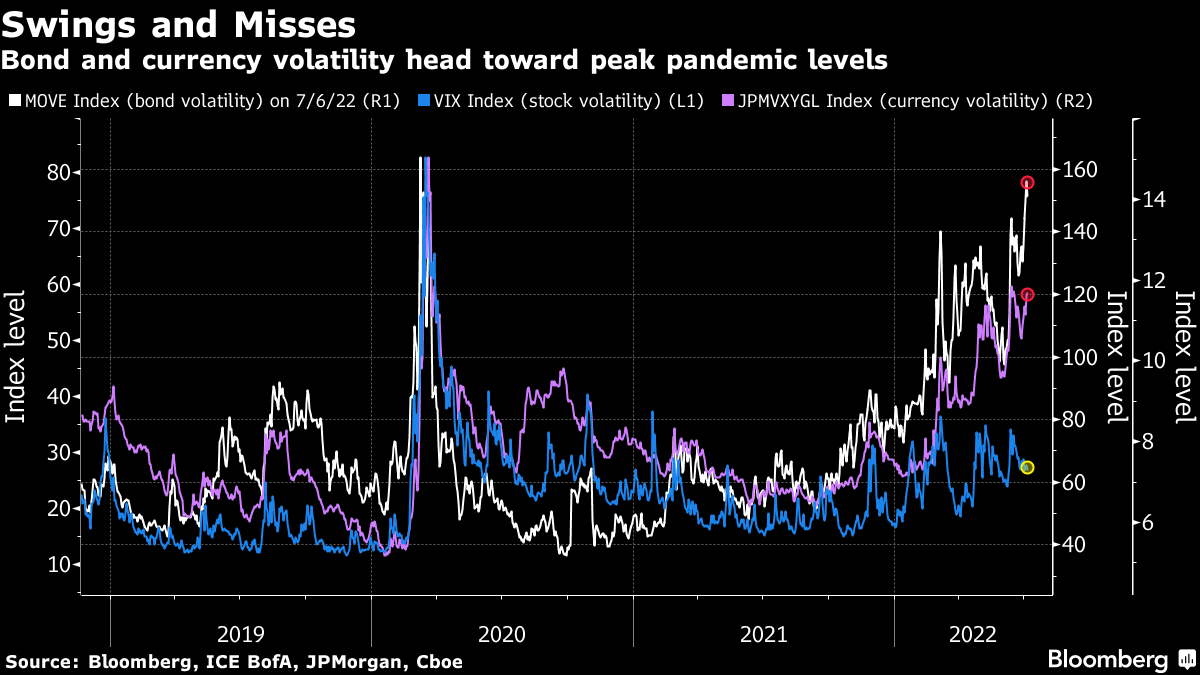

| Good morning. Boris Johnson fights back, euro losing appeal, Fed's commitment to curbing inflation and Russian oil's price cap. Here's what people are talking about. Boris Johnson is desperately clinging to power after suffering an avalanche of resignations from his government that's unprecedented in recent British political history. The UK prime minister made clear in Parliament that he had no intention of stepping down. Johnson also fired Michael Gove — one of the Cabinet's remaining big hitters — in what one official described as revenge for his attempt to remove the premier and a past act of betrayal. Meanwhile, online betting markets suggest the prime minister will be replaced in 2022, with Paddy Power only paying out £1 ($1.20) for every £10 placed on Johnson's departure before the end of the year. The European economy's lurch toward recession is making traders ever more convinced the euro will drop below parity with the dollar in the near future. Shorting the single currency has become one of the most popular trades, while strategists from Nomura to HSBC have told clients to expect more losses ahead. With the euro at a 20-year low, investors are grappling with the possibility that Russia may cut off gas supply to Europe and plunge the region into recession. The economic shock would make it harder for the European Central Bank to tighten policy and likely widen the interest-rate differential with the US.  | Federal Reserve officials solidified their resolve to keep raising interest rates for longer to prevent higher inflation from becoming entrenched, even if that slowed the US economy. Policy makers backed hiking interest rates at their next meeting in July by either 50 or 75 basis points, according to minutes of the Federal Open Market Committee's June 14-15 meeting released Wednesday. They viewed maintaining the central bank's credibility to control inflation as crucial, especially as an important inflation index is set to show a big jump later this month. That index was flagged by Chair Jerome Powell as being partly behind the jumbo rate hike in June. The US and its allies have discussed trying to cap the price on Russian oil between $40 and about $60 a barrel, according to people familiar with the matter. The range spans from what is believed to be Russia's marginal cost of production and the price of its oil before the Feb. 24 invasion of Ukraine, the people said. G-7 countries and the EU have already agreed to phase out importing Russian oil, but as they have done that, Moscow has looked to increase exports to other buyers at a discounted price. Russia is still taking more than $600 million a day from oil, even as several nations shun its supplies. European stock futures are pointing to gains Thursday after the technology sector lifted Asian stocks amid a slight easing of concerns on inflation and recession. A host of data to come out include Swiss unemployment, Netherlands inflation as well as German industrial production. Earnings are due from Jet2 and Watches of Switzerland, among others. This is what's caught our eye over the past 24 hours. If stock traders think markets are choppy at the moment, they should spare a thought for their bond and currency counterparts. The ICE BofA MOVE Index, a gauge of implied volatility in Treasuries, is rocketing toward levels last seen during the peak pandemic market fears of March 2020 and JPMorgan's Global FX Volatility Index is not too far behind it. Meanwhile, the Cboe's VIX Index — a measure of expected price swings in US stocks — is languishing below levels considered as extreme. Bond yields are being whipsawed by inflation fears and rate hike bets on one side and signs of a looming economic slowdown on the other. The same dynamic is coursing through key dollar pairs, while the yen, pound and euro have their own regional catalysts shaking up trading. The stock market is far from sanguine and under the hood another interesting rotation looks to have begun — out of economically-sensitive value stocks into growth. But moves in equities still look too subdued given the wild swings seen in the other asset classes.  Cormac Mullen is a Deputy Managing Editor in the Markets team for Bloomberg News in Tokyo. New from Bloomberg UK. Sign up here for The Readout with Allegra Stratton, your end-of-day guide to the stories that matter. |

No comments:

Post a Comment