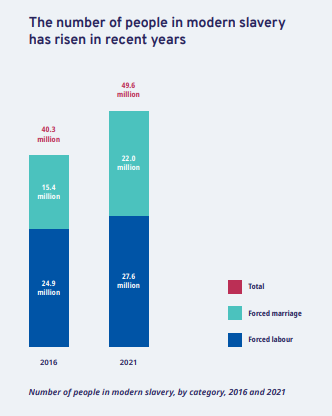

| Being a neutral arbiter of international labor law is a tricky job in normal times — so it's even doubly so in an age where the world's two largest economies are locked in a race for global supremacy. Just ask Gilbert Houngbo, the new director-general of the 103-year-old International Labour Organization, who is calling for a fresh inquiry into allegations of forced labor in global supply chains — particularly in China. The 61-year-old former Togolese prime minister said his goal is to ensure that all ILO members, regardless of their size or economic clout, have a "minimum respect for what we consider as the fundamental rights." The ILO is a United Nations agency that aims to increase social and economic justice through strong global labor standards. The Geneva-based organization estimates that nearly 28 million people were involved in some sort of forced labor last year — 3.9 million of whom were subjected to state-imposed forced labor.  Source: ILO But bringing an end to modern slavery will require pushing major nations to do uncomfortable things — like increase the transparency of China's working conditions, which Houngbo said will almost certainly be criticized by wide array of stakeholders. You basically have two options, Houngbo told Bloomberg. "Either you will refuse to go and could be seen as you are a little bit complacent. Or if you go, in any case, very few will believe in what will be the outcome." Houngbo said he's not deterred and said he supports the idea of sending a team of ILO officials to probe allegations about forced labor being used in China's Xinjiang region — something that Beijing has vehemently denied. "We have to be very clear that any form of forced labor in the context of an employment relationship has to be condemned," he said in the interview. "In China, in Xinjiang, we've got to do a follow up on this discussion." Dangerous Mining In addition to his focus on forced labor in the textile industry, Houngbo said there's a need to address the "really crazy" mineral mining conditions in places like the Democratic Republic of Congo, Ivory Coast and Ghana. Congo is the world's largest source of cobalt and Africa's biggest miner of copper — two key metals used in producing electric-vehicles. In 2019 the nonprofit International Rights Advocates sued a raft of US technology companies for "aiding and abetting" dangerous mining conditions in the Democratic Republic of Congo. With widespread labor shortages in many rich countries, it's not just a developing-world problem, either. Earlier this month, the US Department of Labor obtained a federal court order to prevent an Alabama parts supplier of Hyundai and Kia from employing underage workers in a manufacturing facility. Houngbo said he's confident that his focus on eliminating forced labor from global supply chains is the correct one: "With my African background, the last thing you want to do is to not be clear against forced labor or modern slavery." Read More: —Bryce Baschuk in Geneva |

No comments:

Post a Comment