| US politicians rally support for debt ceiling deal, JPMorgan and Morgan Stanley host China summits, and the Big Tech rally is set to continue. — Liza Tetley President Joe Biden and House Speaker Kevin McCarthy are calling on lawmakers to support a deal that sets the course for federal spending through 2025 and will suspend the debt ceiling until Jan. 1, 2025, to avoid a US default. "I've spoken with a number of the members. I spoke to McConnell. I spoke to a whole bunch of people. And it feels good. We'll see when the vote starts," said Biden on Monday. Voting is expected to begin from Wednesday. The so-called ask yields on securities due June 6, the day after the US may run out of cash, eased on Tuesday as fears over a US default lessened. JPMorgan is due to host its China summit on Wednesday, with CEO Jamie Dimon's visit set against a vastly different business landscape from four years ago, the last time the flagship event was held in person. This year's summit, which gathers together more than 2,600 bankers and clients for two days in Shanghai. Meanwhile, New York rival Morgan Stanley is holding a China-focused event of its own in Hong Kong from Tuesday to Thursday. Both conferences are going ahead even as the risks of doing business in China are greater than ever, with the country's relationship with the US is at its worst in decades. Big Tech stocks have further to run this year, as investors look for equities offering profitable growth against tough economic conditions, the latest Markets Live Pulse survey shows. Some 41% of 492 market participants surveyed said the highest returns this year would come from buying quality stocks focused on profitability, which include long positions in companies like Apple and Microsoft. The tech-heavy Nasdaq 100 is clawing back some of last year's losses, gathering momentum from an AI buzz that's boosting stocks like US chipmaker Nvidia toward a market cap of $1 trillion. Futures on the key US tech gauge, the Nasdaq, are advancing today, gaining 1.1% as at 5:33 a.m. in New York, as the buzz around Nvidia and AI continues. S&P 500 futures are also rising, up 0.6% this morning.

Treasuries are continuing to rebound, with yields falling the most in the middle of the curve, as traders anticipate a deal over the debt ceiling. A measure of the dollar is weakening slightly, erasing earlier gains. Oil prices are dropping significantly today while gold advances. Today we've got US March FHFA House Price Index at 9 a.m., followed by the Conference Board's consumer confidence data for May an hour later, and then the report on US May Dallas Fed Manufacturing Activity at 10:30 a.m.

At 11:30 a.m., the US will sell $63 billion 13-week and $56 billion 26-week bills, and then $50 billion 161-day CMBs at 1 p.m.

In Fed speakers, we have Barkin at 1 p.m. and on corporate earnings, there's HP, HP Enterprise and U-Haul.

Do you prefer to work from home or from the office? Do you find yourself more risk-averse or more risk-tolerant when working from the home office or a laptop? Do you think people working from home are more or less likely to commit financial crimes? This week, the MLIV Pulse survey focuses on work from home and return to office. Click here to share your views. Here's what caught our eye over the past 24 hours: It looks like they're going to get a debt-ceiling hike in before the X-date. There might be some drama in the House. Nothing is done until it's all done. Still, people can start focusing on other things.

One thing to watch is the growing odds of a hike at the June. People had been talking about a "pause" and a "skip" but the market-implied odds of a hike have been creeping higher, thanks to persistent robust data, and firm inflation data. On Friday we got the latest PCE reading, which came in hot. The core number rose by 0.4% in April, faster than the 0.3% expectations.

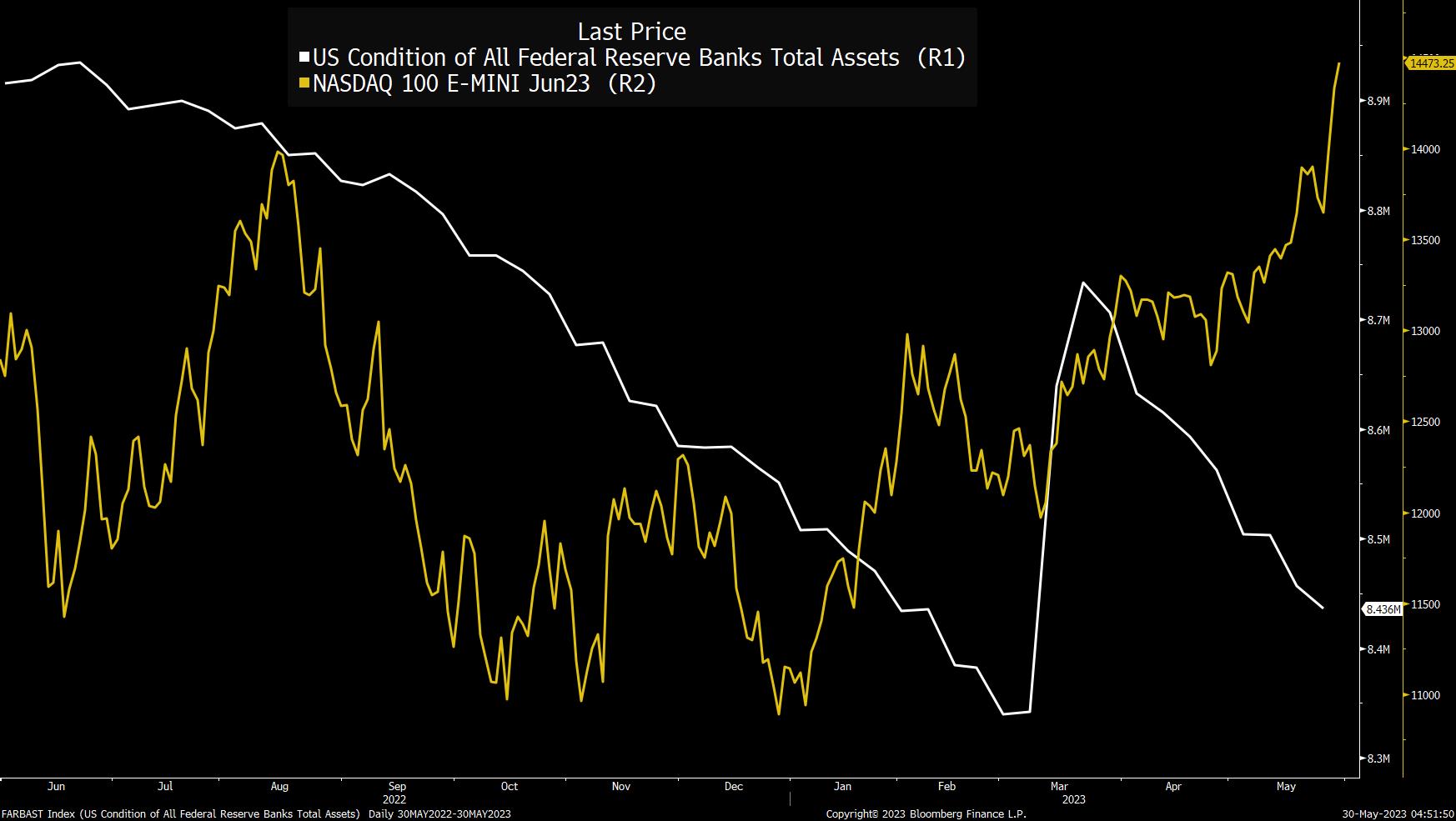

In a note to clients, Tim Duy of SGH Macro writes, "In public appearances, Fed hawks are running circles around the doves and the latter's' insistence that they remain data dependent isn't helping them build a case for not hiking in June. If anything, the opposite is happening as the data reinforce the case for a rate hike." Anyway. What's interesting is that despite the Fed going further and higher, stocks are doing as well as they are. There's been this overly-cynical interpretation of the last several years, that market moves could be simply explained by rates or maybe the size of the Fed balance sheet. "Tech" in particular has come to be seen as this ZIRP phenomenon. And yet... here we have NASDAQ-100 futures at a more than 1-year high, even as rates go higher and the Fed balance sheet resumes its shrinking.  The Fed balance sheet did briefly spike at the beginning of March, around when SVB collapsed. And there was a lot of guffawing about how quantitative tightening was over and they were back to printing money again and all that. And yet the spike proved to be fairly short lived. The asset selling continues as scheduled, the rate tightening hasn't stopped and yet the yellow line has been shooting higher. Yes, it's in large part a story of NVDA and a handful of other juggernauts, but it's worth bearing in mind that for years people claimed that the valuation of all these companies was "artificially" inflated by lower rates or excess liquidity, which can't be used to explain the moves this year.

This isn't to say that the Fed doesn't matter, or that this doesn't all interplay in some way. But an overly mechanical view of how the market works would've led you to a dead end so far in 2023.

Follow Bloomberg's Joe Weisenthal on Twitter @TheStalwart. |

No comments:

Post a Comment