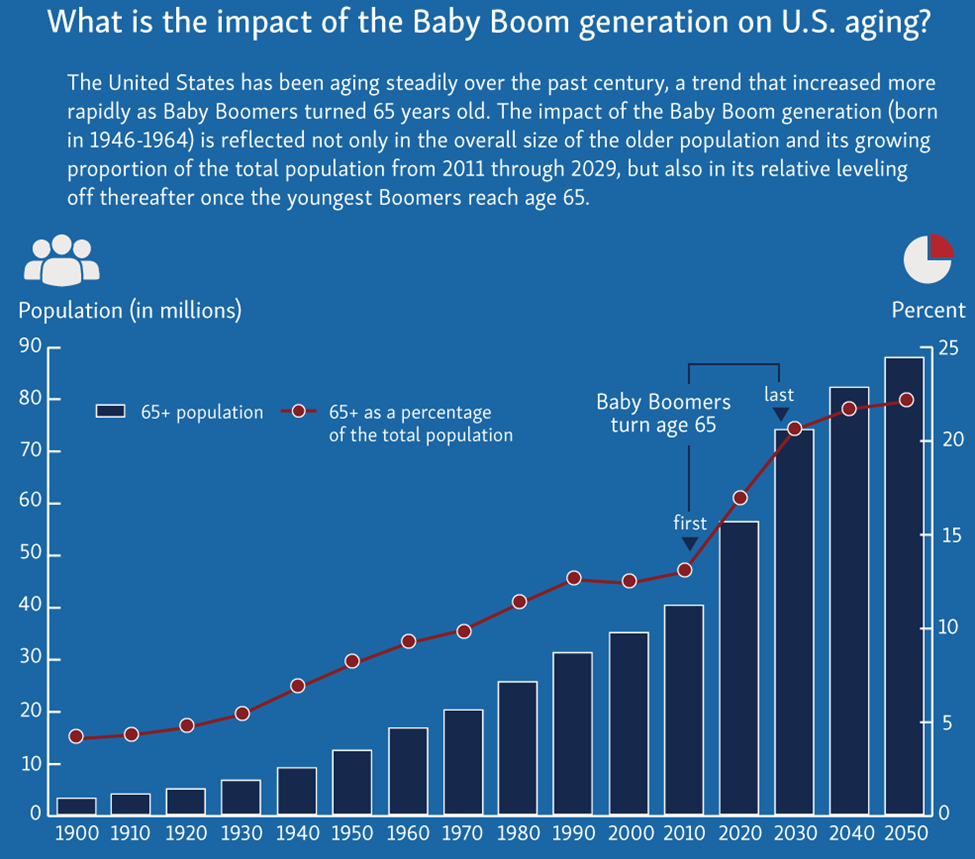

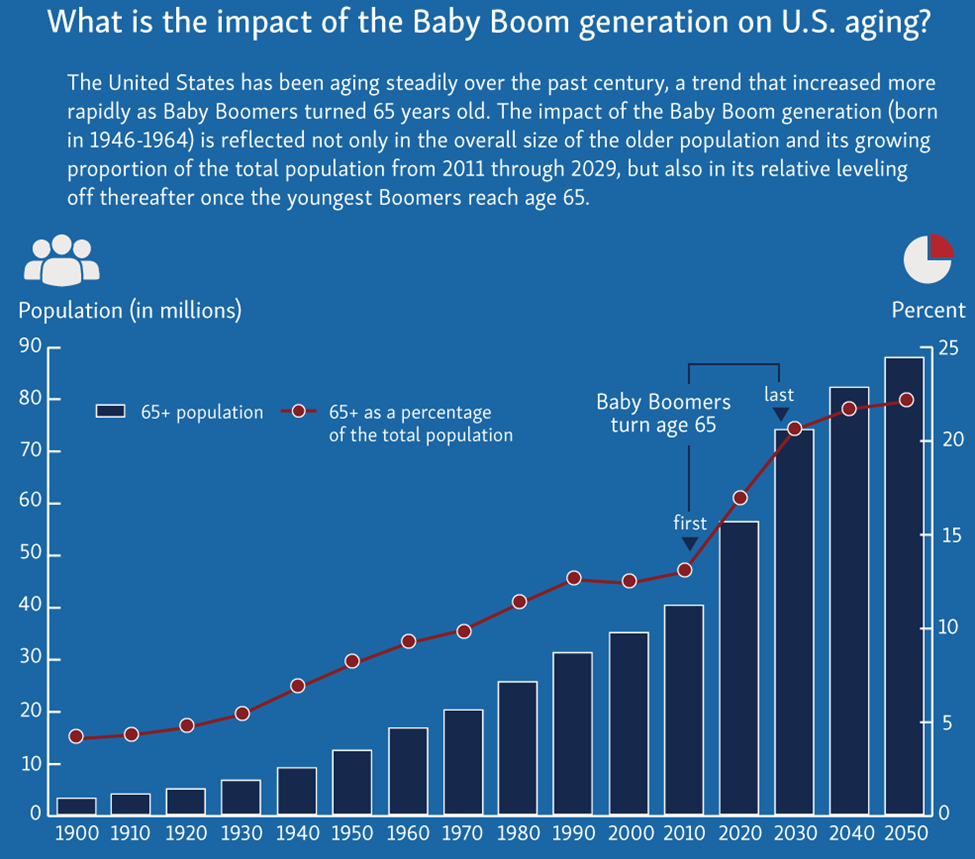

The safest multi-year trend in the market… why 11,000 daily retirees mean income and growth for investors… Brian Hunt, Eric Fry, and Louis Navellier all agree VIEW IN BROWSER Every single day in America, roughly 11,000 people turn 65. That means roughly 4.1 million people will reach that milestone in 2026. Yes, that’s an interesting headline number, but more important for you and me, it’s a cash-flow event. Our aging population – the “Silver Tsunami” as it’s called – means more prescriptions filled… more knee replacements scheduled… more cardiology visits… more diagnostics… more long-term care beds occupied… You get the idea. And for investors, it means more money for those of us who’ve positioned ourselves correctly ahead of time. So, here’s the big-picture setup… Right now, more than 61 million Americans are 65 or older. Their spending is already driving billions in annual revenue across healthcare, housing, financial services, and every day “aging” solutions. But the real surge is still ahead… By 2030, every Baby Boomer will be 65 or older – and the U.S. Census Bureau projects that the 65+ population will swell to about 73 million Americans, turning today’s spending trend into tomorrow’s tidal wave of demand.

Source: agingstats.gov Let’s focus on two ways to invest in this. The first is tangible and income-producing. The second is growth-oriented and innovation-driven. Together, they form one of the simplest long-term investment theses in the market. Recommended Link | | He revived EVs, revolutionized space, and built the biggest satellite network. But this AI tech could go down in history as the crown jewel of Elon’s career. Nvidia CEO Jensen Huang says, “What Elon and his team has achieved is singular. It’s never been done before.” Get the full story here. |  | |

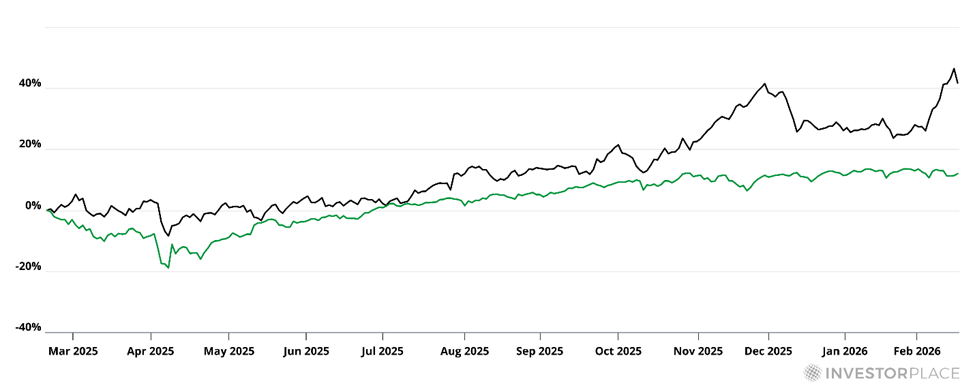

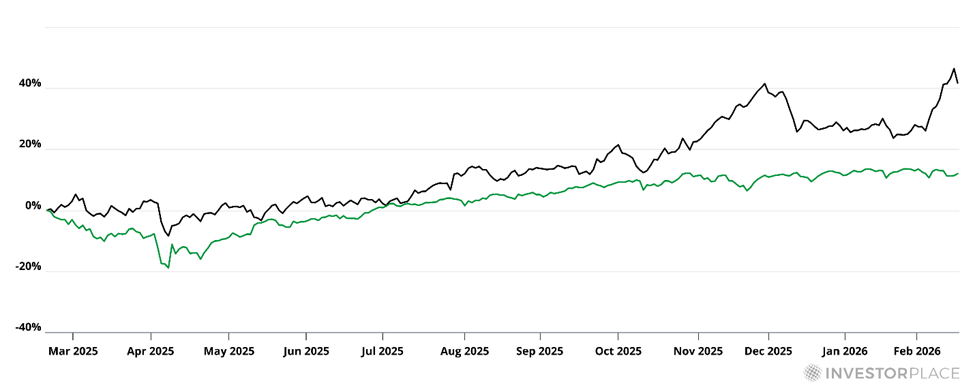

Opportunity #1: Own the buildings Let’s start with the quiet toll booths. Health care REITs (real estate investment trusts) own the physical infrastructure that aging Americans increasingly rely on – senior housing communities, skilled nursing facilities, medical office buildings, and life science campuses. Now, we just saw that the demographic math is a tailwind here, but let’s put more numbers on it. Today, only a small share of Americans 65+ live in formal long-term care facilities – roughly 1.2–1.3 million in nursing homes and around 9.5 million using care facilities annually. However, demand for both institutional and home-based support is poised to grow sharply as the senior population approaches 72–73 million by 2030. For example, Grand View Research reports that the U.S. long-term care market is projected to expand from roughly $470 billion in 2024 to nearly $730 billion by 2030. And stepping back, here's a figure that puts the long-term scale in perspective: healthcare marketing company Sagapixel finds that as many as seven out of 10 adults will need some assisted living care at some point in their lives. So, we’re not talking about niche demand – we have a near-universal phase of aging for most Americans that will drive billions of dollars. This trend is already showing up in the numbers To get a sense for the investment opportunity, let’s look at Welltower Inc. (WELL), the largest healthcare REIT in the U.S. Roughly two-thirds of its net operating income comes from senior housing, including assisted living, independent living, and post-acute care facilities tailored for this generation. As you can see below, over the last year, WELL has jumped more than 40% while the S&P has added just 12%.

Beyond Welltower, check out Ventas, Inc. (VTR) and National Health Investors, Inc. (NHI). They’re leading providers of senior housing. And don’t forget one of the most attractive aspects of investing in healthcare REITs – their dividends, or “mailbox money” as my grandmother used to say. Take a look: - National Health Investors (NHI) – 4.07% dividend

- Omega Healthcare Investors Inc (OHI) – 5.69% dividend

- Sabra Health Care REIT (SBRA) – 5.91% dividend

With the Federal Reserve likely to cut rates later this year, these REITs are offering investors healthy cash flows. So, you aren’t simply betting on price appreciation. You’re getting paid – often handsomely – while you wait. Bottom line: When you combine long-term demographic tailwinds, contractual rental income, and above-market dividend yields, you get something rare in today’s market: income plus structural growth. Opportunity #2: Own the businesses If REITs are the real estate toll booths, then the companies providing care are the economic engine. They’re servicing growing demand for prescription drugs, diagnostics, procedures, and wellness services – the same engine underpinning the long-term opportunity for health care REITs. This is where Brian Hunt has been urging investors to look for months in his free newsletter Money & Megatrends: Regular readers know that Boomer health care is one of our highest conviction long-term investment themes. The bull case here is simple: More than 10,000 Americans reach retirement age every day. This is the enormous Baby Boom generation entering the phase of life where health care and longevity spending skyrocket. For many boomers, a typical month involves going to see at least one doctor to have something looked at, removed, or treated. This means many health care businesses are experiencing huge demand now – and will for at least the next decade.

Brian has been highlighting a variety of ways to play this. Here he is with one of the simplest ways to get exposure: One way to track and trade this megatrend is with the PPH. It’s the largest ETF focused on big drug companies such as Eli Lilly (LLY), Novartis (NVS), Merck (MRK), and Pfizer (PFE). These companies sell Boomers medication by the truckload.

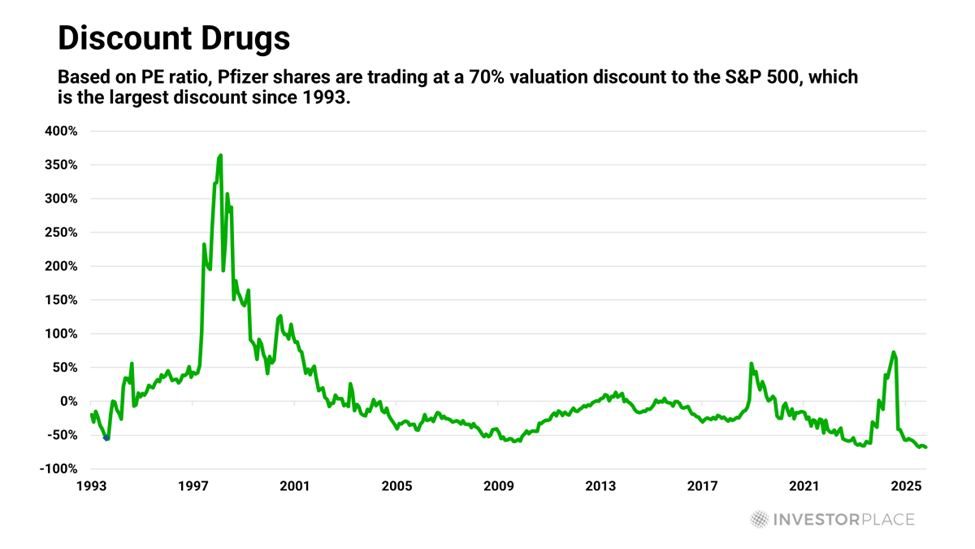

If you want a more targeted approach, Brian has highlighted large-cap biotechs Amgen (AMGN) and Gilead (GILD), as well as health care blue chip Medtronic (MDT). Cheap, ignored… and quietly integrating AI Brian isn’t the only analyst with healthcare on his radar. Our macro investing expert Eric Fry, editor of Fry’s Investment Report, recently made an important point: while investors have been rushing into richly priced AI stocks, they’ve left behind many pharmaceutical leaders – even as those same drug companies are integrating AI into their own operations. From Eric: In a stock market packed with richly priced companies, the pharmaceutical sector has become a conspicuous outlier. Investors have been rushing to the stage to cheer AI rock stars like Nvidia Corp. (NVDA) and Alphabet Inc. (GOOGL), while dismissing most pharma names as has-beens. Ironically, in a market obsessed with AI stocks, few investors seem to care how extensively the biopharmaceutical industry has integrated AI technologies.

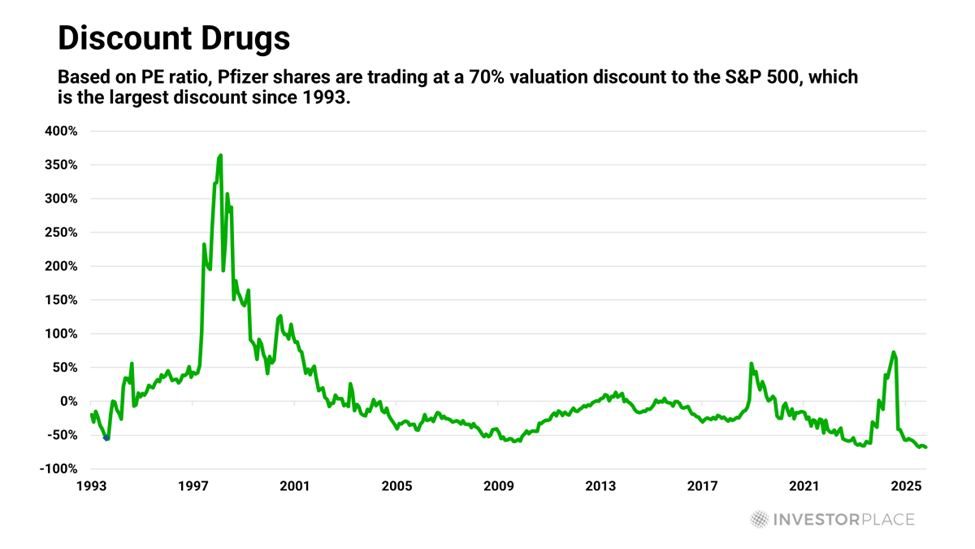

To illustrate the opportunity's attractiveness, Eric points to valuations. He says that healthcare’s valuation has fallen to historic lows relative to the S&P 500. You’d have to go back more than 30 years to find valuations this depressed. One stock in particular has Eric’s eye – Pfizer (PFE): Investors are now paying about 70% less for a dollar of Pfizer earnings than for a dollar of earnings from the S&P 500 as a whole. This is the largest discount since 1993 – right before the start of a powerful bull market for healthcare stocks. Over the next six years, PFE soared more than 1,000% over the S&P 500 index.

Worth noting: PFE currently offers a whopping 6.7% dividend yield. So, while you wait for the valuation gap to close, the stock is paying you generously. This is just one of Eric’s recent healthcare recommendations. To learn more about the others as an Investment Report subscriber, click here to learn about joining Eric. And we won't stop at Eric… For another example of how this trend is already playing out, legendary investor Louis Navellier holds Cardinal Health, Inc. (CAH) in his Growth Investor portfolio. As you’d expect, since Louis recommended it, the company has been putting up strong numbers. Here’s Louis from last Friday: [CAH] provides pharmaceutical solutions and medical products to about 90% of U.S. hospitals. During its second quarter in fiscal year 2026, revenue rose 19% year-over-year to $65.6 billion. Second-quarter earnings increased 38% year-over-year to $877 million, or $2.63 per share, beating estimates of $2.37 per share by 11%. Looking ahead to fiscal year 2026, Cardinal Health now expects adjusted earnings per share between $10.15 and $10.35. That represents 23.2% to 25.6% year-over-year earnings growth.

Growth Investor subscribers opened the position in December but are already up 10% even as the S&P has gone sideways. However, it’s still trading below Louis’ “Buy Below” price of $229.” CAH isn't the only healthcare-related name in Louis' portfolio. To join him in Growth Investor and see all his picks, click here to learn more. Bottom line – don't miss this relatively safe, multi-year investment trend Step back and look at what Brian, Eric, and Louis are each telling us – and notice that they're all pointing at the same thing from different angles. Brian has identified the demand surge. Eric has exposed the valuation disconnect. And Louis has shown the earnings execution already underway. Three analysts. Three different lenses. One conclusion… This trend is real, durable, and already paying investors. Unlike many thematic trades that hinge on hope, this one is grounded in behavior that already exists, rising numbers, and earnings and price leadership that have already emerged. And the best part is that many of the best ways to play it come with dividends – so you're not just betting on price outperformance, you're getting paid while you wait. The Silver Tsunami isn't coming. It's here. And the investors who positioned early are already collecting. If healthcare REITs and pharma, biotech, devices and healthcare services companies aren't in your portfolio today, give them a look. One final note before we sign off… Today’s Digest was all about a slow-moving, multi-year trend – the “Silver Tsunami” and the steady demand surge it’s creating across healthcare. But markets don’t always move slowly. Sometimes they shift fast – and it’s those moments that tend to catch investors off guard. On that note, earlier this week, Wall Street veteran Marc Chaikin (founder of our corporate affiliate Chaikin Analytics) hosted a live market briefing where he walked through why he believes the market is entering a more fragile, higher-risk phase. In short, certain stocks may look strong on the surface but are quietly weakening – while others are attracting real institutional buying pressure. Marc walked through several of the tools he uses to measure market strength, risk, and potential turning points – the kind of data-driven signals designed to help investors get on the right side of key shifts in the market. If you missed his presentation, the full replay is still available for free – but just a heads-up, we’ll be taking it down soon, so we’re nearing last call. Have a good evening, Jeff Remsburg |

No comments:

Post a Comment