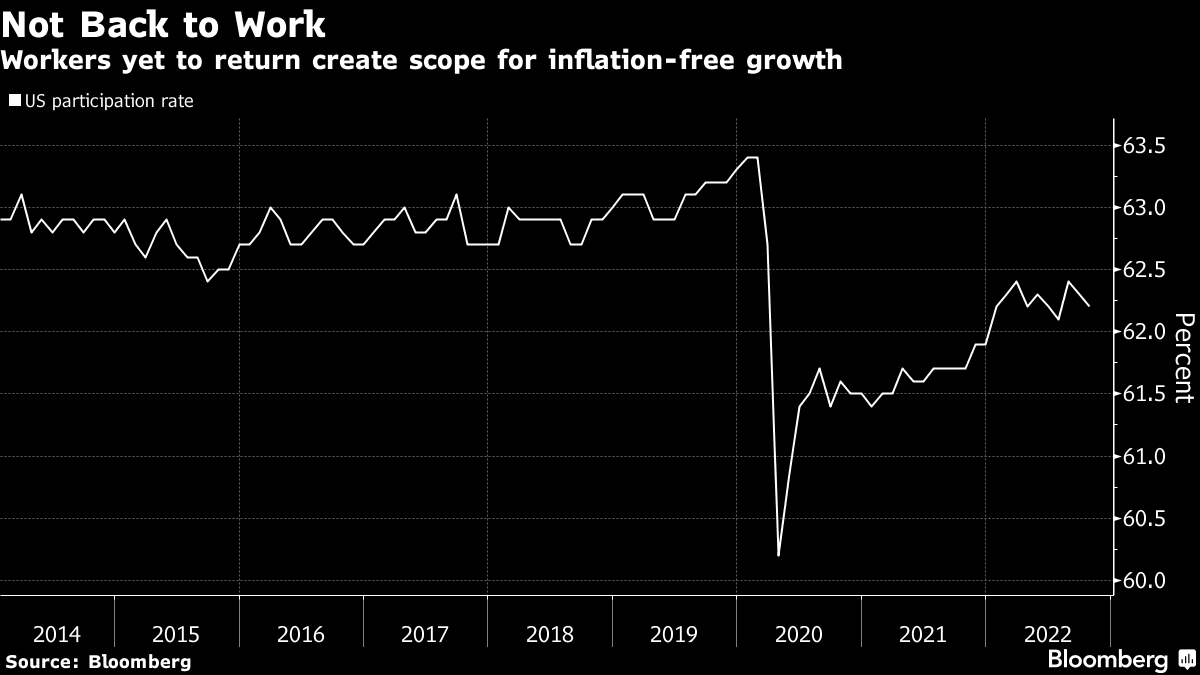

| Good morning. Another signal from Jerome Powell, mysterious hole in FTX's balance sheet and a new phase in China's fight against Covid. Here's what people are talking about. Chair Jerome Powell signaled the Federal Reserve will slow the pace of interest-rate increases in December, while stressing borrowing costs will need to keep rising and remain restrictive for some time to beat inflation. His comments, in a speech Wednesday at the Brookings Institution in Washington, likely cement expectations for the Fed to raise interest rates by 50 basis points when they meet Dec. 13-14. Meanwhile, the Fed's Beige Book regional economic survey, released on the same day, shows the US economy grew only slightly through late November, with businesses reporting that high inflation and rising interest rates clouded their view of the economic outlook. Mystery continues to shroud the missing billions at bankrupt crypto exchange FTX after its disgraced founder Sam Bankman-Fried denied trying to perpetrate a fraud while admitting to grievous managerial errors. In his first major public appearance following the Nov. 11 implosion of FTX and sister trading house Alameda Research, Bankman-Fried said Wednesday by video link at the New York Times DealBook Summit that he ``screwed up'' at the helm of the exchange and should have focused more on risk management, customer protection and links between FTX and Alameda. His participation was controversial given there are outstanding questions about how FTX ended up with an $8 billion hole in its balance sheet and whether it mishandled customer funds.  | Beijing will allow some virus-infected people to isolate at home, starting with residents of its most-populous district, a significant shift that reflects the pressure officials are under from a record outbreak and public opposition to Covid Zero. Low-risk patients can do home isolation for a week if they choose, people familiar with the plans said, dialing back a nationwide policy that has seen everyone with Covid sent to government quarantine sites regardless of severity, to halt transmission chains. Earlier, China's top official in charge of the fight against Covid-19 said the country's efforts to combat the virus are entering a new phase with the omicron variant weakening and more Chinese getting vaccinated. Russia's invasion of Ukraine has elevated US concerns that Vladimir Putin's government could use biological weapons, according to a top US State Department official who's in Geneva for a review of the global treaty addressing such threats. Under Secretary for Arms Control and International Security Bonnie Jenkins said that the concerns have increased as Russia has continued to make unsupported allegations about US development of biological weapons in Ukraine. Such disinformation could mask Russia's own weaponization of infectious diseases, she said. European shares are set to join a global stock rally after Fed Chair Jerome Powell signaled a slower pace for rate hikes. French President Emmanuel Macron meets US President Joe Biden at the White House. There's a slew of manufacturing PMIs coming out across Europe, while it's relatively light on the earnings front. This is what's caught our eye over the past 24 hours. NEW | Like this newsletter? Sign up for John Stepek's Money Distilled newsletter for the biggest developments in the world of markets and economics, and what it all means for your money. Asset prices these days are a function of liquidity, that much is widely agreed. The post-lockdown rally in risky assets wouldn't have happened but for the ``Don't Fight the Fed'' and ``There Is No Alternative'' mantras that became the memes that drove trading after March 2020. Subsequently, this year's drawdown in stocks is a direct result of tightening at the Federal Reserve and other central banks. Tightening, in turn, is a consequence of inflation, which the prevalent wisdom goes, probably isn't transitory. Except it might be, at least in the current round, because headline CPI readings have started to surprise to the downside -- largely driven by lower energy costs -- and much-feared wage-cost increases have so far been limited. That makes the biggest numbers that we're going to get out of the US this week the labor force participation rate, and average hourly earnings, which will feed all the way back, through the loop, to move asset prices and investor sentiment.  Eddie van der Walt is Deputy Managing Editor of Markets Live in London. @EdVanDerWalt |

No comments:

Post a Comment