in August with a 19% year-over-year rise in registrations, according to Jato. Automakers are still weighing the potential impact of the EU tariffs, which affect all EVs imported from China, including those from non-Chinese companies like BMW, Stellantis and Tesla. The added duties are set to be finalized by November, pending a member state vote, with negotiations between Beijing and Brussels taking place amid furious lobbying. "There is nothing clear regarding the role of the Chinese EVs in Europe," Munoz said. "Although there are many plans and announcements, there is even more uncertainty around their future and how Europe will react to the increasing competition." Bloomberg News reported on Friday that China's Chery has pushed back a goal to start building EVs at a plant it's taken over in Spain by one year, to October 2025, as the company weighs the amount of work to be carried out at the Barcelona site. A broader slide in EV demand across Europe has added to the uncertainty for carmakers. Registrations across the region fell 5.5% in the first eight months of the year, after major markets including Germany removed buyer incentives. European automakers have called on Brussels to reconsider key climate targets including 2025 fleet-emissions goals that could lead to billions of euros in fines. Sales trends for EVs imported from China have been uneven in the wake of the tariffs. In the UK and Norway, for example — countries which haven't followed the EU's lead — EV registrations rose in August. Among Western brands, BMW, Mercedes-Benz and Renault all saw declines of 50% or more in August registrations across the region, according to Jato. Yet the popular Volvo EX30 helped drive a more than doubling of sales for the Swedish brand's parent, Geely. Tesla, which imports some cars to Europe from China, posted a 7% gain. — By Anthony Palazzo  Illustration by Sean Dong Joe Biden has aimed hundreds of billions of dollars at clean energy and enacted regulations to throttle planet-warming pollution from cars, oil wells and power plants. Donald Trump, by contrast, has promised to end what he calls Washington's "green new scam." Investors, analysts and developers whose decisions shape the American energy transition are resolute: A victorious Trump can't fully halt the country's green shift, though there's obvious potential for a slowdown. "The question for me is not ultimately the direction of travel — it is about the pace," said Manish Bapna, president of the NRDC Action Fund, the political arm of the Natural Resources Defense Council. "A Trump 2.0 would pull back from policies and investments and create a much more costly and disruptive transition." |

No comments:

Post a Comment