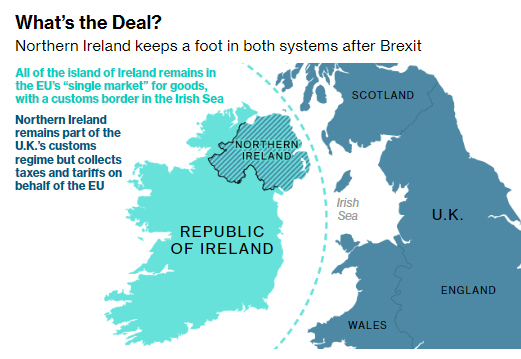

| Talks in the US between West Coast dockworkers and their employers look to run past the expiration of their contract Friday, with both sides expected to stay at the bargaining table while cargo keeps flowing during peak shipping season. One possible option: both parties agree on a short-term contract extension to preserve the current deal's no-stoppage clause as negotiations continue. (Click here for today's full story from Bloomberg's Augusta Saraiva). The stakes are high given the fragility of the US economy and state of the shipping industry. Container lines are reeling in record profits and want to invest in technology that improves efficiency at port terminals. Unions worry that advances like automation threaten their livelihoods. Labor impasses have already added to supply-chain disruptions worldwide this year. Korean industries have faced production woes due to a weeklong trucker union strike in June. Protests among logistics workers have also occurred in Germany, Spain, the UK and Argentina. Gene Seroka, the Port of L.A.'s executive director, sounds optimistic both sides are committed to avoiding a major disruption. (Watch his interview on Bloomberg TV here.) Seroka said this month's cargo volumes "will rival our best June ever, set just last year, and we're matching box for box our record-setting 2021." Meanwhile, inbound shipments over the next few weeks are looking solid, according to the port's internal forecasts. For more: —Brendan Murray in London  factory No chance | The EU's chief Brexit negotiator, Maros Sefcovic, said he won't contemplate a hard border on the island of Ireland, while suggesting that the UK's plan to override the part of the Brexit deal governing trade in Northern Ireland may harm European cooperation with Britain on financial services. Sefcovic said the EU can't accept Britain's efforts to "unilaterally and illegally" dis-apply the arrangements in the Brexit deal that keep Northern Ireland in the bloc's single market while creating a customs border with the rest of the UK. But he also stressed the importance of protecting the 1998 peace deal for the region by preventing the return of a hard border with Ireland. - Recovery path | China's economy showed further signs of improvement in June with a strong pickup in services and construction as Covid outbreaks and restrictions were gradually eased.

- Weakening demand | South Korea's chip stockpiles increased by the most in more than four years, suggesting a slowdown in demand for memory chips used in electronics worldwide.

- Not enough | The world is heading for a "turbulent period" as tightening supplies of liquefied natural gas and oil exacerbate a global energy crunch, Shell Chief Executive Officer Ben van Beurden said.

- Export controls | US restrictions on exports "are at the red-hot center of how we best protect our democracies" because they cut off supply of crucial technologies to countries that threaten American national security, Commerce Secretary Gina Raimondo said.

- Bargain hunters | Skittish consumers hunting for deep discounts — or just sitting on their wallets — look likely to hold down revenue for US retailers in the crucial back-to-school shopping season, according to a new survey.

- Metal fatigue | Base metals headed for the worst quarterly slump since the 2008 global financial crisis as China's economy recovered only gradually and fears of a worldwide recession intensified.

- Stephanomics podcast | This week's episode explores the economic and societal fallout of the end of Roe v. Wade, the landmark 1973 ruling holding that there is a Constitutional right to abortion, and how it fits with that worldwide trend.

| - No breaks | In the first quarter of 2022, steps to contain the omicron variant caused Japan's economy to shrink. Now China's lockdowns are slowing the rebound by hitting trade. Bloomberg Economics says as it cut its 2022 growth forecast for Japan.

- Rougher seas | Dry-bulk operators face increased uncertainty from the ripple effects that Russia's war on Ukraine is having on coal and grain trades. Moreover, demand from China is being hampered by lockdowns and a cooling housing market, Bloomberg Intelligence says.

- Use the AHOY function to track global commodities trade flows.

- Click HERE for automated stories about supply chains.

- See BNEF for BloombergNEF's analysis of clean energy, advanced transport, digital industry, innovative materials, and commodities.

- Click VRUS on the terminal for news and data on the coronavirus and here for maps and charts.

Don't keep it to yourself. Colleagues and friends can sign up here. We also publish the New Economy Daily, a briefing on the latest in global economics. For even more: Follow @economics on Twitter and subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. How are we doing? We want to hear what you think about this newsletter. Let our trade tsar know. |

No comments:

Post a Comment