|

Reading time: 5 minutes |

News | Crypto Converter | Crypto Calculators |

XRP fundamentals improve, price action still lags |

|

Key points: |

Large XRP holders and ETF inflows continued to grow even as price action remained capped below $2. A dense supply zone near $1.96–$1.98 continued to absorb buying pressure, delaying any sustained breakout.

|

News - XRP's price remained under pressure toward the end of January, trading near $1.87 after multiple failed attempts to reclaim the $2 level. While short-term momentum stayed weak, a growing set of on-chain and institutional signals pointed to steady accumulation beneath the surface. |

Data from Santiment showed that the number of wallets holding at least 1 million XRP rose by 42 since the start of the year. This marked the first increase in such wallets since September 2025, suggesting that larger holders were gradually rebuilding exposure despite broader caution across the crypto market. |

Institutional flows echoed that trend. U.S.-listed spot XRP ETFs recorded net inflows of $91.72 million this month, diverging from continued outflows in bitcoin ETFs. The contrast suggested selective positioning rather than a broad shift toward risk-taking. |

Why price still struggles near $2 - Despite these supportive signals, XRP's price continued to stall just below $2. On shorter timeframes, repeated attempts to reclaim key moving averages lacked sustained follow-through. Buying activity faded quickly, allowing sellers to regain control. |

On-chain cost basis data pointed to a structural hurdle. Roughly 1.86 billion XRP were clustered between $1.96 and $1.98, creating a heavy supply zone. As price approached that range, holders appeared willing to sell into strength, limiting upside unless demand expanded enough to absorb the supply. |

Network activity sends a longer-term signal - At the same time, activity on the XRP Ledger reached notable highs. Decentralized exchange transactions and overall network usage climbed to levels historically associated with stronger recoveries. Past periods of elevated transaction activity were followed by sharp price moves, though timing varied. |

For now, XRP remains caught between improving long-term positioning and a stubborn overhead supply zone. Until buying conviction strengthens enough to clear resistance near $2, accumulation signals may continue to build without immediately translating into higher prices. |

Institutions split on Bitcoin exposure: Yield vs accumulation |

|

Key points: |

Institutional investors continued to explore Bitcoin exposure through both market-neutral yield funds and balance-sheet accumulation strategies. Sygnum's arbitrage-based fund drew steady inflows despite Bitcoin's price pullback, while Metaplanet moved to raise capital for debt reduction and further BTC purchases.

|

News - Institutional approaches to Bitcoin exposure continued to branch out, with new capital flowing into both yield-focused products and corporate treasury strategies. Recent developments from Sygnum and Metaplanet highlighted how investors and companies are navigating volatile markets without relying solely on price appreciation. |

Sygnum Bank and Starboard Digital raised more than 750 BTC, worth roughly $65 million, for their BTC Alpha Fund in the months following its October launch. The market-neutral fund reported an annualized net return of 8.9% in its first full quarter, despite Bitcoin declining by about 25% since the fund's debut. |

Rather than betting on rising prices, the fund aims to generate Bitcoin-denominated returns by exploiting pricing differences across spot and derivatives markets. These arbitrage and relative-value strategies are designed to perform across market conditions, reflecting growing institutional interest in structured products that emphasize yield and capital efficiency. |

Yield without selling Bitcoin - Demand for the fund appeared to reflect a broader shift toward income-generating Bitcoin strategies. Shares in the BTC Alpha Fund can also be used as collateral for Lombard loans through Sygnum, allowing investors to access liquidity without selling their underlying Bitcoin exposure. This structure appealed to investors seeking flexibility amid uncertain market direction. |

Corporate treasuries take a different route - At the same time, Tokyo-listed Metaplanet pursued a more direct balance-sheet strategy. The company approved a capital raise of up to $137 million through new shares and stock acquisition rights, with proceeds earmarked for additional Bitcoin purchases and partial debt repayment. |

Metaplanet currently carries roughly $280 million in debt and holds 35,102 BTC, making it one of the largest corporate Bitcoin holders globally. Part of the new funding is intended to restore borrowing capacity while continuing to expand its Bitcoin treasury, even as its shares reacted cautiously to near-term dilution concerns. |

Together, the two strategies underscored a broader trend. Whether through yield-focused funds or corporate accumulation, institutional players continued to refine how they gain and manage Bitcoin exposure in a market that remains volatile and selective. |

Bybit pushes into banking with IBAN accounts |

|

Key points: |

Bybit plans to launch personal IBAN-based accounts in February, allowing users to move fiat and crypto under their own name. The rollout marks a strategic shift toward payments and banking services as the exchange explores broader global expansion.

|

News - Bybit is preparing to expand beyond crypto trading with the launch of "My Bank," a retail banking product that will provide users with personal IBAN accounts starting as early as February, subject to regulatory approval. The service is designed to allow users to send, receive, and hold fiat currencies while maintaining direct access to crypto markets on the same platform. |

According to the exchange, My Bank accounts will support transfers across up to 18 fiat currencies, with U.S. dollar support expected at launch. Users who complete Know Your Customer (KYC) checks will receive accounts issued through partner banks, enabling them to deposit fiat, receive salaries, pay bills, and trade digital assets without relying on third-party on-ramps. |

From crypto exchange to neobank features - Bybit CEO Ben Zhou said the product aims to reduce friction faced by users whose traditional banks restrict crypto-related transactions. By issuing accounts in the user's own name, the platform positions itself closer to a neobank model rather than a trading-only service. |

The accounts are being developed in collaboration with multiple banking partners, including Pave Bank, a Georgia-licensed lender. Bybit said fiat deposits would allow near-instant conversion into crypto, streamlining entry into digital assets. Access and launch timing remain contingent on regulatory approvals across supported jurisdictions. |

Expansion plans and open questions - The banking rollout comes as Bybit evaluates broader international growth. Zhou confirmed the exchange is reviewing a potential U.S. market entry, which would require a licensed local partner, and reiterated that a public listing remains a long-term ambition. |

The move also follows a challenging period for the exchange. In early 2025, Bybit suffered a $1.4 billion hack attributed to North Korea's Lazarus Group. The company said client assets were fully replaced under its reserve guarantees and that multiple security upgrades followed. |

While fintech firms have added crypto features after building banking products, Bybit's approach reverses that path. Whether a crypto-native platform can scale banking services within regulatory constraints remains uncertain, but the launch signals a clear attempt to integrate fiat and crypto activity more tightly under one roof. |

UAE registers its first USD stablecoin, with strict limits |

|

Key points: |

Universal Digital launched USDU as the first USD-backed stablecoin registered under the Central Bank of the United Arab Emirates payment token regime. The stablecoin is limited to regulated digital-asset settlement and is not permitted for general retail or consumer payments.

|

News - Abu Dhabi-based Universal Digital launched USDU on January 29, marking the first US dollar-backed stablecoin formally registered with the UAE Central Bank under its Payment Token Services Regulation. The registration establishes USDU as a compliant settlement token for digital-asset transactions and derivatives within the UAE, though its use is tightly restricted. |

Under the framework, USDU may only be used for regulated digital-asset settlement by professional and institutional participants. The token cannot be used for everyday payments such as rent, retail purchases, or other mainland commercial transactions that already rely on established payment rails. |

USDU is issued as an ERC-20 token and is backed one-to-one by US dollar reserves held in safeguarded onshore accounts at Emirates NBD and Mashreq, with Mbank providing corporate banking services. Monthly reserve attestations are conducted by an international accounting firm. |

Compliance first, utility second - Universal Digital operates under dual oversight, regulated by the Financial Services Regulatory Authority of Abu Dhabi Global Market and registered with the UAE Central Bank as a Foreign Payment Token Issuer. The structure prioritizes regulatory clarity, banking integration, and reserve transparency over broad consumer reach. |

The company has appointed Aquanow, regulated under Dubai's Virtual Assets Regulatory Authority, as its global distribution partner to support institutional access and settlement infrastructure. Universal is also working with AE Coin, the UAE's dirham-denominated stablecoin, to enable future USD-AED conversions for domestic settlement. |

A narrow role in a crowded market - Despite being the only USD stablecoin formally registered under the UAE Central Bank's payment token regime, USDU enters a market where USDT and USDC already dominate crypto trading and over-the-counter activity without central bank registration. These global stablecoins offer broader liquidity and fewer usage constraints, raising questions about how much demand regulated settlement alone can attract. |

Universal Digital has positioned USDU as a compliance-driven instrument rather than a consumer payment product. While the launch strengthens the UAE's regulated digital-asset framework, the stablecoin's impact will likely depend on institutional adoption rather than retail usage. |

|

More stories from the crypto ecosystem |

|

Interesting facts |

Dubai now accepts crypto for car insurance premiums: Dubai Insurance, in partnership with Zodia Custody, became the world's first regulated insurer to launch a dedicated digital wallet for Bitcoin and other cryptocurrencies. This allows policyholders to pay car insurance premiums and receive claim payouts in digital assets, marking a massive leap for mainstream crypto integration in the UAE. Fortune 500 firms are expected to formalize crypto strategies by end of 2026: Ripple's president Monica Long predicts that roughly half of Fortune 500 companies will embed blockchain or digital asset strategies into their operations by the end of 2026, signaling deepening corporate adoption beyond niche experiments. Singapore delayed new crypto prudential standards to 2027 after industry feedback: The Monetary Authority of Singapore pushed its updated crypto regulatory standards back to 2027 to allow more time for consultation and alignment with global norms, reflecting how regulators are pacing innovation with market readiness.

|

Fact-based news without bias awaits. Make 1440 your choice today. |

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed. |

Sign up now! |

|

Top 3 coins of the day |

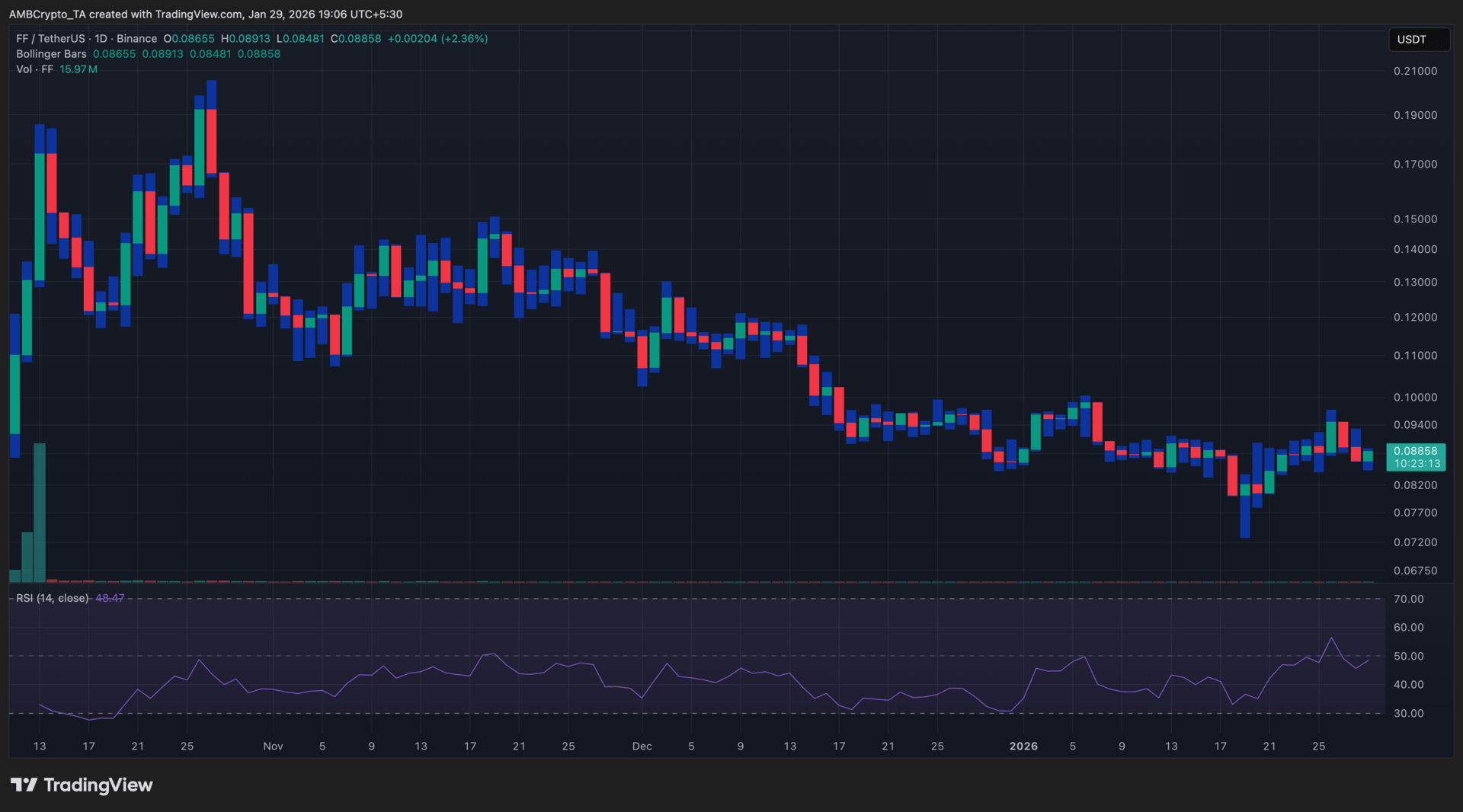

Falcon Finance (FF) |

|

Key points: |

FF edged higher to $0.0885 in the latest session, posting a mild intraday gain while remaining range-bound. Price action stayed compressed within the Bollinger Bars, while RSI hovered near neutral, reflecting consolidation rather than trend strength.

|

What you should know: |

FF ended the session slightly higher, holding steady amid a softer broader market. Price continued to trade within a narrow Bollinger range, pointing to consolidation rather than directional follow-through. Volume remained muted, reinforcing the absence of aggressive buying or selling pressure. |

Momentum indicators stayed balanced, with the RSI holding near the midline, suggesting neither exhaustion nor strong accumulation. From a narrative standpoint, Falcon Finance's exposure to tokenized gold yield and real-world assets added a supportive backdrop, but the development failed to translate into immediate upside amid cautious market conditions. |

For now, $0.0875 remains immediate support, while a sustained push above $0.0900 is required to signal a clearer recovery attempt. |

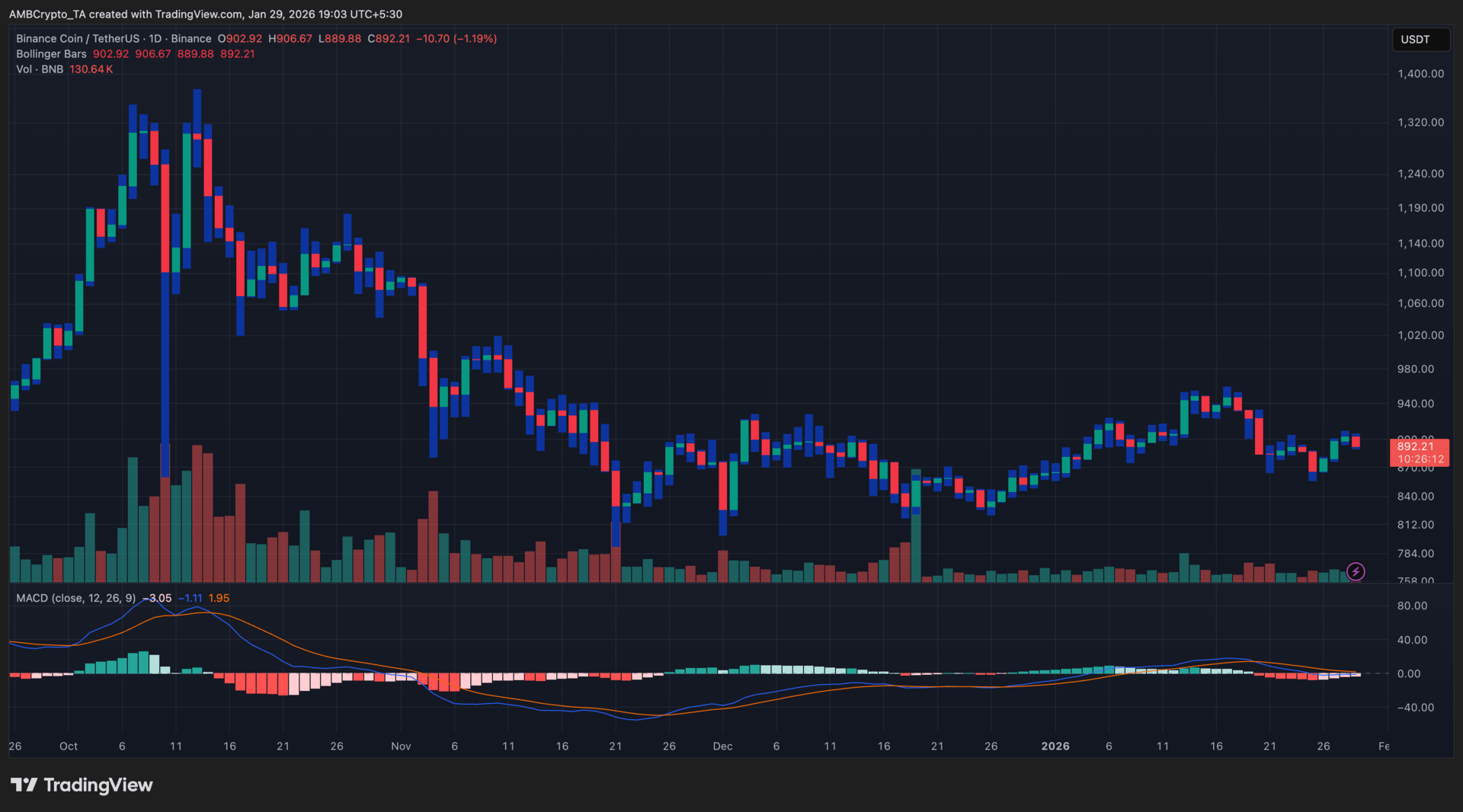

BNB (BNB) |

|

Key points: |

BNB eased toward $892 in the latest session, extending a mild pullback after repeated rejection near recent highs. Momentum indicators remained soft, with muted volume and a weak MACD structure reflecting consolidation rather than aggressive selling.

|

What you should know: |

BNB's latest dip unfolded amid a broader risk-off tone across crypto markets, which weighed on large-cap assets. Price failed to build on earlier rebounds and instead consolidated after facing repeated rejection near the $920–$930 zone. Bollinger Bars stayed relatively tight, signaling subdued volatility and limited directional conviction. |

The MACD histogram remained marginally negative, pointing to mild bearish pressure rather than a decisive trend shift. Volume also stayed lighter than during earlier sell-offs, suggesting the move lacked panic-driven exits. Structurally, BNB continues to hover above the $885–$890 support band, while a deeper pullback could expose the $870–$875 region if selling pressure builds. |

Beyond technicals, market-wide caution has been the dominant headwind. In addition, lingering security-related chatter around BNB Chain appears to have capped short-term confidence, reinforcing hesitation near resistance. For upside continuation, buyers would need stronger volume and a sustained push above $920. |

Worldcoin (WLD) |

|

Key points: |

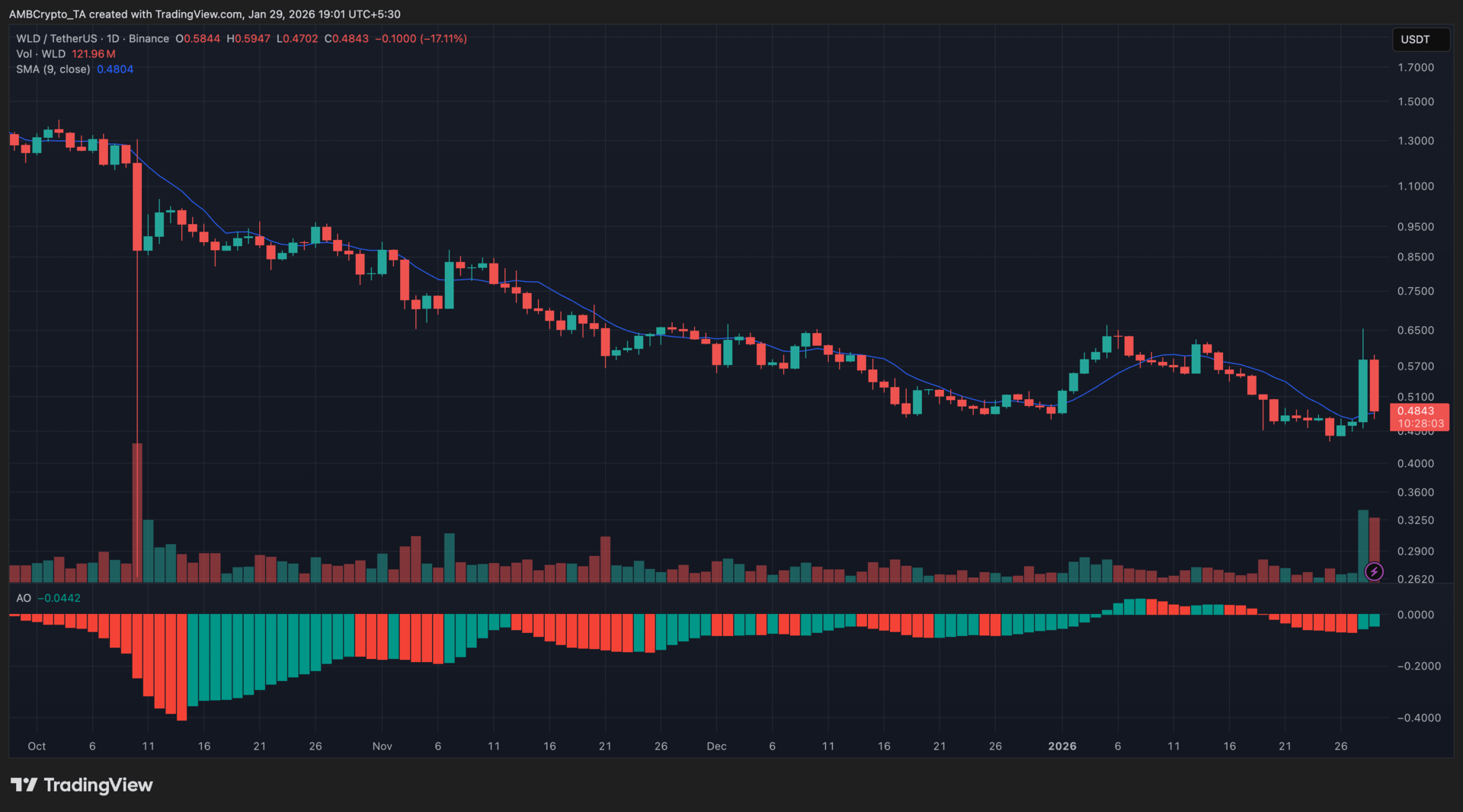

WLD rebounded to $0.4843 after defending recent lows, briefly diverging from a weaker broader market as dip buyers stepped in. Short-term momentum improved, with price reclaiming the 9-day SMA and the Awesome Oscillator printing green bars despite remaining below zero.

|

What you should know: |

Worldcoin rebounded to $0.4843 after holding recent lows, with the last two daily candles closing above the 9-day SMA at $0.4804, signaling short-term stabilization. The move followed a sharp intraday dip and was accompanied by higher volume, suggesting active dip-buying rather than passive consolidation. |

Momentum indicators showed early relief. The Awesome Oscillator flipped green, though it stayed below the zero line, pointing to easing bearish pressure instead of a confirmed trend shift. As long as price holds above its short-term average, downside momentum appears to be cooling. |

Sentiment was also supported by renewed speculation around OpenAI developing a "humans-only" social platform, with traders linking potential biometric verification use cases back to Worldcoin's Orb-based proof-of-personhood model. While unconfirmed, this narrative likely amplified the rebound. |

From a structure standpoint, the $0.4800–$0.4840 zone now acts as near-term support, while $0.5200 remains the next resistance area to watch. |

How was today's newsletter? |

|

No comments:

Post a Comment