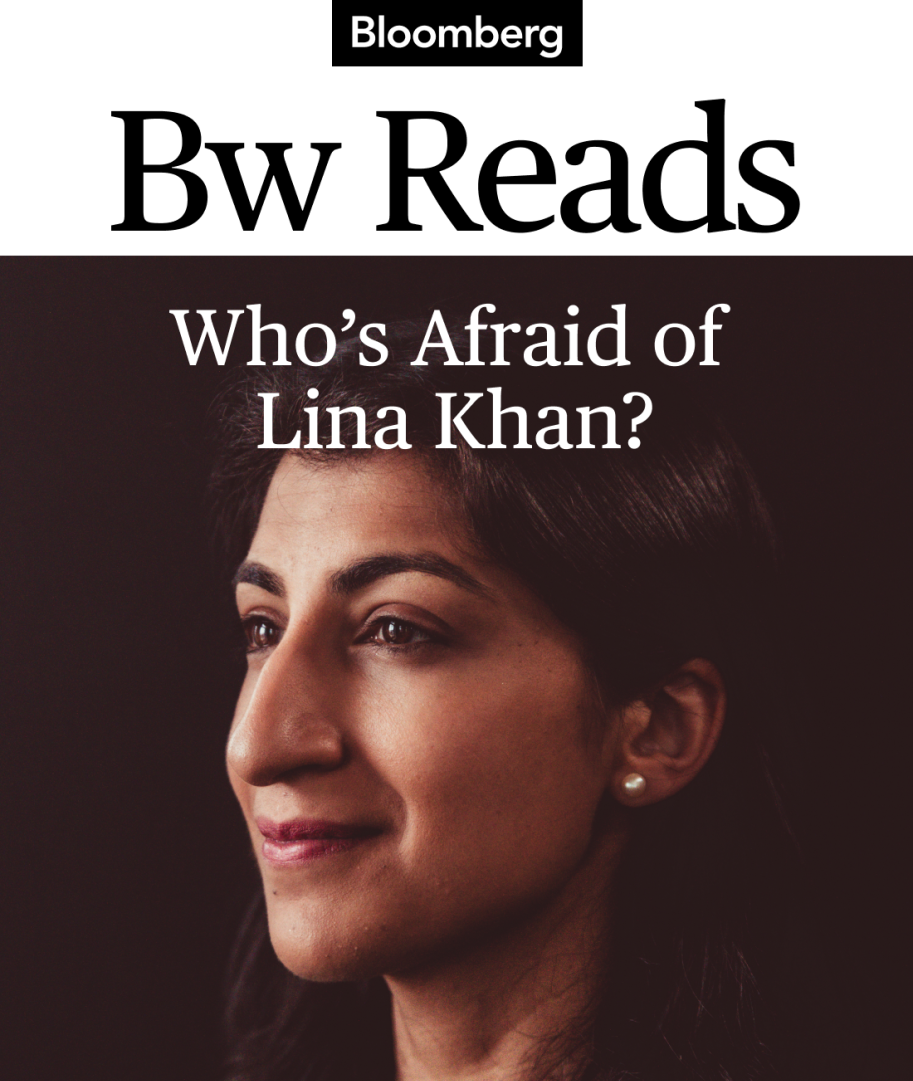

| Welcome to Bw Reads, our weekend newsletter featuring one great magazine story from Bloomberg Businessweek. Today it's Josh Eidelson and Max Chafkin's profile of Lina Khan, the chair of the Federal Trade Commission, who's aggressively fought mergers and noncompetes—and angered Democratic donors along the way. You can find the whole story online here. If you like what you see, tell your friends! Sign up here. A few days after Joe Biden dropped out of the presidential race in July, Reid Hoffman appeared on CNN and voiced his support for Kamala Harris, with an asterisk. Hoffman, a Democratic megadonor and venture capitalist best known for co-founding LinkedIn, made his case for Harris as the candidate of business. He said that as a former senator from California, she understood the value of his industry. He said that in contrast to Donald Trump, she represented stability, unity, the rule of law. But there was at least one person he hoped she wouldn't keep around: Lina Khan, the chair of the Federal Trade Commission. Khan, he said, was overstepping her bounds, "waging war" on business and "not helping America." Soon after, media mogul Barry Diller, chairman of IAC Inc., echoed the call for Khan's ouster, telling CNBC she was a "dope." He and Hoffman joined the bipartisan club of tech figures who've singled her out for criticism, including venture capitalists Vinod Khosla, Chamath Palihapitiya, Joe Lonsdale and Peter Thiel. What neither Hoffman nor Diller mentioned was that their interest wasn't exactly dispassionate. At the time both billionaires called for Khan's firing, she was investigating their businesses. In August the FTC announced an $8.5 million settlement with an IAC subsidiary it accused of deceiving workers. The company didn't admit wrongdoing. Diller retracted his use of the word "dope" but not his call for Khan's removal. He declined to comment for this story. Hoffman, who's on the board of Microsoft Corp. and was an early investor in OpenAI Inc. and board member until last year, is a party to five different FTC inquiries. The agency is investigating whether Microsoft's $13 billion-plus investment in OpenAI violated antitrust law; whether OpenAI violated consumer protections; and whether a $650 million deal between Microsoft and Inflection AI, another company Hoffman co-founded, was structured to avoid FTC scrutiny. According to a person familiar with the agency's investigations, who spoke on the condition of anonymity because the inquiries haven't been made public, the agency asked Inflection to turn over emails and texts from Hoffman and other senior leaders. The agency is also looking into whether Hoffman violated antitrust laws by sitting on both companies' boards and, separately, has asked LinkedIn to preserve documents related to its use of customer data in its AI tools. Microsoft didn't comment for this story but has said the Inflection deal wasn't anticompetitive. Hoffman declined to comment but has defended the Inflection deal as "100% legal," adding that he "wasn't in the room" for the negotiation. During a morning sit-down in her Washington office in September, Khan says she's gotten used to flak. "It's no surprise to me personally that monopolists, and executives associated with monopolies, would prefer that the anti-monopoly cops just go away," she says, flashing a smile before snapping back into cop mode. "But that's not the job that we've been given." For decades, the FTC was as anonymous as any Washington regulator. Although its 1,200 staff have a broad mandate to protect Americans from unfair or deceptive corporate behavior, including illegal monopolies, the agency is almost comically outgunned. It often faces off in court against companies that field as many law firms as it fields lawyers. During Bloomberg Businessweek's visits to FTC headquarters, signs by the water fountains warned not to drink the water. Agency leaders from both parties have tended to act as if the best way to regulate the big dogs was to stay out of the way.  Biden passes a pen to Khan, a souvenir as he signs an executive order on "promoting competition in the American economy." Photographer: Alex Wong/Getty Images Not Khan. Her FTC overhauled its criteria for judging mergers and acquisitions and challenged a bunch of big ones. Nvidia, Sanofi, HCA Healthcare, Illumina and Lockheed Martin abandoned planned mergers after the FTC sued, and Kroger Co. might be next. The FTC is also suing Amazon.com Inc. and Facebook parent Meta Platforms Inc. for alleged anticompetitive practices. It helped push Big Pharma to dramatically cut prices for inhalers. It secured one settlement banning Rite Aid Corp. from using facial recognition tech to blacklist shoppers and another refunding hundreds of millions of dollars that Epic Games Inc. allegedly tricked Fortnite players into spending on in-game purchases. (Neither company admitted wrongdoing.) It's proposed rules to ban so-called junk fees and to restrict the use of kids' data, and it's facing off with conservative judges as it tries to abolish noncompete clauses. "The only winners if this merger is blocked will be larger, non-unionized retailers," Kroger said in a statement. Amazon and Meta, which have denied wrongdoing, declined to comment for this story, as did Epic and Nvidia. The other companies didn't respond to requests for comment. Taken as a whole, the agency's work has made Khan the face of a fresh backlash against concentrated corporate power. In her own telling, her tenure has been about returning the FTC to its original mission of protecting people from predators. "You're always having to look around the corner to figure out, are you about to get screwed or taken advantage of or ripped off?" And many scams, she says, are hidden costs of laissez-faire oversight. "These things are not some type of inevitability," she says. Khan is among a handful of Biden appointees who've taken a firm hand with business. US Department of Justice antitrust chief Jonathan Kanter won a federal trial ruling Google a monopoly and is suing Apple Inc. SEC Chair Gary Gensler has been pushing back on the crypto industry. It's Khan, though, who's been the tallest lightning rod for America's loudest rich dudes. Demographics may have something to do with it. It's Khan who's the woman of color, who's Muslim, who's 35 years old, who finished law school when Trump was president. As new as she is to Washington, she's not focused on ingratiating herself with the old boys' club. "A lot of people in the back of their heads are thinking, 'Yes, I'm going to be tough. Yes, I'm going to be aggressive. But I do care if, when I'm out of this job, Fortune 100 companies are going to hire me,' " says fellow FTC Commissioner Alvaro Bedoya. "I don't think Lina cares what they think about her in Davos or Aspen. That thought does not cross her mind." Khan's willingness to take big swings has made her a policy wonk with a measure of celebrity. Her public appearances draw crowds of starstruck law students as well as people with more direct stakes in her decisions. "If you're in government, and you're making a lot of big corporations mad, you're probably doing a pretty darn good job," says Lynne Fruth, who runs a regional pharmacy chain based in West Virginia. Fruth has told the FTC she's getting squeezed by take-it-or-leave-it contracts from pharmaceutical middlemen, several of which the agency sued in September. The FTC's work has become a talking point for several Democrats running in swing states this fall, part of a larger shift in the way US politicians relate to big companies at a time when voters of both parties are pushing candidates to embrace populism. Trump would likely replace Khan, but it isn't clear how much of her work he'd undo. His running mate, JD Vance, has called her "one of the few people in the Biden administration that I actually think is doing a pretty good job." Other "New Right" figures (think Trumpism without Trump) have been similarly complimentary, notably Josh Hawley and Matt Gaetz. Khan says she's a "close student" of what her Reagan-era counterparts did to reorient the agency and that she admires their effectiveness even if she hates the results. Like the Reaganites, Khan's work could reshape our laws and realign our politics for decades to come, especially if she gets to keep doing it. Harris has avoided weighing in for or against Khan, but she's proposed expanding the FTC's authority to include "price gouging" on food. Khan seems ready to take her up on that idea—and to serve another term. "It certainly feels like, in some ways, there's a lot more work to do," she says. Keep reading: Lina Khan Is Just Getting Started (She Hopes) |

No comments:

Post a Comment