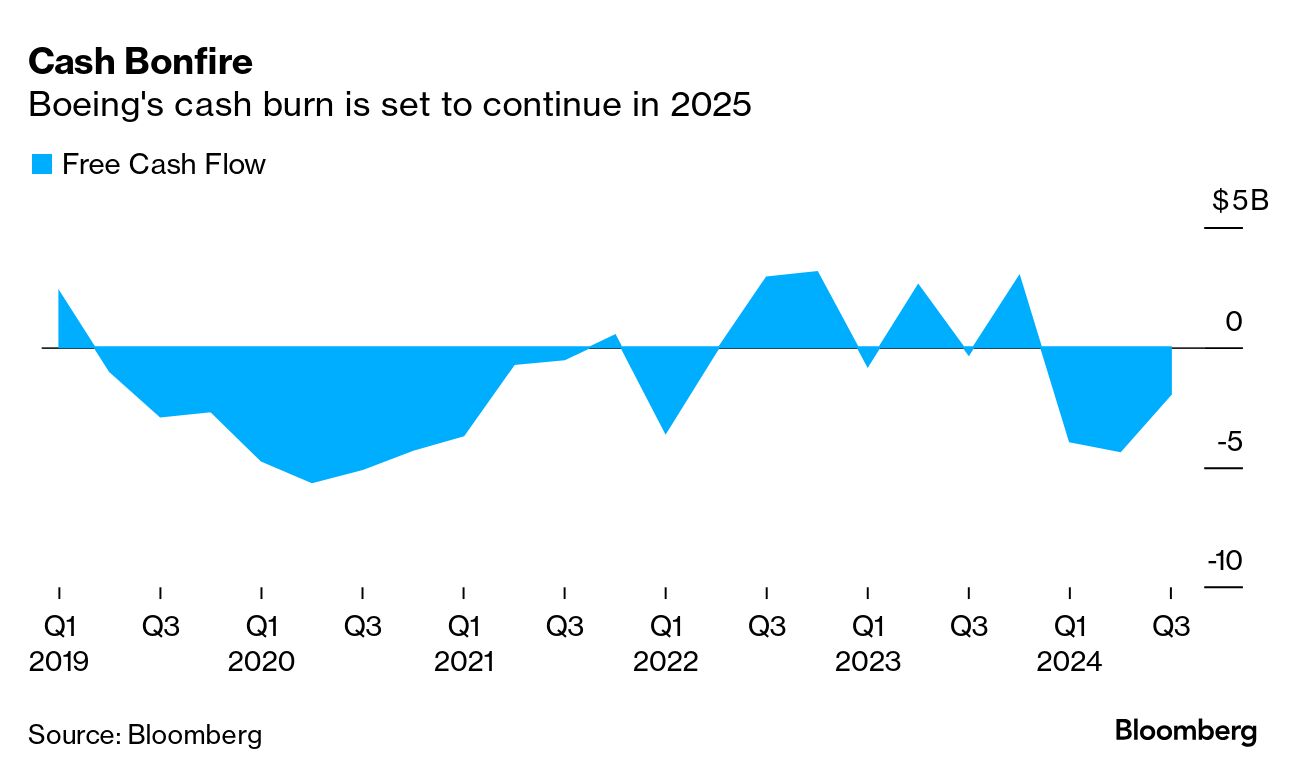

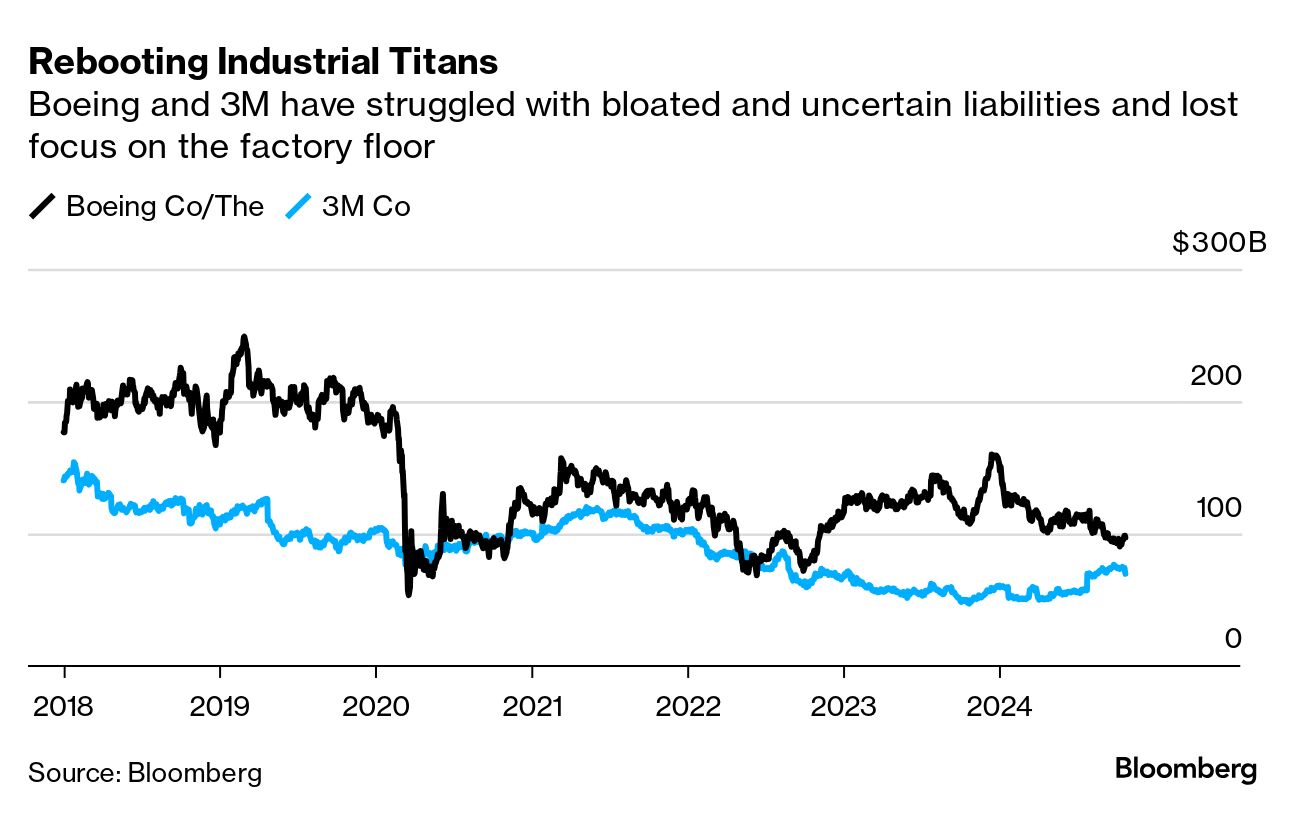

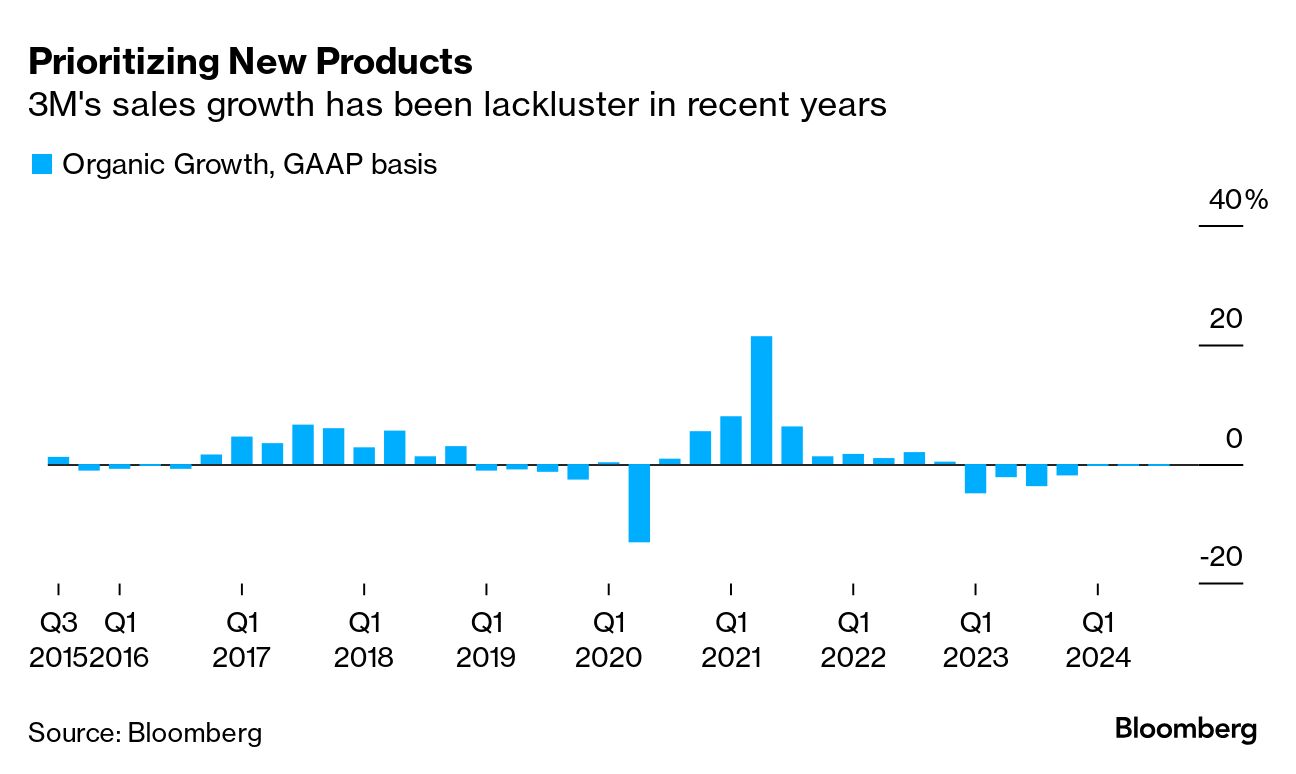

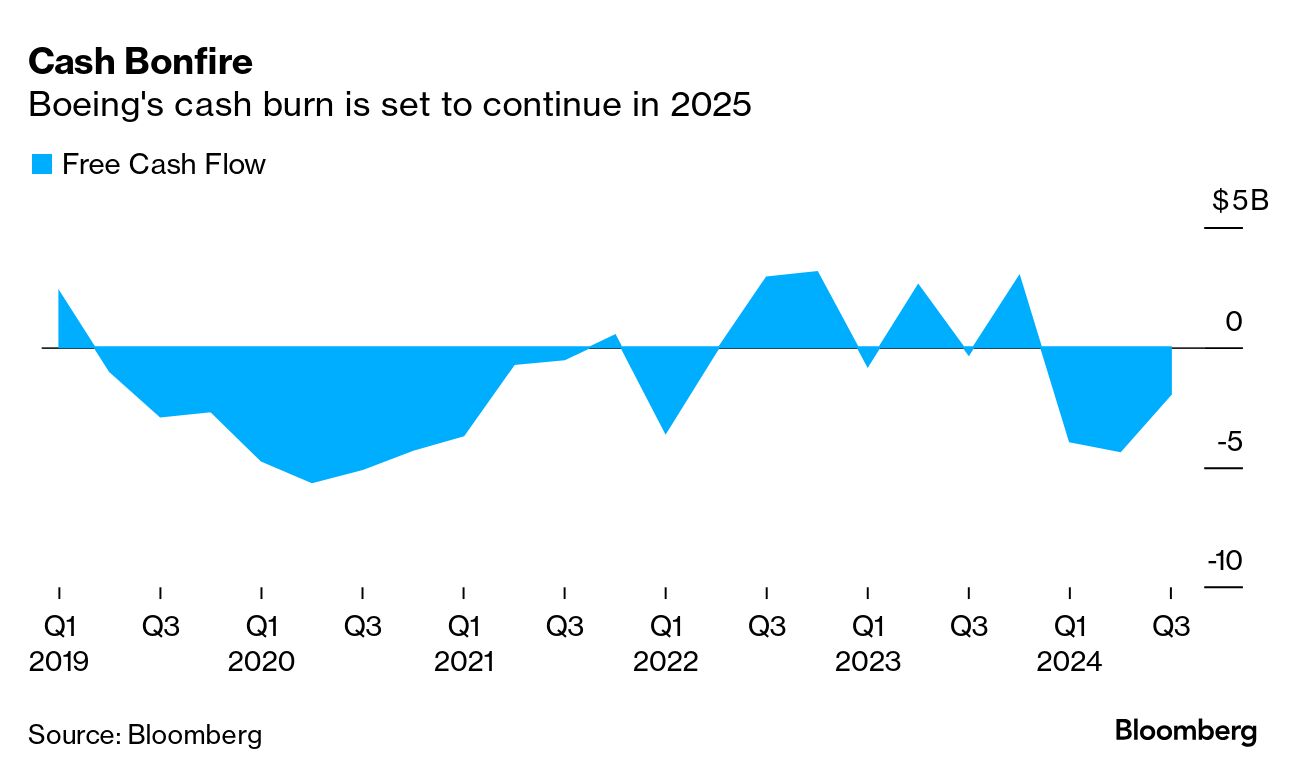

| Have thoughts or feedback? Anything I missed this week? Email me at bsutherland7@bloomberg.net. To get Industrial Strength delivered directly to your inbox, sign up here. Industrial turnarounds are measured in years, not quarters, and there are no quick fixes for cultural atrophy and lackadaisical manufacturing practices. That was the takeaway from earnings updates this week from 3M Co. and Boeing Co., two industrial giants that might charitably be described as being in turnaround mode after losing a combined $150 billion of market value since the start of 2018. Both companies have new CEOs: Bill Brown, the former L3Harris Technologies Inc. leader, took on the top job at 3M in May, while Kelly Ortberg became Boeing's chief executive officer only in August. Both Brown and Ortberg have earned praise for being clear-eyed about the challenges their companies face and for outlining specific priorities for improvement, with an emphasis on the factory floor and a back-to-basics approach for good manufacturing hygiene. But the two leaders have also been at pains to emphasize that they're at the beginning of a protracted process. "These are only initial steps on a long journey," Brown said on 3M's earnings call Tuesday, in reference to his efforts to revitalize the company's pedestrian sales growth by reinvigorating new product development and better focusing its research and development spending. He's also working on improving 3M's delivery performance, after 11% of its goods showed up late or only in part for customers as of the end of the third quarter. "I know we've lost business and have paid fines due to poor delivery performance," Brown said. Still, a fix is "not going to happen overnight," he said. Read more: 3M Is Adrift, and There's No Easy Solution "A lot of these things are going to be realized over time," Brown added of his efforts to make 3M's sprawling supply chain and network of factories more efficient. "This is a football metaphor: it's a couple of yards in a pile of dust and lots of ways to get the ground game going on operational excellence." And that's before taking into account lingering liabilities tied to 3M's legacy manufacturing of per- and polyfluoroalkyl substances, which are known as forever chemicals because they linger in the body and the environment. Barclays Plc analyst Julian Mitchell estimates an additional $10 billion of potential PFAS liabilities for 3M that have yet to be resolved. 3M shares declined 2.3% on the Tuesday earnings update and continued sliding through Thursday. "Despite Bill Brown's impressive playbook for addressing many of the operational weaknesses at 3M, the company is still in the early innings of what is likely a multi-quarter/year (and at times disruptive) turnaround," RBC analyst Deane Dray wrote in a note. Over at Boeing, Ortberg pledged to make Boeing an airplane manufacturing company again — with the culture and attention to factory detail to match. But this is more of "a continuous process improvement rather than a milestone," he said on the company's earnings call on Wednesday. "We have some really big rocks that we need to get behind us to move the company forward." One of those rocks is a strike by 33,000 members of a machinists union that has shuttered Boeing's factories in the Pacific Northwest and halted production of the 737 Max jet, depriving the planemaker of its biggest cash-generating product for the time being. That strike is set to continue after workers late Wednesday rejected a new labor contract that would have increased their wages by 35% over four years. The extension of the work stoppage raises fresh questions about a disappointing free cash flow outlook that Boeing had offered mere hours earlier and another of Ortberg's "rocks" — the fragility of the company's investment grade rating. The company was already expecting to burn about $4 billion in cash in the fourth quarter, putting it on pace for an outflow of about $14 billion in total this year. It was also preparing to burn cash again next year, given the challenges of restarting production, preparing the 777X widebody jet for its much-delayed entry into service and navigating regulatory oversight of its manufacturing processes.  S&P Global Ratings has estimated the strike is costing Boeing about $1 billion a month. Both S&P and Moody's Ratings have said in recent weeks that they're considering cutting Boeing's credit grades into junk territory.

"We have a lot of work to do," Ortberg said. "We have a plan, and change is already underway. This is a big ship that'll take some time to turn." Boeing's shares continued their slide this week, putting the company on track for its worst annual performance since 2008. It's no small thing to be forthcoming and specific about what ails a more than 100-year-old manufacturing giant with a storied history and plenty of regulatory and legal baggage. If it was easy, Brown and Ortberg's predecessors would have done it and the current CEOs wouldn't have the jobs they do today. Both of them have the benefit of an outsider's perspective, similar to that which Larry Culp brought to General Electric Co. in 2018. Culp's systematic improvement of GE's manufacturing processes generated the stability necessary to chip away at a mountain of debt and eventually break up the quintessential industrial conglomerate. Read more: GE Bet on Being the Biggest, Then It Had to Break Up to Keep Up But the recent experience of GE can be deceiving. Shares of the company — which now primarily just sells jet engines — are up more than 75% this year, while its GE Vernova Inc. energy spinoff is the best performing industrial stock on the S&P 500 so far this year. That didn't happen overnight; Culp's turnaround took years and was full of false starts, not to mention a pandemic. "The returns of hindsight capital are legendary," said Josh Runion, an industrial analyst at wealth advisory firm Mariner. The firm owns 3M shares in customized client accounts but has declined to invest in the conglomerate for its actively managed internal strategies. There are better opportunities elsewhere in the industrial sector and there's a risk that 3M stock moves sideways after a roughly 40% rally this year as Brown slogs through his turnaround efforts, Runion said. Similarly with Boeing, with the shares down 40% so far this year, "we can understand why investors might be looking at this as a trough for the share price," Vertical Research Partners analyst Rob Stallard wrote in a note. "But it is a leap of faith that we find hard to take at this point. We agree with Kelly that Boeing has some big problems, and it's going to take some time to fix them." "I am sharing my remarks directly with you this morning, because when it comes to our future the only way to be successful is by working together." — Boeing Co. CEO Kelly Ortberg Ortberg made the comments in a message to employees this week, explaining his decision to share his full prepared remarks for the planemaker's earnings call in advance. He not only shared them with Boeing's workers; they were also released to the public around the same time as the company's third-quarter report. The point may have been to encourage solidarity with a workforce that's borne the brunt of Boeing's many challenges over the years and is freshly divided by a prolonged labor strike and plans to cut 17,000 jobs. But it also begs the question of why more companies don't handle their earnings calls this way. For the uninitiated, the typical approach to earnings reports is to put out a press release and a slide deck presentation with (most of) the important numbers and then host a call with analysts (and sometimes media) several hours later. The first half of the earnings call is traditionally devoted to prepared remarks from the CEO and the chief financial officer. For most normal companies, these comments often just reiterate what was already in the press release with the added pizazz of canned corporate jargon. Once that's over, analysts get to ask questions, which usually provoke more insightful and human commentary. It's never been totally clear what the point of this structure is. Ortberg did go through the motions of still reading his prepared remarks on Boeing's earnings call but he didn't technically have to do that. If every company pre-released the CEO commentary, then executives could spend more time answering questions and providing context for their results. Or they could simply cut the length of earnings calls (which often run about an hour long) in half. Such time savings would be quite valuable for analysts and investors, particularly on crowded earnings days. On Thursday morning, for example, nine different industrial companies on the S&P 500 Index reported their results. Earnings calls serve an important purpose as a public discussion forum on the state of a company's business. They give analysts, investors and journalists an opportunity to dig deeper than formulaic and arguably random sets of numbers. It's a practice that should be maintained. But it's also one that could use some updates. Southwest Airlines Co. reached a truce with Elliott Investment Management that will see five of the activist shareholder's proposed candidates join the airline's board. In addition to those backed by Elliott, including former Virgin America CEO David Cush and ex-WestJet CEO Gregg Saretsky, Southwest said that former Chevron Corp. CFO Pierre Breber will also become a director. Southwest Executive Chairman Gary Kelly agreed to accelerate his retirement to help make way for the new directors, although CEO Bob Jordan is staying in his role — for now. Elliott had sought to oust both leaders but has agreed to a standstill and information sharing agreement with Southwest in conjunction with the board overhaul.

Siemens AG is in talks to acquire industrial software maker Altair Engineering Inc., Bloomberg News reported, citing people familiar with the matter. Altair has a market value of about $8.9 billion. The company has been exploring a sale and other bidders may emerge, the people said. Such a deal would be Siemens' largest acquisition and would deepen the company's focus on technologies that power digitally connected factories and other industrial sites.

Spirit Airlines Inc. is weighing a potential bankruptcy filing as a means of facilitating a takeover by Frontier Group Holdings Inc., Bloomberg News reported, citing people with knowledge of the matter. Frontier had agreed to acquire Spirit for $2.9 billion in early 2022 before JetBlue Airways Corp. wrested the airline away with a series of higher bids. JetBlue's proposed acquisition of Spirit collapsed earlier this year after a federal judge sided with the Justice Department in blocking the deal on antitrust grounds, sending shares of the would-be target into a tailspin and forcing tough conversations with creditors. A potential takeover of a bankrupt Spirit by Frontier is less likely to spark antitrust pushback than the defunct JetBlue deal, in part because Spirit's future as a standalone company is murky. Spirit, which now has a market value of about $300 million, separately this week said it had sold some of its Airbus SE jets for $519 million to help boost its liquidity. Alaska Air Group Inc. completed its takeover of Hawaiian Holdings Inc. in September after getting clearance from the Transportation Department with commitments to preserve service on key routes and to rural areas. - Sales of existing homes are on track for the worst year since 1995

- But the worst of the home-remodeling spending slump may be over

- GE Vernova takes $700 million charge as offshore blade issues swell

- Mexico needs a national car champion but not a government-run one

- Rivian's Illinois factory racks up staggering number of safety violations

- Arkansas may have vast reserves of lithium, a key battery ingredient

- FAA releases final safety rules for emerging air taxi industry

- Auto supplier Dana explores sale of off-highway unit

- FreightVana focuses on flexibility, hard-to-reach markets: Talking Transports

- Specialty chemicals maker Element Solutions is up for sale

- Manufacturing loses luster as emerging economy growth booster

- The F-35 has missed its combat readiness goals for six years straight

- How Home Depot's 12-foot skeletons changed the Halloween industry

|

No comments:

Post a Comment