| I'm Malcolm Scott, international economics enterprise editor in Sydney. Today I'm looking at US-China ties at a government and company level. Send us feedback and tips to ecodaily@blooomberg.net or tweet to @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - The debt-limit agreement forged by President Joe Biden and House Speaker Kevin McCarthy heads into the final stretch

- Prices at UK stores are rising at a record pace, while Spain's inflation rate slowed more than forecast

- Two surveys suggest China's manufacturing sector improved or at least stabilized in May

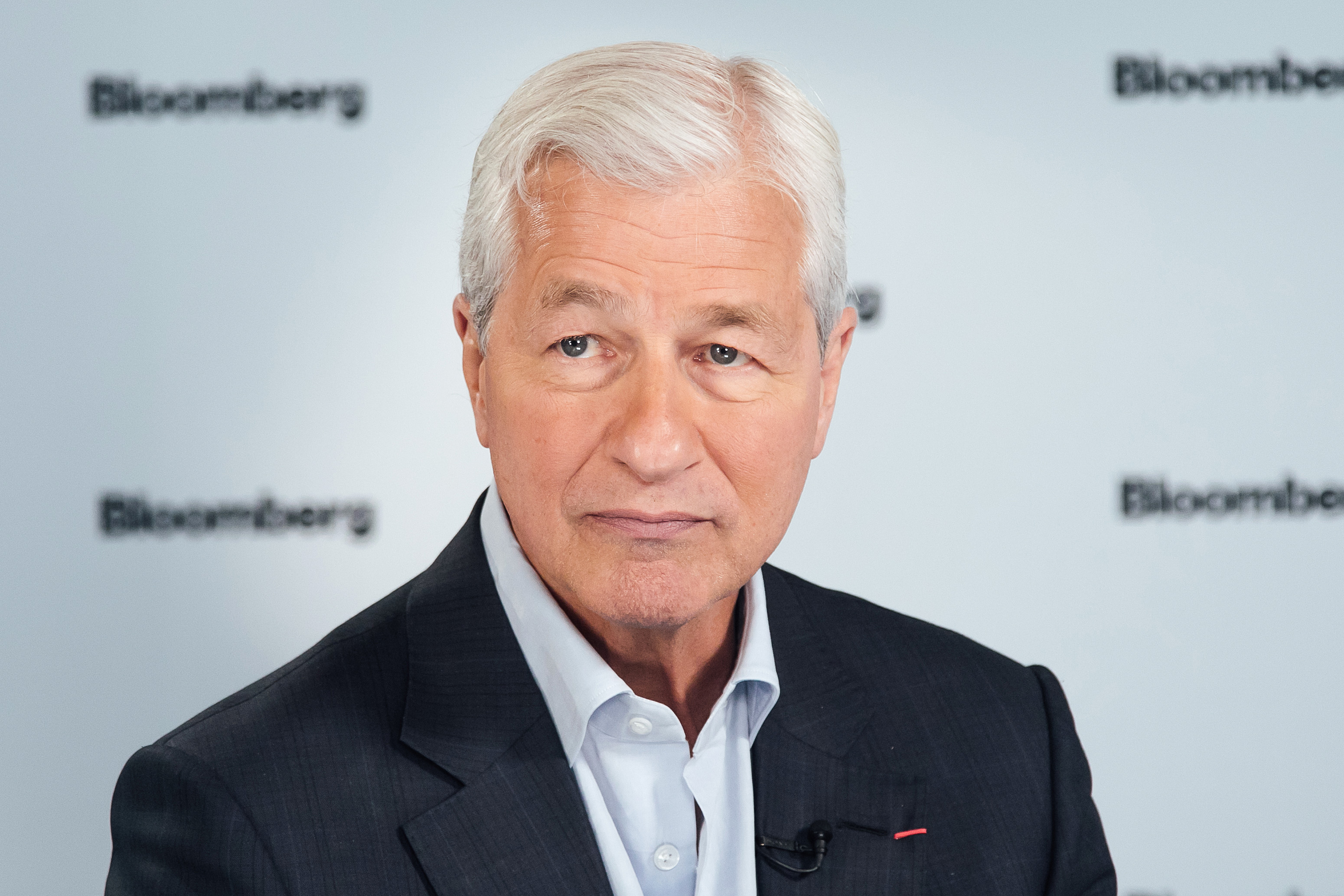

A tale of two events says a lot about the state of US-China ties right now. At the governmental level, the relationship remains frosty. China just declined a US request for the countries' defense chiefs to meet in Singapore this week during the Shangri-La Dialogue, a marquee Asia-Pacific security gathering. By contrast, Jamie Dimon will take center stage at JPMorgan's China summit on Wednesday — the first time the flagship event will be held in person since 2019 as China reopens after its strict Covid controls. In another sign that US-China commercial ties are weathering the diplomatic discord: Elon Musk's private jet has landed in Beijing.  Jamie Dimon, CEO of JPMorgan Chase, in Paris on May 11. Photographer: Cyril Marcilhacy/Bloomberg The JPMorgan conference opens with a talk titled "We are Back!" by Asia-Pacific Chief Executive Officer Filippo Gori, signaling the firm will emphasize its long-term commitment to the country despite headwinds. The agenda is littered with business heavyweights from both the US and China, including the chief executive officers of Pfizer, Baidu and Starbucks. For American firms, the China market is just too juicy to turn a back on, even if recent regulatory crackdowns have caused unease. JPMorgan, for instance, has exposure of more than $10 billion in China. Meantime, China's rejection of a meeting between Secretary of Defense Lloyd Austin and Li Shangfu in Singapore is the latest rebuff of US efforts to strengthen military communications and a setback for White House efforts to restore ties with key officials amid heightened tensions. China had demanded that the US lift sanctions imposed on Li in 2018 over the role he played overseeing an arms purchase from Russia. Officials have questioned the "sincerity" of the Biden administration's recent outreach, saying the US requests for communication jar with efforts to contain it. Yet even amid the diplomatic freeze, Chinese officials are courting US firms. At a recent meeting with US executives in Shanghai, Commerce Minister Wang Wentao said China will protect foreign businesses' interests and rights and will push for more opening up. Businesses and governments don't operate in isolation. Any further deterioration in US-China ties will inevitably hurt the interests of American firms — the chip wars have just ensnared Micron Technology. By using their familiar tactic of dangling access to a market of 1.4 billion people, China's leaders appear to be betting that the influence can work the other way too with businesses improving ties even if governments don't. - Washington's debt-limit deal barely dents the roughly $20 trillion in projected budget deficits

- Five often-overlooked markets for raw materials show how China's recovery extends to almost every corner of its economy

- Japan's unemployment rate fell for the first time in three months

- The Swiss economy picked up momentum in the beginning of the year after a stagnant finish of 2022

- The ECB is getting nearer to the point where it can stop raising borrowing costs, according to Governing Council member Pablo Hernandez de Cos

- Australian approvals to build new homes fell to the lowest in 11 years

The Bank of Japan will gradually build a case for a major overhaul of its stimulus framework in the second-half of next year, using the results of a review to support its move, according to Bloomberg Economics. Governor Kazuo Ueda is aware that the current yield-curve control stimulus framework is unsustainable, as it distorts prices, lacks flexibility, needs big purchases of government bonds and leaves the yen vulnerable to speculators, BE's Taro Kimura wrote in a report released Tuesday. "We think the least-bad option for Ueda is to restore the Overnight Call Rate as the policy rate and anchor it at zero, and continue quantitative easing — but with a reduced amount of JGB purchases," Kimura said in the report, referring to BE's baseline scenario.

Follow the money... Read more reactions on Twitter |

No comments:

Post a Comment