|

Reading time: 5 minutes |

News | Crypto Converter | Crypto Calculators |

Bitcoin slides below $80K again as bulls lose the narrative |

|

Key points: |

Bitcoin printed a fourth straight red monthly close, and the mood across desks is shifting from "buy the dip" to "protect the floor," with $74,000 to $73,000 now the key zone traders keep circling. Derivatives and ETF positioning are adding pressure: a large CME Group futures gap sits near $84,445, while spot Bitcoin ETF holders are broadly underwater after months of net outflows.

|

News - The new week opened with Bitcoin trying to stabilize after a sharp weekend slide and a brief bounce into Wall Street hours. Price action has now logged four consecutive red monthly candles, a rare streak previously seen only twice in past cycles, and several traders are treating the October 2025 peak near $126,200 as the likely top for this run. |

On the derivatives side, the selloff created a notable futures gap on CME Group: contracts closed Friday at $84,445 and reopened Sunday at $77,385. That disconnect is being watched as a potential magnet level, even if it does not fill quickly. |

Meanwhile, CNBC host Jim Cramer called out the weekend volatility as a reminder that Bitcoin can behave like a headline-driven asset in the short term. He highlighted $73,000 as an important floor and said reclaiming $77,000 would help rebuild a base toward the low $80,000s. He also pointed to Michael Saylor and Strategy as potential narrative anchors ahead of the firm's February 5 earnings. |

Why this drop feels heavier than a normal dip - Spot ETF investors are sitting on average paper losses of roughly 15%, with an implied average entry near $90,200 per BTC. Analysts warn that being underwater can trigger redemptions from short-term holders, adding incremental sell pressure even if longer-term institutional capital remains relatively sticky. |

Macro crosswinds traders are watching next - Market chatter also linked the violent pullback in gold and silver to the nomination of Kevin Warsh as the next Federal Reserve Chair, alongside higher margin requirements that accelerated deleveraging. With the US dollar rebounding and the Coinbase premium remaining deeply negative, market signals continue to point to weak US spot demand rather than a clear rebound driven by fresh buying. |

Strategy and Binance step in as Bitcoin tests conviction below $80K |

|

Key points: |

Strategy added $75.3 million worth of Bitcoin last week, buying into weakness as BTC briefly slipped below the firm's average cost basis for the first time since 2023. Binance began reshaping its $1 billion SAFU user protection fund toward Bitcoin, moving 1,315 BTC into the reserve while outlining plans to complete the transition over the coming weeks.

|

News - As Bitcoin volatility intensified over the weekend, two of the market's largest institutional players moved in different but closely watched ways. Strategy disclosed the purchase of 855 BTC for $75.3 million, according to a Monday filing, paying an average of $87,974 per coin. The timing stood out as Bitcoin briefly fell below the company's long-term average purchase price of $76,052, a level it had held above since late 2023. |

The buy lifted Strategy's total holdings to 713,502 BTC, accumulated at a total cost of roughly $54.26 billion. While modest compared with the firm's larger weekly buys in recent months, the purchase reinforced Michael Saylor's long-running playbook of adding exposure during drawdowns. Strategy funded the acquisition through the sale of common stock, even as its shares slid to fresh multi-year lows in premarket trading. |

At the same time, Binance executed the first operational step of its previously announced plan to reposition its Secure Asset Fund for Users (SAFU) toward Bitcoin. On-chain data showed 1,315 BTC, valued at about $100 million, transferred into the SAFU reserve. |

Binance later confirmed that the move aligned with its proposal to convert the $1 billion fund from stablecoins into BTC within roughly a 30-day window, though blockchain data suggested the observed transaction itself resembled an internal reallocation of existing Bitcoin rather than a fresh market purchase. |

Why these moves matter now - While early speculation framed Binance's action as aggressive dip-buying, on-chain analysis points to the transfer being largely an internal treasury shift. Even so, tying SAFU more closely to Bitcoin introduces greater price volatility and places added weight on Binance's pledge to replenish the fund if its value drops below $800 million during market swings. |

Signals traders are weighing next - Beyond balance sheets, sentiment markets are also watching accumulation expectations. On Polymarket, bettors assign an 81% probability that Strategy's Bitcoin holdings will exceed 800,000 BTC by the end of 2026, despite rising odds of deeper near-term price weakness. Together, these moves underscore how conviction-driven buyers are positioning themselves as Bitcoin searches for a durable floor. |

XRP slips toward $1.50: Macro stress meets fresh Ripple headlines |

|

Key points: |

XRP dropped to $1.52 on February 2 before bouncing near $1.60, but the weekly drawdown remained heavy amid a broader market sell-off. Despite positive regulatory news from Ripple, multiple indicators continue to flag fragile support between $1.48 and $1.50.

|

News - XRP started the week under pressure after sliding to a multi-month low of $1.52, its weakest level since December 2024, before recovering toward $1.60. The move unfolded alongside a broader crypto sell-off linked to geopolitical tensions in the Middle East. On a weekly basis, XRP was down roughly 14%, pushing its market capitalization below $97 billion. |

Adding to near-term supply dynamics, Ripple completed its scheduled February escrow activity on February 1, unlocking 1 billion XRP and relocking 700 million. The remaining net 300 million XRP stayed unlocked, keeping supply conditions in focus as price weakness extended into the new month. |

What is weighing on price - Positioning remains a key pressure point. XRP is trading close to its aggregated realized price near $1.48, a level that reflects the average cost basis of tokens in circulation. |

This suggests a large share of newer holders are near breakeven or already underwater. A sustained move below this zone would likely increase downside risk, especially with whale flows still net negative and stablecoin balances on exchanges remaining subdued, which can reduce buying pressure during rebounds. |

Separately, renewed attention around the Epstein files has sparked debate online, but the released documents do not show Jeffrey Epstein directing any action against Ripple. David Schwartz, Ripple's former Chief Technology Officer, has publicly dismissed resurfaced claims as misinformation, framing them as recycled narratives during a period of heightened market stress. |

What could change the tone - On the fundamental side, Ripple's newly secured Electronic Money Institution license in Luxembourg gives the firm regulatory clearance to expand Ripple Payments across the EU. |

From a market perspective, XRP-only on-chain data shows an increase in long-term, inactive holdings, indicating that some sellers may be exhausted even as price trends lower. For now, key support areas remain centered around $1.48 to $1.50, with additional downside risk toward the lower band near $1.43 if weakness persists. |

Crypto crime turns physical: Wrench attacks surge across Europe |

|

Key points: |

Physical crypto theft, known as "wrench attacks," rose 75% in 2025, with 72 confirmed incidents involving violence and losses exceeding $40 million. Europe accounted for over 40% of cases, with France emerging as the global hotspot amid a broader rise in crypto-related crime.

|

News - Crypto crime took a darker turn in 2025 as physical violence became a growing method of theft. According to a new report from CertiK, so-called wrench attacks increased 75% year over year, marking a shift where attackers increasingly target individuals rather than systems. |

These incidents typically involve coercion through physical force to obtain private keys, often during home invasions or kidnappings. CertiK documented 72 verified cases globally last year, alongside a 250% jump in physical assaults. Confirmed financial losses reached more than $40 million, though researchers warned that underreporting likely masks a much higher total. |

Europe accounted for over 40% of all reported attacks, nearly double its share in 2024. France stood out with 19 recorded incidents, surpassing the United States. Investigators linked the surge to organized crime groups targeting known crypto holders, sometimes extending threats to family members. In some cases, attackers exploited personal relationships or staged romantic connections to gain access to victims. |

A widening crypto security gap - CertiK described this trend as a "technical paradox." As digital defenses improve and hacking becomes harder, criminals are reverting to the weakest link: human vulnerability. The rise in physical attacks contrasts sharply with advances in custody technology and on-chain security. |

The shift comes amid a broader spike in crypto crime. CertiK reported that $370.3 million in cryptocurrency was stolen in January alone, driven largely by phishing and social engineering scams. While most of those losses were digital in nature, the figures underscore how crypto crime is expanding across multiple attack vectors. |

How the industry is responding - The growing threat has prompted new defensive measures. Some insurers, including Lloyd's of London, have begun offering coverage that explicitly includes physical crypto theft. CertiK also urged holders to reduce public exposure, use decoy wallets, and separate key storage locations, signaling that personal safety is now part of the crypto risk equation. |

|

More stories from the crypto ecosystem |

|

Did you know? |

Bitcoin's "digital gold" status cracked under macro pressure: Bitcoin slid below ~$76,000, marking one of its weakest price levels since late-2025 and triggering heavy market liquidations worth roughly $2 billion. The move underscored how Bitcoin trading has become increasingly sensitive to broader macro conditions. India doubled down on crypto surveillance, not relief: India's 2026 crypto tax and reporting regime remained unchanged, with the Union Budget retaining the 30% tax on gains and 1% TDS. It also introduced stricter penalties for inaccurate transaction reporting, reinforcing a compliance-first approach. Nation-state hackers dominated crypto crime in 2025: Cryptocurrency theft surged last year, with North Korean-linked actors estimated to have stolen over ~$2 billion, accounting for nearly 60% of total crypto losses. The data highlighted the growing role of state-backed cyber operations in blockchain-related crime.

|

|

Top 3 coins of the day |

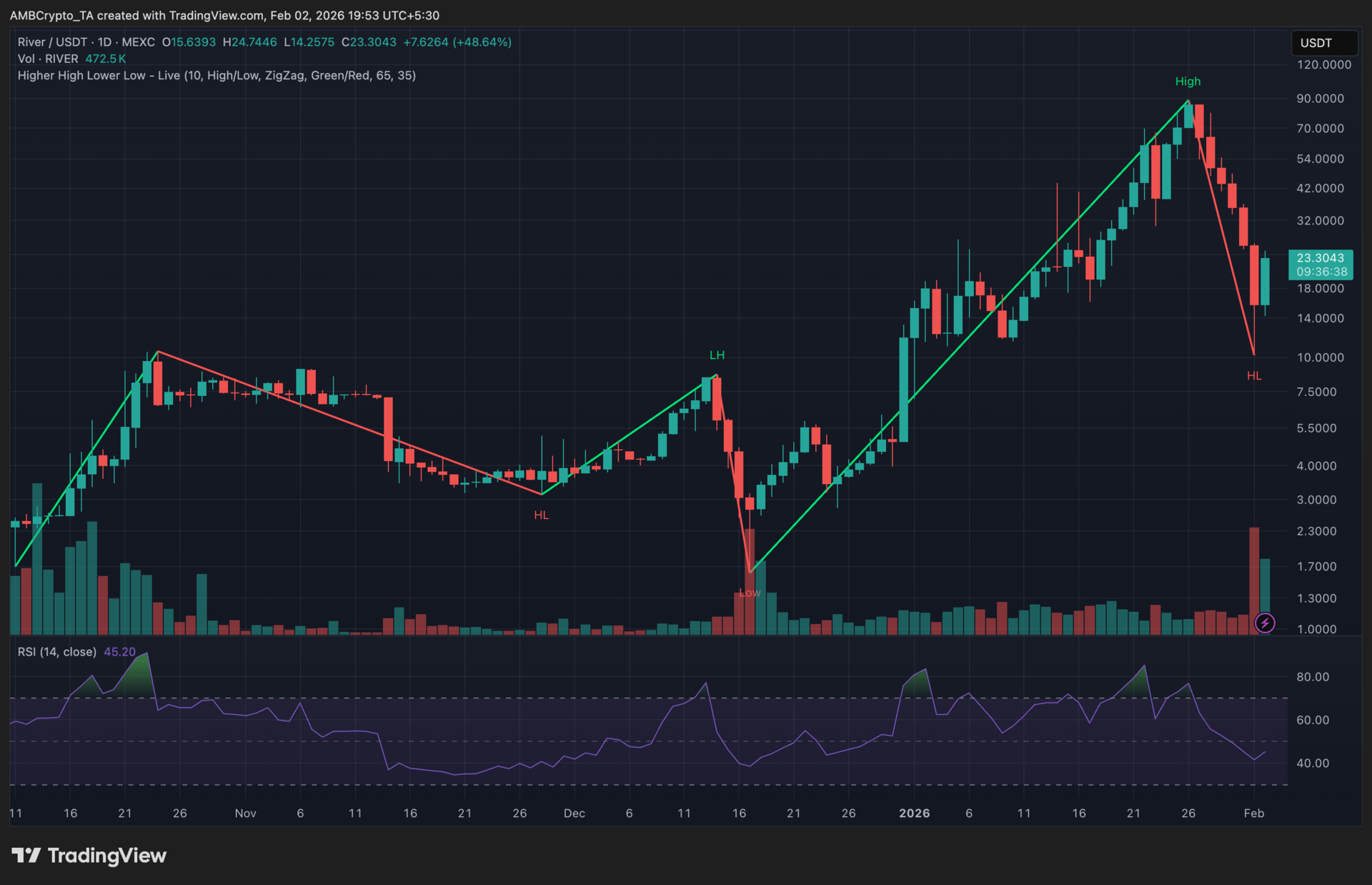

River (RIVER) |

|

Key points: |

RIVER was last seen trading near $23, after rebounding sharply from its recent swing low around $10 and recovering a portion of its steep post-peak decline. The RSI remained below the neutral 50 mark, while volume spiked during the rebound from the lows, signaling improving momentum but not a confirmed trend shift yet.

|

What you should know: |

On the daily chart, RIVER's price action showed a strong corrective move after topping out near the $90 zone, with sellers driving the token toward a marked lower low close to $10. That sell-off was accompanied by a notable volume surge, pointing to capitulation rather than steady distribution. Following this, price rebounded aggressively, reclaiming the $18 to $20 area and extending toward $23. |

Despite the recovery, the broader structure remained in a reset phase, as the rebound had not yet established a fresh higher high. The RSI climbed back into the mid-40s, reflecting easing bearish pressure but still signaling cautious momentum. |

From a narrative perspective, RIVER's bounce coincided with renewed trading interest amid ongoing ecosystem activity and sustained attention following high-profile strategic backing announced earlier in January. Going forward, the $17 to $18 zone acts as immediate support, while resistance remains present around the $30 to $32 region. |

MYX Finance (MYX) |

|

Key points: |

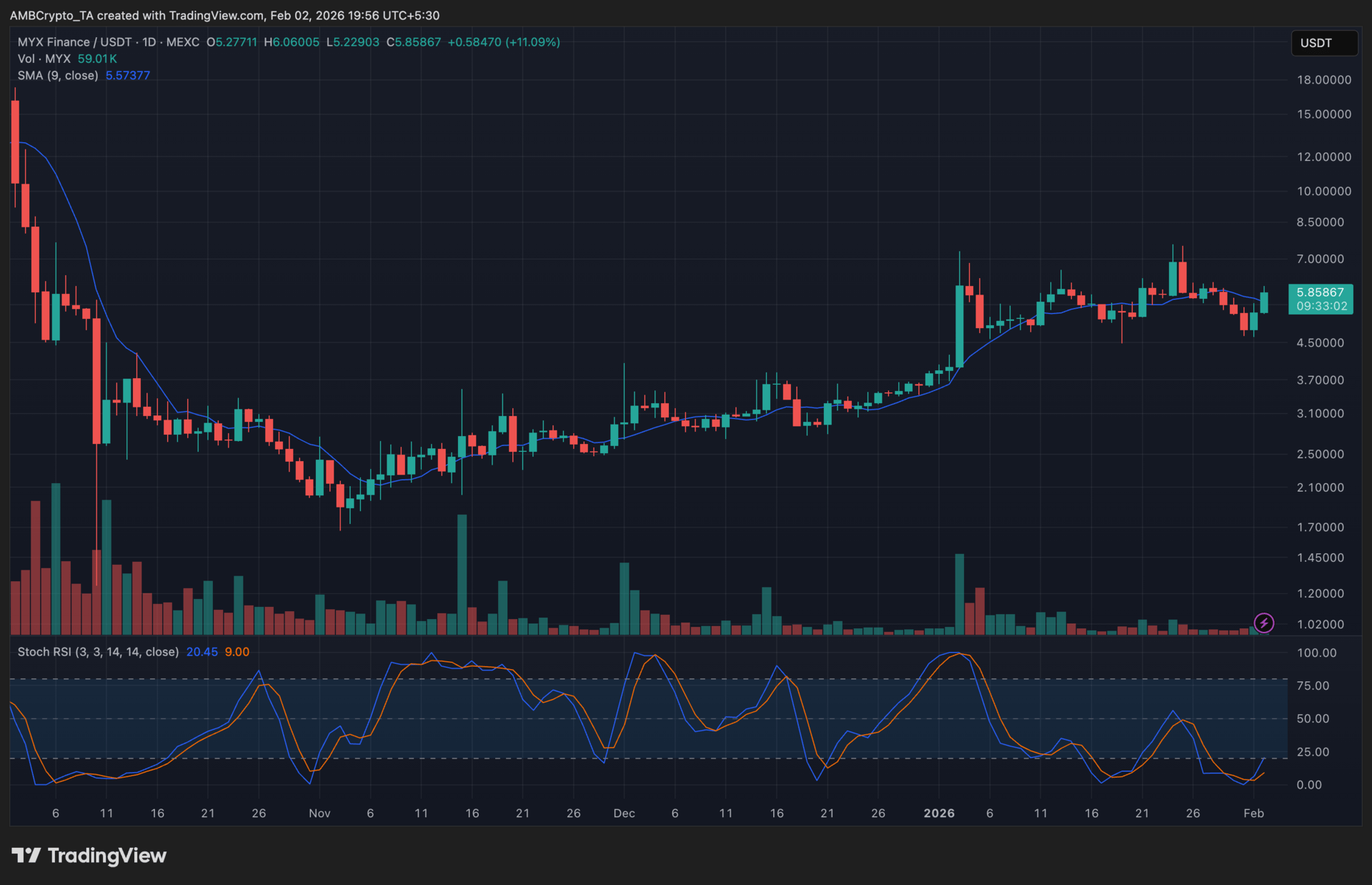

MYX hovered near $5.85 after holding its recent range, following a steady expansion that unfolded over several weeks rather than a single impulsive move. The 9-day SMA continued to guide price action, while the Stochastic RSI lifted from lower readings, hinting at stabilizing momentum within consolidation.

|

What you should know: |

MYX's daily chart highlighted a shift from volatility compression into a gradual repricing phase, with price spending several weeks building acceptance above its earlier lows. Instead of a sharp reversal, the token advanced in stages, forming higher closes as downside volatility faded. This progression eventually carried MYX into the $6.00 region, where buying pressure began to slow. |

After testing highs near $7.00, price rotated into a sideways structure rather than reversing aggressively. Recent candles reflected this pause, with MYX trading close to $5.85 and maintaining proximity to the rising 9-day SMA. That behavior suggested short-term balance between buyers and sellers, rather than distribution. |

Momentum readings echoed this tone. The Stochastic RSI eased toward its lower band before turning upward, pointing to a reset in momentum rather than trend deterioration. Earlier in the move, higher trading activity accompanied the advance, supporting participation during the breakout phase. For now, the $5.20 to $5.40 zone acts as immediate support, while resistance remains present around the $6.80 to $7.00 range. |

Jupiter (JUP) |

|

Key points: |

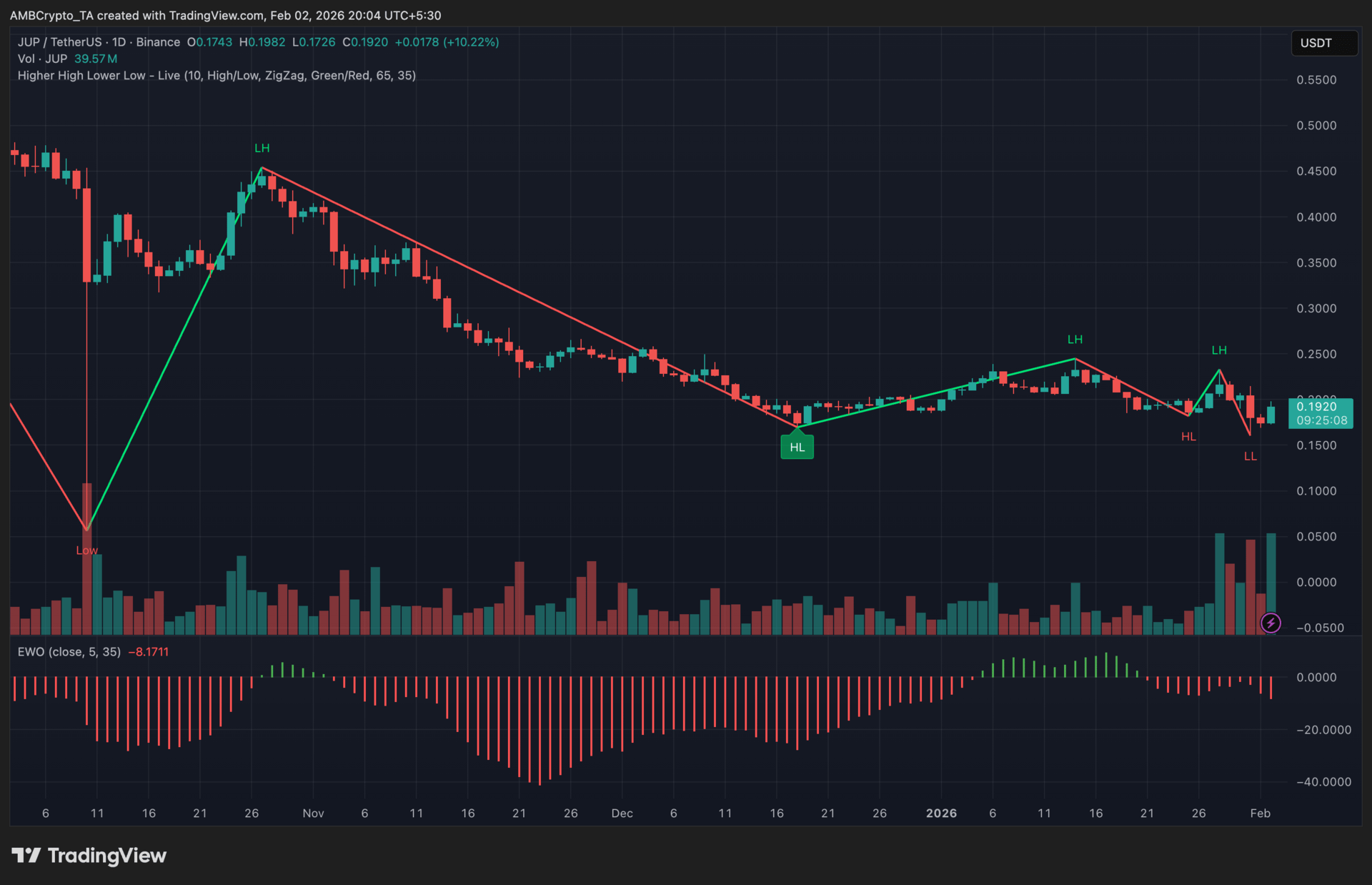

JUP's recent rebound unfolded alongside renewed attention on Jupiter's ecosystem expansion, though price action continued to struggle with reclaiming prior breakdown levels. The EWO remained negative with the latest red bars expanding, while volume picked up near local lows, reflecting active trading but unresolved bearish momentum.

|

What you should know: |

JUP's recent price movement played out against the backdrop of fresh ecosystem developments rather than a clear technical reversal. The token drew renewed interest following ParaFi Capital's $35 million strategic investment and Jupiter's integration of Polymarket, both of which reinforced Jupiter's positioning within Solana's DeFi stack. This coincided with higher trading activity as price attempted to stabilize after its December sell-off. |

On the chart, however, structure remained fragile. JUP failed to sustain moves above the $0.23 to $0.25 region, and the Higher High Lower Low indicator continued to reflect unresolved downside pressure. |

After bouncing from the $0.16 area, price briefly formed a lower low before settling back near $0.19. Momentum readings echoed that caution. The EWO stayed below zero, and while it had shown contraction earlier, the most recent red bars expanded again, signaling a short-term pickup in bearish momentum rather than stabilization. The $0.16 to $0.17 zone acts as near-term support, while repeated rejections cluster around $0.23 to $0.25. |

How was today's newsletter? |

|

No comments:

Post a Comment