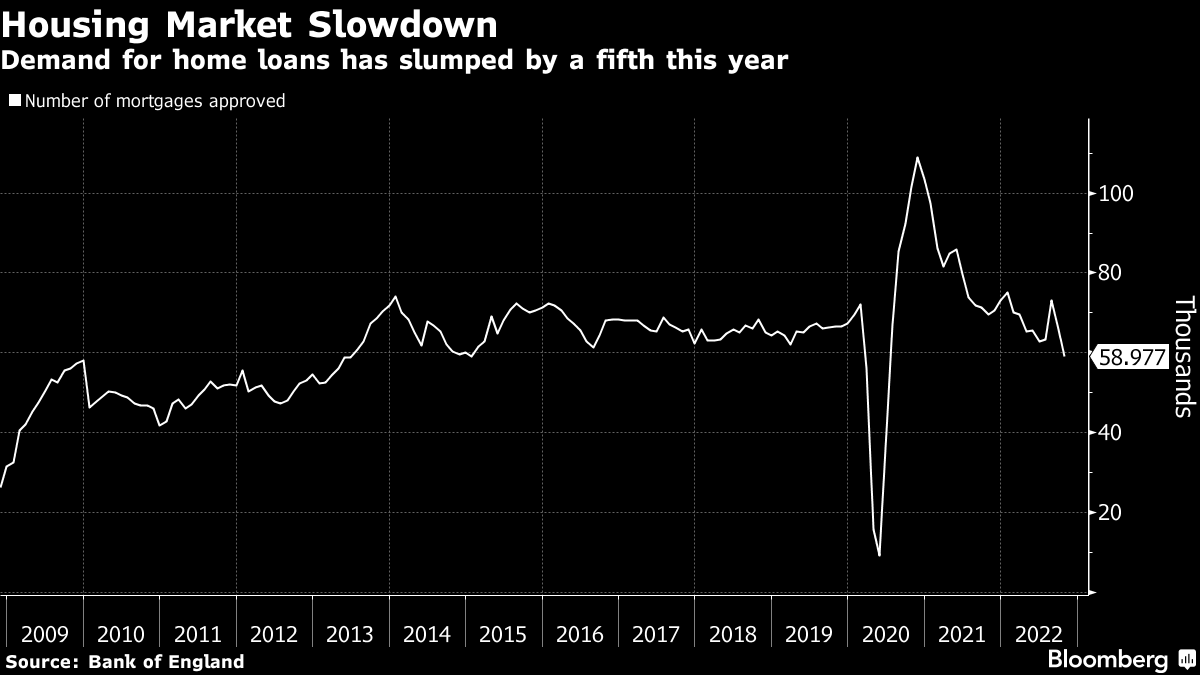

| Good morning. China growth under pressure, the UK deregulates banks and Fed officials warn of more pain ahead. Here's what people are talking about. China's economic activity contracted further in November amid a record Covid outbreak, with growth likely to remain weak and the central bank expected to add more stimulus to bolster the recovery. The International Monetary Fund may have to trim its forecast for China's economic growth as Covid-19 related restrictions and difficulties in the property sector weigh on prospects, its chief said. The UK government will relax the ring-fencing of banks as part of efforts to deregulate the City of London and get a "Big Bang" out of Brexit, according to a person familiar with Treasury plans. Ring-fencing requires banking groups to separate their retail banking services from their investment and international banking activities. It was part of the government's response to the global financial crisis in 2008 and was aimed at protecting UK retail banking from shocks emanating from elsewhere. Banks in the US and Europe with around $42 billion of buyout debt stuck on their balance sheets are making the most of their last chance to get rid of it this year. Stabilization in the leveraged loan and high yield bond markets has led to an opening for deals as banks try to reduce debt on their balance sheets before the holidays. Offloading the so-called hung debt, even at steep discounts, confines losses to this financial year while also appeasing risk departments and regulators. Federal Reserve Bank of St. Louis President James Bullard repeated his call for additional interest-rate hikes to a level that will restrict economic growth, which he said sets the stage for a return to more ordinary monetary policy in 2023. "The policy rate has not yet reached a level that could be considered sufficiently restrictive," Bullard said in an article posted online Tuesday, saying estimates show a rate of at least 4.9% would be needed. European stocks are headed for gains as investors weigh China's Covid policy and await a speech from Fed Chair Jerome Powell. German Chancellor Olaf Scholz and Norway's Prime Minister Jonas Gahr Store participate in a conference. Italy GDP and CPI, inflation numbers also across France to Portugal are among expected data. Salesforce unveils earnings, and is tipped to post its slowest sales growth ever as its customers delay software purchases. RBC, CPI Property Group and Allegro also report. This is what's caught our eye over the past 24 hours NEW | Like this newsletter? Sign up for John Stepek's Money Distilled newsletter for the biggest developments in the world of markets and economics, and what it all means for your money. Tighter credit conditions have led to widespread warnings of a housing market collapse -- particularly in the UK. Yet limited supply should keep prices supported even as activity declines, and that would have positive implications for home builders and banks. House building remains woefully below the Government's ambition of 300,000 new homes per year, with supply of just 216,000 in 2020/21 on Covid lockdowns and supply-chain disruption. A bounce back is unlikely as long as credit remains tight and the outlook stays uncertain. Which, counter-intuitively, could keep house prices supported into next year. And while falling mortgage approval rates -- banks and building societies authorized 58,997 home loans in October, the fewest since June 2020 and down from 65,967 in September as seen in the chart by Liza Tetley -- seem to back up the bearish argument, it's perhaps better seen as a signal of a lower-liquidity market than one heading for collapse.  Eddie van der Walt is Deputy Managing Editor of Markets Live, based in London |

No comments:

Post a Comment