| Read in browser | ||||||||||||||

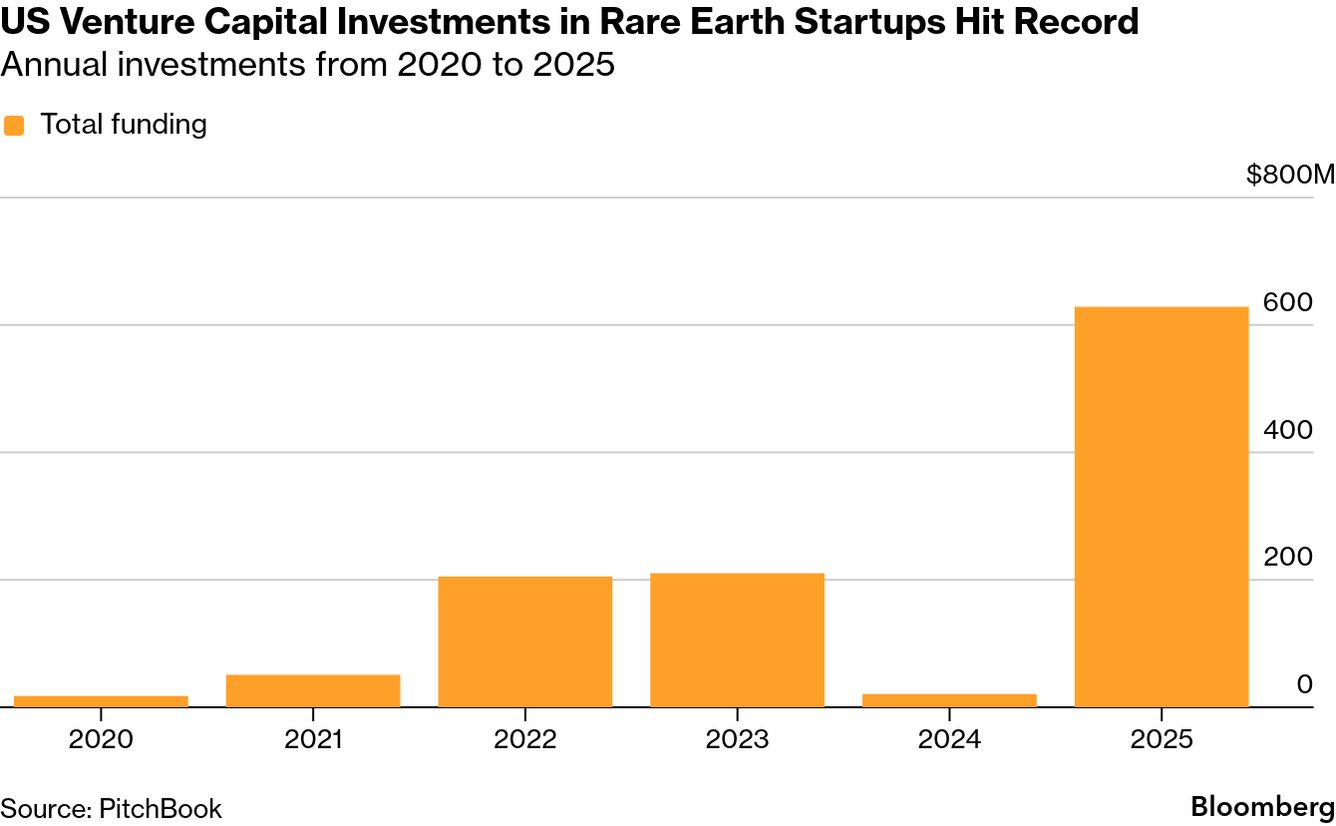

The Trump administration is hostile to clean tech. But its national security moves have had some unexpected benefits for the industry. The latest example? The plan to invest $12 billion to build a critical mineral stockpile. Today's newsletter looks at what Project Vault means for US startups and investors. But first, a popular anesthesia is a surprise climate superpolluter. Here's how doctors are trying to replace it. Did someone forward you this newsletter? Subscribe to Green Daily for more free reads on climate and clean technologies. Sleeper greenhouse gasBy Emma Court For decades, hospitals have relied on desflurane, a popular anesthetic, to put patients to sleep on the operating table. But the chemical is a potent greenhouse gas, so regulators, health systems and hospitals around the world are moving to phase it out. Starting this year, the EU will largely get rid of desflurane except in cases of medical necessity, following a 2023 ban by Scotland's public health-care system. Hospitals in Singapore and Australia are also moving away from desflurane, and Chinese clinicians are discussing taking similar measures. Nearly 600 hospitals of about 1,000 surveyed in the US and Canada have stopped routine use of the anesthetic over the last decade, according to a tally by the nonprofit Practice Greenhealth. "It was so easy compared to all the other things we've looked at over the years," says Tessa Huncke, an anesthesiologist who has been leading efforts to reduce emissions from desflurane and other polluting anesthetics at NYU Langone Health, which are expected to wrap up this year. "This is really low-hanging fruit, and it does make a big difference in the carbon footprint of the operating room."  At NYU Langone Health in New York, the nitrous oxide outlet on the anesthesia machine is capped and not in use. Desflurane has been around since 1992, when hospital supplier Baxter introduced it in the US. Promoted for faster wake-ups, desflurane became widely adopted and a generation of anesthesiologists was trained to use it. Baxter International Inc, a major manufacturer of the anesthetic, said that it takes environmental stewardship seriously and that choice of anesthetic agents is necessary for quality patient care. But around 2010, scientists started to raise alarms about the global warming potential of the drug and other inhaled anesthetics. Desflurane, for example, has 2,530 times the global warming effects of carbon dioxide over a 100-year period and heats up the atmosphere as much as 50 times more than comparable anesthetics over a 100-year timescale. Now, regulators and medical professionals are starting to zero in on hospital emissions, including those generated by the roughly $5 billion-a-year anesthesia market. The health care sector is responsible for about 5% of global emissions. If it were a country, it would be the world's fifth-largest emitter. While anesthetic gases make up a tiny fraction of that, they can represent as much as 60% of an operating room's emissions. Desflurane and another anesthetic called nitrous oxide produce emissions equivalent to driving 12 million gas cars in the US each year, one study found. In the case of nitrous oxide, also known as laughing gas, the problem is also that it's delivered to operating rooms via pipes, which can leak. Brian Chesebro, the medical director of environmental stewardship at the US hospital system Providence St. Joseph Health, discovered that the creaky piping systems were leaking more than 90% of the anesthesia. "I did that math 50 times. I didn't believe it," he says. Research suggests that hospitals elsewhere, including in the United Kingdom and Australia, also face this problem. Hospitals are switching to less-polluting alternatives, including other inhaled sedatives and intravenous anesthesia that doctors say doesn't harm care. The shift away from desflurane has contributed to a nearly 30% decrease in anesthetic greenhouse gas emissions over a decade, according to a Lancet Planetary Health study published in 2025, though it noted that desflurane use is creeping up in lower-income countries. Read the full story to see how countries like the Netherlands are dealing with anesthesia's major carbon footprint. Critical mineral movesBy Coco Liu and Emily Forgash US startups and venture investors are eager to reap the benefits of the Trump administration's planned $12 billion initiative to stockpile critical minerals, which provides another national security-driven lifeline to green tech. The new initiative "signals a clear move" to support domestic supplies, and venture capitalists will likely follow suit by investing more in the sector, said Duncan Turner, a partner at SOSV whose firm has bankrolled several startups in the critical minerals sector. That will help cultivate and scale up next-generation approaches to mining, processing and refining minerals — areas in which the US is heavily reliant on China. The venture, dubbed Project Vault, is set to marry $1.67 billion in private capital with a $10 billion loan from the US Export-Import Bank to procure and store the minerals that industries from automotives to renewable energy rely on. The investments will also help shield those sectors from supply shocks. A government initiative could help quell wild price swings, which has been a "real concern" for startups and their backers, Turner said. Investors have been increasingly bullish on critical minerals, even before the new initiative was announced. Pitchbook data shows that venture capitalists invested more than $628 million in US startups working on rare earth minerals in 2025, accounting for 90% of all funding globally. That represents a nearly 3,000% jump compared to 2024.  "We expect every investor to be reaching out to understand what sales contracts we will have with the stockpile," said Nick Myers, chief executive officer of Phoenix Tailings, a startup that recycles mining byproducts into rare earth minerals. Read the full story to learn more about the connection between critical minerals and green technologies. Supply-demand mismatch10% The amount of graphite the US needed in 2025 that was provided by domestic suppliers, according to BNEF. Green lens"We frame rare earths as a climate issue because it's fueling so much of the transition" James Lindsay Director of investments at Builders Vision, an investing and philanthropic platform founded by billionaire Lukas Walton. This week's Zero What is the best way to tell a climate story? This week on Zero, Akshat Rathi speaks with Booker Prize-winning novelist George Saunders. His new novel Vigil is an exploration of guilt, told on the deathbed of an oil executive haunted by ghosts. Rathi asks Saunders what he learned about climate change, his thoughts on whether AI complements or compromises human creativity, and why literature still matters in the era of TikTok. Listen now, and subscribe on Apple, Spotify or YouTube to get new episodes of Zero every Thursday. More from Green Photo courtesy of Avalanche Energy Fusion startup Avalanche Energy Inc. has raised $29 million to develop reactors small enough to sit on a desk that it hopes can one day power satellites, underwater drones and remote bases. The oversubscribed funding round was led by RA Capital Management and joined by new investor Overlay Capital and existing backers Congruent Ventures and Lowercarbon Capital. Fusion offers the promise of abundant, clean energy, but the technical and engineering obstacles remain daunting, particularly to build reactors at such a small scale. While the funding round is modest, it's another sign that investors are willing to pour money into the elusive technology. The industry has attracted more than $9.7 billion, according to the Fusion Industry Association's 2025 report, including $2.6 billion invested in the 12 months ending in June 2025. China's solar generating capacity is expected to surpass coal for the first time this year, according to the country's top electricity industry group. The UK government is increasingly concerned that more protectionist policies pursued by the European Union could exclude British companies from supply chains in key sectors including green tech. More from Bloomberg

Explore all Bloomberg newsletters. Follow us You received this message because you are subscribed to Bloomberg's Green Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|

Tuesday, February 3, 2026

A $12 billion critical mineral lifeline

Subscribe to:

Post Comments (Atom)

Epstein fallout reaches Coinbase

PLUS: Trump denies $500M crypto deal ...

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment