|

Reading time: 5 minutes |

News | Crypto Converter | Crypto Calculators |

Epstein Files drag Coinbase into the spotlight |

|

Key points: |

DOJ-released emails suggest Jeffrey Epstein gained early exposure to crypto venture deals, including a Coinbase Series C stake routed through entities tied to him in 2014. The documents show proximity and awareness, not operational control, but they are reigniting scrutiny around early-era due diligence and reputational risk.

|

News - A fresh batch of DOJ-released "Epstein Files" dated February 2, 2026, has put Coinbase back into an uncomfortable historical frame. The records include emails, asset lists, and deal chatter indicating Epstein-linked entities bought into Coinbase's December 2014 Series C round when the exchange was valued around $400 million. |

Across the documents, the reported size of the stake varies. One asset list line item shows a $3,001,000 "purchase of Coinbase," while other emails reference figures in the $3.2 million to $3.25 million range, including a note about 195,910 Series C shares. Either way, the central point is consistent: Epstein appears to have secured an early position in Coinbase through an LLC linked to him, with intermediaries discussing entity naming and wiring logistics. |

How the Coinbase stake got done - The email trail repeatedly circles back to crypto venture intermediaries, including Blockchain Capital leadership and Brock Pierce, who is referenced as helping facilitate introductions. |

Some of the emails appear to place Coinbase co-founder Fred Ehrsam on the thread about a potential meetup, while other documents say the released materials do not clearly establish that Coinbase executives knew the ultimate beneficial owner at the time. |

By 2018, emails show offers to buy back part of the position at a higher valuation. One thread describes $15 million being wired for roughly half the stake, implying a major markup from the original entry. |

Bigger than Coinbase: Bitcoin funding, rivalries, and inbox updates - The same trove also reinforces Epstein's presence around early Bitcoin-adjacent institutions: exposure to Blockstream's 2014 seed round and donations connected to MIT's Digital Currency Initiative during a period when core developer funding was fragile. |

Other records show him copied on competitive-era commentary involving Ripple and Stellar, reflecting awareness of ideological and investor tensions rather than orchestration. A separate March 12, 2019, email also flagged Coinbase's Neutrino backlash and the broader surveillance trust debate that erupted at the time. |

Why this matters now - None of the material shows Epstein as a founder, developer, or protocol decision-maker. But it does underline a reality crypto keeps running into: off-chain history and early funding choices can resurface years later as a compliance and credibility test for an industry still trying to prove it has matured. |

Trump denies knowledge of $500M UAE stake in WLFI |

|

Key points: |

Trump said he was unaware of a $500 million UAE-backed investment in WLFI, despite a WSJ report detailing the deal. The investment has intensified conflict-of-interest concerns and is now complicating negotiations over U.S. crypto market structure legislation.

|

News - U.S. President Donald Trump has denied knowledge of a $500 million investment by an Abu Dhabi-backed entity into World Liberty Financial (WLFI), a crypto venture linked to his family. Speaking to reporters at the White House, Trump said the company's business dealings are handled by his sons, adding that he is not involved in its day-to-day operations. |

The denial followed a Wall Street Journal (WSJ) investigation reporting that an entity tied to Sheikh Tahnoon bin Zayed Al Nahyan acquired a 49% stake in WLFI just four days before Trump's January 2025 inauguration. As per the report, the agreement involved a $500 million commitment, with $250 million paid upfront. |

According to WSJ, $187 million from the initial payment was directed to Trump family-controlled entities. The same reporting said at least $31 million was slated for entities tied to Steve Witkoff's family, while another account in the source set described the $31 million as linked to an entity associated with WLFI founders Zak Folkman and Chase Herro. |

Why the deal is drawing political fire - The timing and structure of the investment have triggered sharp criticism from Democratic lawmakers. Senator Chris Murphy described the transaction as "brazen, open corruption," arguing that it preceded the Trump administration's approval of expanded UAE access to advanced U.S. AI chips that had previously been restricted. |

Murphy and other Democrats have alleged that the sequence raises national security concerns, though WLFI and White House officials have denied any connection between the crypto investment and U.S. policy decisions. A WLFI spokesperson said neither Trump nor Witkoff was involved in the transaction and called claims linking it to chip approvals "100% false." |

Crypto legislation caught in the crossfire - The controversy is now spilling into Capitol Hill negotiations over bipartisan digital asset market structure legislation. Analysts at TD Cowen said the WSJ report has increased pressure on Democrats to demand stricter conflict-of-interest rules, potentially barring senior officials and their families from owning or controlling crypto firms. |

With partisan lines hardening, TD Cowen warned that breaking the legislative deadlock may now require Trump's direct intervention. |

Bitcoin caught between metal mania and a search for a floor |

|

Key points: |

Gold and silver's crisis-level rally has drained risk appetite from crypto, leaving Bitcoin lagging despite signs of stabilization. Analysts are split on timing, with some seeing bottoming signals near $78K while others warn of a deeper test toward $60K or lower.

|

News - Bitcoin's recent volatility is unfolding against an unusual backdrop: a historic surge in gold and silver, which Fundstrat's Tom Lee linked to Washington policy moves that redirected capital into safe-haven trades. Lee said policy decisions in the U.S. temporarily sidelined crypto during a critical moment. |

Gold jumped 6.5% in a single session to nearly $5,000 per ounce, while silver surged more than 13%, marking their largest daily gains since the 2008 financial crisis. Lee argued that this metals frenzy coincided with crypto deleveraging late last year, capping Bitcoin's upside even as fundamentals improved. |

Bitcoin briefly slipped below $76,000 during a late-January sell-off that triggered over $2 billion in long liquidations. While prices have since recovered toward the $78,000 area, analysts say the rebound has not yet invalidated downside risks. |

Where analysts see support forming - Galaxy Digital's Alex Thorn warned that Bitcoin could still drift lower, with weak demand between $70,000 and $80,000 creating a vulnerable zone. Compass Point analysts similarly described this range as an "air pocket," noting limited structural support. |

Thorn said a test of $70,000 remains possible, followed by a potential move toward the realized price near $56,000 or the 200-week moving average around $58,000. Historically, those levels have marked long-term entry points near cycle bottoms. |

Thorn noted that roughly 46% of Bitcoin's circulating supply is now held at a loss, a condition seen in past late-stage bear markets. However, he also highlighted a slowdown in long-term holder profit-taking, a trend that has previously aligned with market bottoms. |

Rotation debate resurfaces - Compass Point analysts offered a slightly more constructive view, describing the crypto bear market as entering its final innings. Their base case sees Bitcoin bottoming between $60,000 and $68,000, barring a broader U.S. equity bear market. |

Tom Lee echoed the possibility of a rotation back into crypto, pointing to rising network activity on Ethereum and comparisons to 2020, when gold peaked before capital flowed into risk assets. Whether metals continue to dominate or begin to cool may determine how soon Bitcoin finds its footing. |

AI buzz grows, but crypto still waits for its breakout |

|

Key points: |

Industry leaders say crypto-linked AI lacks a clear consumer product, even as interest accelerates across tech and finance. Institutional capital continues to favor AI over crypto, highlighting a widening gap between hype and adoption.

|

News - Crypto's push into artificial intelligence (AI) is gaining attention, but not yet traction. Tron founder Justin Sun said the sector still lacks a defining, consumer-facing AI product that delivers obvious value beyond speculation. Posting "All in AI" on X, Sun argued that most AI-linked tokens remain conceptual and that the industry needs a clear breakthrough similar to ChatGPT before adoption can scale. |

Until that happens, Sun said crypto's most dependable growth continues to come from established use cases such as stablecoins and cross-border payments, particularly in regions where local currencies are unstable. He pointed to the widespread use of USDT on Tron as a practical financial rail rather than a speculative bet. |

AI momentum builds outside crypto - While crypto searches for product-market fit, AI momentum is accelerating elsewhere. xAI, backed by Elon Musk, has posted job listings for crypto specialists to train its models on on-chain data, market structure, and real-world trading behavior. The role focuses on teaching AI systems how professional traders interpret blockchain activity, manage risk, and navigate fragmented liquidity. |

The hiring push reflects growing demand for AI systems that can reason through complex financial environments, especially as crypto markets mature and institutional participation increases. |

Capital still favors AI over tokens - Despite this convergence, large pools of capital remain cautious on crypto exposure. A 2026 survey by JPMorgan Private Bank found that 89% of family offices hold no crypto assets, while 65% prioritize AI as a key investment theme. Average crypto allocations remain below 1%, underscoring how volatility continues to limit adoption among wealthy investors. |

Bitcoin exposure adds another layer - Meanwhile, Musk's broader empire highlights how AI and crypto exposure can overlap. The merger of SpaceX with xAI brings renewed attention to SpaceX's roughly 8,300 BTC holdings ahead of a possible IPO, raising fresh questions around disclosure and investor perception. |

For now, the message is clear: AI enthusiasm is real, but crypto's next growth cycle may depend on delivering products that feel essential, not experimental. |

|

More stories from the crypto ecosystem |

|

Interesting facts |

Vietnam became the first country to fully legalize crypto under standalone digital tech law: Vietnam's National Assembly passed the Law on Digital Technology Industry in June 2025, making it the first nation worldwide to enact standalone legislation that legally recognizes crypto assets and creates a regulatory sandbox for controlled blockchain innovation, with mandatory AML/CFT compliance. Bhutan turned into an unexpected blockchain pioneer with sovereign crypto strategy: The Himalayan kingdom built a $1.3 billion Bitcoin reserve, ~40% of its GDP, and launched a blockchain-based national ID and gold-linked digital token, positioning itself among the most crypto-integrated countries globally. Blockchain roots pre-date Bitcoin by more than a decade: Foundational cryptographic timestamping concepts that would evolve into blockchain were first introduced in 1991, long before Bitcoin's 2009 debut, meaning the tech is the result of decades of distributed systems innovation.

|

|

Top 3 coins of the day |

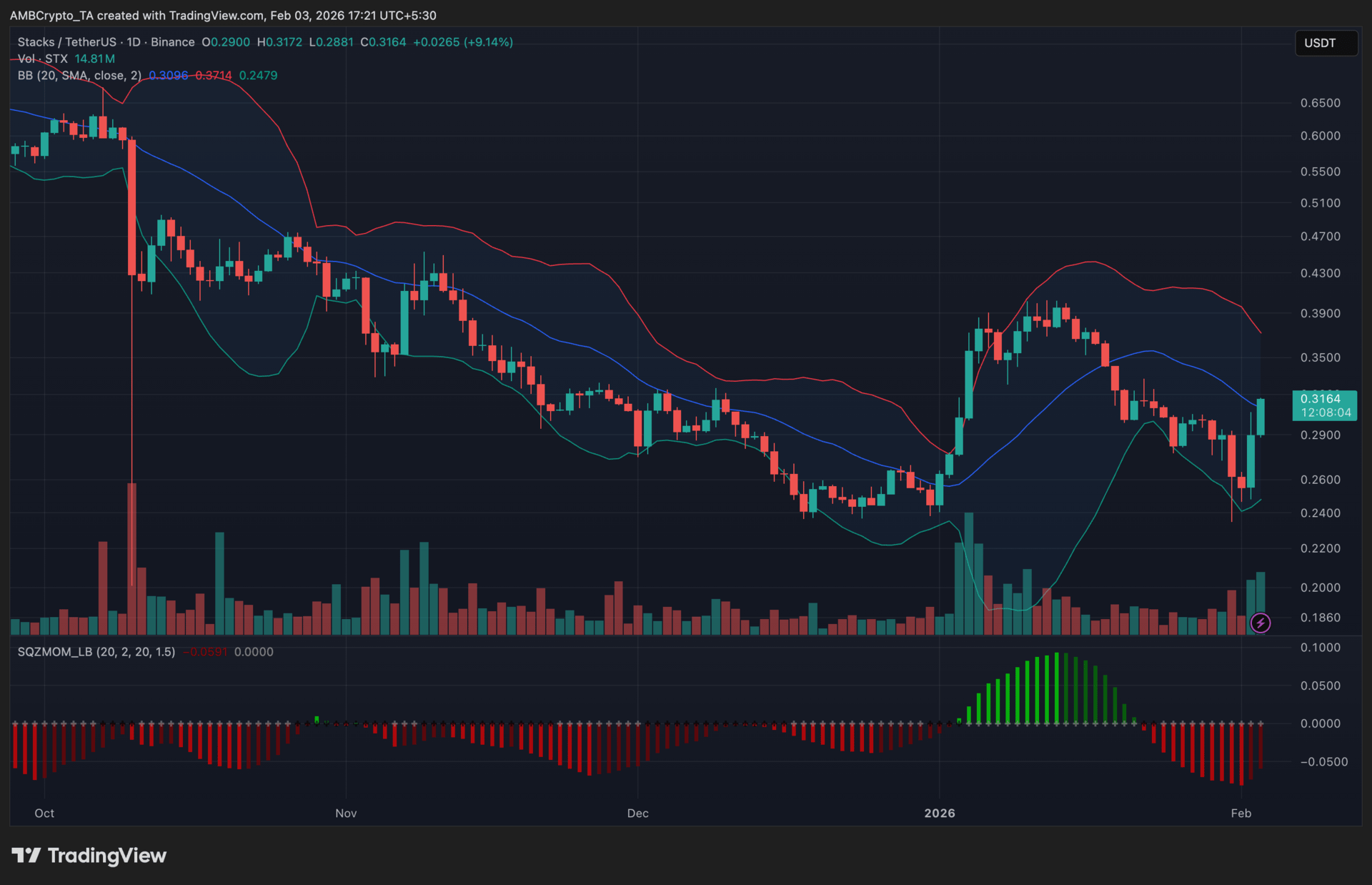

Stacks (STX) |

|

Key points: |

STX advanced toward $0.32 after breaking out of a multi-week compression range, with price nearing the upper Bollinger Band rather than decisively breaking beyond it. The Squeeze Momentum Indicator showed bearish pressure easing lately, while volume expanded sharply during the move, hinting at speculative participation alongside spot demand.

|

What you should know: |

STX's latest move followed a prolonged volatility squeeze that developed after weeks of sideways trading between $0.24 and $0.27. When price expanded, it did so quickly, pushing toward $0.32 and lifting the token into the upper half of its Bollinger Bands. Importantly, candles closed inside the band, signaling controlled expansion rather than an overheated breakout. |

Momentum conditions stayed mixed. The Squeeze Momentum Indicator had shown contracting bearish pressure during the base, though recent readings suggested momentum cooled again after the initial push. Volume behavior added clarity. Trading activity jumped noticeably on the expansion, confirming participation beyond a thin move. The advance also coincided with rising leveraged interest, which likely amplified short-term price speed rather than durability. |

Beyond positioning, attention returned to Stacks amid renewed focus on Bitcoin Layer 2 development, including progress around sBTC and ecosystem integrations. On the chart, $0.27 to $0.28 acts as near-term support, while $0.32 to $0.34 caps upside attempts for now. |

Hyperliquid (HYPE) |

|

Key points: |

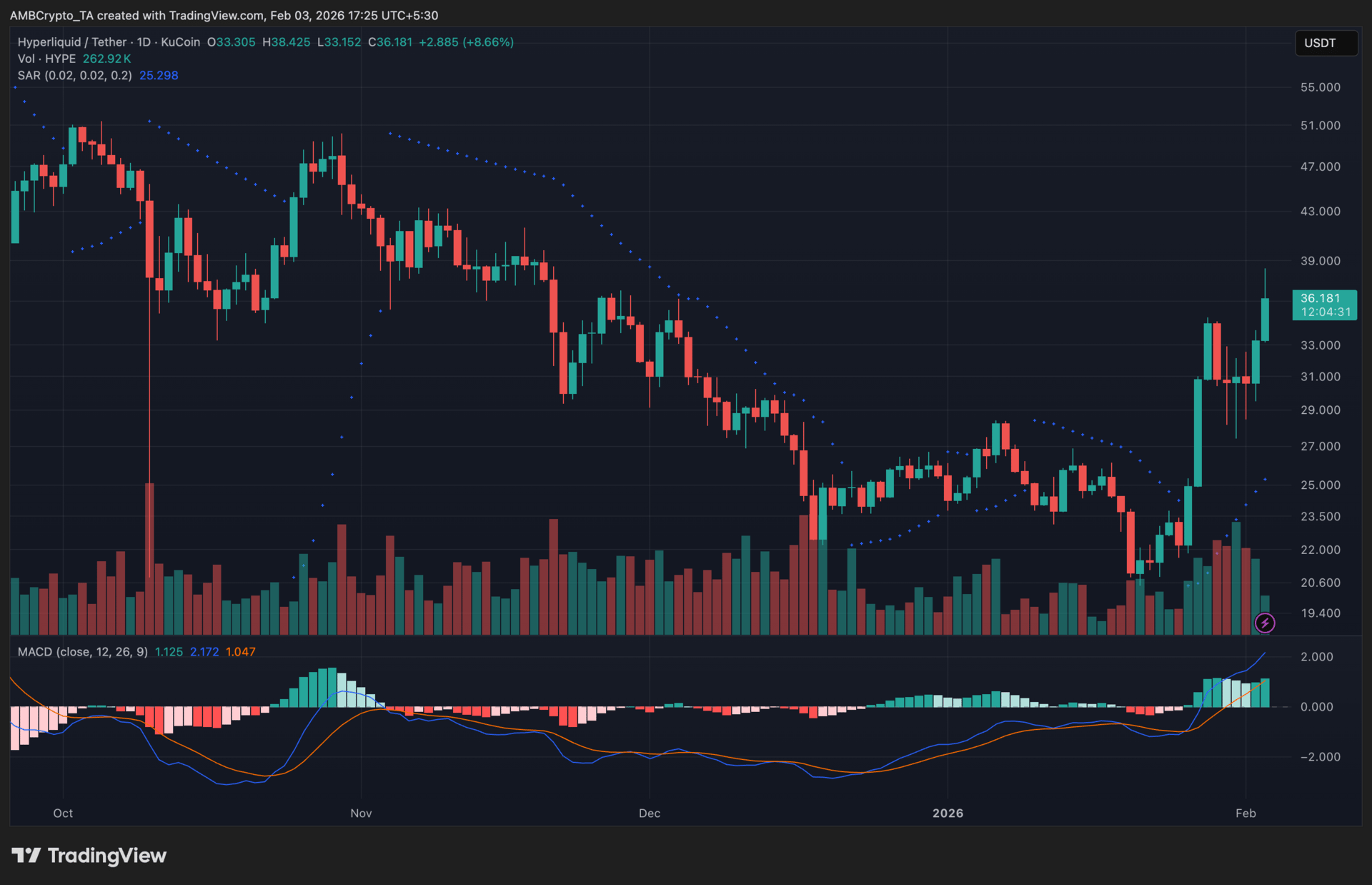

HYPE extended its rally toward $36 after reversing sharply from the $20 to $22 base, with price strength sustained rather than fading after the initial breakout. Parabolic SAR flipped below the candles and stayed there, while the MACD crossover strengthened alongside rising volume, reinforcing the shift in momentum.

|

What you should know: |

HYPE's recent move marked a decisive change in behavior after weeks of lower highs capped price action. Once buyers defended the $20 to $22 region, upside momentum rebuilt quickly, sending HYPE through $30 and into the mid-$30s without immediate rejection. The Parabolic SAR flip confirmed the trend change early in the advance, while the MACD crossed bullishly and expanded higher, signaling accelerating momentum rather than a short-lived bounce. |

Participation also increased meaningfully during the move. Volume climbed across multiple sessions, pointing to sustained engagement instead of a single impulse candle. Beyond the chart, the rally aligned with Hyperliquid's HIP-4 announcement, which introduced outcome-style contracts and expanded the protocol's product scope beyond perpetuals. That upgrade narrative, combined with heightened speculative interest, appeared to amplify the speed of the advance. |

On the chart, $30 to $32 acts as immediate support, while $38 to $40 remains the next area where price faces overhead pressure. |

Polygon (POL) |

|

Key points: |

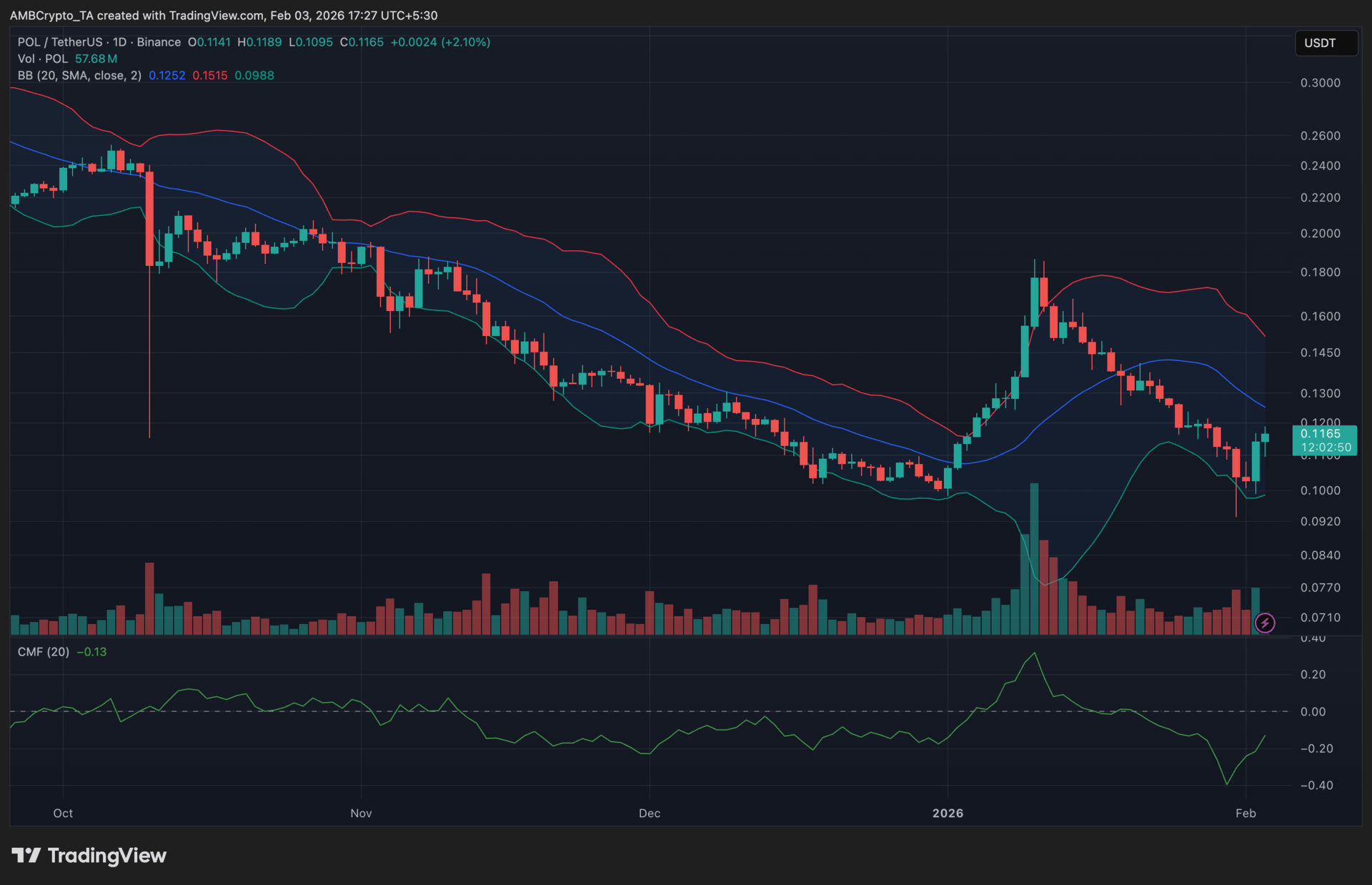

POL stabilized near $0.11 after volatility expanded sharply from January lows, though follow-through buying failed to sustain momentum beyond the initial surge. Bollinger Band expansion eased back into compression while CMF remained below zero, signaling hesitation rather than decisive accumulation.

|

What you should know: |

POL spent the past several weeks under steady downside pressure, with price compressing along the lower Bollinger Band as sellers stayed in control. That structure broke briefly when volatility expanded from the $0.10 to $0.11 zone, triggering a sharp push toward $0.17. However, the move failed to sustain, and price slipped back toward the middle band instead of establishing higher acceptance. |

This price behavior pointed to reactive positioning rather than a confirmed trend shift. Bollinger Bands widened during the surge but began narrowing again as momentum cooled. CMF recovered from its weakest readings yet remained negative, showing that selling pressure eased without flipping into sustained inflows. Volume followed a similar path, expanding during the breakout attempt before tapering off. |

Outside the chart, recent discussion around Polygon's token burn activity and its longer-term payments-focused strategy helped frame the move, though neither translated into persistent buying. On the chart, $0.09 to $0.10 acts as key support, while $0.13 to $0.14 limits near-term upside. |

How was today's newsletter? |

|

No comments:

Post a Comment