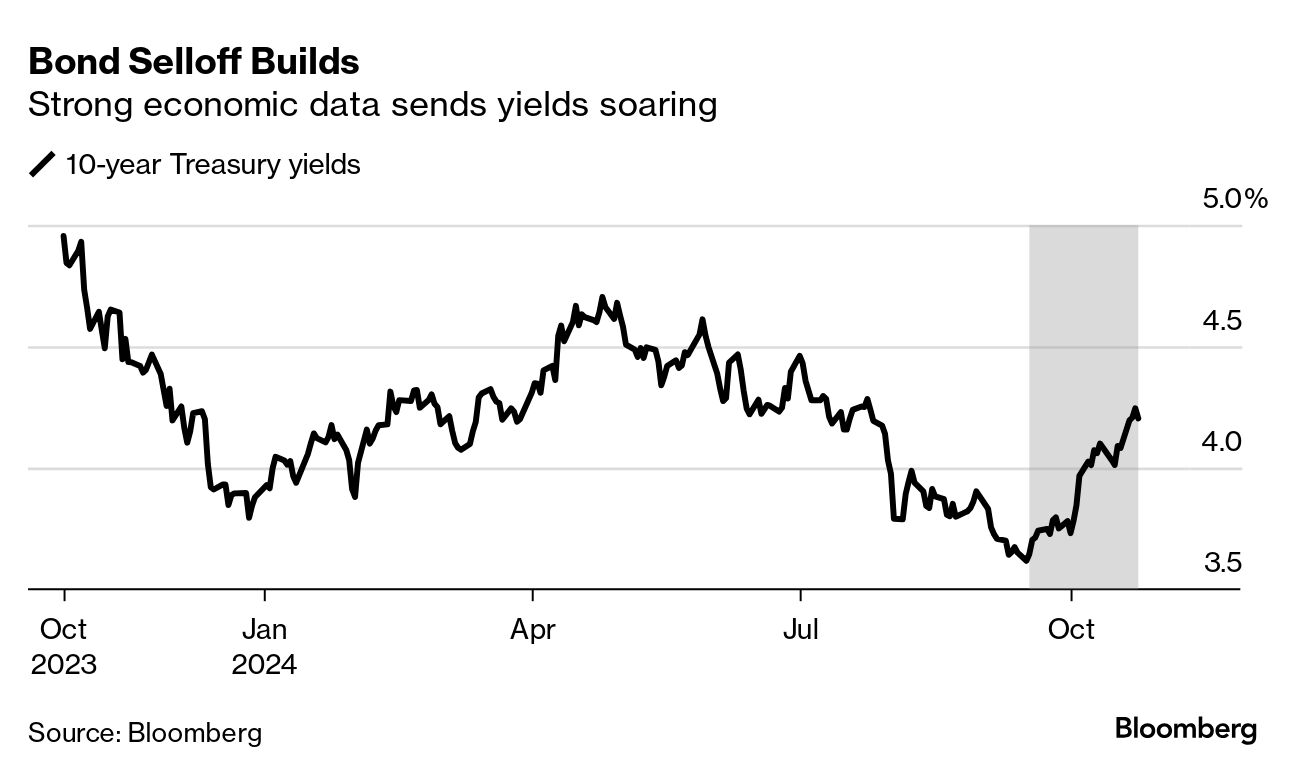

| A rapid runup in bond yields is obsessing investors, stoking volatility, and now may claim a major casualty in risk assets: the six-week streak of gains in the S&P 500. For a clue as to why, consider the massive glacier of cash that many hoped was poised to melt out of money market accounts and provide fresh impetus for stocks. Textbooks would tell you that rising rates are scary for equities because of their impact on valuation -- they debase future earnings in discounted cash flow diagrams and other fancy models. But a simpler explanation for why a backup in yields may put the rally at risk is the chilling effect it has on people who might have been thinking about moving their money out of cash. Aggressive bets on further Federal Reserve easing have been quietly evaporating as economic data keeps surprising to the upside. The most recently evidence was Thursday's unexpected drop in weekly initial jobless claims. Currently, traders are pricing in just about 40 basis points of cuts over the remainder of 2024. That's a far cry from the odds of an additional 80 basis points of easing that investors were positioning for in mid-September. Such pricing and the concurrent fattening in short-term bond yields implies all that cash sitting in money-market funds — $6.51 trillion, to be precise — may not come pouring out any time soon. It was easy to build a bull case on top of still-sidelined cash a month ago: a dramatically easing Fed meant that those lofty cash yields were doomed to drop, chasing that money back into the arms of the equity market. A less-urgent central bank could conceivably kneecap that narrative. —Katie Greifeld |

No comments:

Post a Comment