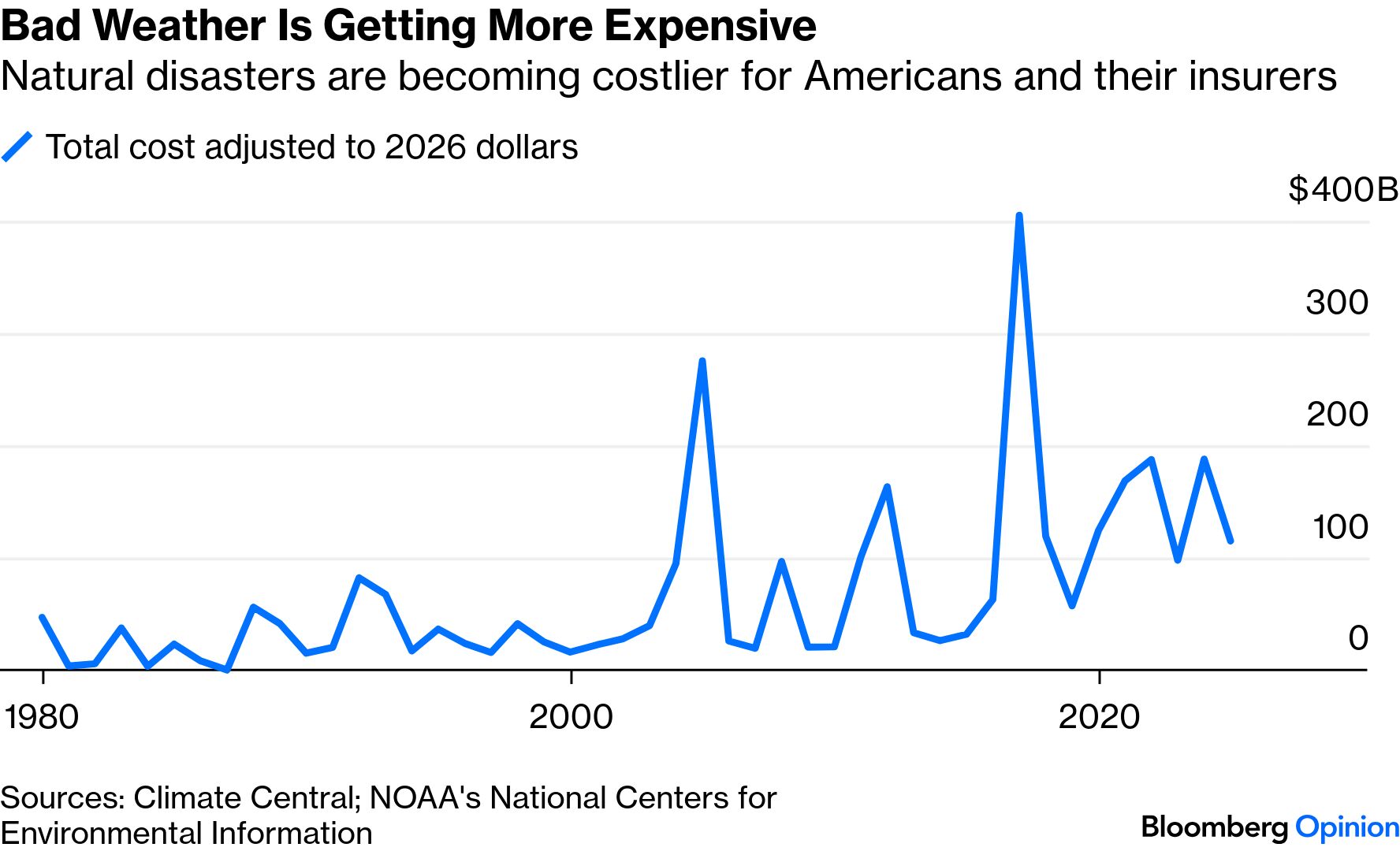

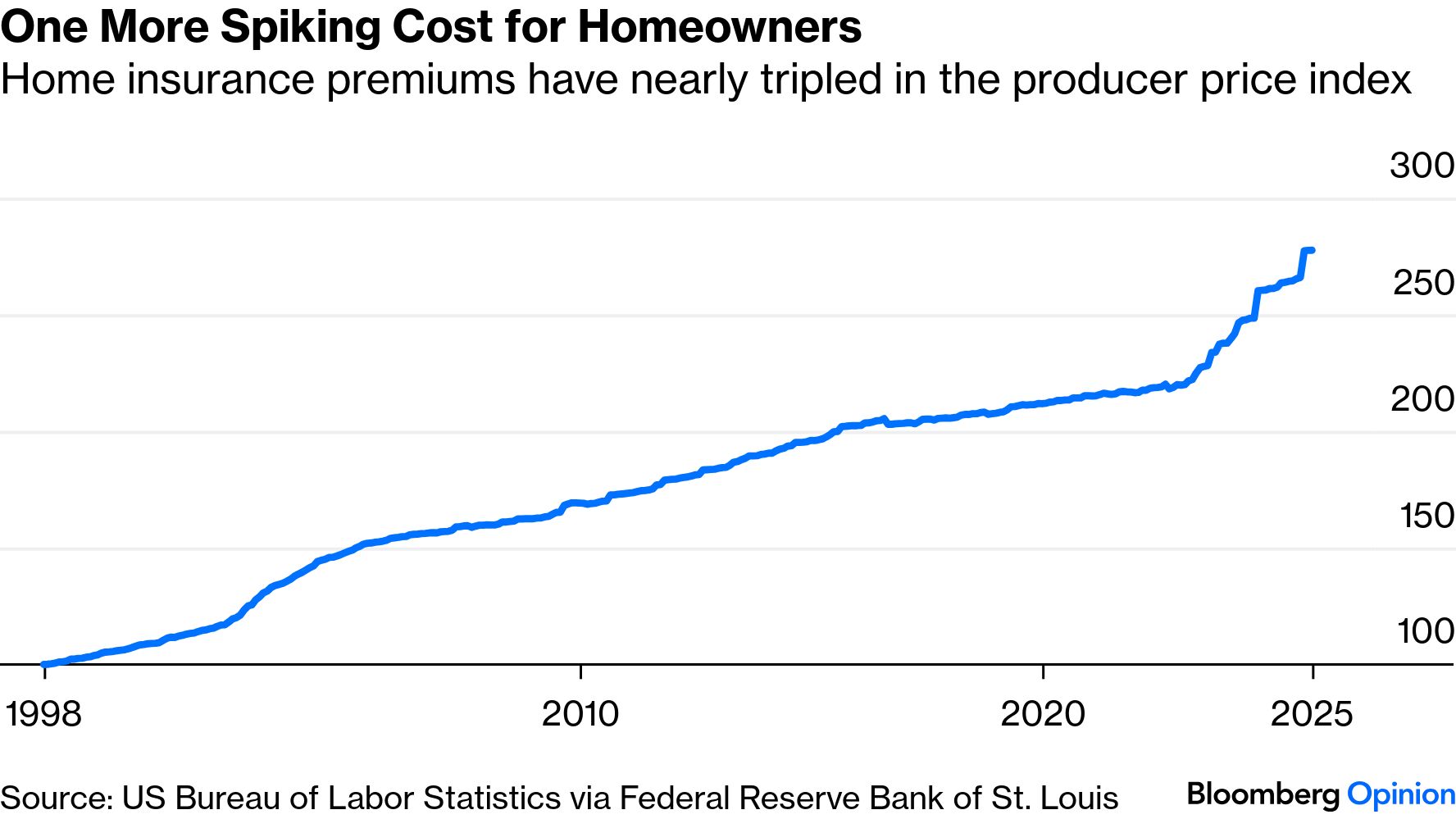

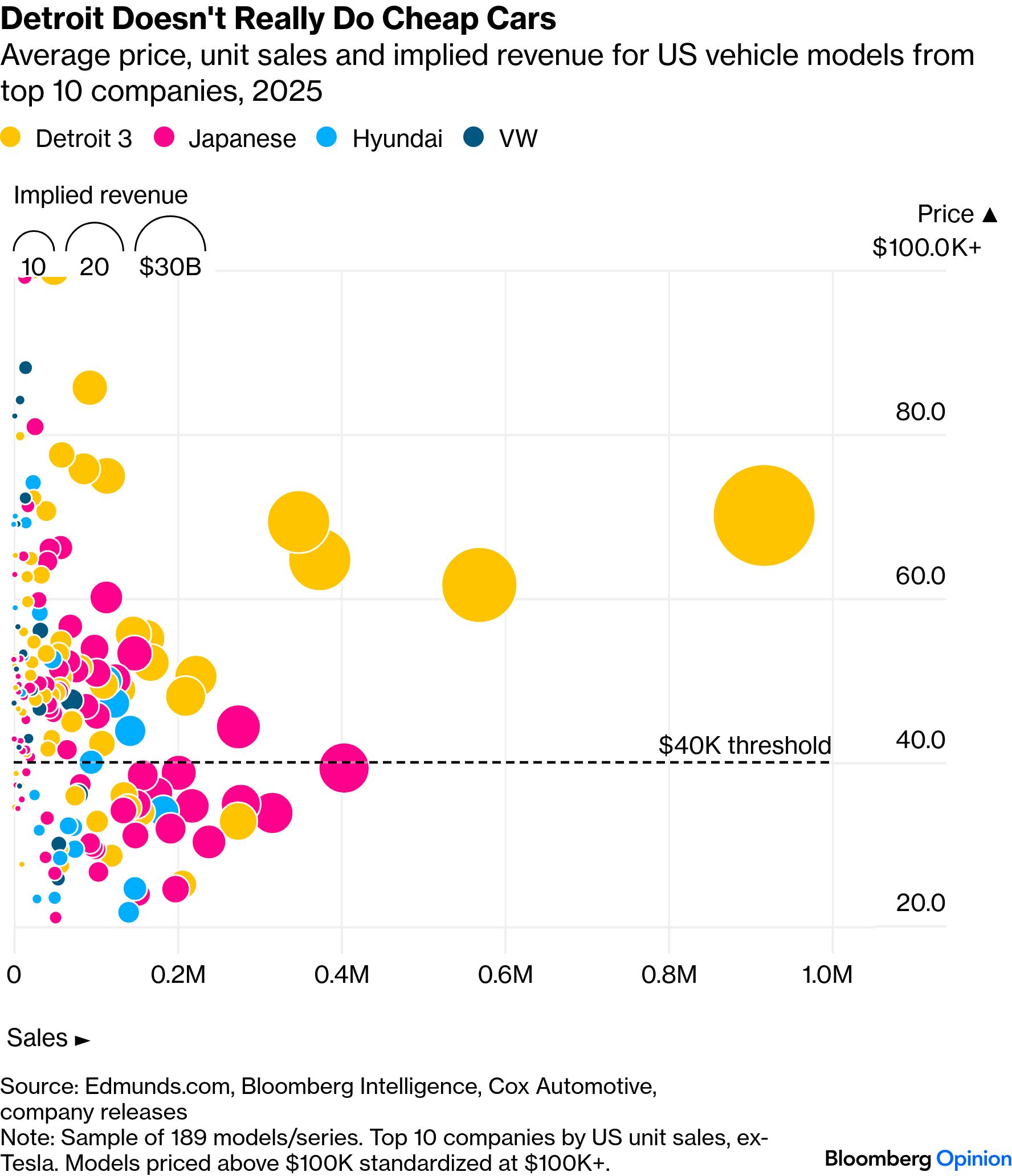

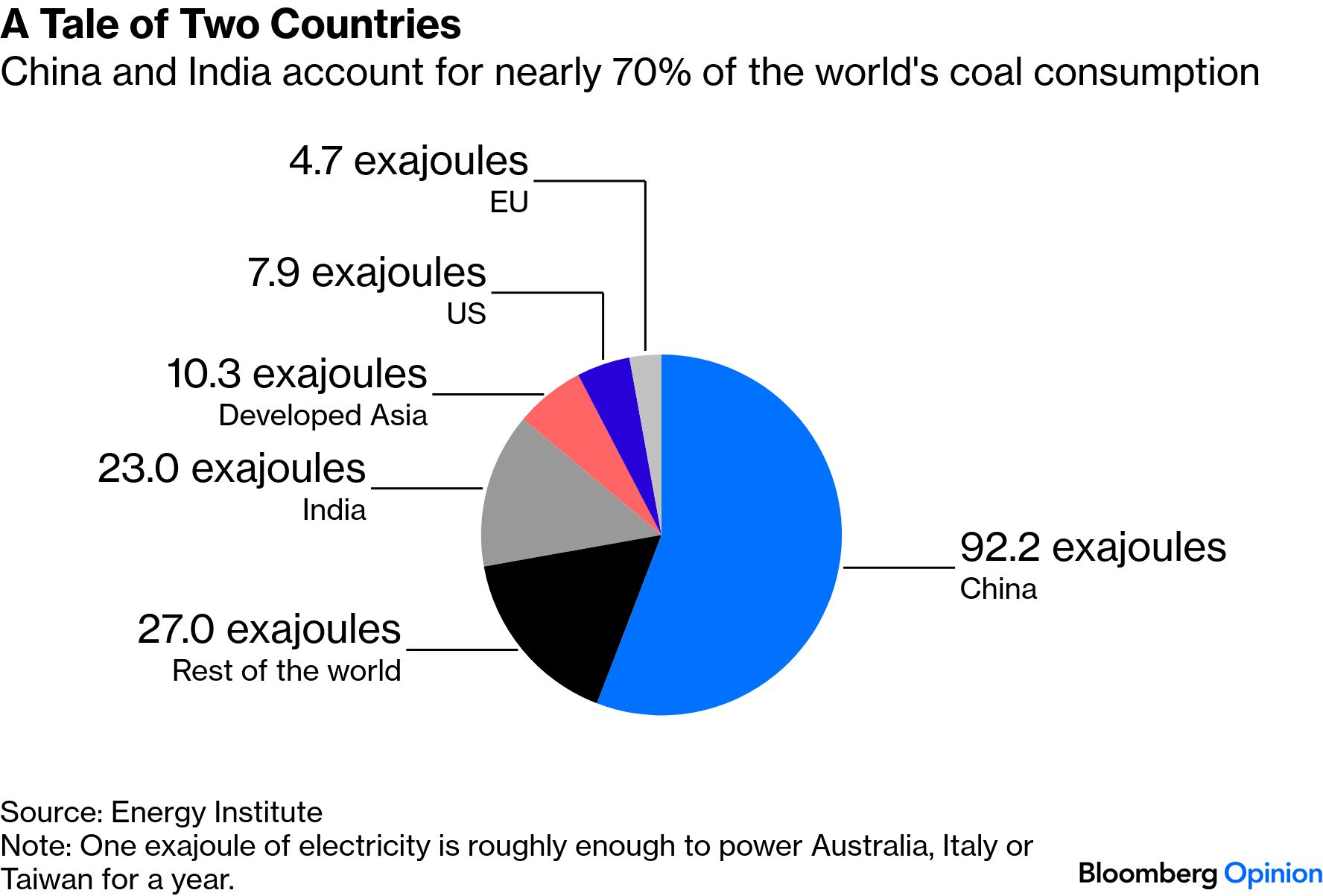

| This is Bloomberg Opinion Today, the biblical kind of awe of Bloomberg Opinion's opinions. On Sundays, we look at the major themes of the week past and how they will define the week ahead. Sign up for the daily newsletter here. This week I am going to attempt the impossible, or at least the highly improbable: Writing a readworthy newsletter about insurance. But first, there is this bit of insanity, via the New York Times: "President Trump on Thursday announced he was erasing the scientific finding that climate change endangers human health and the environment, ending the federal government's legal authority to control the pollution that is dangerously heating the planet." Welp, that was easy. The only surprise is that it took so long. I mostly understand the political divide in Washington here: Coal and oil and gas companies overwhelming support Republican candidates. (Increasingly, so do renewable energy companies, because the public trough runs along both sides of the aisle.) The partisan divide outside the capital is less straightforward: There is a serious body of evidence showing that MAGA followers are net losers in kneecapping clean energy. So what might make those EverTrumpers look more closely at the facts? Their insurance premiums, natch. "Insurance companies live in a parallel universe where greenhouse gases are heating the atmosphere and intensifying natural disasters, harming human health, destroying property and raising insurance costs," writes Mark Gongloff. "The US government's universe is an increasingly lonely fantasy world. You're trapped in the real one." The phrase "you may not believe in climate change, but your insurance company does," may be a cliché, but like most clichés it contains a good amount of truth. "The cost of insuring a US home has jumped 69% in just the past six years," reports Mark. "In several Midwestern and Southern states, insurance premiums account for 6% or more of household income." Climate isn't the only reason your electricity bill is soaring, the Bloomberg Editorial Board notes. "As policymakers of both parties have made housing affordability a top priority in recent years, they've done far too little to address this crisis in the making," they write. "One problem is that disasters are getting more expensive. Thanks to climate change, surging construction costs and the 'expanding bull's-eye effect' — whereby increasing populations and property values in vulnerable areas lead to costlier damage — there's been a sharp increase in billion-dollar disasters. Insured losses from such calamities reached $108 billion in 2025." One part of the Trump argument for freeing up dirty energy is that we need ENERGY DOMINANCE! Trump even created a council for it that includes the "secretary of defense." Just think how that must have bruised the ego of self-styled Secretary of War Pete Hegseth. "When politicians struggle to explain some action, they often reach for the catch-all of 'national security,'" writes Liam Denning. "The Trump administration has now taken this a step further in its ongoing campaign to revive the US coal industry: Getting the Pentagon to pay for it. And by 'the Pentagon,' I mean you and me." Call it the Department of Defense or the Department of War — it's still an old-fashioned government bailout. "If you are an incumbent industry that's been around for a century or more and you need taxpayer dollars via the DoD to keep going, things are pretty grim," adds Liam. Elsewhere in energy, you've gotta give Trump some credit: He never fails to surprise. This time, it was praise for the global leader in electric vehicles, China. "Speaking last month in Detroit, of all places, implacable Sinophobe President Donald Trump said that if Chinese automakers wanted to build plants in the US, he would 'love that.'" reports Liam. Ford and Xiaomi have denied a recent report that they may collaborate on electric vehicles, but Ford's Chief Executive Jim Farley is "an outspoken fan of Xiaomi's EVs, and generally talks of China's auto sector with awe; the biblical kind that comes with a dose of dread," Liam adds. India's megacities are swamped with literal doses of dread. "India is getting richer every year, but its cities don't seem to be getting any more livable. Not because the country is too poor, or because leaders lack ambition, but because urban citizens are starved of funds and deprived of representation," writes Mihir Sharma. "The government's flagship initiative for urban sanitation had its budget halved, just weeks after dozens died in the central city of Indore after drinking water that had been contaminated by raw sewage. This is a town that the government has ranked as the cleanest in the country every single year of the past eight." With the US now following India's lead on coal, one hopes that fastidious Portland doesn't become the Indore of America. Bonus Don't Drink the Water Reading: What's the World Got in Store ? - Munich Security Conference ends, Feb 15: Putin, Xi and Trump Are Launching a Freedom Counterrevolution — Hal Brands

- Fed minutes, Feb. 18: Kevin Warsh's Fed Job Already Looks Impossible — Jonathan Levin

- US GDP, Feb 20: A 3% Rule for Budget Deficits Would Be a Good Start — The Editorial Board

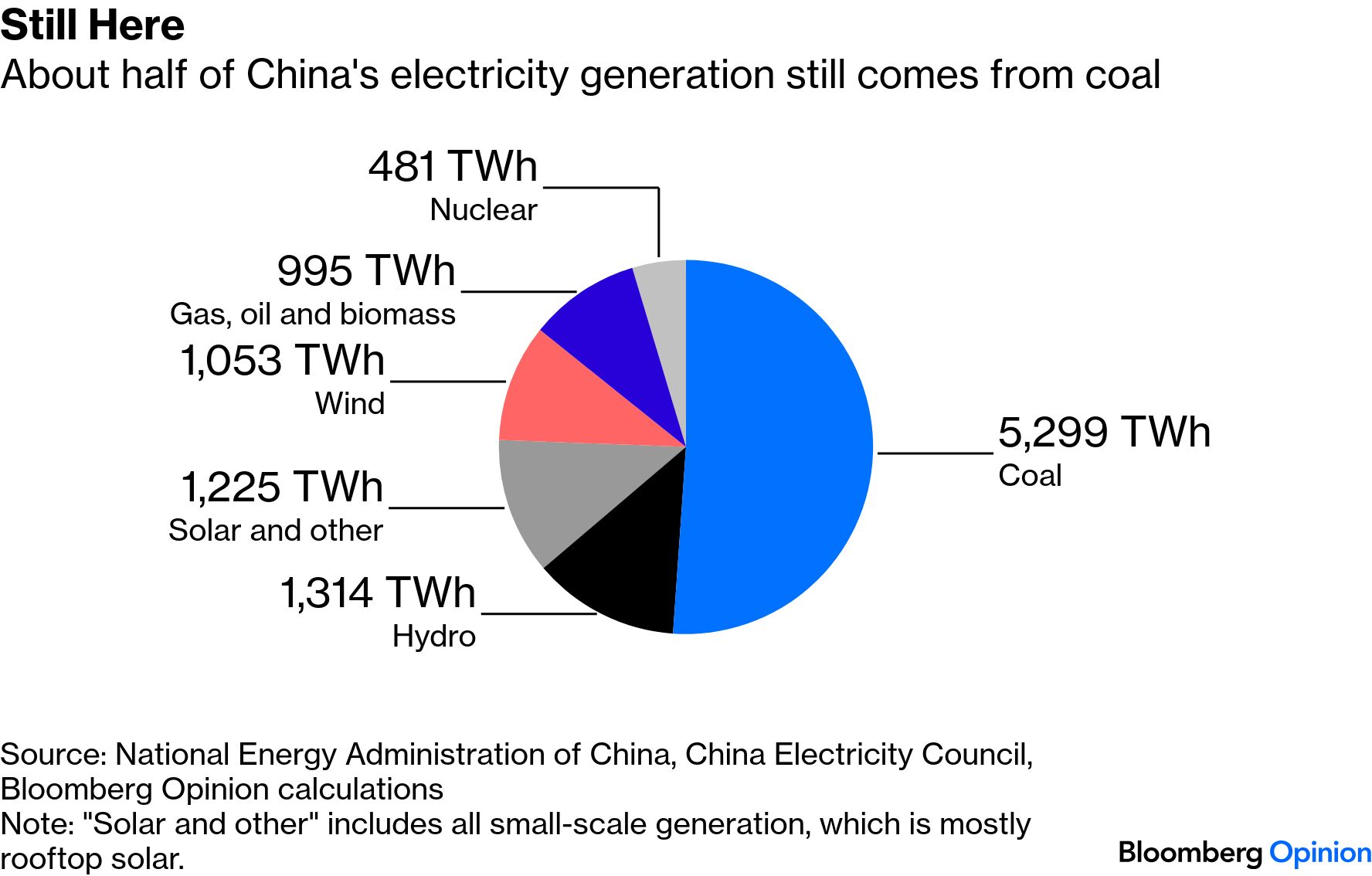

Ford's Jim Farley isn't the only one in awe of the Middle Kingdom. "From the way some talk about it, China sounds like a vision of a zero-carbon future: A clean utopia churning out millions of electric vehicles and billions of solar panels," writes David Fickling. "That portrait, of a solarpunk electrostate as rooted in the future of energy as the petrostates of the Gulf are wedded to the past, isn't entirely wrong. China's clean energy industry justifies most of the superlatives you could throw at it. But there's still a troubling amount of 19th century technology propping up this 21st century reverie." No prizes for guessing what that 19th-century tech is: When we consider energy production, most of us think big: coal plants, EV production lines, gigafactories. But David feels we should also think smaller: in very precious ounces of silver. "Even after a slump from a record $121.65 a troy ounce in late January, silver prices are up 154% from a year earlier. Trading at $81.60 Wednesday, the metal has notched more than double gold's gain," he explains. "60% of silver consumption comes from industrial users and most of the action over the past decade has come from solar." If you feel we have reached "Peak Solar," you might be tempted to short the long end of the curve right now. I don't think David is. "The world's demand for energy is still nowhere close to being sated," he writes. "Almost everywhere, solar is the cheapest way of meeting it. Silver's surge suggests this boom is nowhere close to petering out." So cheers for atomic No. 47, and may it dethrone No. 6 in the energy wars to come. Note: Please send Poha Jalebi and feedback to Tobin Harshaw at tharshaw@bloomberg.net |

No comments:

Post a Comment