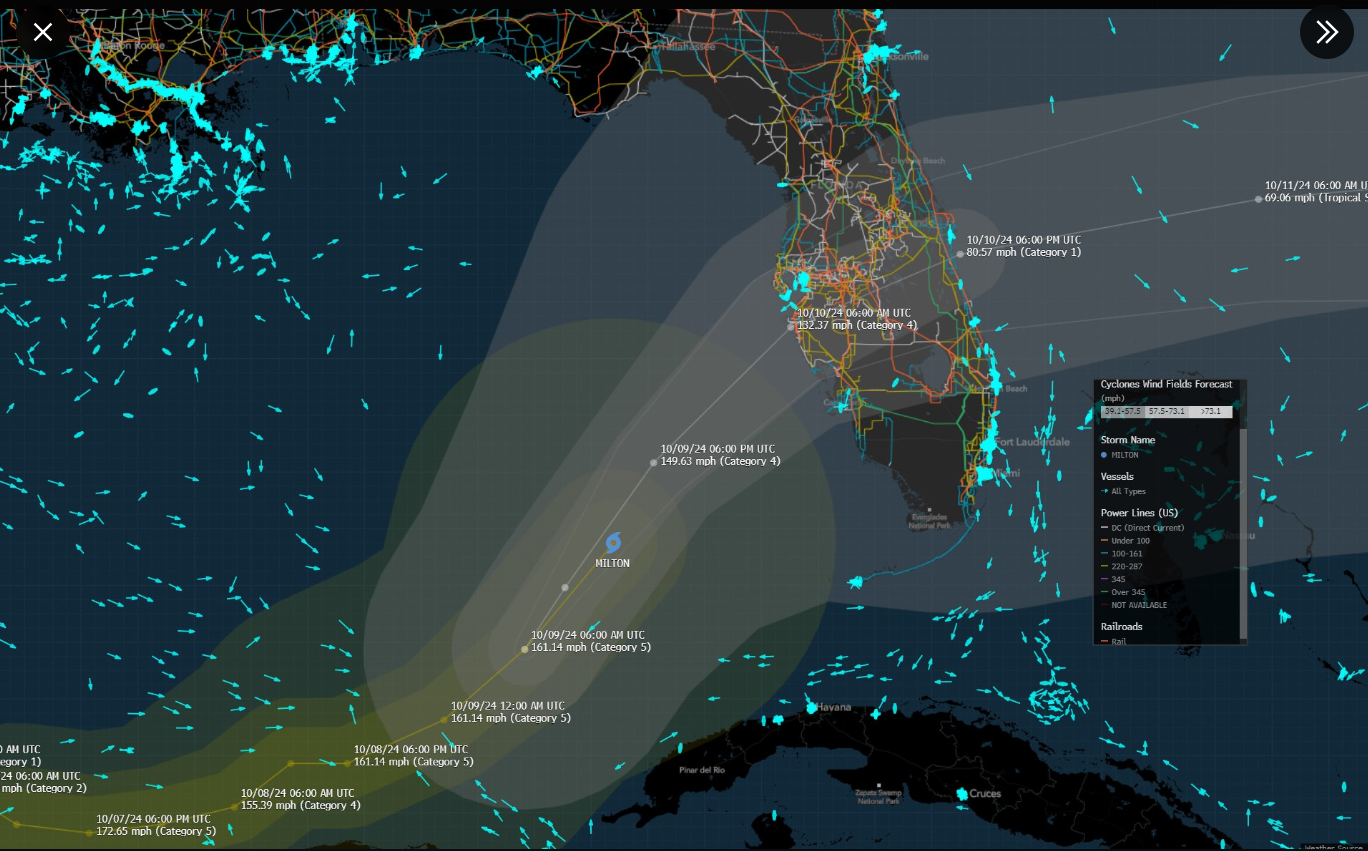

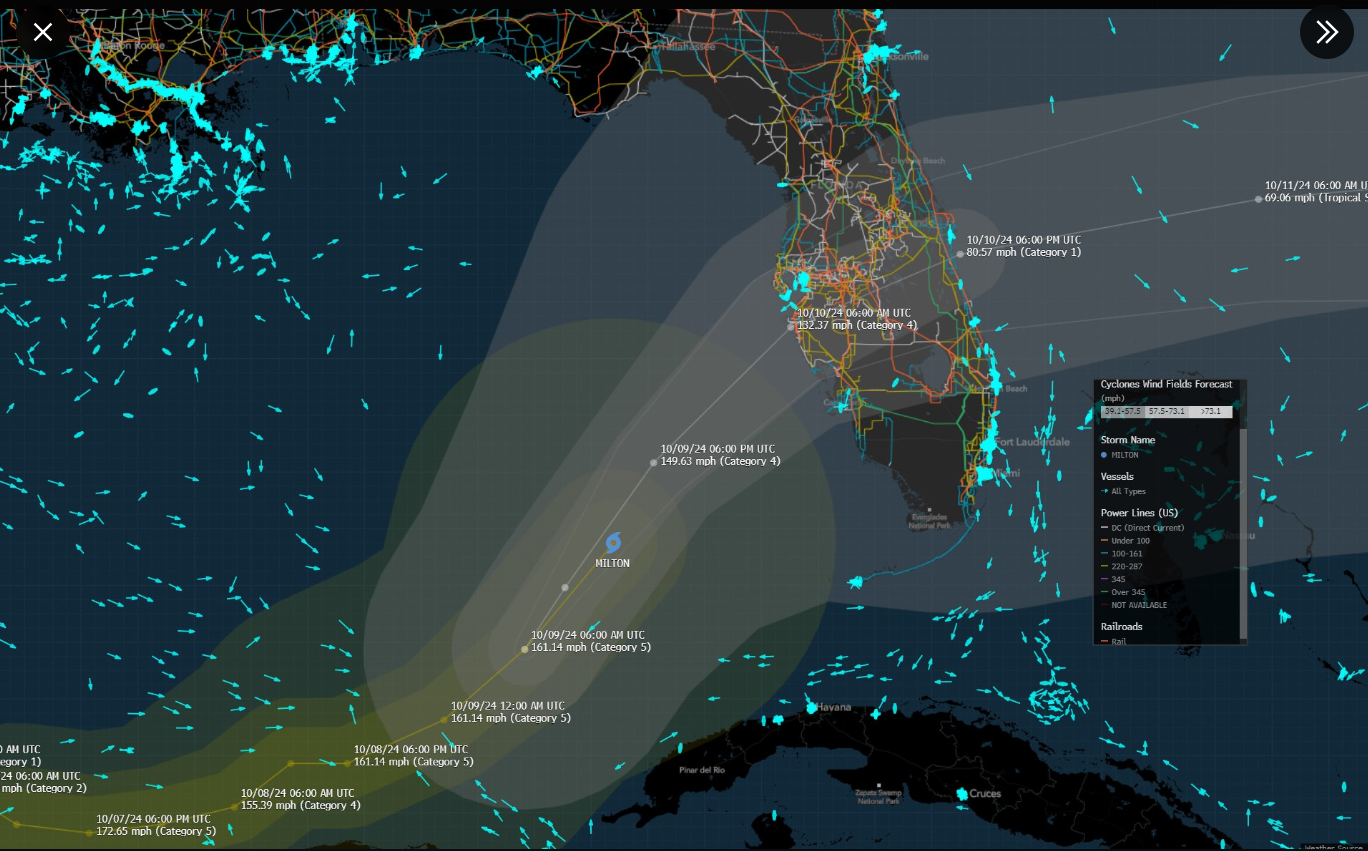

| Florida's Tampa Bay-St. Petersburg area is waking up to widespread damage from Hurricane Milton, just as residents, businesses and utilities were recovering from destruction wrought by another big storm just two weeks ago. Milton made landfall Wednesday evening as a Category 3 hurricane — threatening lives, billions of dollars in infrastructure damage and building-material shortages in a state economy that ranks as the fourth-largest in the country by annual GDP. Follow Bloomberg's TOPLive blog here. Here's More of the Latest: Port Tampa Bay, which closed shipping operations before Milton arrived, handles a variety of goods arriving in containers, as well as bulk cargo, passenger cruise lines and fuel. Tampa is also a key gateway for US fertilizer exports, and an expert warns that prices could stay elevated for the foreseeable future. Officials are "very focused on things like Port Tampa Bay, where about 40% of the refined petroleum that comes in serving the state of Florida comes through," US Transportation Secretary Pete Buttigieg said on CNN. "We just won't know until the damage assessments are through, how long it's going to take to get that port back up and running." Fuel Transport As long as the predicted 15-foot tidal surge doesn't damage the port's fuel storage tanks, they can be refilled by tanker ships waiting to arrive once the storm leaves the area. But gas stations around Central Florida are already low as residents fueled up their vehicles to flee, and refilling them will require trucks to bring fuel from depots to service stations and distribution hubs. "You're going to have a lot of fuel at the port," said maritime historian and former merchant mariner Sal Mercogliano on Wednesday. The problem in central Florida is getting it out of the port and to its destination, he said. Once this storm hits and starts wiping out roads, and knocking down powerlines, the distribution will be more difficult, he said. Given that Florida is a long peninsula, recovery operations are going to require substantial maritime assets from both the private sector and the government, Mercogliano said. Trucking Capacity Trucks hauling goods into and out of Central Florida were scarce on Wednesday as truckers in the Southeast braced for Milton while still recovering from the previous hurricane. In Helene-stricken Tallahassee, demand for flatbed trucks, which haul things like generators and building materials, rose 68% last week compared to the week before, according to freight and analytics firm DAT. "Hurricane Helene is sort of a precursor to what we're going to see with Milton," said Dean Croke, principal industry analyst at DAT.  Bloomberg's Michael McDonough posted an image of Hurricane Milton's projected path, along with key infrastructure: transmission lines, railroads and ocean vessel locations. Trucking rates are expected to jump after the storm as capacity constricts further. The back-to-back disasters are reminiscent of the 2017 hurricane season which brought Hurricanes Harvey, Irma, Jose and Maria and sparked a rally in trucking freight rates, Croke said. "They have a tendency to move markets," Croke said of the storms. "What goes up doesn't come down. It kind of stays up because of the catalyst that it provides for the rest of the the economy as it tries to recover from the devastation." Fertilizer Hub Tampa's port also handles about 25% of all US fertilizer exports, according to Veronica Nigh, senior economist at The Fertilizer Institute. The Tampa region produces more than 40% of the country's ammonium phosphate, and 32% of phosphate rock capacity is in the area, she said during a post on YouTube this week. "Certainly the impact of these hurricanes is going to continue to lead to elevated phosphate prices for the foreseeable future," she said. Mercogliano said major damage to the port would have "a big hit on the economy." Melissa Seixas, president of Duke Energy Florida, said the utility is preparing for Milton but there's nothing it can do to protect electricity infrastructure in the Tampa area from a storm surge of 10 to 15 feet. The company just replaced hundreds of transformers destroyed by Helene two weeks ago and that equipment is now vulnerable again. —Laura Curtis in Boston Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment