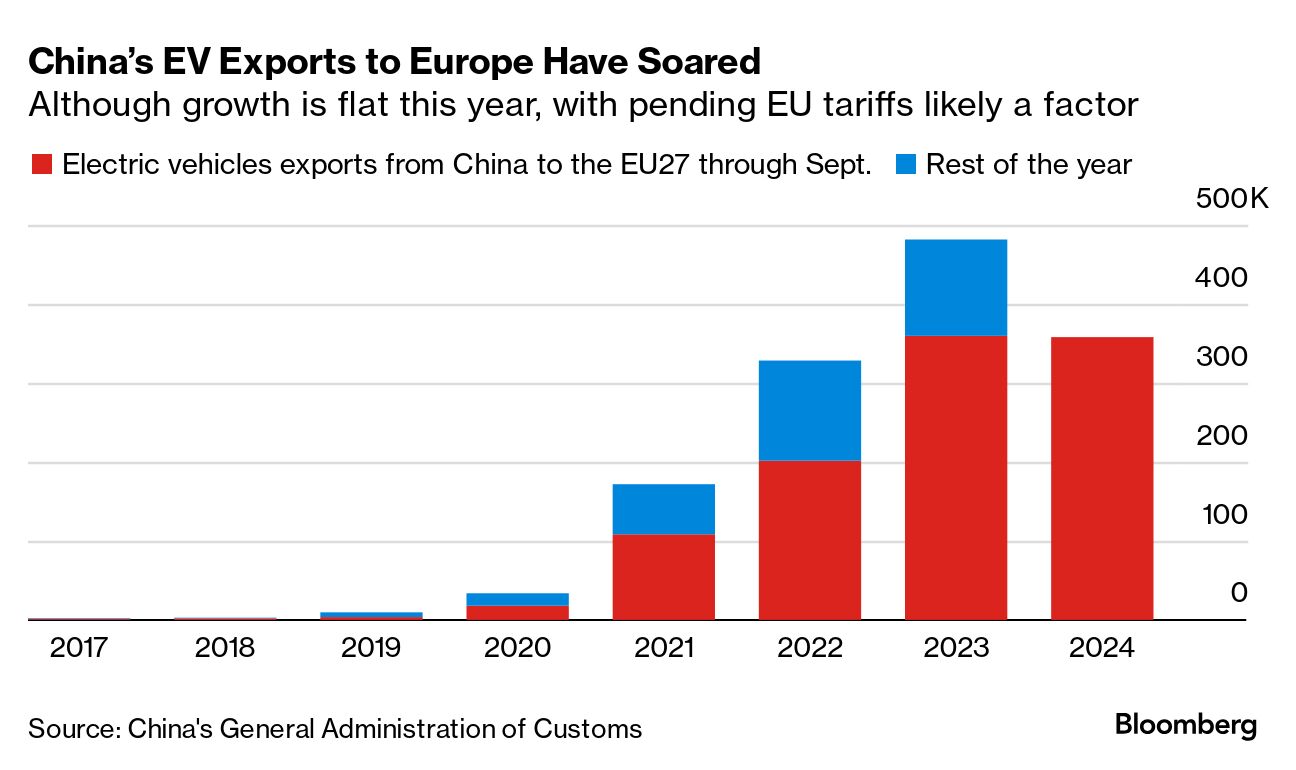

| After months of negotiations, threats of retaliation and auto-industry lobbying, the European Union went ahead and imposed higher tariffs today on electric vehicles from China. The move, which will increase levies to as high as 45%, risks ratcheting up trade tensions between the world's biggest exporters less than a week before a US election where trade protectionism is a key consideration for voters. Read More: EU Imposes Tariffs on China EVs, Risking Retaliation While talks between China and the EU will continue even after the new tariffs take effect, little is expected to happen before the American ballots are tallied and a winner is declared, according to people familiar with the matter. For now at least, some Chinese producers don't seem deterred. On Tuesday, Bloomberg News reported that BYD, China's biggest EV maker, is hiring the former UK chief of Stellantis to help build a team of European executives to lead its expansion in the region. She's the third high-profile executive at Stellantis who has jumped to BYD in recent weeks. China still hopes to find an acceptable resolution with the EU over the tariffs, the nation's Ministry of Commerce said after the regulation introducing the levies was published in the EU's official journal. China will take all necessary measures to defend its companies' rights, it added. In Brussels, the expectation is that China will start retaliating on European goods next month if a deal isn't reached. That will likely further raise the pressure on officials from capitals like Berlin who are keen to see an agreement on an alternative pricing deal. The other big question is how will China respond. So far, while it has threatened to curb investments in Europe, Beijing has mostly acted within the bounds of the rules, opening probes of its own into dairy, pork and brandy as well as warning it could return tariffs on cars with large engines to 2018 levels. The worry in Europe is that China starts taking other, more punitive actions such as restricting critical exports like rare earths needed to make EV batteries. Read More: VW Eyes Closing Three German Factories in Cost-Cutting Push That could see a trade tit-for-tat escalate into something far more damaging for companies on both sides. For now, both Beijing and Brussels will be eyeing next week's US election result. If Donald Trump and his promises of tariffs on both the EU and China return to the White House, they may soon need to divert some of their attention across the Atlantic. - The Big Take: Despite more than six years of American tariffs, export controls and financial sanctions, Chinese President Xi Jinping is making steady progress in positioning China to dominate industries of the future. Click here to read today's Bloomberg Big Take and here to listen to the podcast.

- US Election: Follow our coverage of the US presidential race here.

—Alberto Nardelli in London Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment