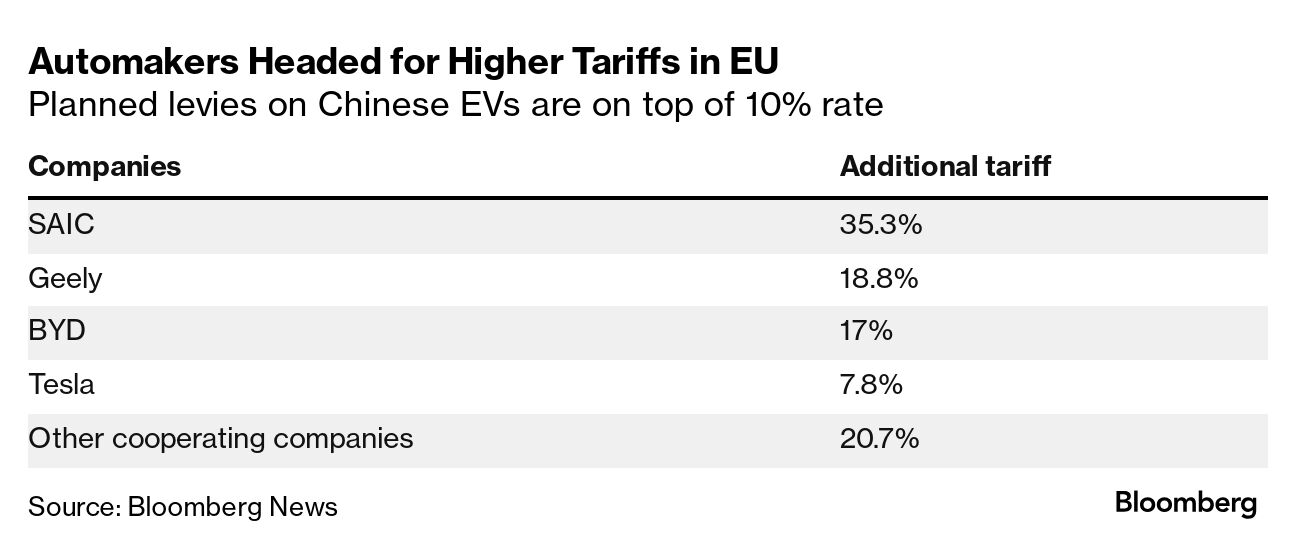

| For years the European Union has talked a tough game on China but words didn't always translate into action. That may have changed last week when the bloc voted to impose tariffs as high as 45% on electric vehicles from the Asian country — the EU's third-biggest trading partner. Spurred on by its carmakers,Germany pushed hard for a softer approach and voted against the levies along with four other member states, including Hungary. Ten nations, including Italy, France and Poland, stuck their necks out and voted in favor of the tariffs. Twelve others, including Spain, abstained. The EU and China will keep negotiating to find an alternative to the tariffs despite the result. The two sides are exploring whether an agreement can be reached on a complicated mechanism to control prices and volumes of exports in place of the duties. Read More: EU Tests Mettle to Take On China With New EV Tariff Fight Any solution "would have to be fully WTO-compatible, adequate in addressing the injurious subsidization established by the commission's investigation, monitorable and enforceable," the bloc's executive arm said after the vote, referring to World Trade Organization rules. Without an agreement, the tariffs are now due by November and would be in force for the next five years. The new rates will be as high as 35.3% and come on top of the existing 10% rate. Read More: VW CEO Sees Threat of Retaliatory Tariffs From China The move is likely to pave the way to more robust trade relations between Brussels and Beijing. Though its efforts to divide member states fell short, China has already threatened to retaliate by targeting imports of pork, dairy, brandy and cars with large engines. The EU has made clear it will defend its interests against any such moves. Now the focus has turned to how and when Beijing will retaliate for the escalation in its biggest trade dispute with the bloc in years. Related Reading: —Alberto Nardelli in London Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment