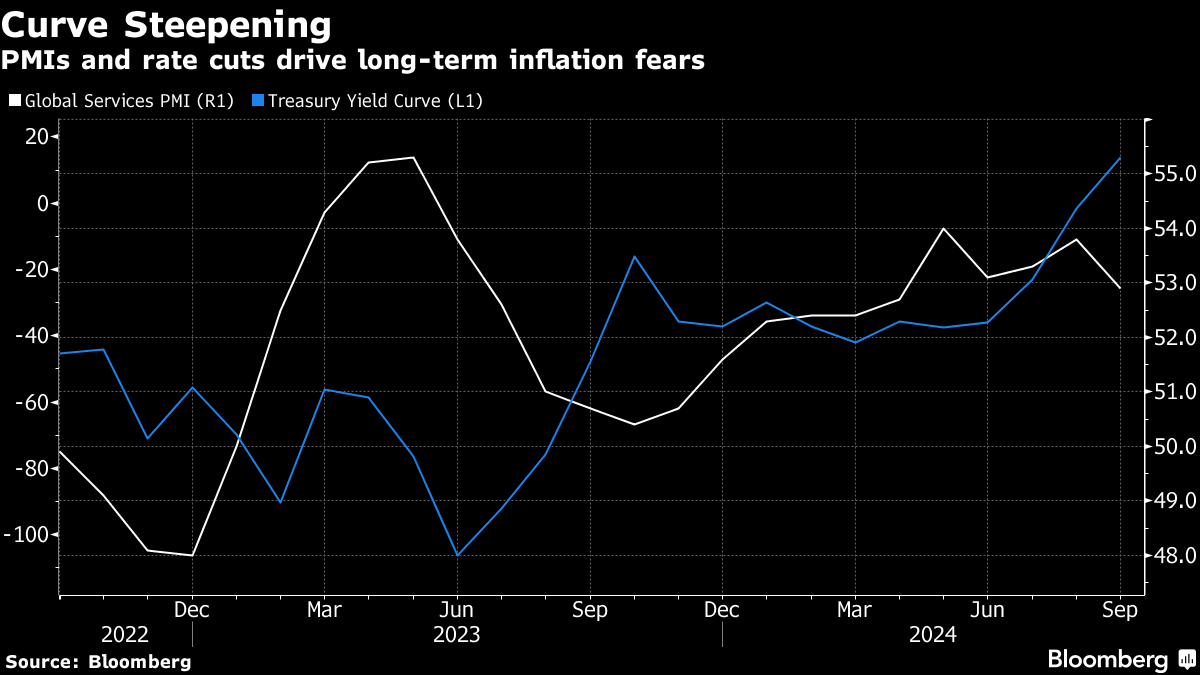

| The JPMorgan Global Services PMI gauge is still running in the expansion zone, while more G-10 central bank interest rate cuts are on the horizon — a setup which will stoke inflationary fears and steepen yield curves. Although the index dipped slightly in September, it was the 20th consecutive month of expansion. The Federal Reserve, the European Central Bank and now the Bank of England — after dovish comments from Governor Bailey — are all set for more easing in the weeks ahead. Moreover, the Bank of Japan appears to be pushing a rate hike into next year while the Reserve Bank of New Zealand is seen cutting by 50 basis points next week. The picture from the JPMorgan Global Manufacturing PMI Index is more cautious with the latest prints coming in below the 50 level, but those readings were taken before the full impact of China's recent multi-pronged stimulus measures would have been fully digested. The country has room to ramp up fiscal support for the economy by issuing as much as 10 trillion yuan in special debt, according to a leading economist in China. All of which points to the risk of higher inflation expectations returning to haunt bond traders in the months ahead, which will tilt yield curves upward. Mark Cranfield is a macro strategist for Bloomberg's Markets Live team, based in Singapore. |

No comments:

Post a Comment