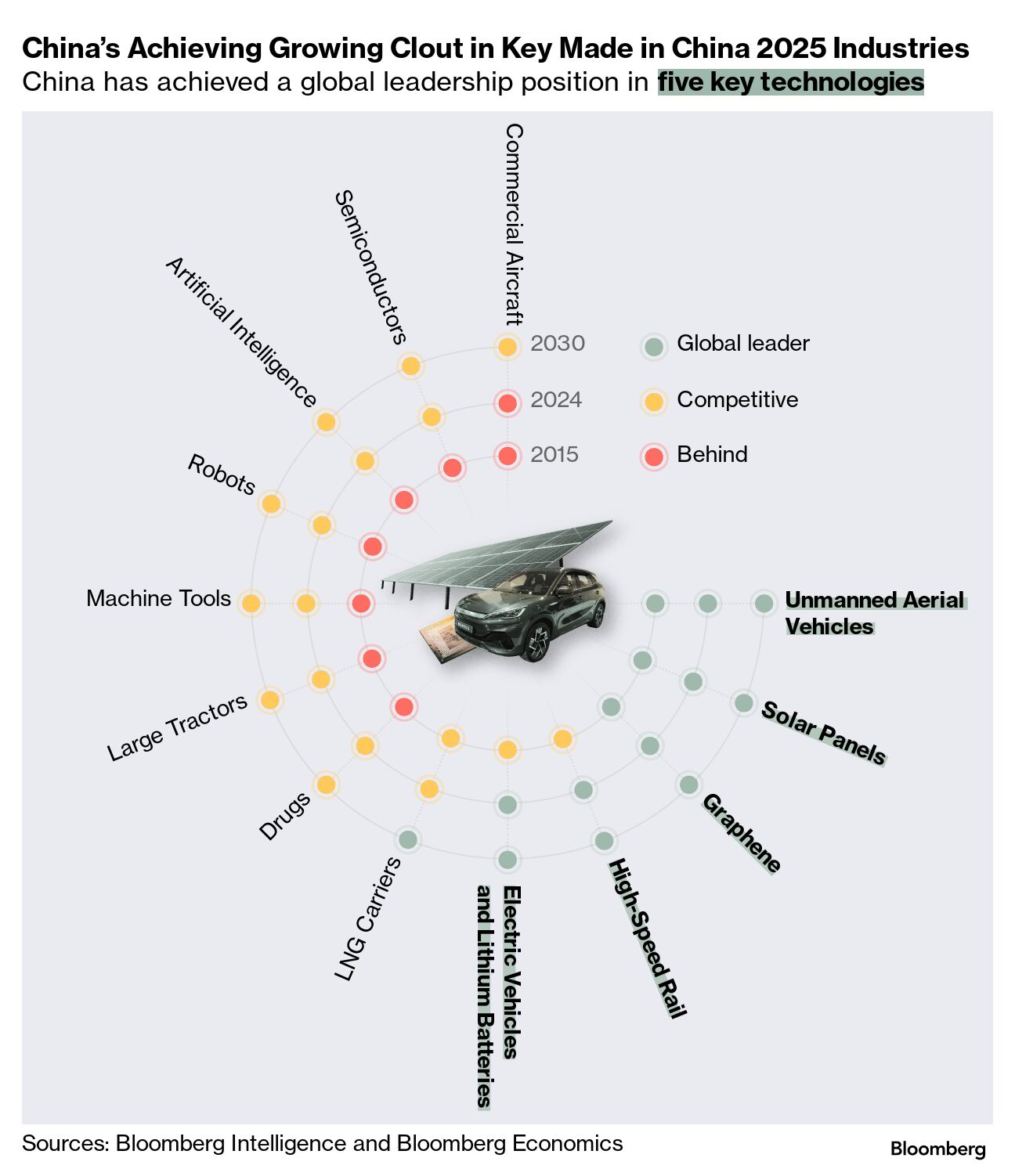

| I'm Malcolm Scott, international economics enterprise editor in Sydney. Today we're looking at US efforts to contain China's industrial advance. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. When then-President Donald Trump announced tariffs on Chinese exports in March 2018, he said the levies would make the US a "much stronger, much richer nation." Six-and-a-half years on — and less than a week ahead of a US election that may see Trump reclaim the White House — exclusive analysis from Bloomberg Economics and Bloomberg Intelligence finds that it's China that has become stronger in many key industries since those tariffs triggered what's now an entrenched trade war. Beijing's industrial policies — notably Made in China 2025 — are succeeding in advancing China across an array of technologies and its export might has only increased, taking its manufactured goods surplus relative to global GDP to the largest of any country since America's own supremacy right after World War II. Now, the next leg of the race against China looms, and either Trump or Kamala Harris, his rival in the Nov. 5 presidential election, must run faster to catch it or try harder to trip it up. But while the broad mission is shared, the policies set to mark Act III in the containment effort are starkly different. Trump is proposing even more drastic tariffs of 60% on Chinese exports, something Bloomberg Economics says would effectively end trade between the two nations. Harris says such moves equate to a tax on the middle class, with analysts expecting she'd continue Biden's policies to lure production back to the US with industrial subsidies and tax breaks while curbing exports of cutting edge chips to China. Analysts aren't convinced either approach will do the trick. "China's technological rise will not be stymied, and might not even be slowed, by US restrictions," said Adam Posen, president of the Washington-based Peterson Institute for International Economics, who has conducted research for governments and central banks around the world. "Except those draconian ones that simultaneously slow the pace of innovation in the US and globally." China, meantime, has doubled down on its quest for self sufficiency in the face of US protectionism, investing massively in electric vehicle, battery and solar technologies. That means the world outside the US is increasingly driving Chinese EVs, scrolling the web on Chinese smartphones and powering their homes with Chinese solar panels. For Washington, the risk is that policies aimed at containing China end up isolating the US — and hurting its businesses and consumers. Stella Li, an executive vice president at EV giant BYD Co., sums up China's bravado. "We don't need to enter the US market," she told Bloomberg in August from the company's headquarters in Shenzhen. "We've got a lot of opportunities to become a great company with the many markets outside of the US." - The Bank of Japan is expected to stand pat Thursday in the face of uncertainty as financial markets brace for the US presidential election and after Japan's polls resulted in a lack of clarity over its next government.

- The European Union has imposed higher tariffs peaking at 45% on electric vehicles from China, ratcheting up trade tensions between the world's leading export powers.

- The Swiss National Bank may have to cut interest rates again as inflation slows, according to President Martin Schlegel.

- Australia's core inflation remained elevated last quarter, reinforcing the Reserve Bank's view that price pressures will take time to dissipate.

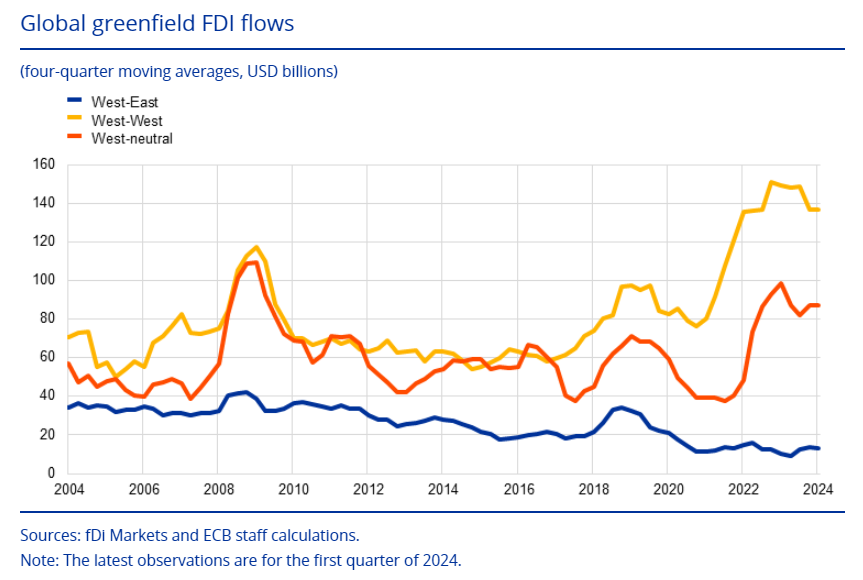

Decisions on where companies invest are increasingly shaped by geopolitics, according to new European Central Bank research. Dividing the world into three blocs — a US-centered western one, a China-centered eastern one, and a neutral third — economists found that western firms have ramped up investments in friendly countries in recent years while lowering them in politically distant ones. Frequent mentions on earnings calls of "friendshoring" corroborate the findings, they said. Outflows from the euro area seem especially tilted to the US, which the ECB speculates may be due to incentives created by the country's Inflation Reduction Act. But it works the other way around as well, with US companies turning their backs on China to the benefit of friendly and neutral nations. What all that means for trade and growth is still uncertain. While euro-area domestic production could be hit by shifting operations abroad, income generated there may also protect high-quality jobs at home. However, to the extent that a change in global investment patterns along geopolitical lines "foreshadows an accelerating fragmentation of global trade networks, the trends detected may prove detrimental to global and euro area output," according to economists Lukas Boeckelmann, Lorenz Emter, Isabella Moder, Giacomo Pongetti and Tajda Spital. |

No comments:

Post a Comment