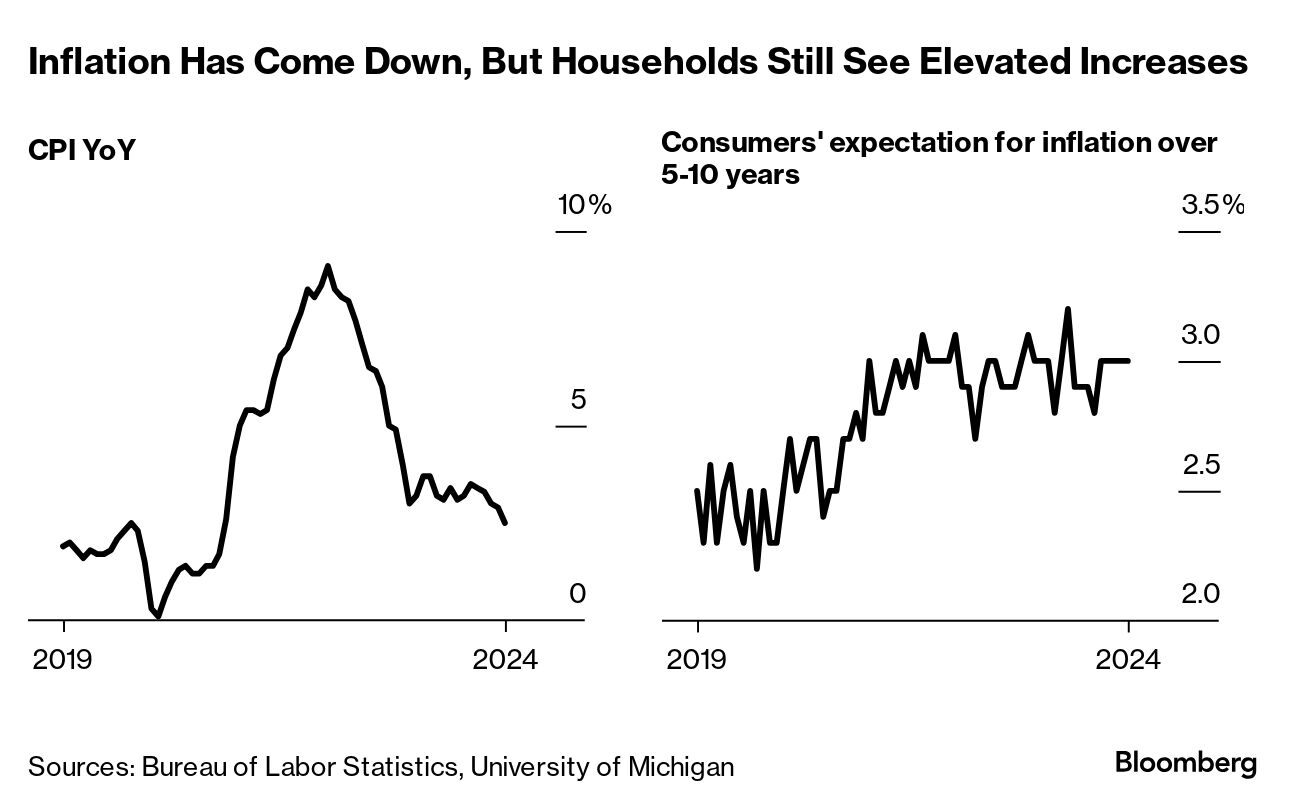

| I'm Stephanie Flanders, head of economics and government at Bloomberg News. Today we're looking at policymaking takeaways from the inflation shock that's now moving into the rear-view mirror. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. On Thursday, the latest reading on US consumer prices is expected to show that the inflation genie has effectively been put back in the bottle — with a 2.3% gain for the 12 months to September, the smallest since early 2021. But surveys show households still see big price gains looming for years to come. So inflation lives on in people's minds — and continues to haunt the politicians whom voters' blame for high prices. That's one lesson of a year of tough election campaigns, not just in the US, but on both sides of the Atlantic. Here's another: Our standard toolkit for responding to big swings in the prices that matter most to voters, and the economy, needs an overhaul. Relying solely on interest rates to tackle the kind of "shockflation" experienced in recent years isn't just politically corrosive, it's costly. The central bank ends up squeezing household spending with higher rates just as governments are spending billions on programs to cushion the cost-of-living crisis. The bottom line is that every government ought to be thinking about how to do better the next time. We don't have a full toolkit yet. But here are three early rules of the road: Limit the Pain Preventing shocks from spreading means more intervention than we were taught in neoliberal Economics 101. The trick is not to intervene so much that the price mechanism fails completely to reshape incentives. A 2022 case study from Germany is worth noting. When gas prices surged, the government came up with a "price brake." That involved applying a well-below-market price cap on 80% of the average household's gas consumption of the previous year. Consumption above 80% had to be paid at full market prices. So households were shielded, but still had an incentive to conserve. Preparation, Preparation Governments should be prepared for companies using price shocks as an excuse to raise margins, especially if a few dominate an industry. It would be useful to identify vulnerabilities posed by extreme concentration and take action before any shock materializes. Reversing over-concentration would not only reduce the risk of price gouging in a shock, but boost long-term growth and productivity to boot. Don't Make It Worse It may seem obvious, but adopting measures that are likely to lead to higher prices should be put off, or canceled, if at all possible. For example, imposing a series of tariff hikes on a competitor nation's imports would be particularly awkward at a time when domestic households are already confronted with a price shock. For more, subscribe to the Voternomics podcast, a weekly look at the way geopolitics — and elections — are upending the longstanding assumptions of policymakers and business people around the world. - The Bank of Japan signaled it's on track to consider more rate hikes, and the country's finance minister cautioned against sudden yen moves.

- French Finance Minister Antoine Armand said the government will present a budget this week that respects EU rules.

- Thailand's Finance Ministry plans to propose a higher inflation target, adding pressure on the central bank to cut its key rate.

- Indonesia's central bank is stepping into the market to support the rupiah that's in its longest losing streak since 2023.

- The Bank of England is tapping TikTok influencers in its quest to reach Gen Z.

- South Africa's many inequalities are obvious, but its sweltering shantytowns versus the cool shade of verdant suburbs isn't among them.

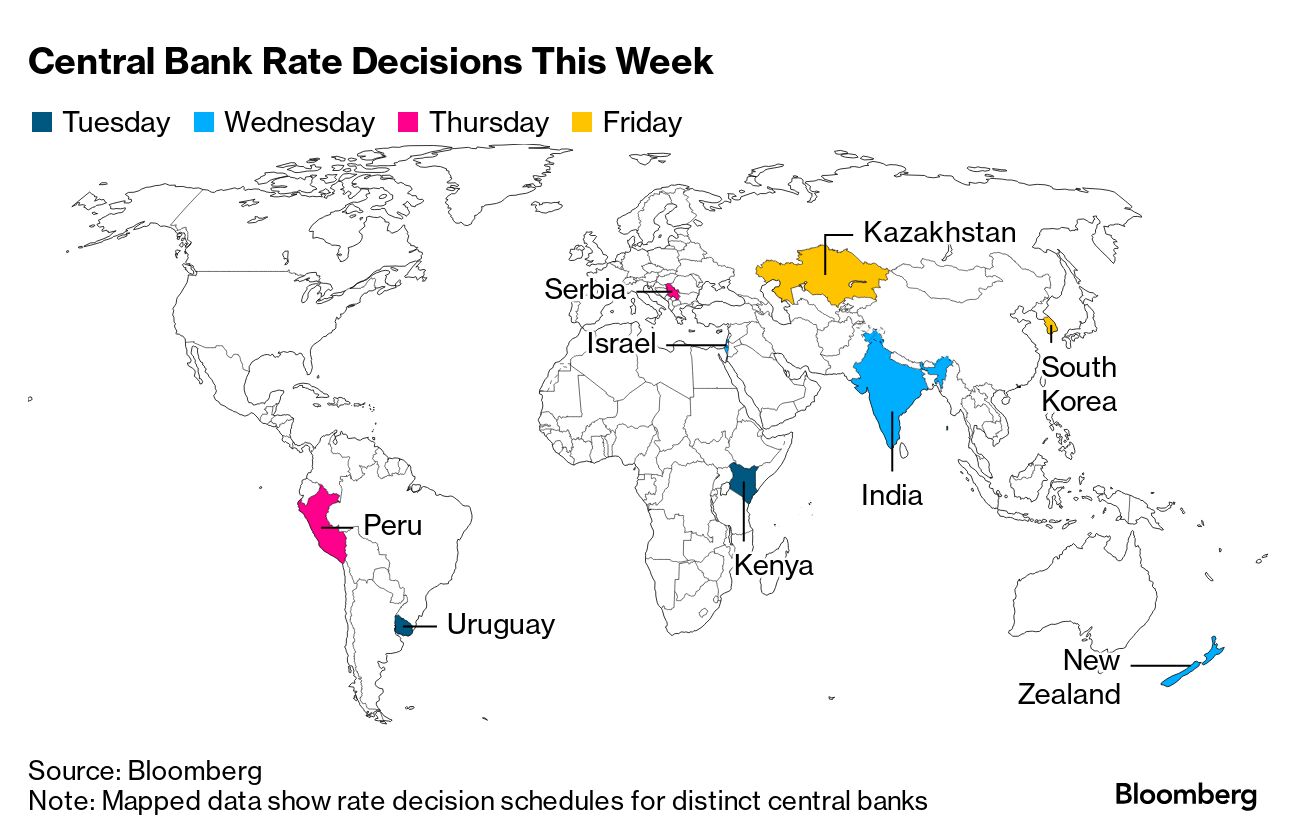

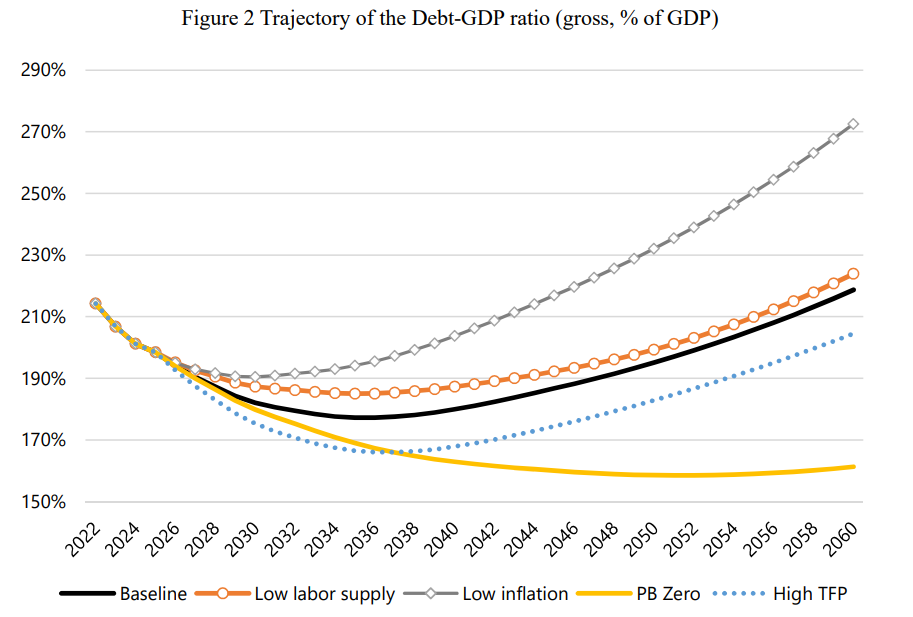

In addition to US inflation numbers on Thursday, this week will see a report on producer prices — a gauge of inflationary pressures faced by businesses. The University of Michigan issues its preliminary October consumer sentiment index and the Federal Reserve will release minutes of the central bank's September meeting. The ECB also publishes such a report, central banks from New Zealand to South Korea may cut rates and France will reveal its budget. See here for the rest of the week's economic events. Among the positives from Japan's turn to inflation in recent years is the prospect that a bigger nominal GDP will help to reduce the developed world's biggest debt burden. A recent working paper by five academic economists for the Japan Center for Economic Research cautions, however, that this dynamic is likely to prove temporary, assuming inflation trends at the 2% target. "Even under optimistic assumptions where the nominal economic growth rate exceeds the interest rate for most of" the coming few decades, the debt ratio rises. "The long-term trajectory is unsustainable," with debt diverging above the path of GDP, they concluded. Stabilizing the situation will necessitate "significant adjustments, such as substantial expenditure cuts, tax increases" or even sharper acceleration in inflation, they wrote. Bloomberg New Economy: The world faces a wide range of critical challenges, ranging from ongoing military conflict and a worsening climate crisis to the unforeseen consequences of deglobalization and accelerating artificial intelligence. But these challenges are not insurmountable. Join us in Sao Paulo on Oct. 22-23 as leaders in business and government from across the globe come together to discuss the biggest issues of our time and mark the path forward. Click here to register. |

No comments:

Post a Comment