| This is Bloomberg Opinion Today, the political asbestos of Bloomberg Opinion's opinions. On Sundays, we look at the major themes of the week past and how they will define the week ahead. Sign up for the daily newsletter here. I used to have a Jeep. It was a 1987 Wrangler ragtop, two-door, black on black. I bought it in the late 2000s as part of what, in retrospect, was clearly a midlife crisis. I loved it, especially when I took the doors off. My wife and daughter hated it, especially when I took the doors off. But I will admit that there were three major problems: - It had the lame rectangular headlights, not the cool old round ones.

- It had an automatic transmission.

- It spent more time in the repair shop than in my driveway.

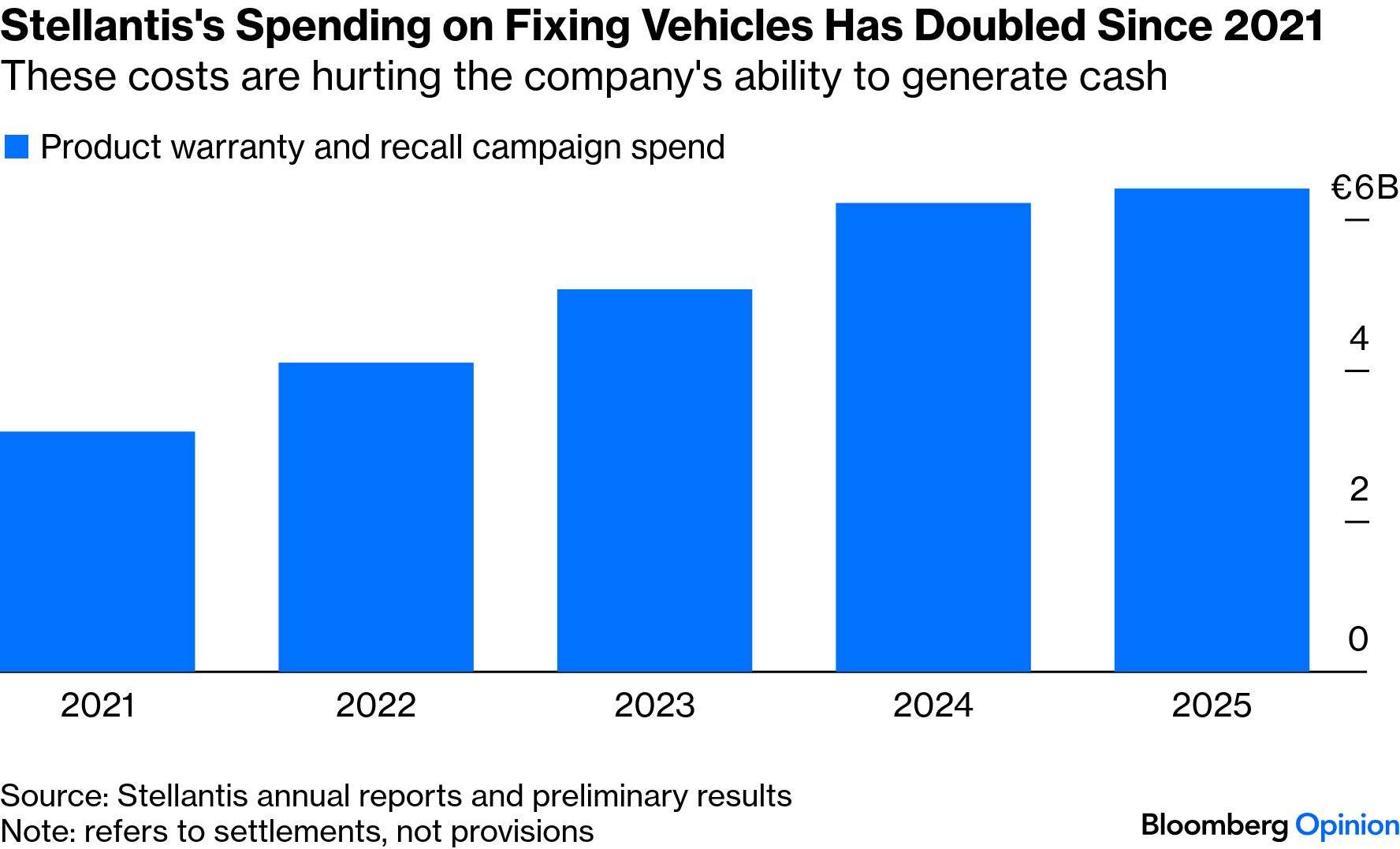

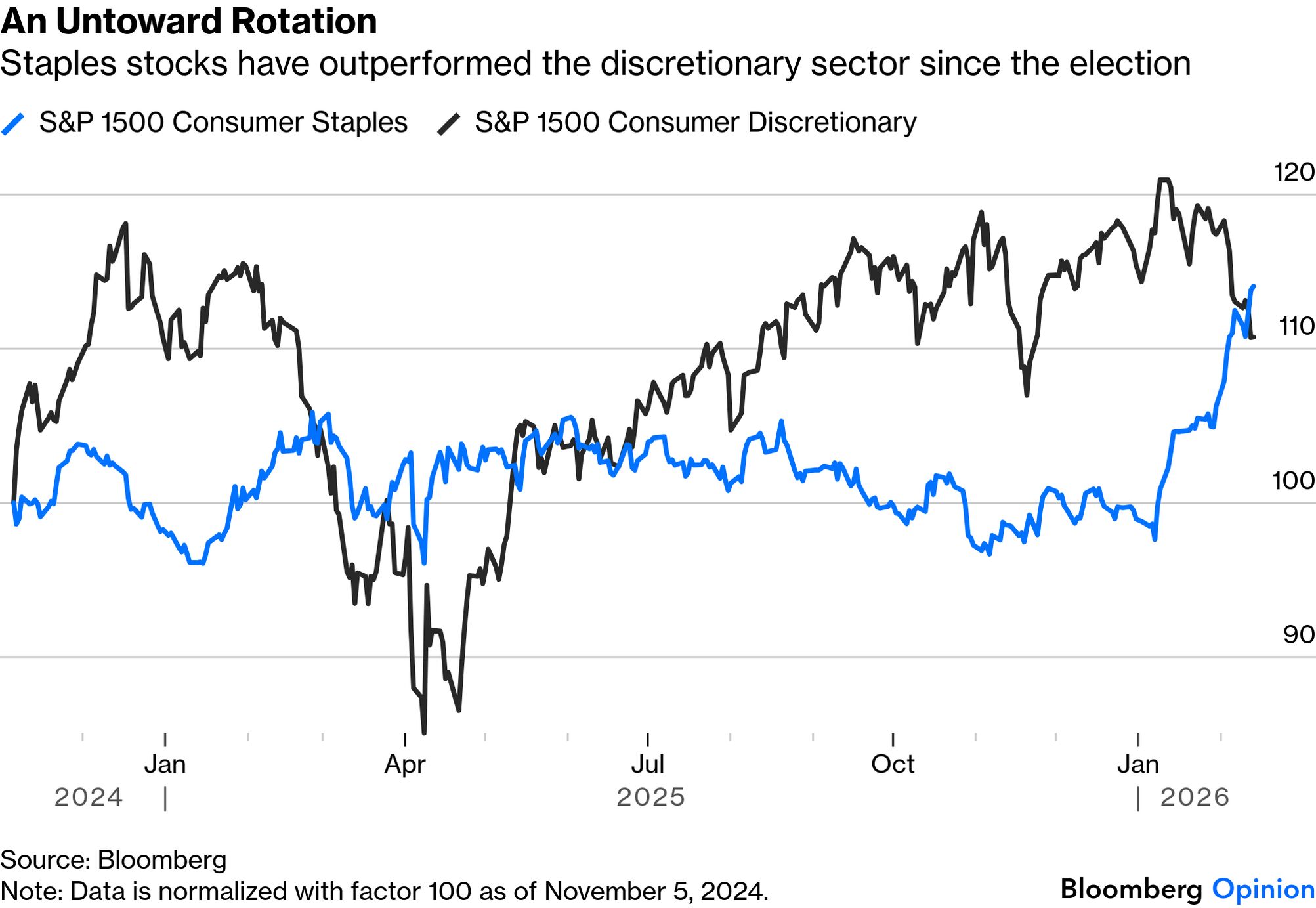

The first two drawbacks were manageable, but the third was not. I may not have put my mechanic's kid through college, but I certainly did my share for Don and his progeny. I eventually asked him just to sell it in lieu of payment due. This picture, with rain cover and Motion W on the spare tire, is all I have left of her. [1]  The author's Jeep, featuring logo of a university he did not attend. So, do I regret my purchase? Maybe. But you know who might really regret buying a Jeep right now? Stellantis, that's who. Yes, yes, yes, I know Stellantis technically didn't buy Jeep-maker Chrysler. Rather, Fiat technically merged with Chrysler in bits and pieces starting in 2009, and a decade later that conglomeration merged with the French PSA Group, maker of Peugeot and Citroën, to form Stellantis. But to say that Fiat merged with Chrysler is to ignore the facts on the ground: The US firm was sinking into Chapter 11, and the vastly larger Italian one hit with force, wiping out jobs and factories, and got a bargain when gas-guzzlers came back into fashion. But some things never change: Jeep owners are again putting a lot of mechanics' children through college. "For a reminder that you can sometimes have too much corporate 'efficiency,' just look at the troubles of carmaker Stellantis NV," writes Chris Bryant. "In North America the rugged reputation of its prized Jeep unit has been dented by the recall of more than 300,00 Wrangler 4xe and Grand Cherokee 4xe plug-in hybrid SUVs because the batteries might catch fire." Yeah, well, my Wrangler's transmission was the gift that kept on giving for Don, but at least it never went down in literal flames. And this couldn't be worse timing: In 2025, Jeep sales rose for the first time in seven years. "Jeep came last in Consumer Reports' owner satisfaction rankings," Chris tells us. "And it's contributing to a massive financial headache for Stellantis. Earlier this month the company revealed a whopping €22 billion ($26 billion) of financial charges." Stellantis isn't the only company having trouble with a niche product: Meta is reportedly adding facial recognition tech to its smart glasses, a plan Dave Lee calls "political asbestos." Meta, during a week of really awful messaging, issued a press release saying that civil-society critics should "have their resources focused on other concerns." Somebody needs a new PR firm. "It stands as one of the most cynical comments to ever emerge from the company," writes Dave. "It has argued that filming with its smart glasses is not meaningfully different from filming with a smartphone, an assertion I'm not sure the women surreptitiously filmed by so-called pickup artists would agree with. Actually, I don't think any person not on Meta's payroll would." Turns out that selling stuff is hard. And it's getting harder, at the speed of AI. "Since the dawn of retail, merchants' primary job has been to tempt human shoppers to part with their cash. Now they have a new customer to woo: the bots," writes Andrea Felsted. "It's still early days, but we are entering the age of agentic commerce, where autonomous artificial intelligence chatbots will be the ones selecting and buying the goods. It's a shift that has the potential to rewire digital shopping." Walmart, which last week lost the crown of world's biggest retailer to Amazon, has big plans to get ahead of the agentic curve. Andrea thinks it may be wiser to stand athwart history. "Walmart must remember that it is first and foremost a store — one that sells essential items to millions of Americans," she warns. "Staying grounded in retail fundamentals is all the more imperative as down-to-earth rivals, led by German discounter Aldi, will be ready to pounce the moment it misses a step." Sticking to staples is good advice not just in retailing but also your 401(k), apparently. "Looking into the entrails of the market, it's in the throes of a rotation," writes John Authers. "Consumer discretionary stocks, which benefit most from a roaring economy, have given up ground and now lag consumer staples since Trump's second election victory. This is typically what is seen when the economy is in trouble and the market is falling." And whether it's buying food or paying off your mortgage, please stick to real money, not credit card points. "I love my points, and always thought they were a harmless pursuit," writes Allison Schrager. "But I am starting to think otherwise because the size of the points industry could be making the economy less efficient. It is leading people to make poor financial decisions, introducing uncertainty into the economy, and misdirecting resources that could be better used elsewhere." I've written about The Credit Card Game previously, and I too have given up on it — not because I care the slightest about an efficient economy, but because I got hopelessly confused and couldn't fit any more cards in my wallet. Still, I do wonder if Don is accepting points from the owners of those flaming Jeeps, and whether they can be used for college tuition as well. Bonus Jeepster Reading: What's the World Got in Store ? - Trump SOTU, Feb. 24: How MAGA's Census Fight Would Reshape Political Power — Ronald Brownstein

- Fourth anniversary of Ukraine invasion, Feb. 24: Putin Doesn't Want Peace. He Wants More Time — The Editorial Board

- Nvidia earnings, Feb. 25: AI Roundabout Isn't a Replay of the Internet Bubble — John Authers

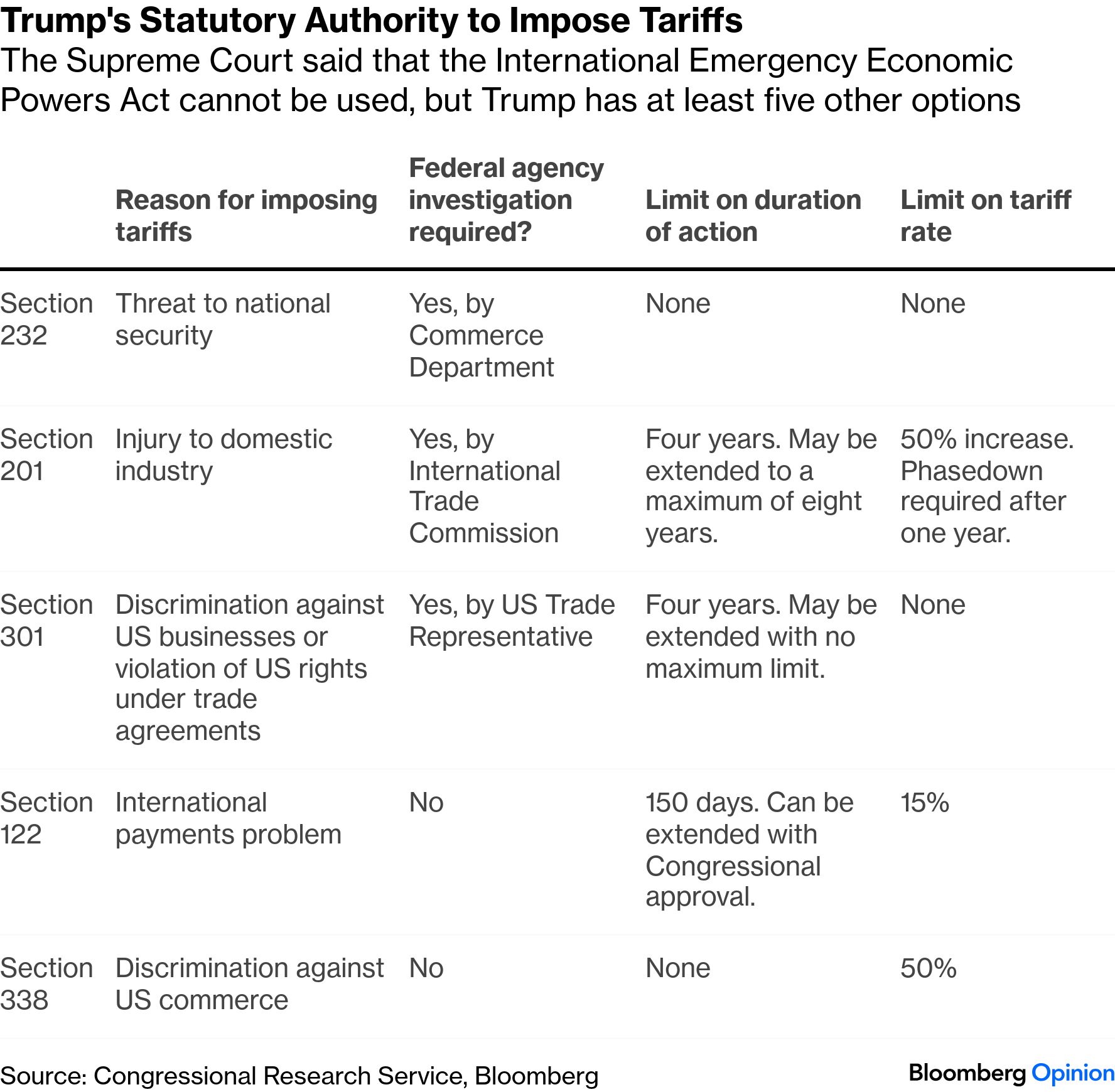

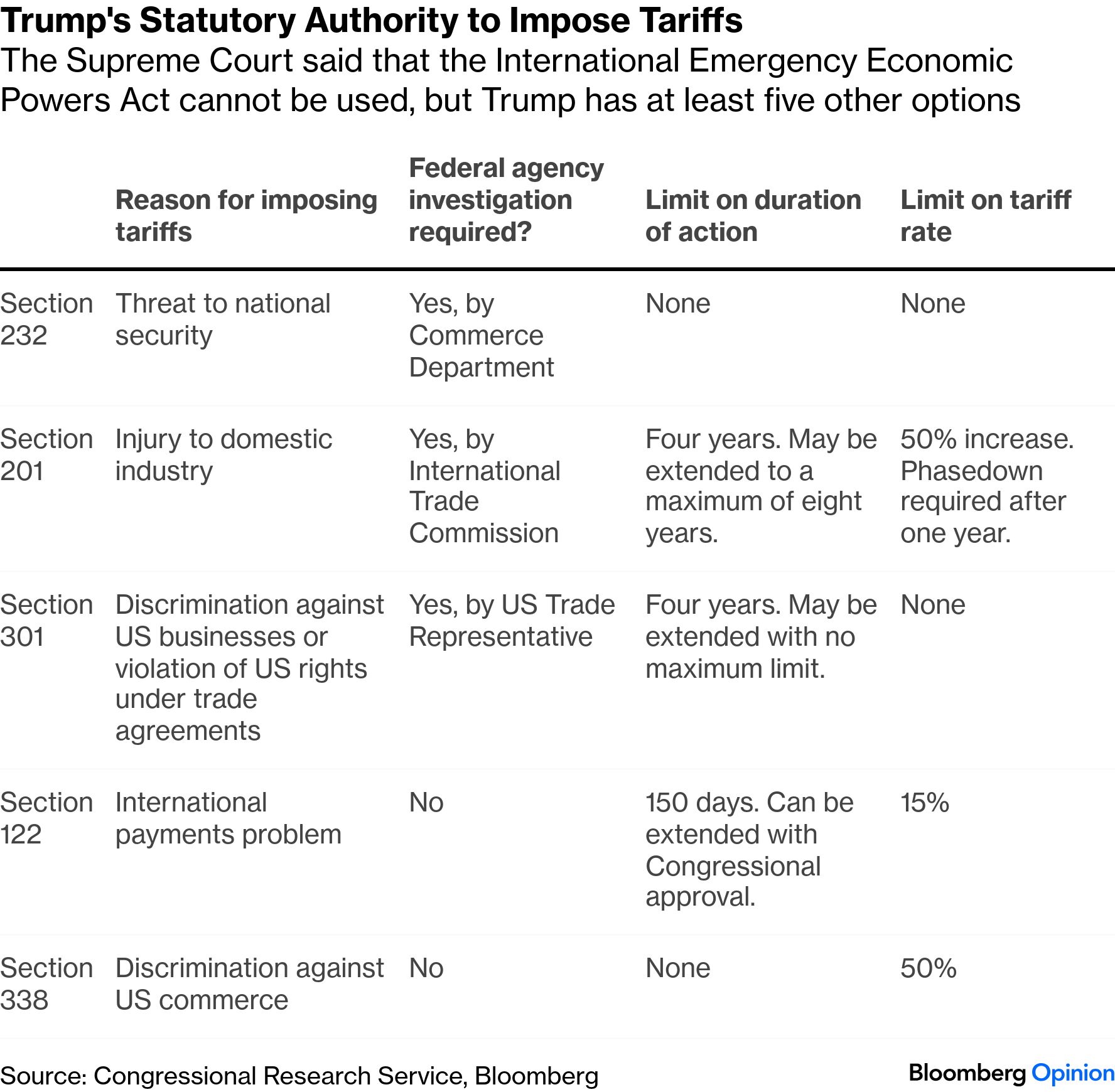

Trump says his tariffs gave America a Liberation Day, but they may have met their doomsday on Friday, when the Supreme Court ruled 6-3 he couldn't use a 1977 emergency law to impose import taxes. Jonathan Levin writes that while it's a win for the rule of law and for the country's reputation as a destination for global capital, "Financial markets should celebrate — but not too much." The problem, for markets and actual humans, is that the president has all sorts of other avenues — and shortly after the court ruling he invoked one of them: national security. Looking ahead, you can use this handy Bloomberg News chart to keep track.  "The decision won't completely offset a year of foolhardy policymaking. As far as companies are concerned, they will face continued questions about their supply chains, especially the small businesses that have been among the worst hit from the policy," adds Jonathan. "At the very least, that will continue to delay investment decisions and restrain economic dynamism. As for consumers, it seems unlikely that companies will reverse price increases that have already taken place." In other words: Trump lost, and so did you. Note: Please send your credit card points and feedback to Tobin Harshaw at tharshaw@bloomberg.net |

No comments:

Post a Comment