| Hello. Today we look at how central bankers are declaring a new era for inflation, the future of business travel, and the different types of price pressures confronting global policy makers. It was great while it lasted. That's the takeaway of Federal Reserve Chair Jerome Powell looking back at the past decade, when globalization helped to keep inflation in check and allow policy makers to instead focus on spurring the job market. "Since the pandemic, we've been living in a world where the economy has been driven by very different forces," Powell said on a panel Wednesday at an annual confab hosted by the ECB in Sintra, Portugal.

A series of supply shocks has upended economic models and forced central banks to throw out their old playbooks, Craig Torres and Carolynn Look report here in a wrap up of the conference. "I don't think that we're going to go back to that environment of low inflation," European Central Bank President Christine Lagarde said.

Powell highlighted the risk of the world dividing into blocs, with supply chains becoming much less efficient, and Lagarde spoke in a similar vein: "There are forces that have been unleashed as a result of the pandemic as a result of this massive geopolitical shock we are facing now that are going to change the picture and the landscape within which we operate," she said.

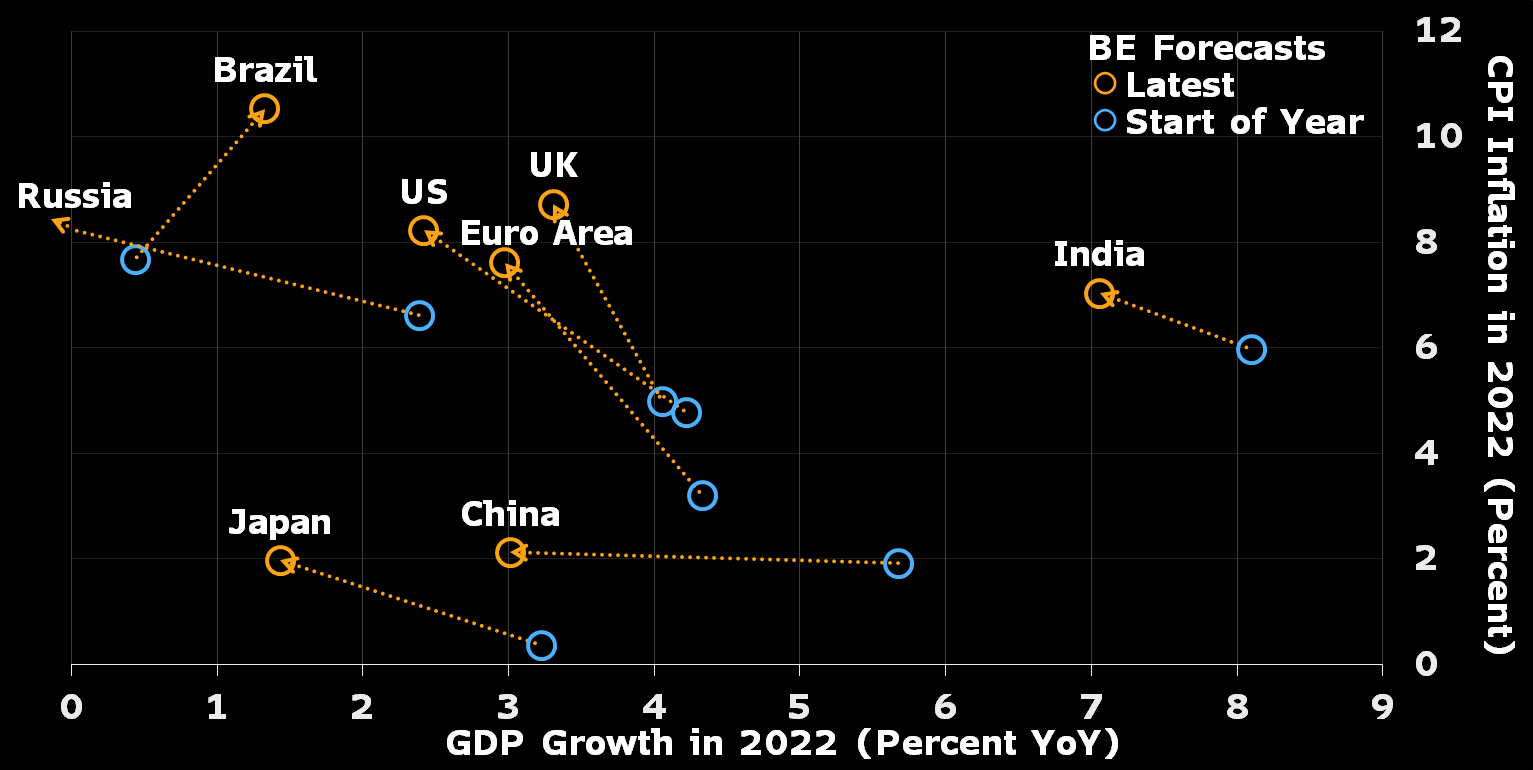

Policy makers signaled perhaps their clearest determination yet to bring down inflation even if it means damaging growth.  Source: Bloomberg Economics Source: Bloomberg Economics "Is there a risk that we would go too far? Certainly there's a risk," Powell said. But, "the worst pain would be from failing to address this high inflation and allowing it to become persistent," he said in a conclusion that was endorsed by Lagarde — "ditto," she said — and by Bank of England Governor Andrew Bailey, who chimed in with, "absolutely." Digesting the signaling at Sintra, Neil Dutta, the typically bullish head of US economic research at Renaissance Macro Research, said "I've turned cautious on the economic outlook (a place I don't normally find myself)," as Molly Smith reports here. "The Fed increasingly believes a recession is necessary to address underlying inflation concerns," Dutta concluded.

Krishna Guha and Peter Williams at Evercore ISI judged that "we should not underestimate how high the bar is for central banks to shift more dovish." Bruce Kasman and Joseph Lupton at JPMorgan Chase are also sounding nervous. They still expect central banks to "become sensitive to growth disappointments" and that the Fed will eventually stop hiking at 3%, the Bank of England at 2% and the ECB at 1%. "But we are not confident in this view and rising uncertainty around their reactions to supply shocks that lower growth and raise inflation increases near-term recession risk," they said in a report on Wednesday.

—Chris Anstey In the new world of work, there's a new type of employee: the business-leisure traveler. It's the latest attempt to find a happy medium between working arrangements like Airbnb's — where staff can work anywhere, anytime — and those at companies like Tesla, whose chief executive officer, Elon Musk, tweeted that unless employees turn up in the office, "we will assume you have resigned."  Tourists at a beach in Seminyak, Bali, Indonesia. Photographer: Putu Sayoga/Bloomberg Employees' growing enthusiasm for business-leisure travel is slowly being met with policy momentum. Governments are trying to work out visa and tax regulations while businesses fret about compliance and corporate culture. Officials in tourism hotspots Thailand and Indonesia see the longer-term travel trend working in their favor — if everyone can get the rules right. - China recovers | China's economy showed further signs of improvement in June with a strong pickup in services and construction as Covid outbreaks and restrictions were gradually eased.

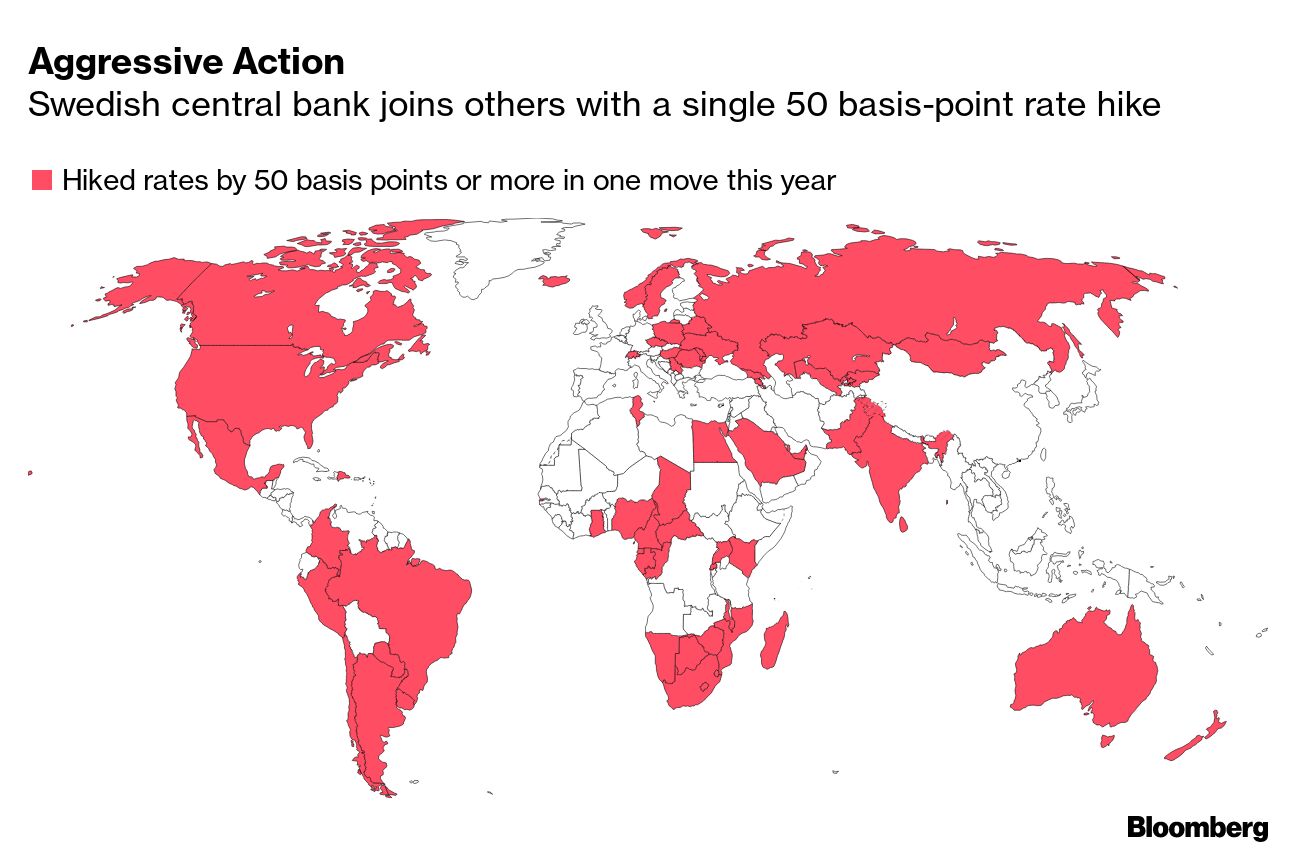

- Rate increases | Sweden's Riksbank doubled its pace of interest-rate hiking to fight inflation and signaled it could accelerate if needed. Colombia's central bank is probably about to go even faster later today.

- Wage gains | South Korea will bump up its minimum wage by 5% next year after government-appointed officials were left to make a decision closely watched by executives, labor leaders and also policy makers.

- After effects | Price controls designed to freeze food costs during the pandemic in Kuwait have long outlasted the worst of the coronavirus, inflicting increasing side effects on companies and consumers.

- Dockworkers | A labor contract for 22,000 US West Coast dockworkers is on the verge of expiring, opening the door to strikes, lockouts or stoppages — but both sides appear willing to avoid such disruptions.

- Hot Aussie housing | Economists agree Australia's housing prices are about to sink. What they're not so aligned on is just how much a slide in the country's property market will drag the economy down with it.

- Asian central banks | The surge in the dollar has set Asian currencies on course for their worst quarter since 1997 and created a dilemma for central bankers.

Central bankers are all fretting about inflation, but they're all dealing with different forms of price pressures. According to Ana Luis Andrade of Bloomberg Economics, the mix may mean the Federal Reserve will be forced to raise interest rates well into restrictive territory, the Bank of England may nudge its benchmark beyond neutral and the European Central Bank might not get that far. As the chart above shows, energy still explains the vast bulk of the euro-area's inflation surge, but in the US a red-hot labor market means services are becoming an outsized driver of prices and that's the kind of inflation that will need tackling by the Fed. Read the full research on the Bloomberg Terminal. Read more reactions on Twitter |

No comments:

Post a Comment