| Bloomberg Evening Briefing Americas |

| |

| Hedge funds have piled into short positions on US stocks. The smart money, as it were, is increasingly betting that artificial intelligence and its disruption of existing business models will continue to wreak havoc. Notional short selling across single stocks last week was the biggest on record in Goldman Sachs data going back to 2016, the bank's prime brokerage team said in a client note. Short sales outpaced long buys by two-to-one. Anxiety over how AI will transform the US economy boiled over last week with a selloff sparked by Anthropic's new tools for automating work tasks in a number of industries. Overall, hedge funds net sold US equities for a fourth week, and they did so at the heaviest rate since Donald Trump launched his trade war. —Natasha Solo-Lyons | |

What You Need to Know Today | |

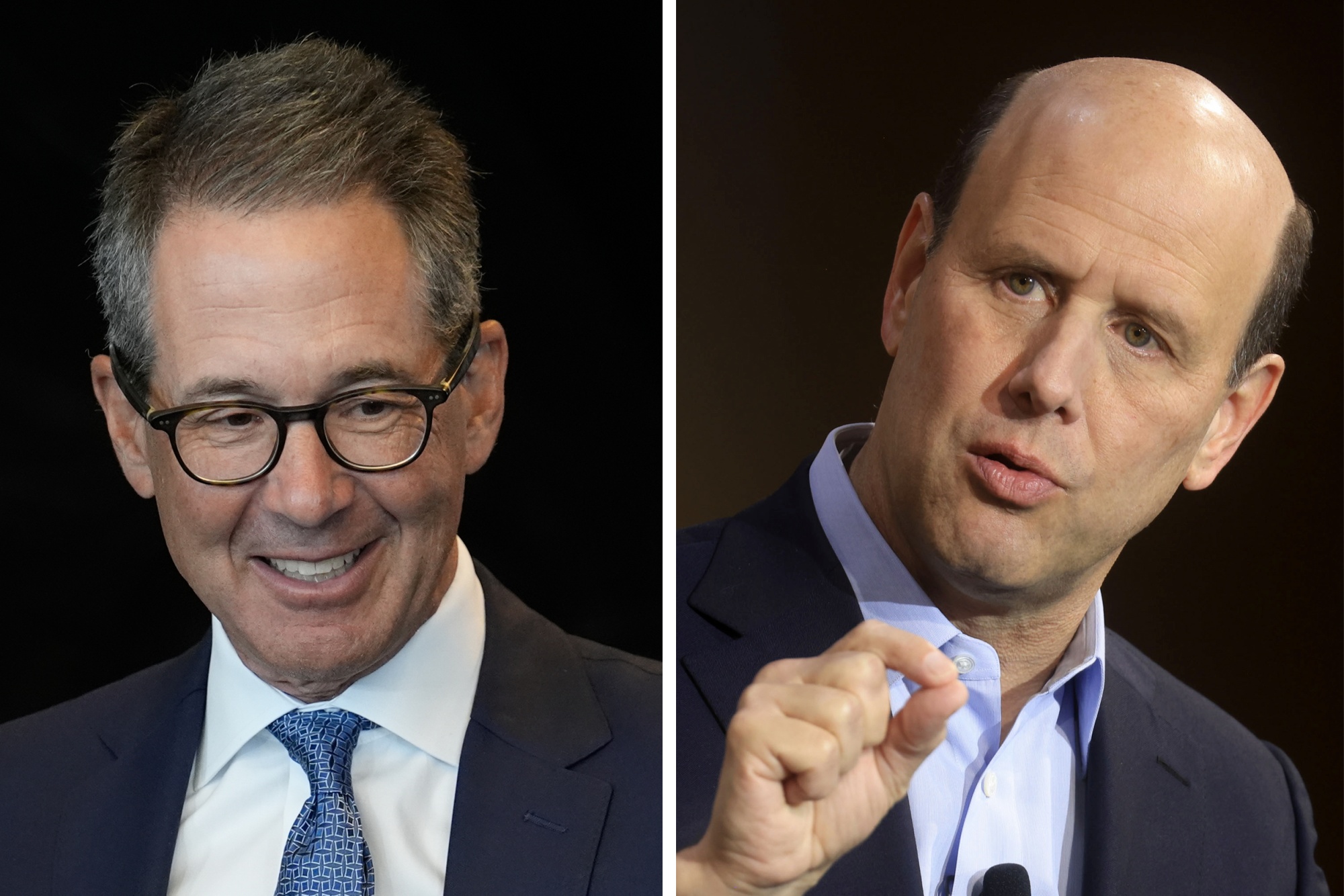

| Blue Owl Capital's record-setting stock plunge was triggered by doubts about the firm's private credit investments. Now, a different form of leverage is threatening to bring more instability to the shares: its founders' loans. Co-Chief Executive Officers Doug Ostrover and Marc Lipschultz have pledged more than half of their Blue Owl stakes in order to secure loans from financial institutions, according to regulatory filings. The value of that collateral however has slumped by $260 million since the start of the year, as Blue Owl's shares have lost 16% of their value. Blue Owl has previously warned investors that the firm's shares "could decline materially" if Ostrover and Lipschultz have to sell more of their stock in the event of a margin call, though the filing notes their loan agreements allow them to "pledge alternative collateral in lieu of the pledged common units."  Doug Ostrover and Marc Lipschultz Photographers: Chris O'Meara/AP Photo, Michael Nagle/Bloomberg | |

|

| Bubble fears notwithstanding, another rally in tech companies drove stocks higher Monday ahead of economic data to be released by the Trump administration. Gold topped $5,000 while the dollar fell. Following a surge in dip buying Friday, the index kept rising today to approach its all-time highs. A gauge of chipmakers climbed 1.4% while an exchange-traded fund focused on software names extended a back-to-back advance to almost 7%—a significant counterpoint to the bloodletting in that sector just a few days ago. "When markets sell off like certain areas in tech have, there's often knee-jerk rallies," said Sameer Samana at Wells Fargo Investment Institute. "Time will tell if we need a retest or if enough value was created." | |

| |

|

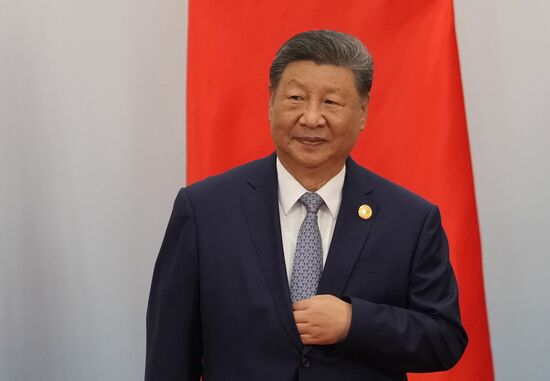

| The US meanwhile has quietly built up its biggest stockpile of copper in decades, distorting flows of the metal to the rest of the world. The influx of copper into American inventories has gathered momentum over the past year and added to upward pricing pressures. The higher prices in turn have reverberated across the copper supply chain. Here's why America is stocking up. | |

|

| |

|

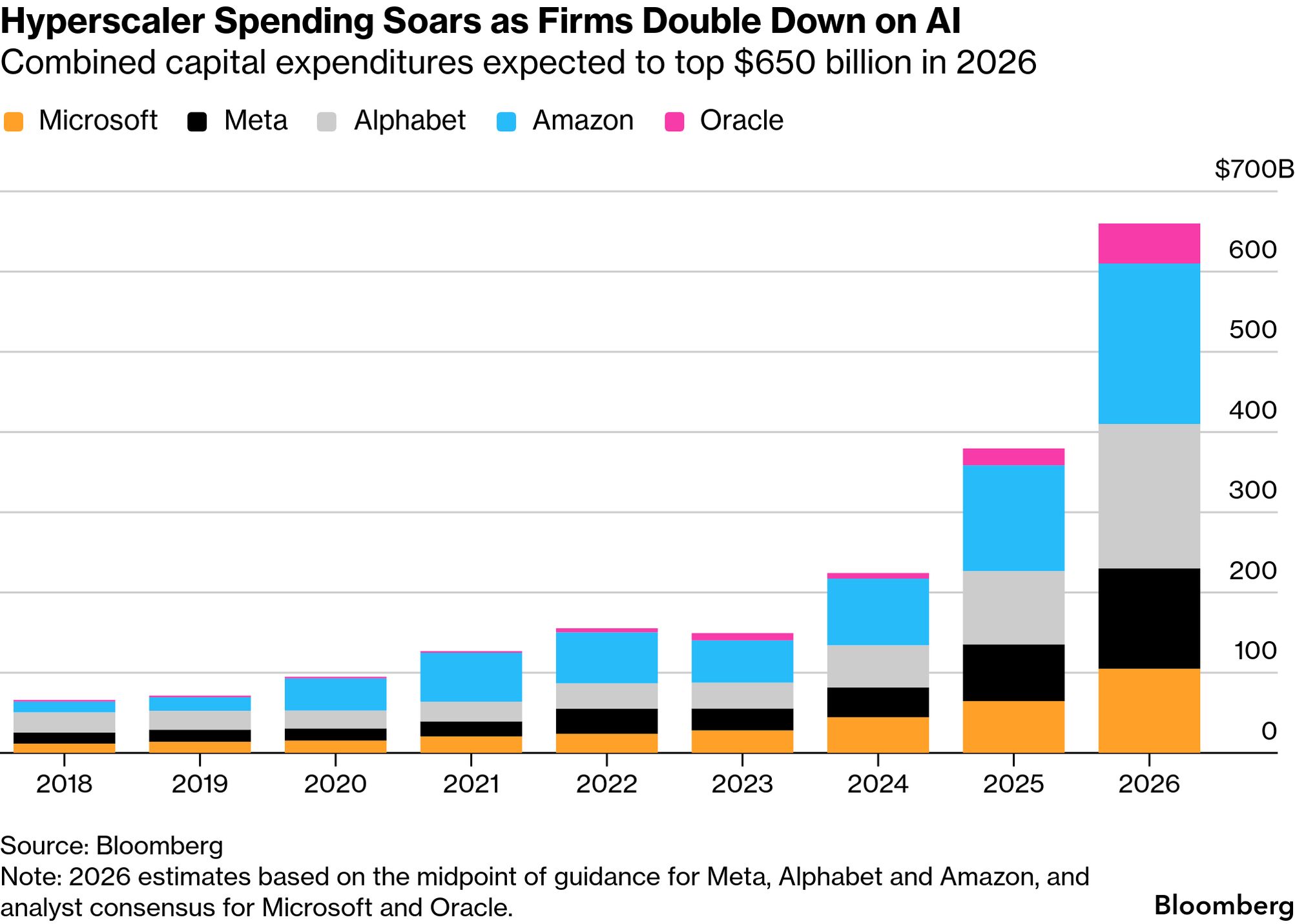

| Alphabet is borrowing far and wide to finance the unprecedented spending plan behind its AI ambitions. The Google parent is joining the race to pile hundreds of billions of dollars into what may be the biggest financial bubble in history, an utterly transformative moment for humanity, both or neither. Tapping the US corporate bond market for $15 billion on Monday, Alphabet also is pitching investors on what would be its first ever offerings in Switzerland and the UK. The latter would include a rare sale of 100-year bonds, the first time a tech company has tried such an offering since—well—the dotcom frenzy of the late 1990s. | |

|

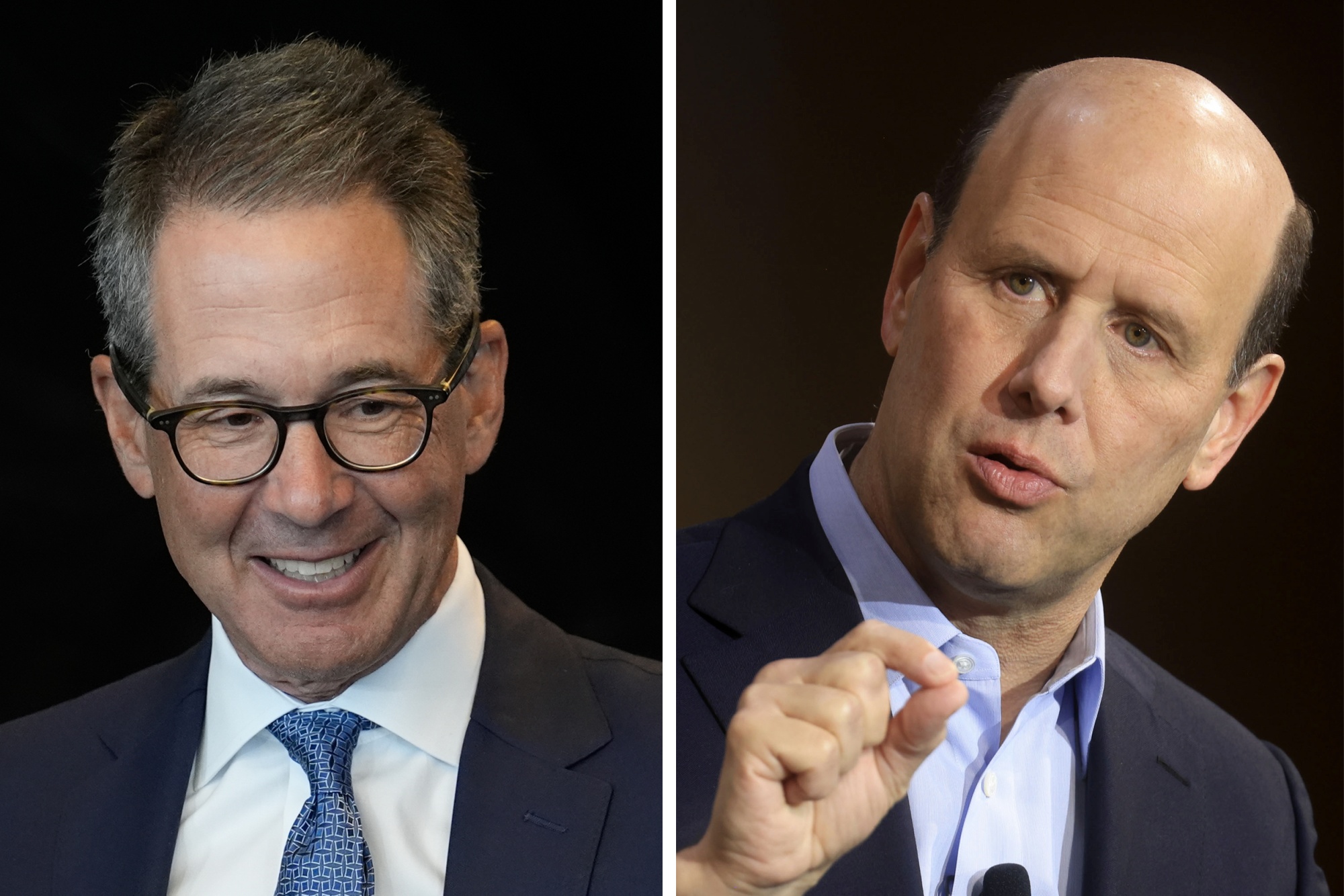

| Japanese Prime Minister Sanae Takaichi's election victory is handing Chinese leader Xi Jinping a dilemma: Engage with Japan's most popular post-war leader or continue a deep freeze with the US's top ally in Asia. Takaichi emerged Sunday from a snap election with a historic majority that arguably gives her a mandate for a more assertive foreign policy. Since November, when she implied in parliament that a Chinese invasion of Taiwan could prompt Japan to deploy its military, Beijing has imposed export controls and tourism curbs. Chinese leaders must now decide whether to maintain economic pressure on Tokyo, or find an off-ramp. | |

|

| |

| New Year Sale: Save 60% on your first year

Enjoy unlimited access to Bloomberg.com and the Bloomberg app, plus market tools, expert analysis, live updates and more. Offer ends soon. | | | | | | |

What You'll Need to Know Tomorrow | |

| |

| |

| |

| Bloomberg Invest Dubai: Join us March 27 as we unite family offices as well as private and public investors to navigate global market uncertainty. As geopolitical risk and tech volatility rise, we'll explore where capital is moving next, how private markets are reshaping wealth and the role the Middle East is playing in the global investment market. Learn more. | |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| |

Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment