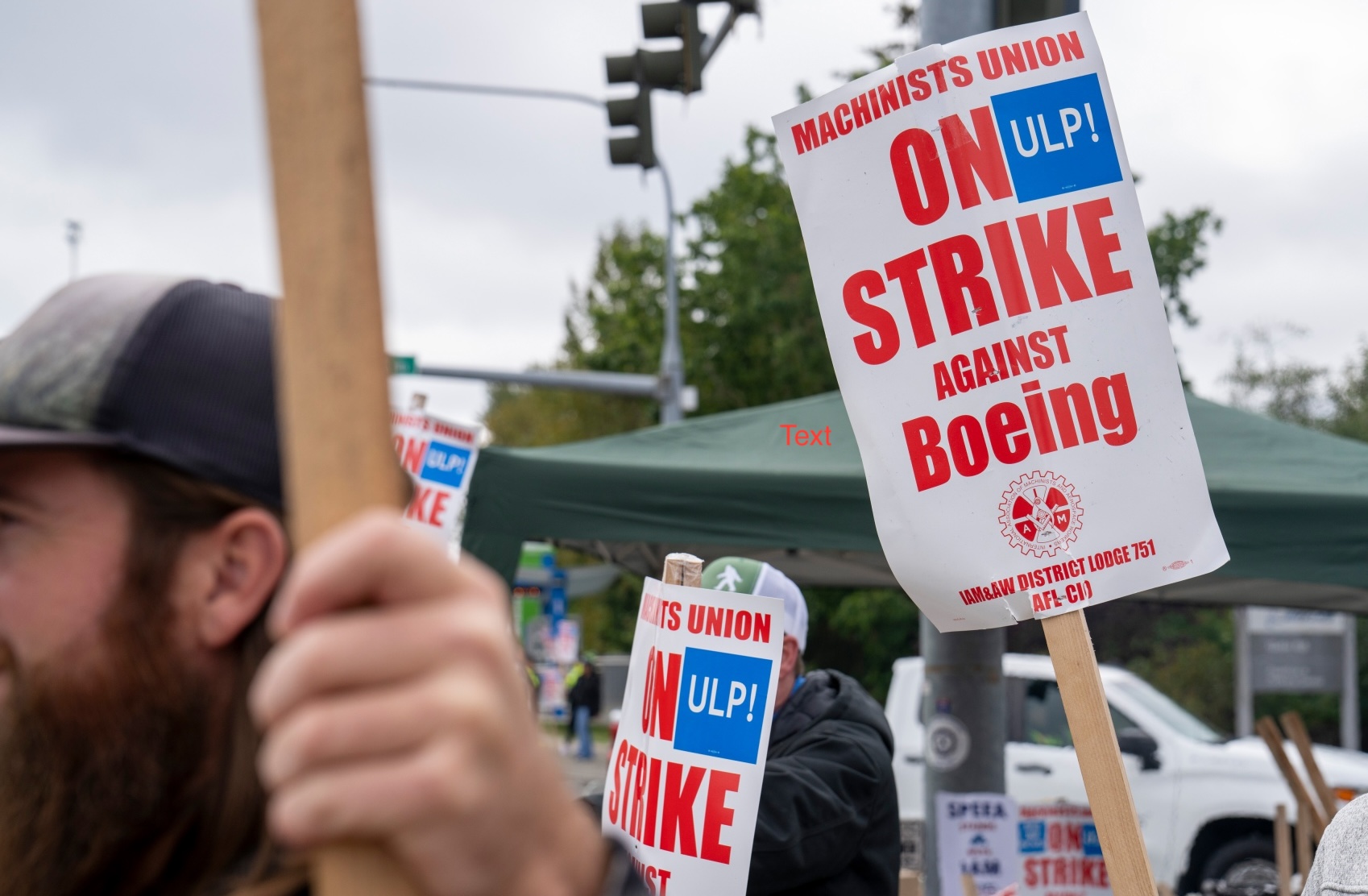

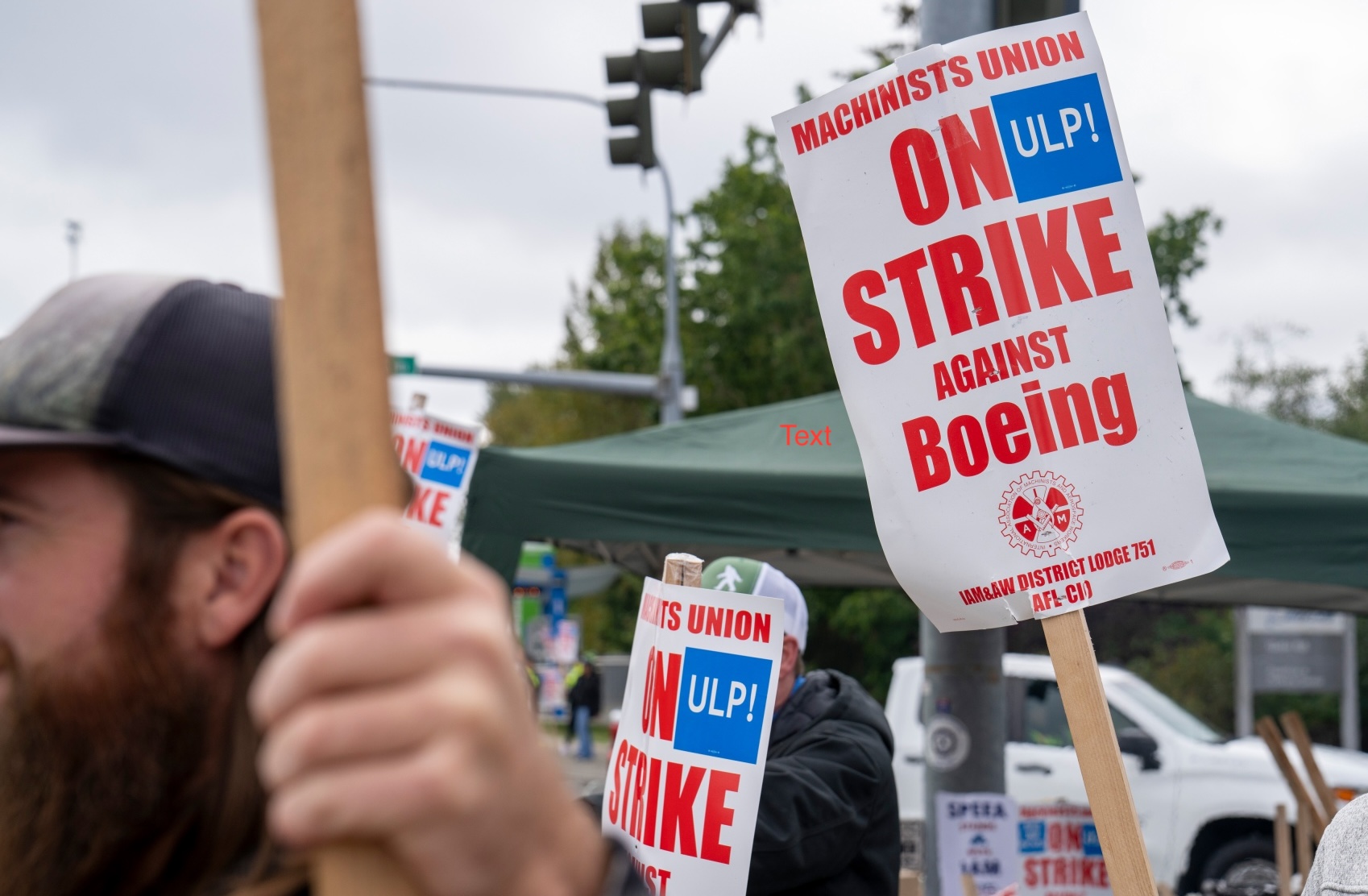

| Note to readers: Starting Monday, we'll be sending you our new Morning Briefing newsletter in addition to the Evening Briefing, bringing you the most important news to start your day and the context and analysis you've come to expect as you head home. Manage your newsletter preferences anytime here. It was a late night for Tesla fans, investors and journalists as the much-discussed unveiling of Elon Musk's "Cybercab" was significantly delayed from its scheduled 10 pm ET start. But while the aesthetics of the new vehicle got some rave reviews, details on production of a new wave of autonomous vehicles—let alone their potential deployment—were scant. The crowd seemed to both laugh and boo at Musk's latest timeline, given his propensity for making promises of new Tesla tech that go unfulfilled. As for the car company's investors, the verdict on Musk's fancy taxi came in almost immediately Friday morning, and it was brutal: Wall Street, it would seem, is taking the train. —David E. Rovella Somebody has to lose and somebody has to win. While the world's richest person picked the short straw Friday, his would-be rivals were sitting pretty. Uber and Lyft climbed in early trading after Musk's reveal fell flat, and just kept on going. Uber's stock jumped as much as 7% to hit an all-time high and Lyft's advanced up to 8.3%. Indeed, it seemed like everyone but Musk was in the black today as markets notched another all-time high. Wall Street kicked off earnings season with a bang as big banks rallied after posting solid results. "We expect earnings season to be solid," said Michael Landsberg, chief investment officer at Landsberg Bennett Private Wealth Management. "Credit card delinquencies are still very low and increased economic activity should drive bank revenues." The S&P 500 topped 5,800, its 45th record this year. Embattled planemaker Boeing, the subject of a month-long work stoppage (its latest crisis among many) decided to contend with the strike by firing approximately 17,000 workers. Boeing said it plans to slash its employees by about 10%, pinning the mass terminations on a worsening cash crunch. Chief Executive Officer Kelly Ortberg also said the company notified customers that the first deliveries of the 777X are now expected in 2026, citing the strike and a flight test pause. In August, Boeing announced it was suspending tests due to cracking in a key component that connects the plane's engines to the wings.  Workers picket outside a Boeing facility in Everett, Washington, last month. Photographer: M. Scott Brauer/Bloomberg Hedge funds fled bearish bets against Brent crude prices at the fastest pace in nearly eight years as war risks ratchet up. Although US President Joe Biden has counseled Israel against an attack on energy facilities in Iran, the possibility is leaving investors on edge and wary of wagering against futures prices. Shell employees excoriated the company's leadership in response to an internal workforce survey as CEO Wael Sawan fires employees across the business. The company's workers expressed dismay at the way Shell's leadership is managing the oil major's biggest restructuring in years. Headline figures in an annual exercise known as the Shell People Survey showed a decline in how employees view the organization's leadership as well as its reputation. BlackRock pulled in a record $221 billion of total client cash last quarter, pushing the world's largest money manager to an all-time high of $11.5 trillion of assets as it seeks to become a one-stop shop for stocks, bonds and increasingly private assets. Investors added $97 billion to exchange-traded funds and $63 billion to fixed-income overall in the third quarter. BlackRock has pulled in $360 billion of total net inflows so far this year, surpassing the full-year net flows of 2022 and 2023. The Kremlin is getting chummier with India, as the latter became the second-biggest supplier of restricted critical technologies to Russia, according to US and European officials. Indian exports of restricted items such as microchips, circuits and machine tools were said to surpass $60 million in both April and May, about double from earlier months this year, and reportedly leaped to $95 million in July.  Indian Prime Minister Narendra Modi, left, hugs Russian leader Vladimir Putin outside Moscow on July 8. Photographer: Gavriil Grigorov/AFP Wheelock Street Capital is exploring a potential sale of the Ben, a waterfront hotel in downtown West Palm Beach, Florida. The property owner has begun approaching potential buyers for a deal that could value the 208-room hotel at around $1 million a key. Wheelock acquired the Ben in 2021, touting the hotel's location at the "work-live-play epicenter of West Palm Beach." The property, soft-branded as part of Marriott International's Autograph Collection, includes a rooftop venue with views of Palm Beach Island and the Atlantic Ocean.  The Ben hotel in West Palm Beach, Florida Source: Marriott |

No comments:

Post a Comment