| I'm Chris Anstey, an economics editor in Boston. Today we're looking at reporting by Liz Capo McCormick and Saleha Mohsin on the implications of the US congressional election. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - Fed Chair Jerome Powell is unlikely to win another big rate cut from his policy committee so long as the labor market holds up.

- Coming Up: Economists anticipate that key measures of US inflation decelerated in September.

- The World Bank raised its growth forecast for South Asia for this year.

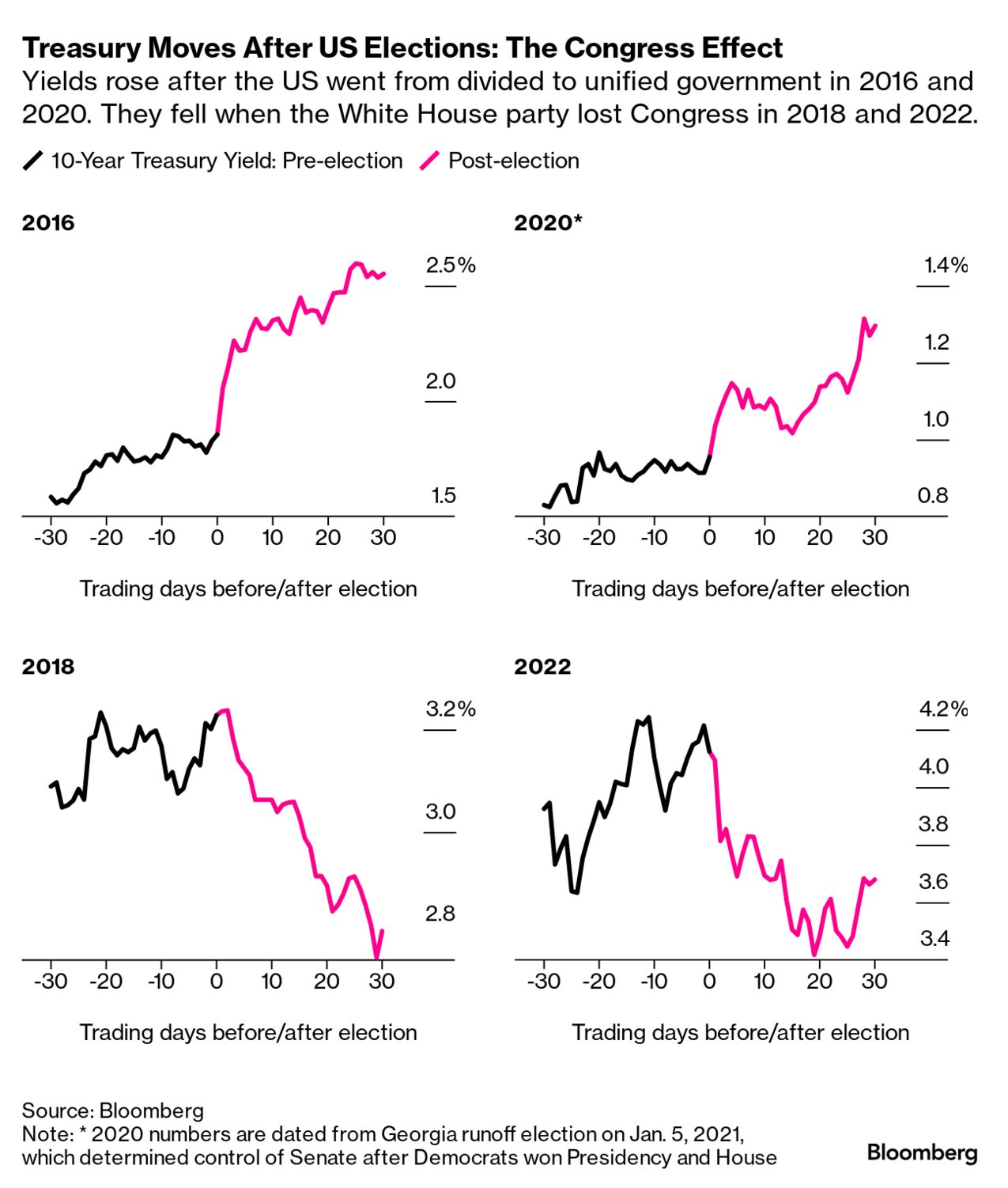

While the public's big fixation right now is on the deadlocked US presidential election, given that it's the Congress that retains the power of the purse, it's worth keeping a close eye on key Senate and House races that may tip the balance of power. It's in the legislature where costly campaign pledges will either get reined in or rubber-stamped — potentially worsening an already-historically high debt burden. Donald Trump and Kamala Harris are both vowing to juice the economy with some combination of tax cuts and new spending, even though the budget is already deep in deficit and growth is running at a healthy clip. The $28 trillion Treasury market has remained largely unfazed, perhaps because polls point to a split Congress that would likely stymie many of the next president's plans. But past congressional outcomes have taken markets by surprise — a reminder that it's control of the legislature, as much as the White House, that shapes America's fiscal path. In 2020, for example, Joe Biden's presidential win didn't shift Treasuries much. Yields took off a couple months later when a run-off vote in Georgia unexpectedly flipped the Senate to Democratic control and opened a door for Biden's spending bills. For now, investors are more focused on the prospect of further Federal Reserve interest-rate cuts than in the potential for one political party to ram through major fiscal legislation next year. But in a post-election economy that's still running hot, the Treasuries market would be "more sensitive to fiscal issues," says Gary Schlossberg, global strategist at Wells Fargo Investment Institute. "Especially if the budget deficit is not coming down, or deteriorating more than expected." The gap for the fiscal year just ended is forecast to come in around $1.9 trillion, up from $1.7 trillion for 2023. Debt interest payments currently account for 13% of public spending, the highest share since 2000. - France is about to unveil its initial course of shock therapy to tackle swelling budget deficits, aiming to reassure skeptical bond investors and navigate forceful opposition in a fractured parliament.

- Wages offered to new hires in China declined after two straight quarters of gains, in a sign of a weakening labor market.

- Donald Trump said he would end income taxes on Americans living in other countries.

- Indonesia's President-elect Prabowo Subianto said that his cabinet may consist of many ministers serving under incumbent leader Joko Widodo.

- Hong Kong's slumping housing market has received a long-awaited boost from interest-rate cuts and a stock market rally.

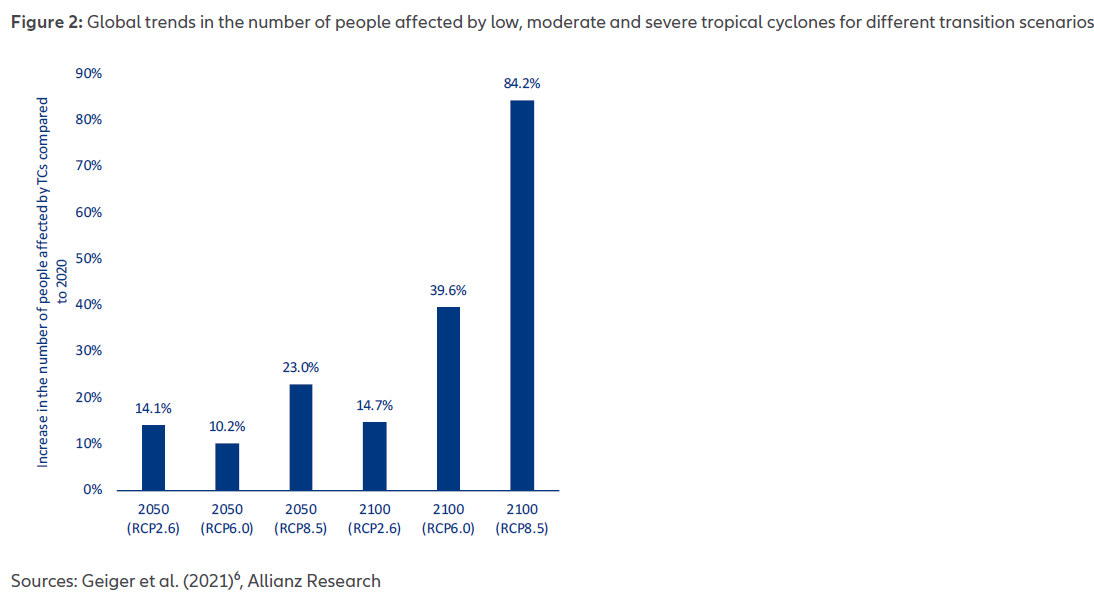

As Hurricane Milton threatens the state of Florida, a new report from economists at the German insurer Allianz warns that tropical cyclones are an increasingly damaging economic force. "The current decade has already incurred $460 billion in damages, double the total losses from 1980 to 1999," Hazem Krichene and colleagues wrote in the report Wednesday. "While immediate economic losses from tropical cyclones are evident, the ripple effects on global supply chains and maritime trade often go unnoticed." If policymakers don't prepare with adaptation measures — investing in infrastructure and early warning systems, setting up financial safety nets and considering nature-based solutions — "the economic consequences of tropical cyclones are likely to escalate as these events become more frequent and intense," the Allianz team wrote. Bloomberg New Economy: The world faces a wide range of critical challenges, ranging from ongoing military conflict and a worsening climate crisis to the unforeseen consequences of deglobalization and accelerating artificial intelligence. But these challenges are not insurmountable. Join us in Sao Paulo on Oct. 22-23 as leaders in business and government from across the globe come together to discuss the biggest issues of our time and mark the path forward. Click here to register. |

No comments:

Post a Comment