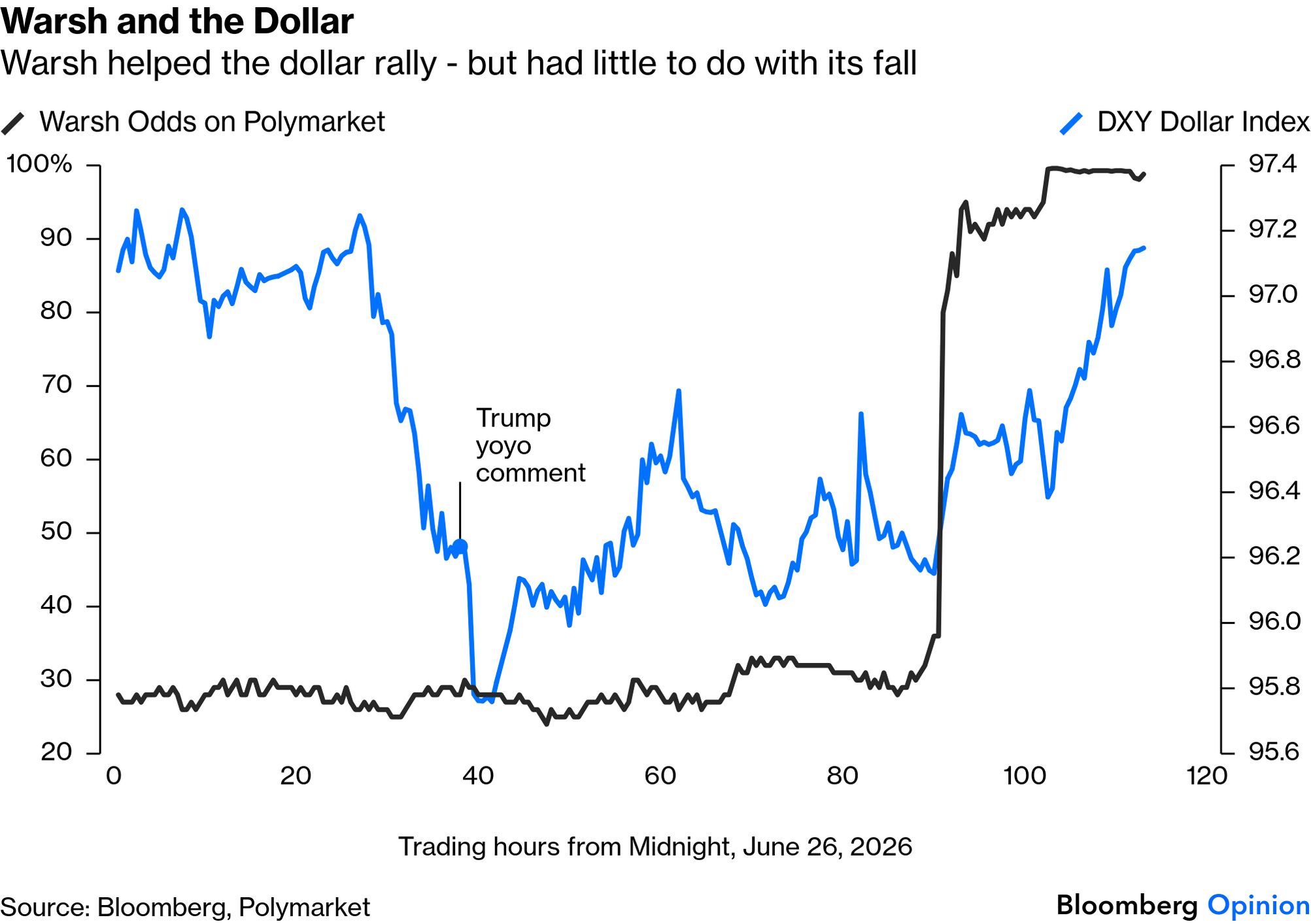

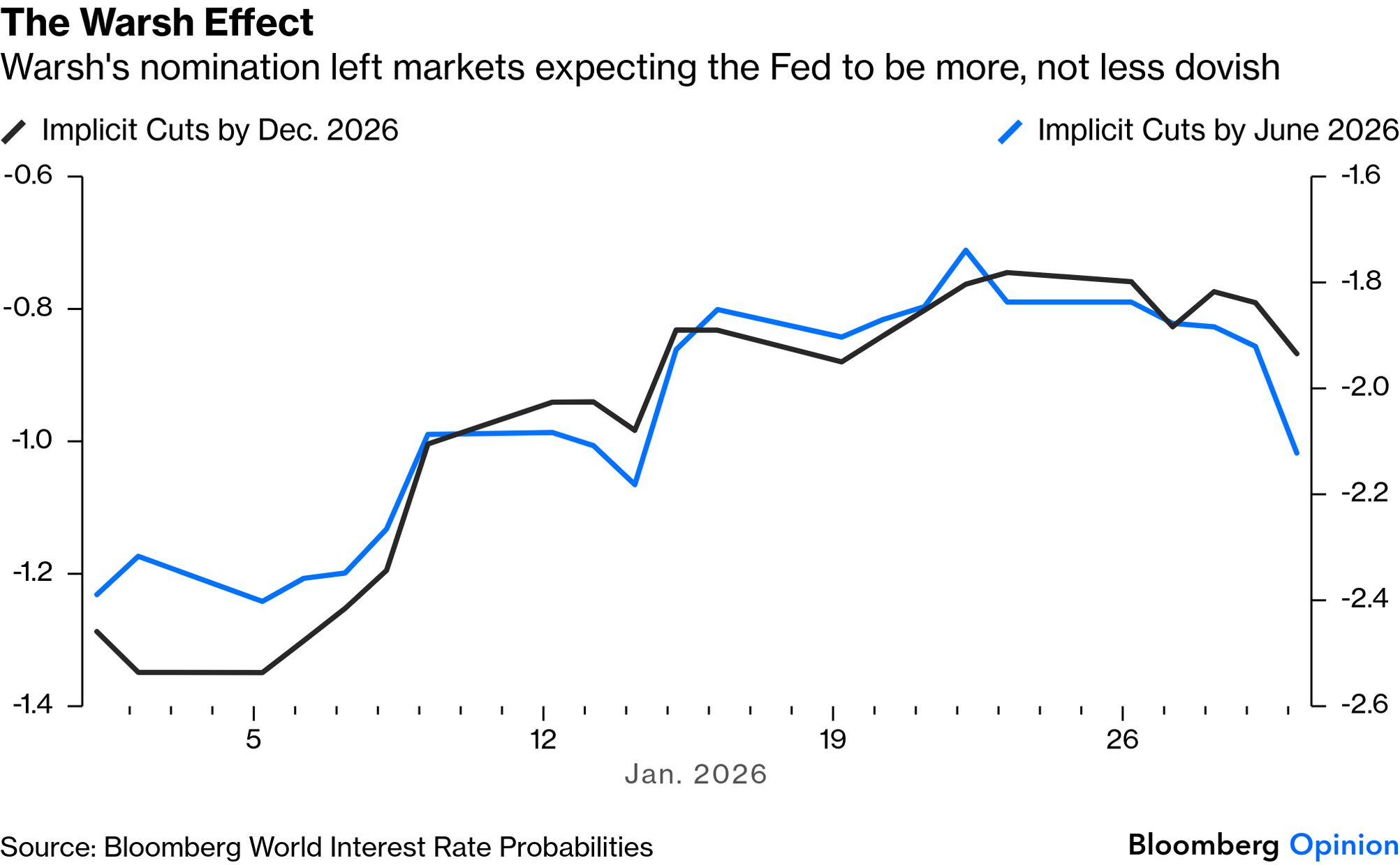

| On Friday, Kevin Warsh received the presidential nomination to be the next chairman of the Federal Reserve. If confirmed, he will be only the sixth leader of the world's most powerful central bank in almost half a century. Also on Friday, silver suffered its biggest fall in history as precious metals tanked and the dollar rallied. These things are related. By setting the price of money, the Fed has a big impact on the price of gold and the dollar. There is a narrative that ties them together, too. When he was last on the board of the Fed, Warsh staked out a relatively hawkish position, meaning he was more willing to raise rates than others. He is not as obviously committed to lower rates as other candidates for the job have been. So the Warsh nomination might have reversed markets, because gold had been rising, and the dollar falling, on fears the new Fed chair would be determined to cut rates even if it meant debasing the currency. But there's much more to the extraordinary goings on in the dollar, and indeed much more to Kevin Warsh. Did Warsh prompt the dollar rally? Prediction markets give us a clear steer as to when traders moved to price in a Warsh nomination as a certainty. His odds on Polymarket shot to 90% after Bloomberg News reported that he had the nod on Thursday evening. That overlapped with a dollar rally. But Warsh's chances had barely moved while the dollar sold off earlier in the week, capped by President Donald Trump's comments Tuesday afternoon that the greenback was like a yo-yo and he didn't mind if it went up or down. In trading parlance, that prompted a "blow-off top" to the short dollar trade. What about the balance sheet? If Warsh has a signature issue, it was his opposition to QE in the latter years of Ben Bernanke's chairmanship. He wants to shrink the assets on the Fed balance sheet, an eminently sensible idea that brings with it risks as liquidity in the market is reduced. Jerome Powell provides a cautionary tale. He took office eight years ago planning to reduce it "on auto-pilot," and hoping that markets would regard this as a separate technical issue from overall monetary policy. They didn't and a drastic selloff forced the "Powell Pivot" over the Christmas period in 2018. The assumption is that Warsh hopes to do something similar, actively helped by Treasury Secretary Scott Bessent (he's widely described now as a monetary policy version of Bessent). That will require treading very carefully. Is Warsh a hawk? At any one time, monetary economists are either hawks or doves, thinking rates should go up or down. But these categories aren't immutable like Keynesian vs. monetarist, or socialist vs. conservative. An economist can be hawkish at some points and dovish at others while still being consistent. The appropriate level of interest rates will change over time. If you have a good model and stick to it, you will at different stages think rates are too high or too low. No economist who believes rates should be permanently low should get within miles of the Fed chairmanship. Warsh cut against the dovishness of the Bernanke Fed when he was a part of it, but he's made far more dovish noises recently, and wouldn't have been given the job if he hadn't. Looking at the implicit rates derived from futures by the World Interest Rate Probabilities function, Warsh's nomination was followed by increasing confidence that there would be cuts both at his first meeting in June and by the end of the year. If the rates market treats him as a dove, it gets hard to argue that gold and silver staged one of their greatest ever selloffs because he's a hawk: A further argument concerns politics. Paul Krugman, the Nobel laureate economist and stalwartly liberal commentator, calls it a category error to describe Warsh as a hawk, when in reality he is a "political animal" who has favored higher rates when Democrats were in power, and lower rates under Republicans. He isn't alone in this. During the 2016 election campaign, Candidate Trump said: "They're keeping the rates down so that everything else doesn't go down. We have a very false economy. At some point the rates are going to have to change. The only thing that is strong is the artificial stock market."

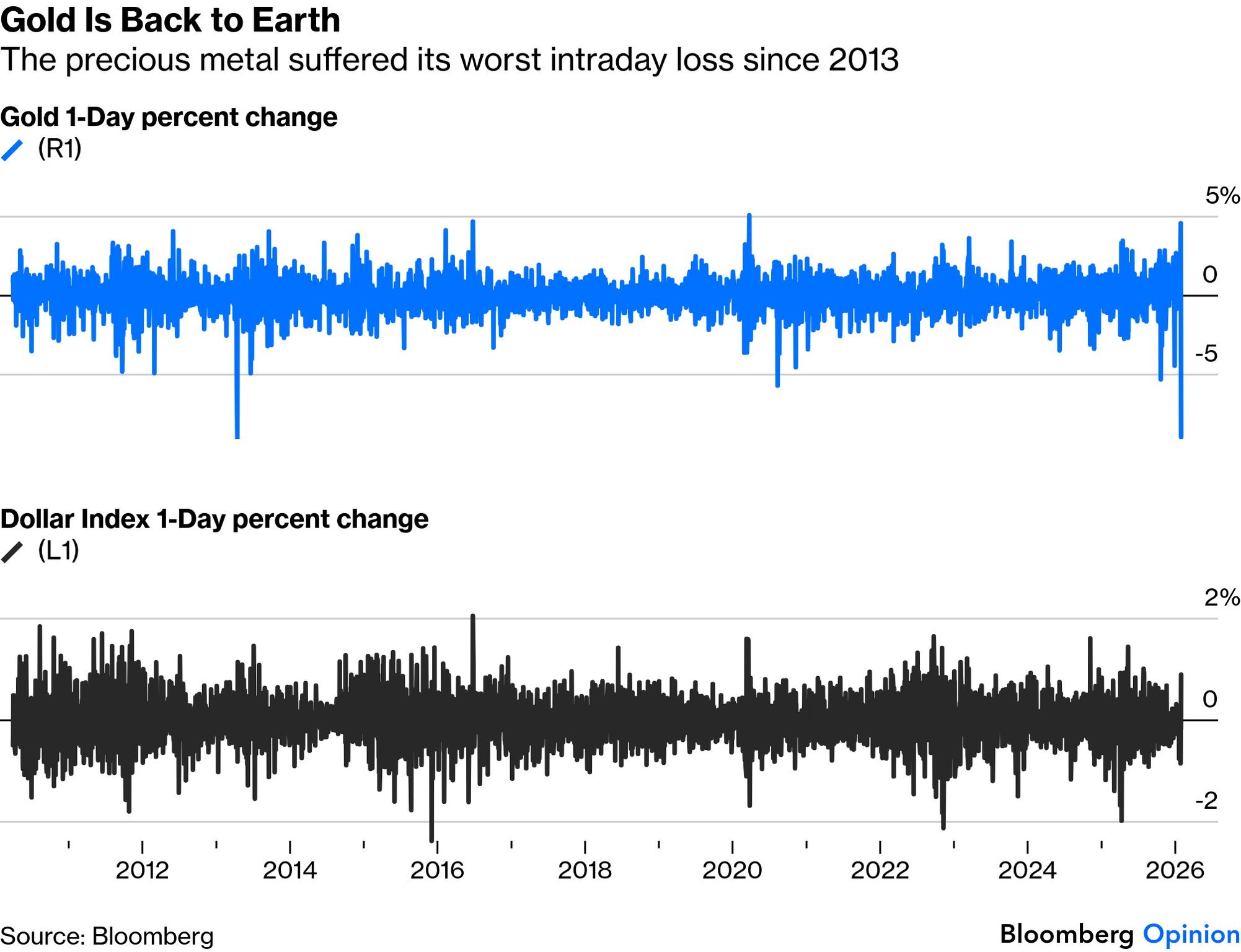

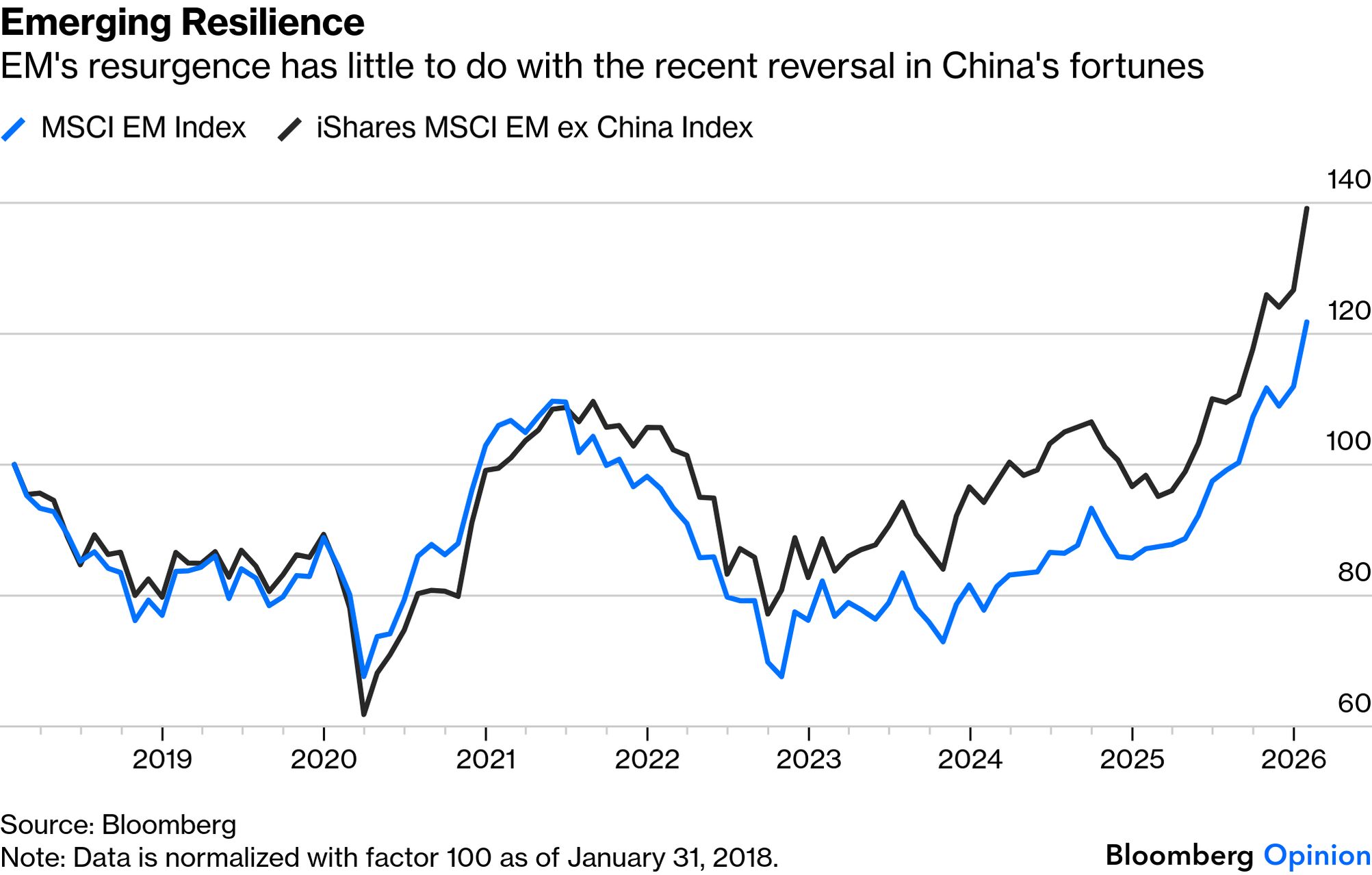

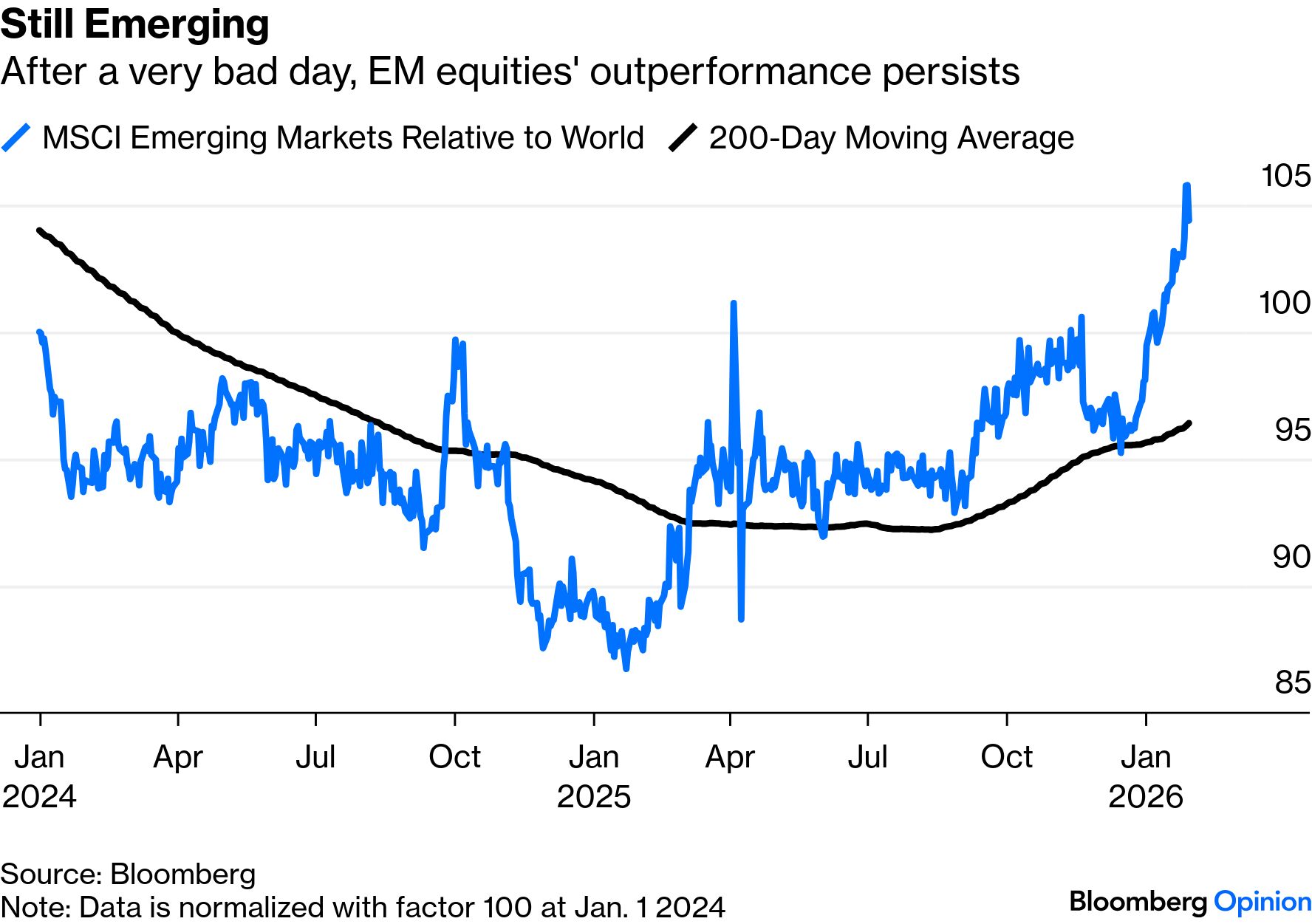

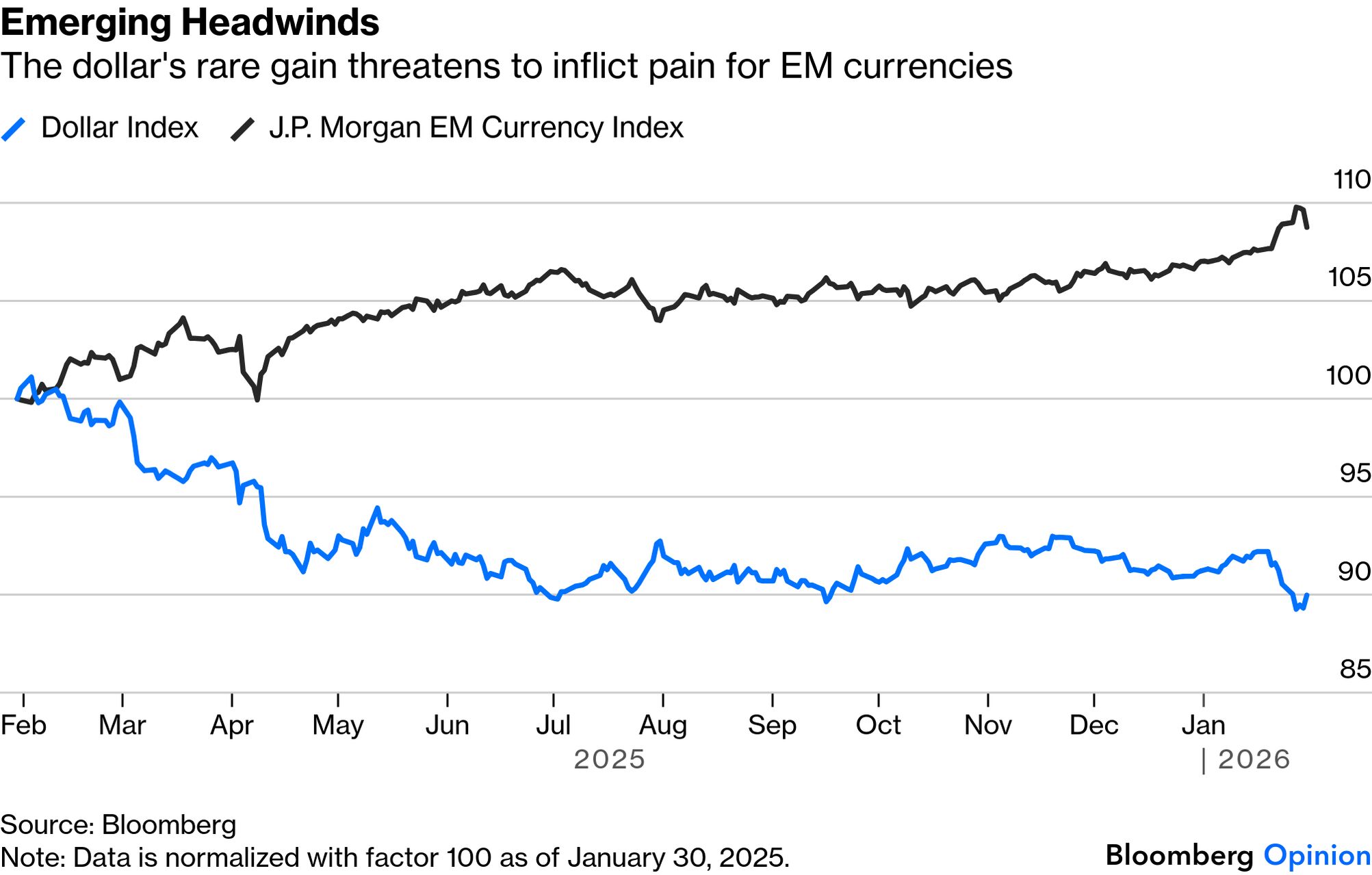

While Trump is in office, politics will probably continue to push rates in a downward direction. Warsh has shown enough independence over the years that it's not clear he won't tighten when necessary. Has the precious metals bubble burst? By any measure, the selloff for gold and silver on Friday was something special. At 26%, silver had its worst day since records began. Gold merely had its worst day since 2013. Ructions like this threaten dislocations and danger: But the notion that this was all some huge debasement bubble that burst when the arch-hawk Warsh got the nod has to contend with the fact that precious metals remain expensive. Crypto is underwater, but gold and silver remain well above their 50-day moving averages: This rally has been driven primarily by buying from China. Whenever prices get parabolic, as they have done recently, they are prone to big moves, and the removal of uncertainty over the Fed offered a good reason to take some profits. But that doesn't mean that the bubble is over. There is a lot more to be unwound. What was all the fuss about? The Warsh appointment matters above all as "an implicit acknowledgment that Trump cannot bend the Fed to his will," as the macro strategist David Woo, who publishes the David Woo Unbound newsletter, puts it. The chairman is only one vote of 12, and the opportunity to impose a new slate of Fed regional presidents is gone, along with any effort to embed a pro-Trump majority. The Supreme Court might well rule out any future attempts to do this. Appointing Warsh signals that the bare-knuckles legal fight to control the Fed is over. That is good news, but to make a final point, which isn't quite "I told you so" (but does, I admit, come close). Way back in April, when the president had made his first online fulmination about firing Powell and withdrawn it within days, Points of Return was headlined "We Need to Talk About Kevin (and Jerome)." My argument then was that there was no need for a risky fight over Fed independence when Powell's mandate was almost up and there was an obvious replacement — Kevin Warsh. As a former Fed governor, with a record of cutting against orthodoxy, with Wall Street and Republican party cred (but without mentioning his looks), my argument at the time was that Warsh was just what Trump needed politically: a "rare combination of genuine change with the stability of continuity." With such an obvious candidate in the wings, I averred, it was "absurd for Trump to make such a fuss over the last few days," and that if the administration really wanted to change the Fed it could "wait until next year with a new man" rather than provoking an unnecessary crisis. Nominating Warsh early could have hastened Powell's lame duckdom. Instead of that, the White House gave us nine more months of dangerous stupidity before accepting the option that had been glaringly obvious all along. There are times when Trump is "crazy like a fox" and gets leverage by starting out with a big demand. On this occasion, it's hard to see that anything was gained by the prolonged maneuvers, beyond learning what most people knew all along. Emerging markets' strong start to the year has carried on from where it left off in 2025 despite US resilience. The MSCI EM Index is currently trading at historical highs, surpassing the peaks reached post-Covid. This is no longer primarily about China. While Chinese equities have enjoyed a good spell since the Communist Party's pivot toward stimulus late in 2024, they are not the major drivers of the current rally: Emerging markets have a habit of starting a calendar year with optimism only to falter. But this rally does appear to be based on substance rather than froth. Bloomberg Intelligence's Marvin Chen notes that, so far, full-year 2025 corporate results are broadly in line with expectations at the start of last year. This is a stark difference from 2023-24 and the median over the past 10 years, when earnings-per-share typically fell 5-15% below expectations. That's a huge difference from the US, where companies' investor relations departments reliably get analysts to set forecasts that they can beat. Chen explains that EM analysts' optimism presumes that last year's tailwinds, AI, and commodities demand will carry into 2026. Then the Warsh nomination threw a wrench into the trade. Precious metals' decline has dulled the shine of emerging markets, which generally profit from a weak dollar — although as with the metals themselves, the rally looks very much intact even after a bad day: It's premature to describe this as a paradigm shift from the debasement trade that propped up gold, casting doubt on the reserve ability of the greenback. But then again, a strong dollar is certain to be at the expense of EM currencies. It was no different this time, helped on by jitters in tech stocks after largely unimpressive earnings: Does the precious metal meltdown foreshadow a disruption for emerging markets? They aren't homogeneous. As Russ Mould of AJ Bell notes, diversity could prove a source of resilience: "It is possible that at least some of those not-so-hidden dangers are already factored into EM valuations." Much will hinge on the Fed. On the margin, Marcelo Assalin of William Blair expects precious metals to remain broadly supportive for developing countries, as gold should continue to benefit from sustained central-bank buying. In the event of a pullback, Bank of America's David Hauner argues that still-moderate strategic allocations mean weakness is more likely to attract buyers than signal a further selloff. The recent yen strength is another tailwind that can trigger some short-term volatility as yen-funded trades are unwound, but helps emerging markets by lowering dollar borrowing costs. Further, Washington wants a weaker dollar. None of this makes Warsh's approach predictable. But a sudden pivot toward hawkishness is unlikely, and so a bet on EM still makes sense. -- Richard Abbey |

No comments:

Post a Comment