| Read in browser | ||||||||||||||

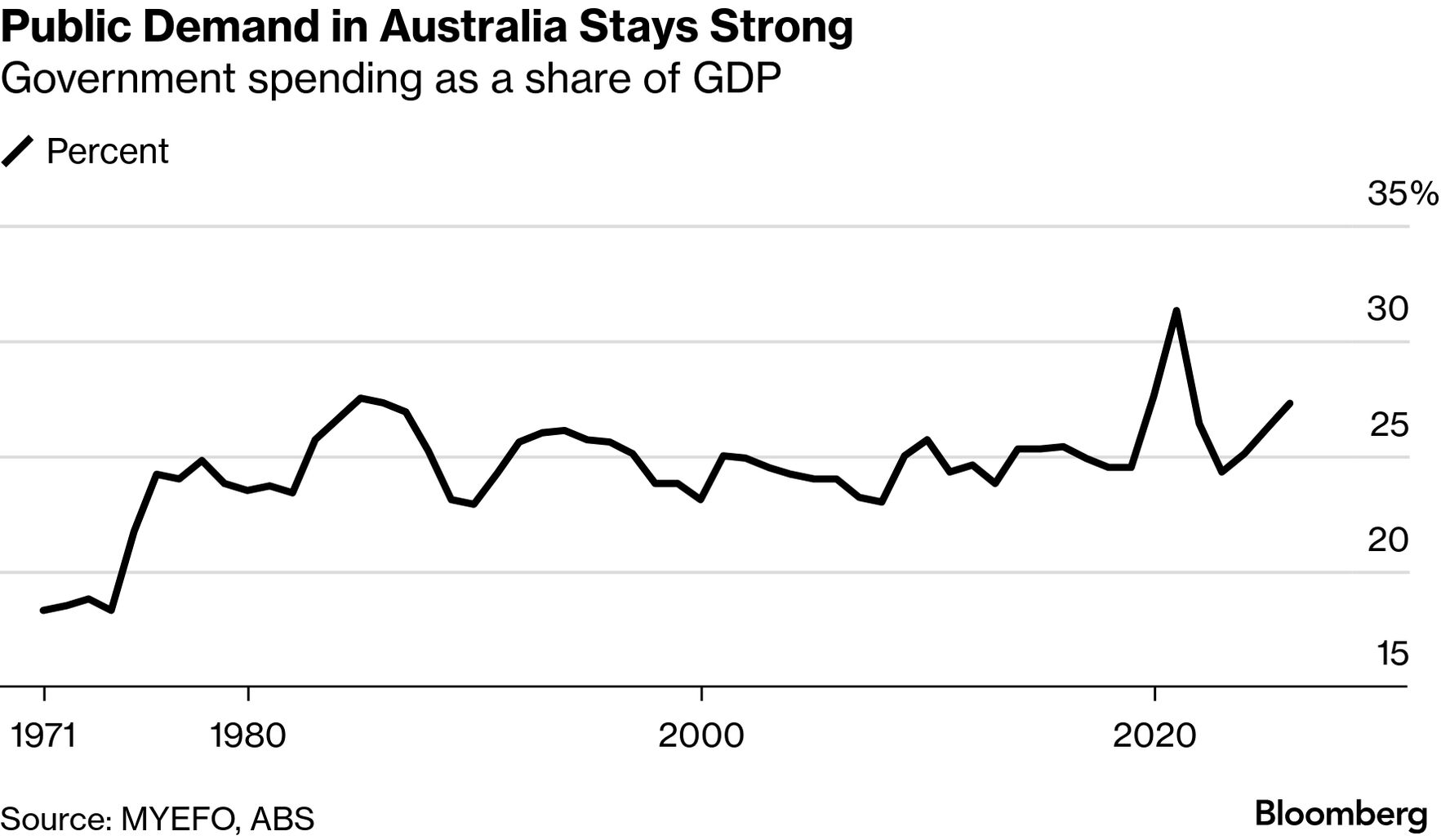

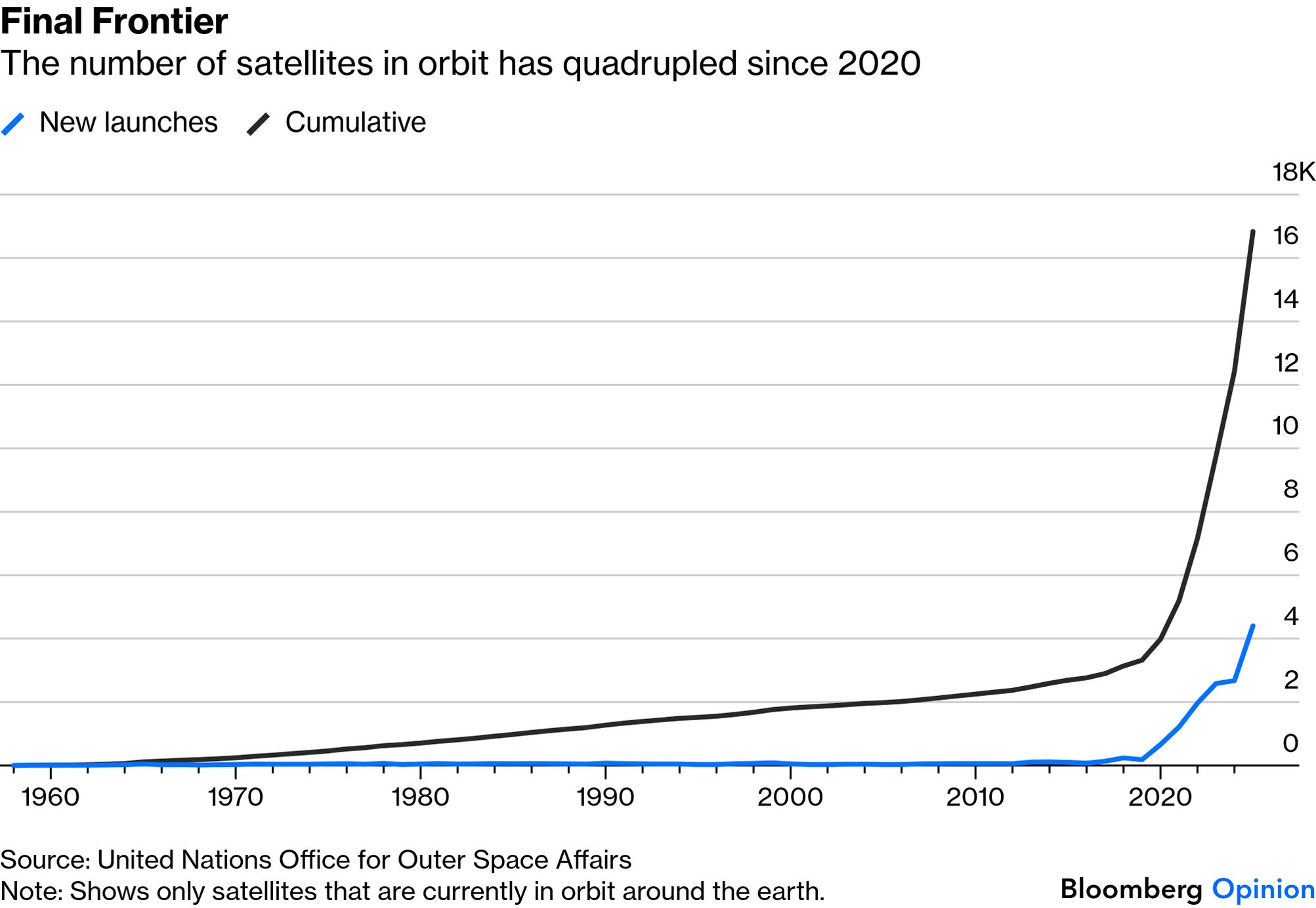

Good morning and welcome back. This morning we've had first-half results from a2 Milk, which makes infant formula. The company may be based in New Zealand, and listed on the ASX, but it's heavily reliant on the Chinese market. Last month, the company's share price plunged after China revealed that births in 2025 fell to the lowest since at least 1949 — fewer babies equals less demand for infant formula. But as my colleague Ben Westcott explained here, there's evidence that firms with premium branding and international cachet can still grow their market share despite fewer Chinese babies. And today, a2 said its sales in China continue to strengthen. — Ainsley Thomson, Wellington Bureau Chief What's happening nowAustralia's economy is undergoing one of its largest structural shifts in decades, with public spending swelling to levels that rival the mining boom of the 2000s, Westpac said. Government outlays now account for a record 35% of gross domestic product, around 7 percentage points higher than a decade ago.  Meanwhile, inflation-focused academic Bruce Preston was appointed to the Reserve Bank's interest rate-setting board, replacing businesswoman Alison Watkins at a time of heightened uncertainty about the economy's outlook. Preston, a professor of economics at the University of New South Wales, will begin his five-year term from March 1, Treasurer Jim Chalmers said. The Australian arm of Octopus Group plans to spend as much as A$20 billion on renewable projects over the next five years, one of the largest investment plans in the country's green sector. Brookfield Asset Management and Singapore's GIC are seeking a A$2.77 billion loan to back the purchase of Sydney-listed National Storage REIT, according to people familiar with the matter. Half a dozen banks — including DBS Group, National Australia Bank and United Overseas Bank — have been appointed as underwriters for the borrowing, which comprises several tranches split across three- and five-year tenors, said the people. Across the Tasman, flights in and out of Wellington have been canceled, homes evacuated and power cut to tens of thousands as strong winds and heavy rain lash the lower North Island.  What happened overnightWarner Bros Discovery is considering reopening sale talks with rival Hollywood studio Paramount Skydance after receiving its hostile suitor's most recent amended offer, people with knowledge of the matter said. Members of the Warner Bros. board are discussing whether Paramount could offer a path to a superior deal, people familiar with the board's thinking said, a move that may ignite a second bidding war with Netflix. The stock market turmoil unleashed by the AI industry reflects two fears that are increasingly at odds. One is that AI is poised to disrupt entire segments of the economy so dramatically that investors are dumping the stocks of any company seen at the slightest risk of being displaced by the technology. The other is a deep skepticism that the hundreds of billions of dollars that tech giants are pouring into AI every year will deliver big payoffs anytime soon. John Hurley, the Trump administration's top sanctions official, is set to leave his post after friction with Treasury Secretary Scott Bessent, according to people familiar with the matter. Hurley's expected departure as Treasury's undersecretary for terrorism and financial intelligence follows months of internal tension over the tactics and targets of US sanctions policy, said the people. If orbital space is the 21st century's high seas, China looks to be preparing an armada, writes David Fickling for Bloomberg Opinion. Government plans submitted late last year to the United Nations' International Telecommunications Union, or ITU, promise a fleet of 203,000 satellites to be deployed by the mid-2030s. That would dwarf the ambitions of Elon Musk or Jeff Bezos: SpaceX's Starlink network has nearly 10,000 orbiters so far, while Amazon.com's Leo constellation will top out at just 3,232.  What to watch• Nothing major scheduled One more thing...Around the world, nightlife's lights have dimmed from New York and Montreal to London, Berlin and Sydney. Even Las Vegas has lost some of its after-hours heat. But São Paulo is making a global case for staying up late. Brazil's largest city is leaning into the night, especially in its historic downtown.  A scene from a pre-carnival ball in São Paulo.

We're improving your newsletter experience and we'd love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg's Australia Briefing newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|

Sunday, February 15, 2026

a2 Milk gets China boost, stock market doom loop

Subscribe to:

Post Comments (Atom)

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment