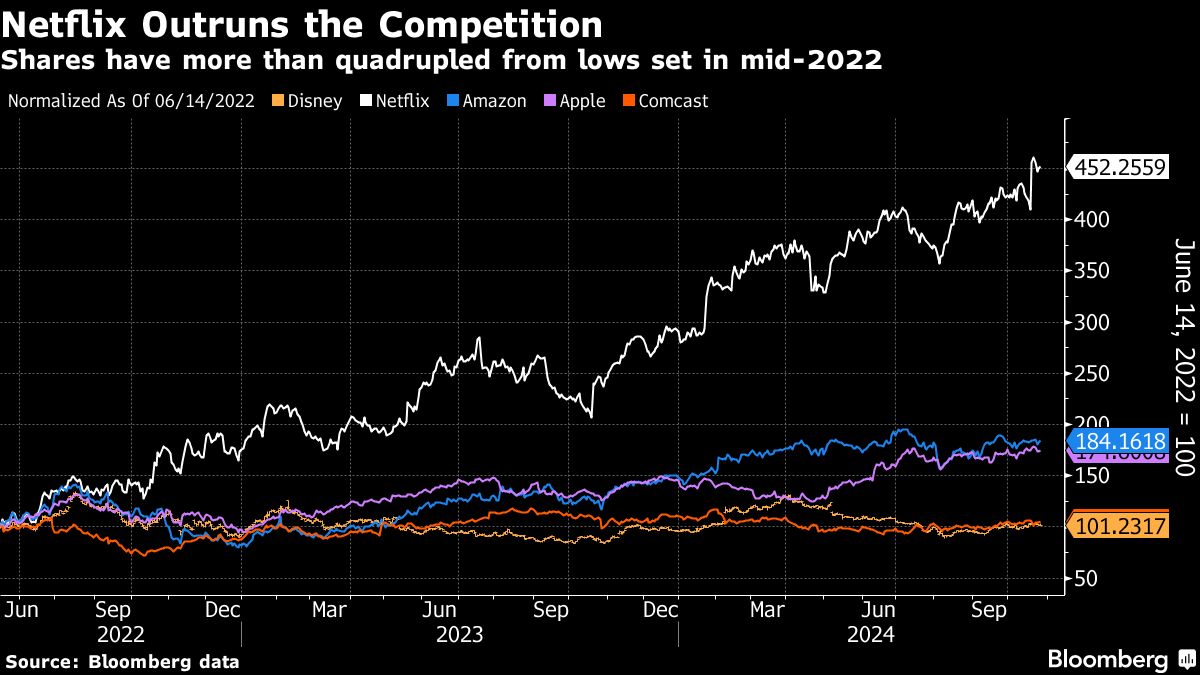

| On June 14, 2022, as Netflix shares were hovering near their lowest price in five years, Matthew Harrigan decided it was time to sell. An analyst with Benchmark Co., he issued a target price of $157 and said investors should sell the stock until it dropped below that level. Anyone who listened to Harrigan, and a couple others who swam against the tide, missed out on one of the great stock market runs of the last few years. Shares of Netflix have more than quadrupled since then thanks to a crackdown on password sharing and the rollout of a Netflix subscription that includes advertising. The company has added more than 60 million customers over that span, with its market value growing to more than $320 billion. "Clearly I've gotten kneecapped the last couple years," Harrigan told me this past week. "I've reached the point where I'm tired of getting this wrong." While Harrigan wishes he had upgraded the stock a couple years ago, he has maintained his sell rating. Harrigan, a graduate of Brown University and the University of Pennsylvania's Wharton School of Business, has been a Wall Street analyst for 25 years. He is one of three top analysts who believe Netflix's share price is too high. Matthew Dolgin at Morningstar and Barclays Kannan Venkateshwar both have published target prices of $550 – about $200 below where Netflix is trading. Their skepticism is rooted in a fundamental calculation. Netflix is trading at too high a valuation considering its current earnings and future growth potential. "It's a simple valuation calculation," says Dolgin, who shifted to covering media and entertainment from communications services over the last couple years. Netflix is on track for almost $9 billion in net income this year, which would suggest a much lower valuation for a more mature company. Comcast Corp., which makes more money, trades at about half the value. Netflix is treated like a growth stock and trades at a similar multiple to Amazon. The company has posted several quarters of strong subscriber growth, and Wall Street is treating Netflix as though that growth will continue. But some analysts believe that growth will slow as the boost from the password crackdown fades. Harrigan and Dolgin are hardly the first to be stung by their skepticism for the streaming giant, which has consistently traded at a price far higher than its business fundamentals would suggest. Tony Wible made this argument between 2007 and 2010 – the very beginning of Netflix's streaming-fueled boom. He missed a return of more than 500%. Michael Pachter was the resident Netflix bear for most of the 2010s, when the company's investment in original programming and international expansion transformed the DVD-by-mail company into Hollywood's standard bearer. Pachter, a whisky lover and video-game expert, missed out on a return of nearly 3,800% by the time he changed his rating to neutral in March 2022, according to data compiled by Bloomberg. Wible is no longer a media analyst while Pachter has since become a Netflix convert. His firm has had a buy rating on the stock for the past couple years. While Wible and Pachter at times doubted the long-term viability of Netflix, the current skeptics don't. "Netflix is phenomenal and a winner in its space," Dolgin said. Its competition resembles "the gang that couldn't shoot straight," Harrigan said. Dolgin and Harrigan say they are just taking the long view. They see a company with more limited upside – one that could still stumble in the next year or two. It was just two years ago that Netflix lost customers for two quarters in a row, causing investors to worry about the long-term viability of streaming as a business. The benefit from the password crackdown will diminish over time. The company's advertising tier is still years away from being a meaningful contributor. And the gaming division hasn't found its footing. Unless it identifies a new source of growth, Netflix will at some point resemble a very well-managed but mature media company, as opposed to a tech company that swallows an entire category (a la Nvidia). Of course, if these analysts are wrong, there's plenty of time to change their minds. Warner Bros. won an auction to produce and release an adaptation of Wuthering Heights directed by Emerald Fennell (Saltburn) and starring Margot Robbie, outbidding Netflix and Amazon (among others). Much of the press has focused on Warner Bros. beating Netflix, which offered more money but wouldn't commit to a traditional run in movie theaters. But the bigger story is in the details of the rejected offer from Amazon. The commerce company, which has emerged as the most compelling streaming service in the movie business, offered to put the film exclusively in theaters for more than a month — just like any studio — and then make it available on Prime Video, according to three people familiar with the talks. It also discussed paying the filmmakers for each view on streaming, a new kind of compensation that could be a huge windfall for producers, said the people, who declined to be identified discussing private negotiations. This is the latest example of streaming services toying with new kinds of performance-based compensation. While many of the proposals amount to bonuses based on levels of viewership, this is one of the first that would pay someone for every view. Participants would receive one rate for a viewer who signed up to Amazon to view the title and a lower rate for the average viewer. The potential payday from such deals would rival and could even exceed those from traditional studios — if the films prove to be hits. Artists would get paid in success for the performance in theaters and on streaming. Amazon has yet to fully develop the model and is still finding the right movie. But it didn't win this round, largely because Warner Bros. offered to spend far more money marketing the film. The No. 1 song in the world is…Apt., a new song from Rosé of the Korean pop group Blackpink and Bruno Mars. Members of Blackpink are enjoying huge success as solo acts this year. Mantra, a new release from Rosé's bandmate Jennie, was the top song on YouTube last week. Mars, meanwhile, has two of the biggest songs in the world right now. His collaboration with Lady Gaga is the top song on Spotify. The No. 1 movie in the world is… Venom 3. The film grossed $51 million in North America and $175 million worldwide. That is the lowest domestic opening of the three Venom movies, but a big number overseas. Deals, deals, dealsMy colleague Jason Schreier has written a book about video game publisher Blizzard Entertainment that is a New York Times bestseller. You should check it out. When I got home from the Dodger game Friday I was way too wired for bed, so I finally watched Richard Linklater's Everybody Wants Some!! How had I never seen that movie? |

No comments:

Post a Comment