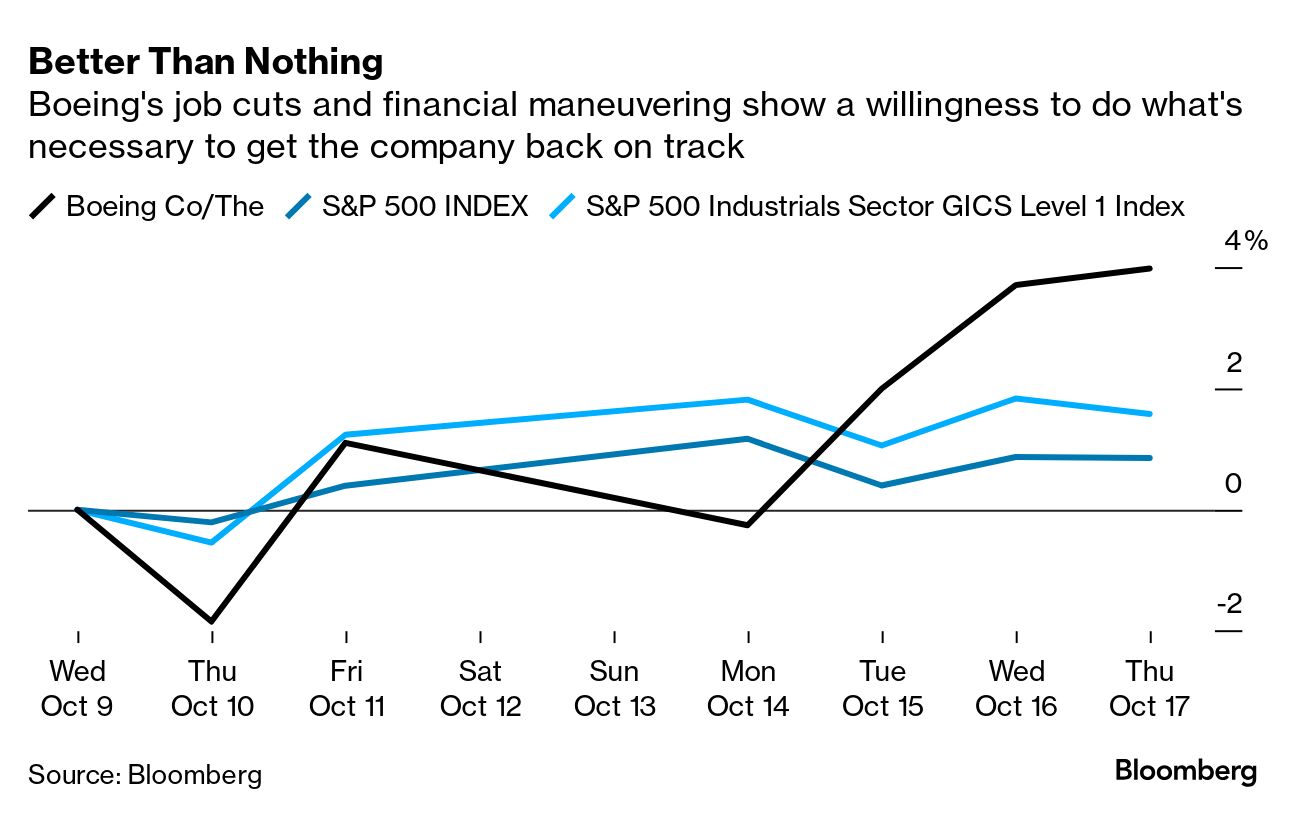

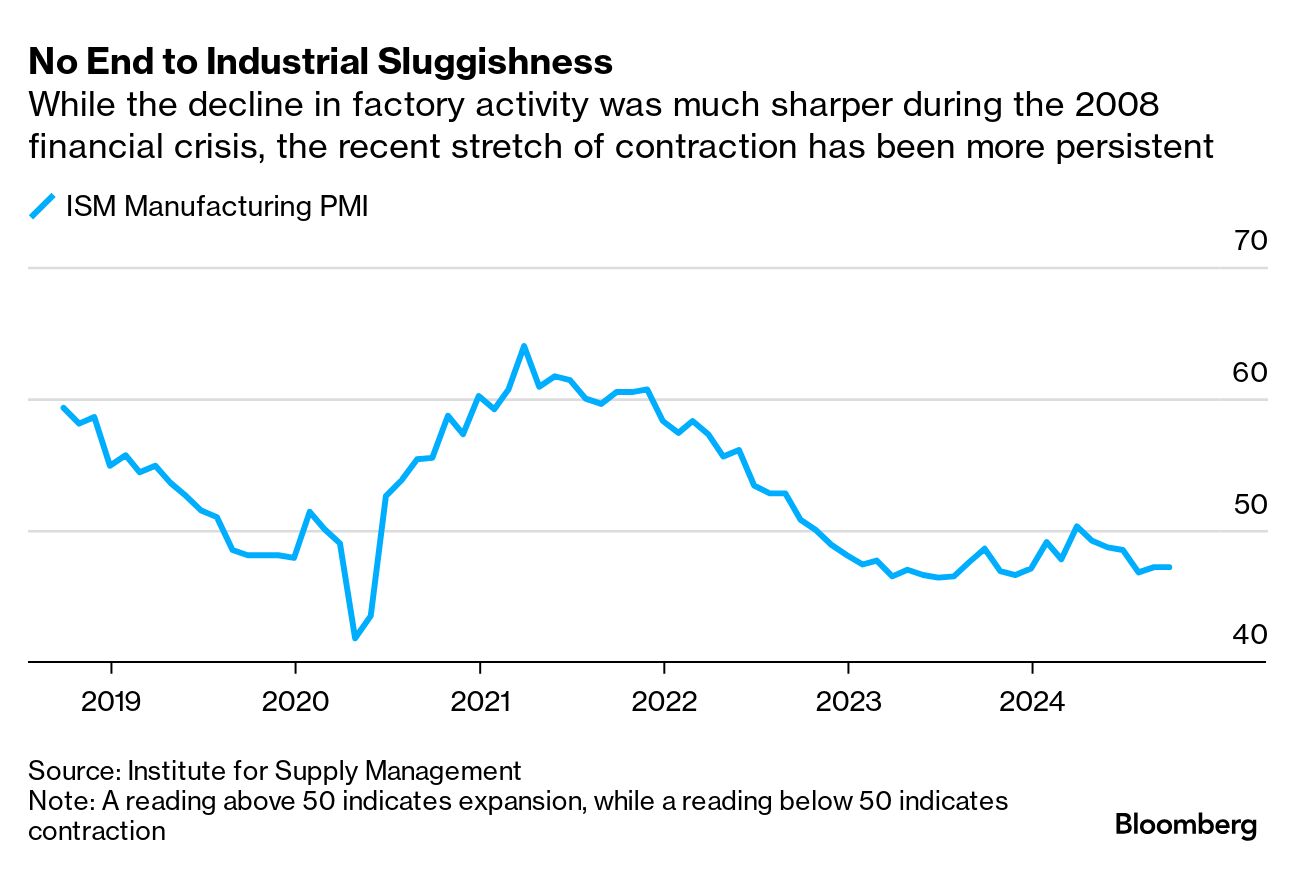

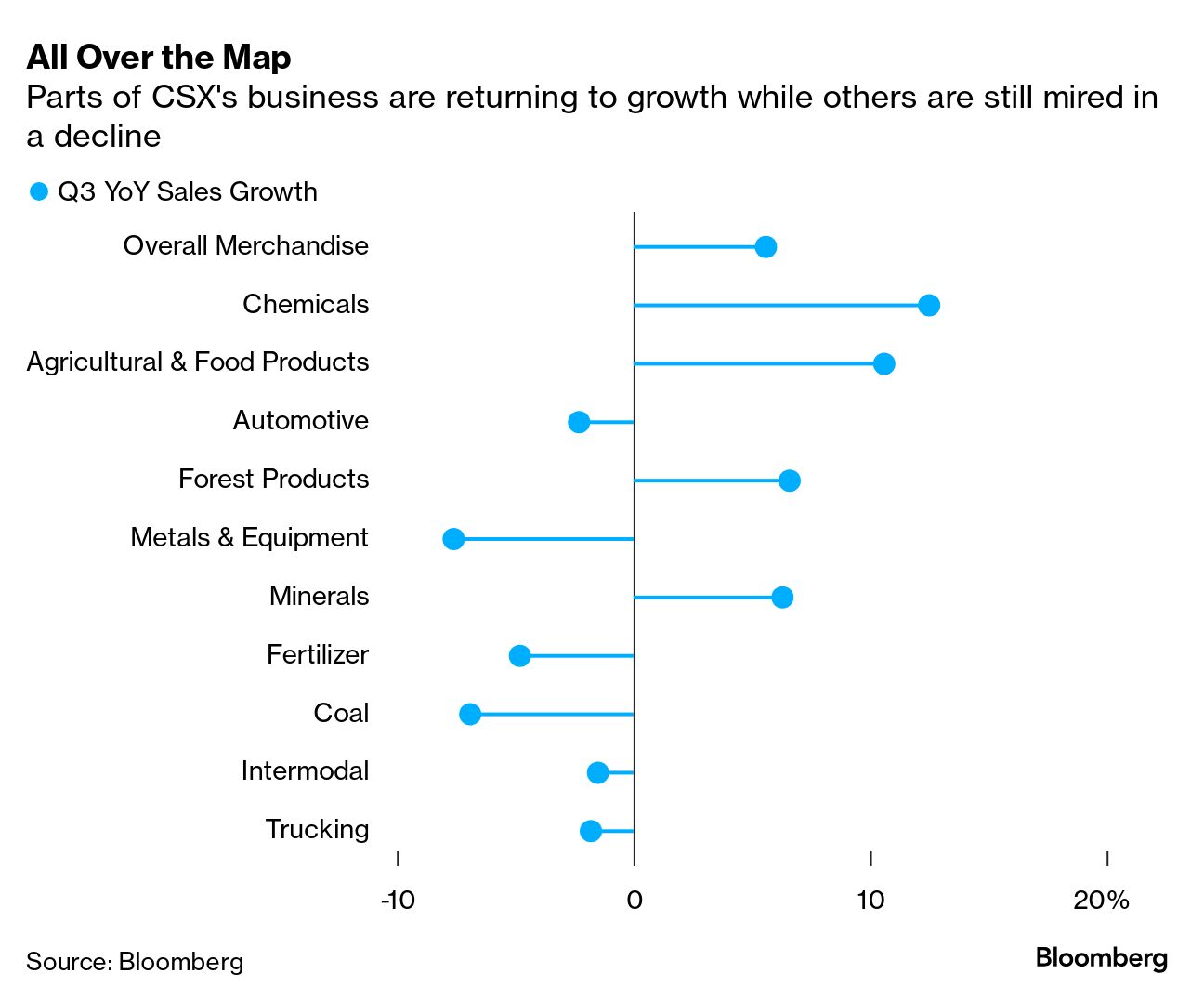

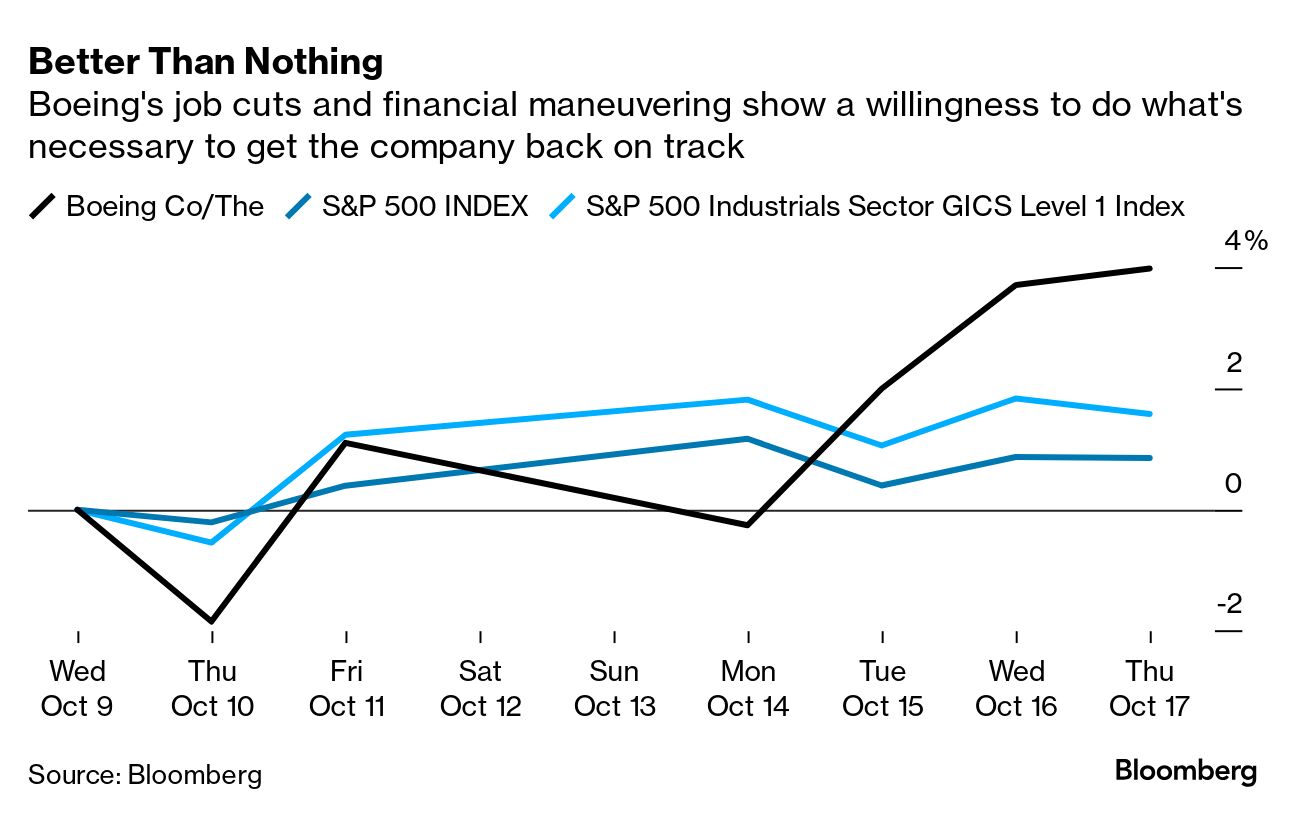

| The rolling industrial recession just keeps rolling. Earnings season for manufacturers heads into high gear next week, and the results are expected to show more of the sluggishness that has plagued one type of factory or another for roughly two years. The Institute for Supply Management's key gauge of US factory activity has been in contraction territory for 22 of the last 23 months, the longest period of weak demand since the dot-com bubble burst in the early 2000s. Warnings of project delays and flatlined orders have become more prevalent — even if there's no indication that the industrial economy is falling off a cliff. Rather, what's happened is more akin to a rolling recession whereby various parts of the manufacturing universe shrink at different times. The slump started in consumer and housing-related products as the pandemic spending boom slowed and spread to a broader inventory hangover, a freight recession that's still ongoing and a chemicals industry downturn that one executive likened to "Lehman II." Despite executives' insistence that an industrial super-cycle powered by stimulus funds was just around the corner, the slowdown infected the broader factory economy late last year as a combination of high interest rates, weakness in China and Europe and political uncertainty weighed on demand for everything from fasteners to car manufacturing and automation equipment. With the help of easier comparisons, there is potential for an industrial recovery this earnings season — at least for companies that have already weathered a meaningful slump. But for most firms, the third quarter will reflect a holding pattern. While the Federal Reserve's pivot to interest rate cuts should help grease the wheels of industrial investment, it will take time. And everyone is looking for more clarity after the US presidential election in less than three weeks. Several manufacturers, including Rockwell Automation Inc., have explicitly linked a slowdown in demand to election uncertainty as customers wait to see the outcome before deciding how to allocate their investment budgets. Industrial markets that are sensitive to high interest rates or were grappling with the whiplash effect of Covid spending returned to growth in the second quarter and should continue to recover, in part because results in the year-earlier period were so bad, according to Melius Research analyst Scott Davis. Still, that's countered by a slowdown in machinery sales that's just getting started. "You can see the rolling recession realities: that the end markets just have not aligned and been supportive," he said in a video report this week. Fastenal Co., a distributor of factory floor odds and ends, unofficially kicked off the coming deluge of profit updates late last week and reported improving sales trends in September, despite disruptions from Hurricane Helene. "The primary challenge remains sluggish end markets," Fastenal Chief Financial Officer Holden Lewis said on the company's earnings call. Still, the feedback from field offices is more mixed lately as customers start to look ahead to 2025, "which is an improvement on the universal pessimism of preceding months," Lewis said. Read More: Pool Slowdown Throws Cold Water on Recovery Meanwhile, railroad CSX Corp. this week reported lower-than-expected third-quarter revenue as faltering demand for coal, metals, fertilizer and cars outweighed a recovery in shipments of chemicals and agricultural products. Automotive markets in particular have been a weak spot of late. "The industry has seen consumer demand diminish by high retail prices and interest rates, which has led to higher dealer inventories and slower production," Chief Commercial Officer Kevin Boone said on the company's earnings call Wednesday. Paint manufacturer PPG Industries Inc. also warned of a slump in automotive production in both the US and Europe in trimming its organic sales and earnings outlook for the full year to the low end of its previous guidance ranges. PPG also plans to cut about 1,800 jobs and close some of its facilities after striking deals to divest its silica products and North American house-paint businesses. Even aerospace and defense manufacturers — one of the strongest corners of the industrial world — are laying off workers and warning of disappointing results. Airbus SE announced this week that it would cut as many as 2,500 jobs at its space and defense unit, which has struggled with delays and rising costs for complex projects. Boeing Co. plans to eliminate about 17,000 employees from its workforce as the company grapples with the financial fallout from a jet blowout in January, money-losing contracts in its own defense business and a prolonged labor strike. The walkout has essentially halted commercial aircraft manufacturing work at its Seattle-area factories, compounding earlier delivery shortfalls because of supply-chain logjams and regulator limits on production. Airbus is struggling to get enough engines, aircraft interiors and aerospace structure components to build its jets. September deliveries totaled just 50 jets, putting the year-to-date sum well short of the already lowered annual target of 770 planes. Airbus and Boeing's production challenges are leaking into their supply chains: Senior Plc, which makes ducting systems and other aircraft components, announced last week that it will reduce its headcount through both furloughs and permanent cuts and postpone capital spending to prepare for lower near-term deliveries. Spirit AeroSystems Holdings Inc. said Friday that it will also start furloughing workers in response to the strike at Boeing. The combined effect of all these mini-recessions and job cuts is a general vibe of industrial malaise that's proved difficult to shake. Manufacturing executives have little incentive to paint a rosier picture right now. Third-quarter earnings reports are always a bit weird as investors have largely moved on to thinking about a new year that most companies — save for those operating on an off-calendar fiscal year — aren't yet prepared to discuss. This year will be even weirder, with the vast majority of industrial companies set to report results just weeks before a nail-biter US election that will have a meaningful effect on what might be in store for them in 2025. "The thing that industrial manufacturers like the least in the world is uncertainty," Steven Hedlund, chief executive officer of welding and cutting equipment manufacturer Lincoln Electric Holdings Inc., said at a conference in September. "Until we get through the election and until we start to see a general trend in the macroeconomic indicators to be more favorable, we're probably going to continue to see the kind of demand profile we see today."  Boeing shares are trending toward their best week since August after the planemaker announced sweeping job cuts and laid the groundwork for a potential monster equity raise. While neither announcement should be considered good news, Boeing needs to take these kinds of aggressive steps to stabilize its degrading finances and avoid slipping into junk territory in the eyes of bond rating firms. The moves suggest that new CEO Kelly Ortberg is clear-eyed about Boeing's many and daunting challenges and that he's willing to do whatever is necessary to get the company back on track, something that couldn't always be said about his predecessors. Boeing will cut about 10% of its workforce, the equivalent of about 17,000 employees. It also filed a shelf registration with regulators to raise as much as $25 billion through any combination of stock and bond sales. The company late last week said it's expecting an operating cash outflow of about $1.3 billion in the third quarter. While that's not as dire of a situation as analysts had estimated, the cash drain still leaves Boeing with a very thin balance sheet buffer as it tries to hold onto its investment grade credit rating. A strike by 33,000 members of a machinists union at Boeing factories in the Pacific Northwest is costing the company more than $1 billion a month, according to S&P Global Ratings estimates. There's been little progress in negotiations with the union after talks broke down earlier this month and Boeing withdrew an offer for a 30% wage increase. Deere & Co. announced it's laying off about 300 more people across its facilities in Iowa and Illinois as slumping crop prices and high interest rates weigh on demand for new agricultural equipment. The company had already announced hundreds of production job cuts over the past year at its Midwest plants as revenue resets from the record levels of the post-pandemic period. Deere is also moving ahead with plans to build a new facility in Mexico that by 2026 will take on production of mid-frame skid-steer and compact-track loaders that's currently handled by its plant in Dubuque, Iowa. The company confirmed the investment this week, despite claims by former president and current Republican nominee Donald Trump in an interview with Bloomberg News's Editor-in-Chief John Micklethwait that Deere had scrapped its Mexico factory because he threatened the company with tariffs. The Dubuque plant will continue to manufacture machinery including large-frame loaders, backhoes and construction crawler dozers. The shift to Mexico for some product lines helps establish "a new, globally competitive manufacturing operation," Deere had said in an August statement. Read more: Musk Is Outlier in Pausing Mexico Factory Among the other industrial companies that got a shoutout in Trump's conversation with Micklethwait, shares of United States Steel Corp. declined after the former president said he would block a proposed takeover of the company by Japan's Nippon Steel Corp. if he's elected. Trump also bragged about negotiating a discount with Boeing for a new Air Force One fleet; the company has racked up more than $2 billion in losses as it grapples with cost overruns and delays on the program. Schneider Electric SE agreed to acquire a 75% stake in data center cooling specialist Motivair Corp. for $850 million. Schneider already sells electrical equipment and cooling technologies to data center and network customers, with this sector comprising more than a fifth of its orders in fiscal year 2023. The advent of artificial intelligence relies on graphics processing units, or GPUs, which are capable of processing huge streams of data in parallel but require twice the power of traditional central processing units, or CPUs. Higher power use also means more heat is generated, so data centers need to invest in more efficient technologies that can keep both the equipment itself and the ambient temperatures appropriately cool. Cooling-related spending is the fastest growth area within electrical equipment for data centers, Barclays analysts said in a report, citing data from technology research and advisory group Omdia. The acquisition of Motivair boosts Schneider's exposure to cooling demand and gives it a more complete portfolio of data center equipment. The company expects to acquire the remaining 25% interest in Motivair in 2028. - Trump waves off concerns about knock-on effects of aggressive tariff plan

- US backs EV battery component plant in Georgia with $671 million loan

- The hyper-politicization of America is stifling big ideas

- Elliott officially launches a proxy fight — and a podcast — at Southwest

- Electric vehicles have a "Republican problem"

- Honeywell is in advanced talks to sell face-mask unit to private equity

- Consumer concerns about missing payments hit highest level since 2020

- RTX to pay $950 million to settle defense contract pricing, bribery probes

- Musk's plan for mass manufacturing of robotaxis runs afoul of US rules

- Baxter limits home dialysis access after hurricane damage to key factory

- China sends pandas to DC zoo after 11-month absence

|

No comments:

Post a Comment