| Bloomberg Evening Briefing Americas |

| |

| For Wall Street skeptics and diehard members of Team Recession, there's always some evidence to support their grim prognostications. And while they've been proven wrong time and again by an effervescent US economy, right now equity valuations are indeed stretched, corporate bond spreads are tightening and gold is at a record. As a result, there's been a rush of late to options and other instruments designed to protect gains. But alongside this burst of prudence is a vocal subset of managers who take their cues from two years of relatively good news when it comes to markets, unemployment and dissipating inflation. They say there's reason to believe it's still early in the bull run for risky assets. One of them is Nancy Tengler, who helps oversee $1.4 billion for Laffer Tengler Investments in Scottsdale, Arizona. Convinced corporate earnings growth is greater than it seems thanks to a steep falloff in inflation that's bolstering consumers, she's pushing clients out of Treasuries and into a broader list of bets on municipal bonds, electrical equipment makers and utilities. "The growth is there and it's still driven by the consumer," she said. "Earnings season will be pretty robust. We will see more surprises to the upside than to the downside. We are very bullish." —David E. Rovella | |

| |

| Cigna is said to have revived efforts to combine with its smaller rival Humana after merger talks fell apart late last year. The two health insurance giants have held informal discussions recently about a potential deal, though Cigna is said to be looking to close the sale of its Medicare Advantage business before committing to any other transactions. Cigna and Humana held talks to combine in 2023, but Cigna walked away after failing to agree on a price, Bloomberg News reported in December. Shares of Humana were up 4.3% after the close of regular trading Friday, while Cigna fell about 3.4%. In the broader market, Wall Street traders handed up their verdict on a week filled with corporate results and more signs the US economy continues to fire on all cylinders, driving stocks to their longest weekly advance in 2024. Here's your markets wrap. | |

|

| |

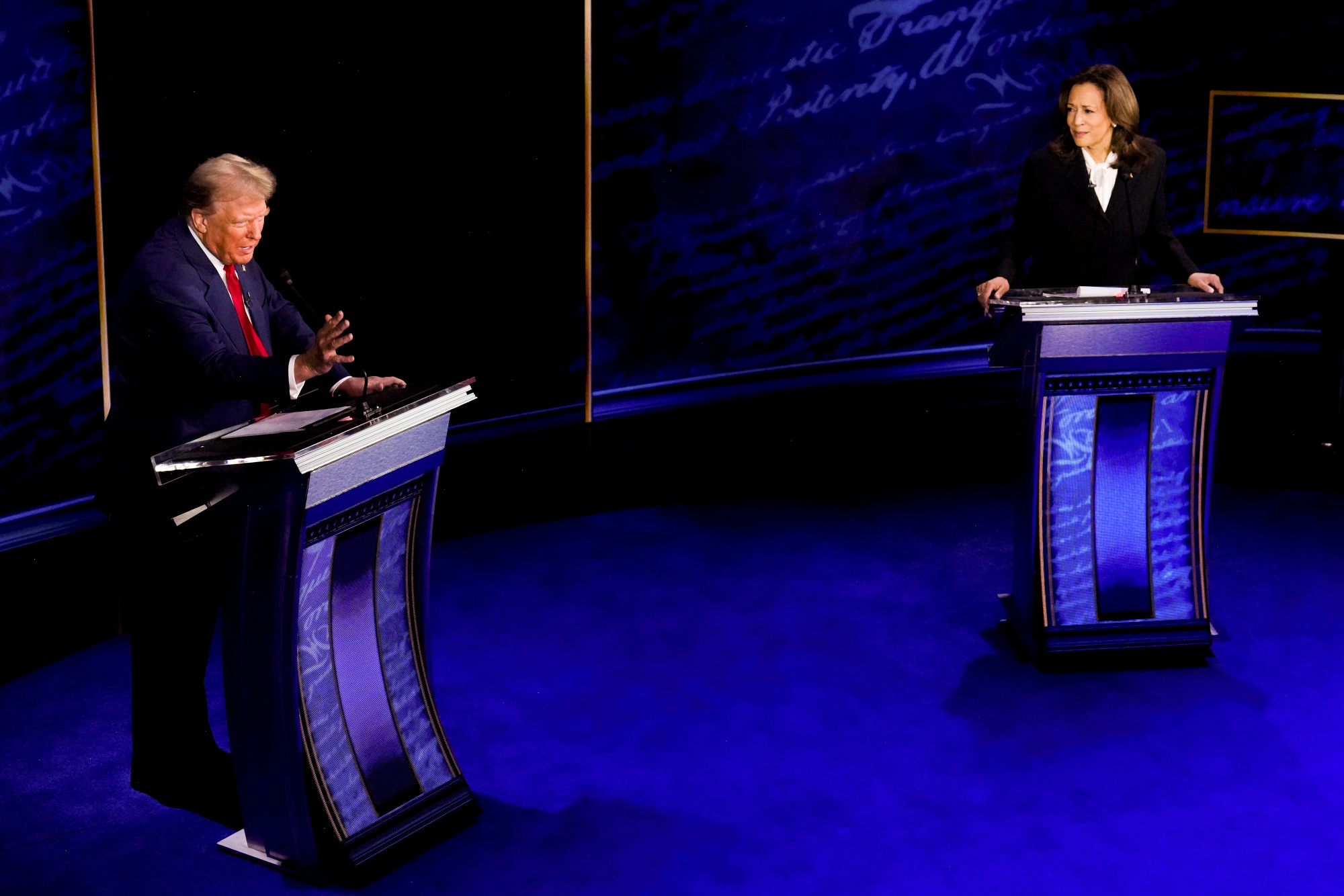

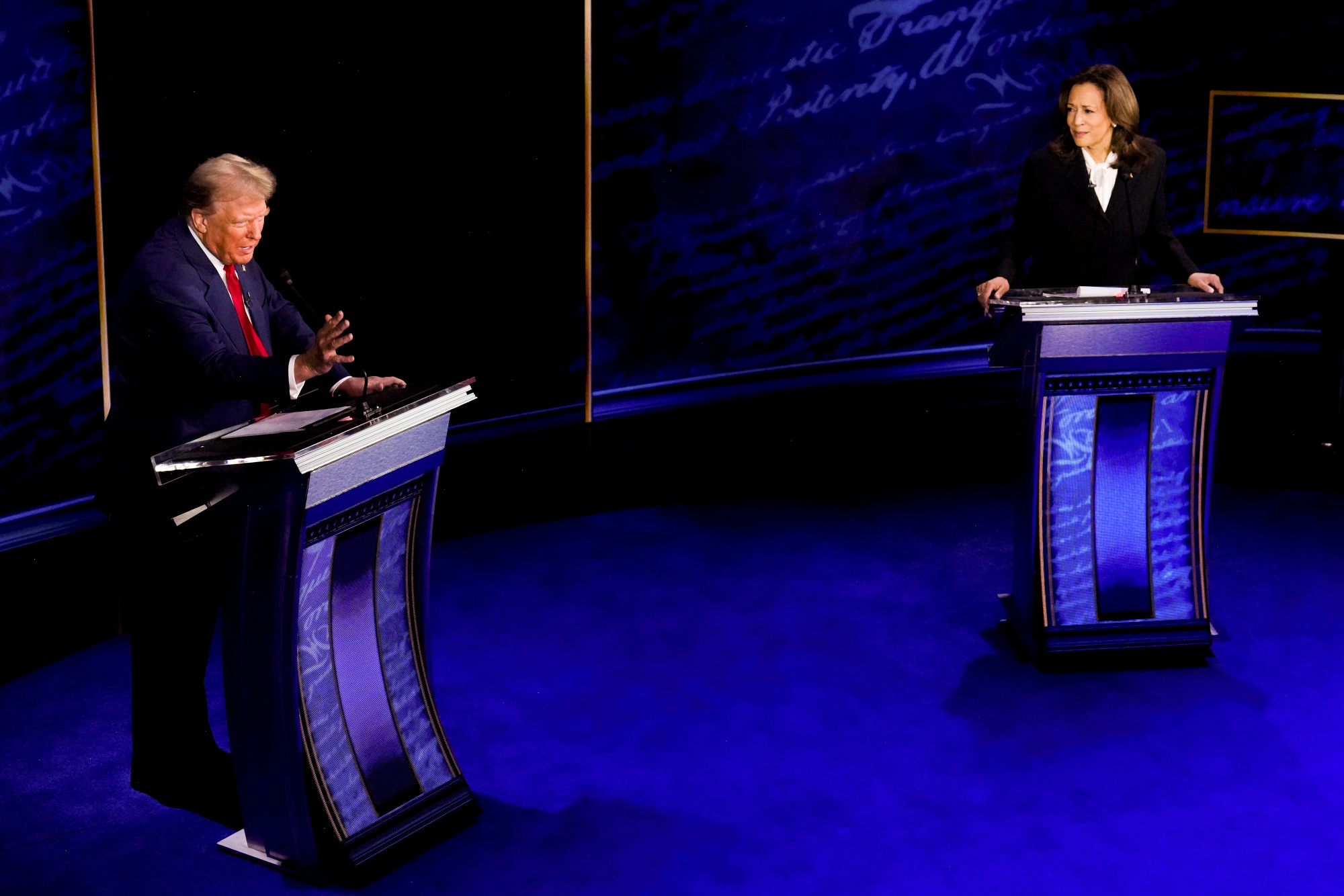

| Vice President Kamala Harris used Donald Trump's cancellation of a series of planned media appearances to suggest the 78-year-old former president can't handle the rigors of the Oval Office. The remarks by Harris, 59, may mark the revival of long-simmering arguments that the Republican is too old to serve as commander-in-chief. Harris, a former US senator and prosecutor, has been questioning whether Trump, who regularly gives meandering speeches generously sprinkled with nonsensical asides and falsehoods, is up to the task. In the final weeks of the campaign, Harris has already been pointing to Trump's promises to act as a "dictator" by prosecuting political enemies and ordering the military to be used against American citizens. Now her campaign is taking aim at Trump's stamina. "I've been hearing reports that his team, at least, is saying he's suffering from exhaustion, and that's apparently the excuse for why he's not doing interviews," Harris said. "Being president of the United States is one of the hardest jobs in the world, and so we really do need to ask, if he's exhausted being on the campaign trail, is he fit to do the job?" On Friday, Trump said he would consider exempting police, firefighters and additional members of the military from paying federal taxes. It would be the latest in a long list of tax cut proposals that are, under Article I of the US Constitution, the province of Congress.  US Vice President Kamala Harris, right, and Donald Trump on Sept. 10 during their only presidential debate. Harris has sought a second debate after Trump's widely panned performance in Philadelphia. He has repeatedly declined. Photographer: Doug Mills/The New York Times | |

|

| |

| CVS Health Corp.'s new Chief Executive Officer David Joyner issued a plea for help to workers as he sets upon fixing the troubled health conglomerate he took over from ousted CEO Karen Lynch. "Here's where I need your help," Joyner said in an internal memo sent to staff on Friday seen by Bloomberg News. "It is no secret that our industry faces significant and dynamic challenges, and that CVS Health must make financial and operational improvements to drive elite execution and maintain our position as a leading health care company." Joyner takes over the company following months of upheaval, including missed earnings targets, activist interest and shareholder unrest that spilled into public view in recent weeks. | |

|

| |

| Money managers that used Western Asset Management Co. to help invest their bond portfolios are being pressed about their dealings with the firm, as US authorities ramp up their investigation of how once-star trader Ken Leech allocated winning bets. Fidelity Investments, Russell Investments and SEI Investments are said to be among the firms that received information requests from federal prosecutors in recent months. As a force in the bond market for decades, Wamco has overseen money for institutional investors and fixed-income allocations for other money managers. US authorities are examining whether Leech parceled out winning trades to favored clients at the expense of others—a practice known as cherry-picking. Investors have pulled billions of dollars from Wamco funds since the firm disclosed criminal and civil investigations earlier this year. | |

|

| Tired of the cold winters in Canada, Renhai Wang packed his bags in 2021 and headed to Portugal to start a new life in Europe. But three years after sinking $380,000 into an apartment in Lisbon, the Chinese national is still waiting on Portugal's immigration agency to decide about his status. He's one among thousands of people who applied for the country's golden visa program, which promises investors a path to citizenship. He's also among hundreds stuck in limbo as the country struggles to deal with a massive inflow of immigrants. "If I knew this would take so long," he said, "I wouldn't have invested in Portugal. There are other places where it's easier to get a golden visa." | |

| |

| |

|

| BlackRock is pushing to have its money-market digital coin more widely used as collateral for crypto derivatives trades. It's part of a broader push by Wall Street firms to dive deeper into digital asset markets. The world's biggest asset manager and its brokerage partner, Securitize, are said to be in early talks with some of the largest global crypto exchanges about using BlackRock's new BUIDL token as collateral for derivatives trades. Having the coin accepted directly as collateral on platforms like Deribit and Binance would greatly expand the potential market for BlackRock. | |

| |

|

| Some three billion people in the developing world still can't access the internet. In five years, at least a billion of them will arrive online for the first time, thanks in large part to new technologies being developed in Silicon Valley and elsewhere. How will these new users embrace the internet to transform their lives, and what will it mean for the rest of the world? On the latest episode of the Bloomberg Originals series The Future with Hannah Fry, Fry explores both how this new revolution is unfolding and who stands to gain from it. Across Asia, the Middle East and Africa, there are billions of people who companies like Google and Amazon see as a vast untapped market. But first they have to reach them. | |

| |

| |

| |

| |

| |

| In the premiere episode of the Bloomberg Originals series Momentum, Bloomberg's Haslinda Amin pulls back the curtain on a network of private companies behind India's accelerating space ambitions, and how the world's most populous nation is fast joining the historical space powers in orbit and beyond. India has become the first nation in the world to land near the south pole of the moon, where scientists believe there may be vast reserves of ice water—a critical requirement for new efforts to build and sustain lunar outposts. In Beyond Earth: Private Ambitions in Space, learn how India achieved this feat, and how its strategy may be a blueprint for the global space industry. | |

| |

| Bloomberg New Economy: The world faces a wide range of critical challenges, ranging from ongoing military conflict and a worsening climate crisis to the unforeseen consequences of deglobalization and accelerating artificial intelligence. But these challenges are not insurmountable. Join us in Sao Paulo on Oct. 22-23 as leaders in business and government from across the globe come together to discuss the biggest issues of our time and mark the path forward. Click here to register. | |

| Enjoying Evening Briefing? Check out these newsletters: - Markets Daily for what's moving in stocks, bonds, FX and commodities

- Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Opinion Today for an afternoon roundup of our most vital opinions

Explore all newsletters at Bloomberg.com. | |

| |

No comments:

Post a Comment