| Read in browser | ||||||||||||||

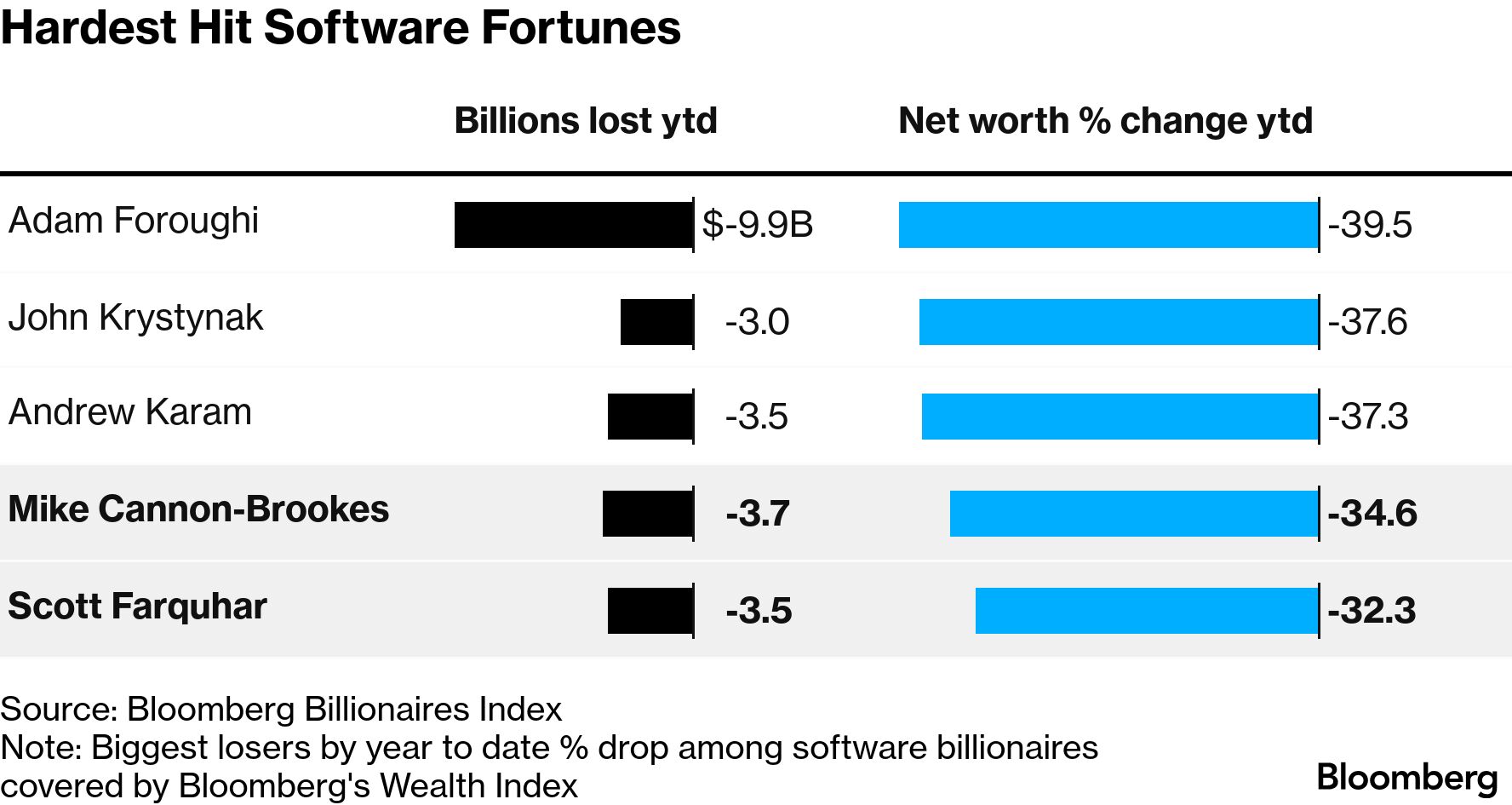

Spare a thought for two of our young tech billionaires. As the global tech rout hits our shores, Atlassian's Mike Cannon-Brookes and Scott Farquhar have lost a third of their wealth this year, or about a combined $7.2 billion. That makes them some of the entrepreneurs hardest hit by the selloff, caused by fears of AI's impact on software. Elsewhere, the RBA's looking justified in its decision to raise interest rates after unemployment came in lower than expected on Thursday, hinting at a stronger economy that could keep inflation higher for longer. And that inflation pressure is coming through in earnings, with Wesfarmers CEO Rob Scott telling Bloomberg TV that people were spending less as cost-of-living concerns grow. — Ben Westcott, Asia Agriculture Reporter What's happening nowCannon-Brookes became one of Australia's richest tech executives with Atlassian's initial public offering just over a decade ago. Now, along with co-founder Farquhar, he's at the sharp end of a global rout in stocks that are seen as threatened by artificial intelligence. Both have been nudged out of the Bloomberg Billionaires Index of the world's 500 richest people.  Rio Tinto reported a doubling of copper profits last year after expanding its flagship mine and as prices surged, as part of its full-year profits on Wednesday. However improvements in copper and aluminum failed to offset a combination of one-time restructuring costs, US tariffs and China's drag on its key iron ore unit. In other earnings results, Wesfarmers shares dropped the most since October after the first-half performance of its key retail units fell short of analyst expectations. Meanwhile, Australian payment company Zip saw dropped the most in more than a decade after forecasting flat cash earnings growth in the second half of the financial year.  Rob Scott, chief executive officer of Wesfarmers Ltd. Photographer: Philip Gostelow/Bloomberg Australian unemployment stayed low in January and hiring remained strong, validating the RBA's view that the economy can withstand tighter monetary policy without a sharp rise in layoffs. Across the Tasman, New Zealand's central bank is in the unusual position this year of expecting a strong economic recovery without triggering inflation pressures, Assistant Governor Karen Silk said in an interview. Sydney is one of the least dense major cities in the developed world. The government is trying to change that but in the affluent suburb of Woollahra, residents are pushing back against a plan to revive a long-abandoned incomplete train station and build 10,000 new homes nearby. Bloomberg's Swati Pandey and Aradhana Aravindan join the podcast to unpack what's at stake — from property prices and lifestyle trade-offs to productivity, inflation and the Reserve Bank. Listen and follow The Bloomberg Australia Podcast on Apple, Spotify, on YouTube, or wherever you get your podcasts.  What happened overnightHere's what my colleague, market strategist Mike "Willo" Wilson says happened while we were sleeping… Oil settled at its highest level since August on concerns that the US and Iran are inching closer to a fresh conflict as the former continues its military build up in the region. The sour backdrop hit stocks while gold held near $5,000. The dollar edged higher on strong jobless claims data while Aussie and kiwi held gains made in Asia. Treasuries rose as haven demand outweighed oil-fueled inflation concerns. Australia has some activity gauges due and RBNZ Governor Anna Breman is scheduled to speak. ASX futures speak to a soft opening for local equities. Andrew Mountbatten-Windsor, the brother of the UK's King Charles, was released under investigation on Thursday after being arrested on suspicion of misconduct in public office. The king issued a statement outlining his "deepest concern" about the matter and promising Buckingham Palace's "full and wholehearted support and co-operation."  Andrew Mountbatten-Windsor Photographer: Jordan Pettitt/Pool/Getty Images Former South Korean President Yoon Suk Yeol faces life in prison after being found guilty of leading an insurrection with his 2024 martial law declaration, a move that shocked the nation and triggered the country's most severe political crisis in decades. The US military is stationing a vast array of forces in the Middle East, including two aircraft carriers, fighter jets and refueling tankers, with President Donald Trump saying that Iran had 10 to 15 days at most to strike a deal over its nuclear program. Since the dawn of retail, merchants' primary job has been to tempt human shoppers to part with their cash. Now they have a new customer to woo: the bots, writes Bloomberg Opinion's Andrea Felsted. What to watchAll times Sydney: One more thing...Do you have a young person (or slightly older person) who won't stop belting out Golden at the top of their lungs? Are they waiting with bated breath for more of their favorite, Kpop Demon Hunters? Well, they might have to be patient. Fans of the Netflix animated film which has taken the world by storm are in for "a long wait" for the sequel, creator Maggie Kang said in an interview with Bloomberg.  KPop Demon Hunters

We're improving your newsletter experience and we'd love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg's Australia Briefing newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|

Thursday, February 19, 2026

Atlassian billionaires’ wealth slump, Rio Tinto copper boom, UK royal arrested

Subscribe to:

Post Comments (Atom)

Thank you for being my partner in crime

I have a huge lifetime deal for you today View in browser View in browser First off… I want to say thank you for being...

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment