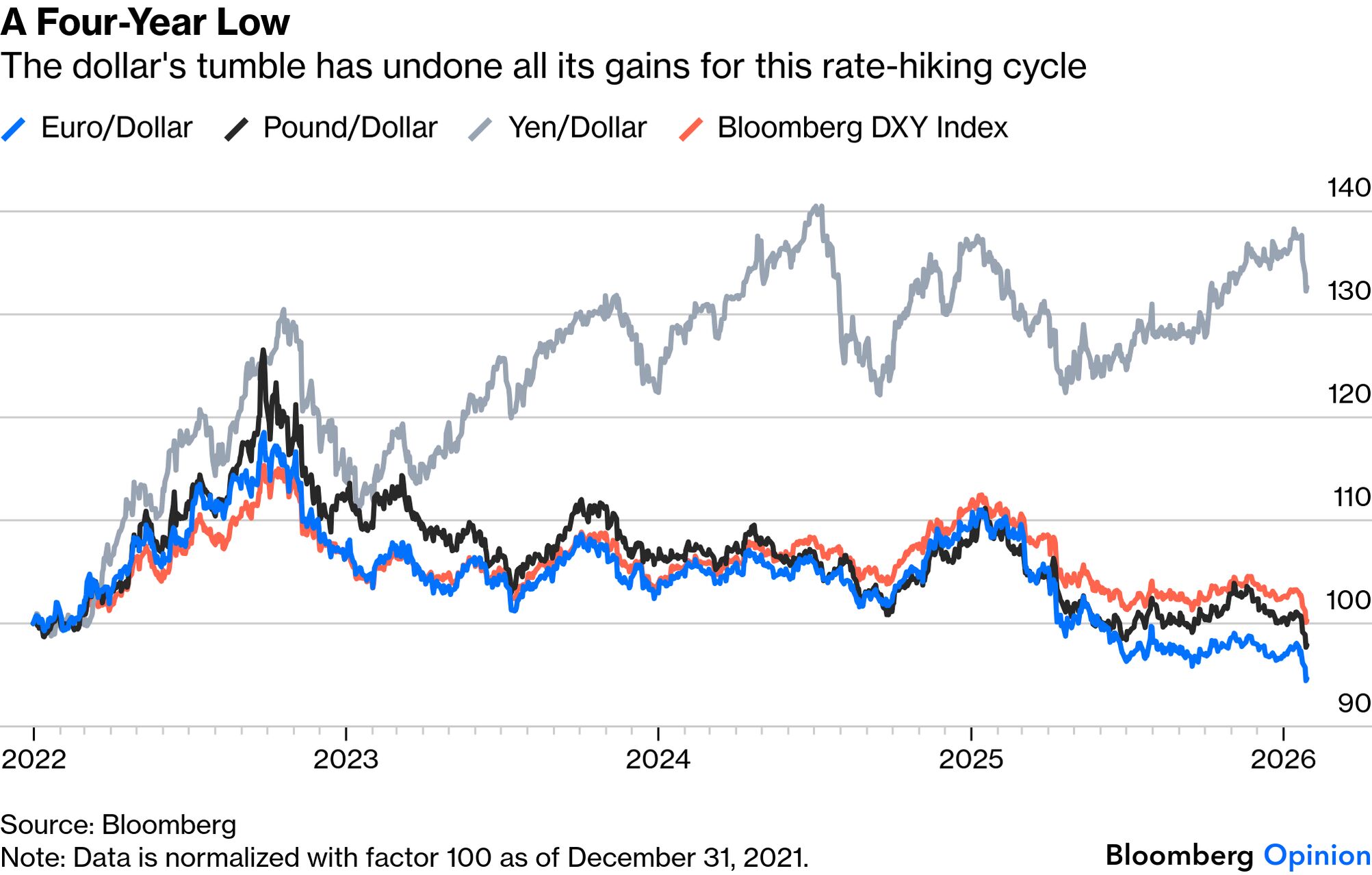

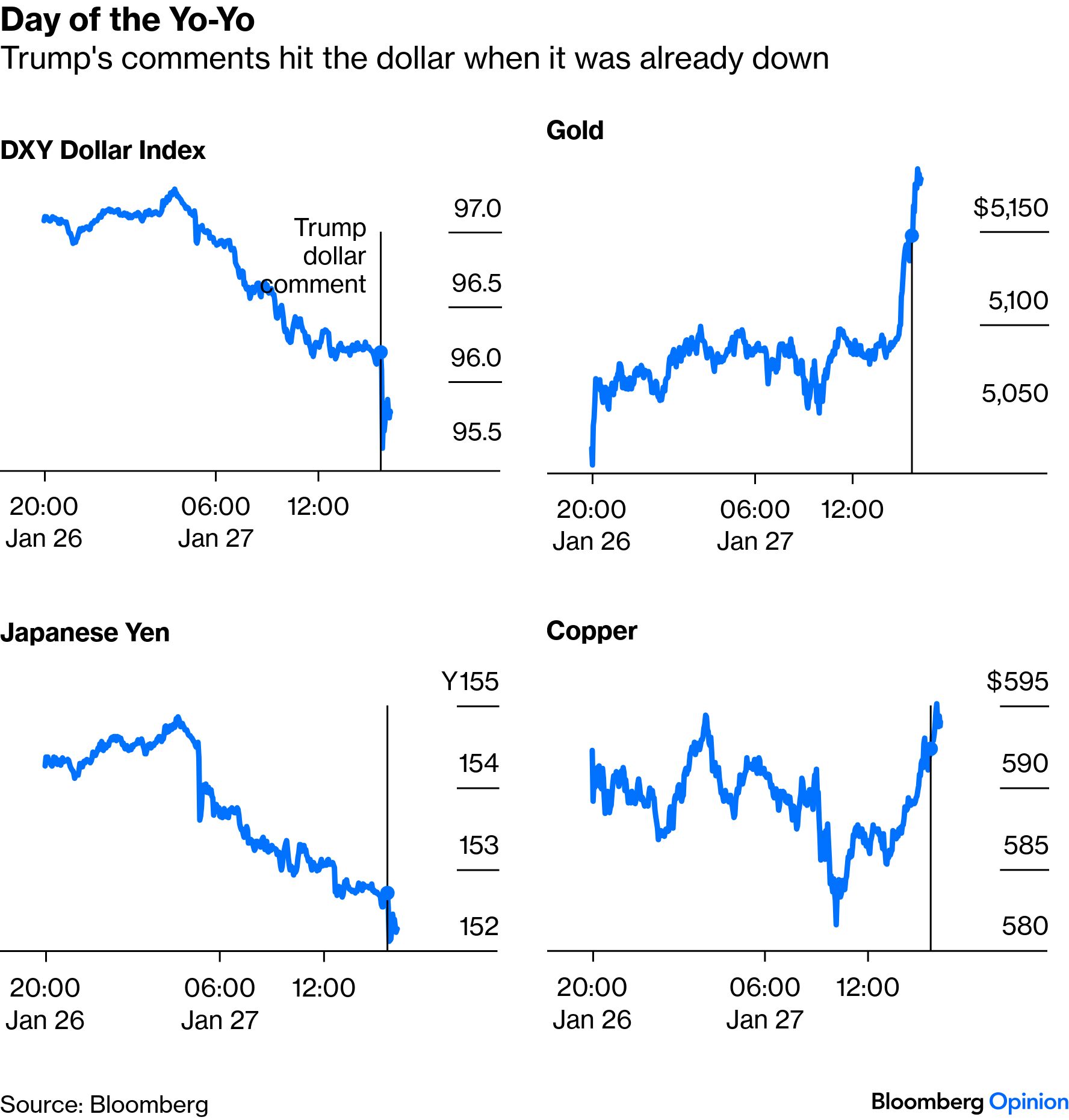

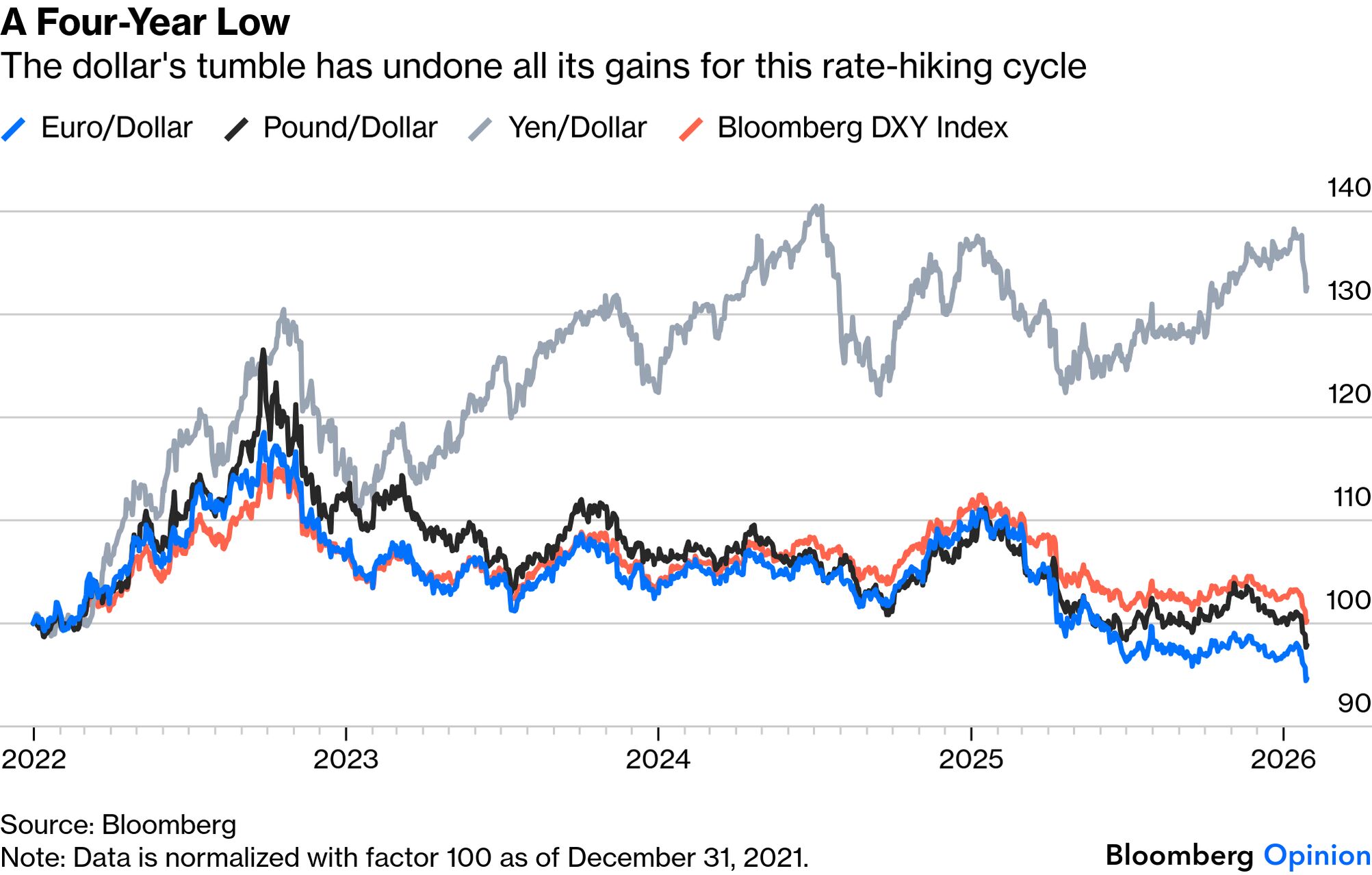

| Look at them yo-yos, that's the way you do it, as someone once said. Only, that's not the way. Yo-yos are great fun. They go down and then go up — until the moment when the intrepid user loses concentration, gets the timing just wrong, and the yo-yo comes to rest at the bottom of its string. That appears to have happened to the dollar Tuesday after President Donald Trump offered the toy as an analogy for setting the exchange rate of the world's reserve currency. "I could have it go up or go down like a yo-yo," he said. "I want it to be — just seek its own level, which is the fair thing to do." Asked if he was worried by the dollar's sharp fall, he said: "No, I think it's great. I think the value of the dollar — look at the business we're doing. The dollar's doing great." Those words, coming at a point when the currency had already sketched out a first yo downward, created another down yo. The effect was most dramatic for the broader dollar, but it also galvanized both precious and industrial metals, which have been on their own related run: It's obvious that Trump's comments, making as clear as only he could that he wasn't minded to intervene to stop a weaker dollar, had an effect. Dave Sloan, US economist at Continuum Economics, said that Trump had given traders a green light to take the dollar through the next key levels, which they promptly did. As gold set an all-time high, Bloomberg's DXY dollar index dropped to its lowest since early 2022, just before the Federal Reserve sparked a dollar revival by hiking rates. The euro and the pound are both now significantly higher than they were then — even though rates are no lower in the US than in either the UK or the EU:  This has major economic ramifications. A weak dollar makes US exports more competitive, and imports more expensive — a key Trump 2.0 aim and a reason why he has advocated for a weaker dollar in the past. The problem is inflation. While US CPI isn't as sensitive to import prices as in smaller economies, Sloan said that "a sliding USD does make the Fed's task a little harder." There are limits to how much all of the dollar's travails can be laid at the president's door; the obvious trading reaction to the yo-yo comments doesn't fully cover it. The chaos surrounding the administration, at home and abroad, grows ever greater — but it's hard to see how this alone would have such a big impact on the dollar while having relatively limited effects on other markets. Jonas Goltermann of Capital Economics said it appeared investors were still looking through the noise: Lingering discomfort from last week's standoff over Greenland, President Trump's latest tariff threats against Canada and Korea, the potential for another government shutdown from this Saturday, and a new perceived front-runner for the next Fed chair all add to the uncertainty around the greenback. But all of those factors would, if taken seriously, probably also weigh on equity and bond markets.

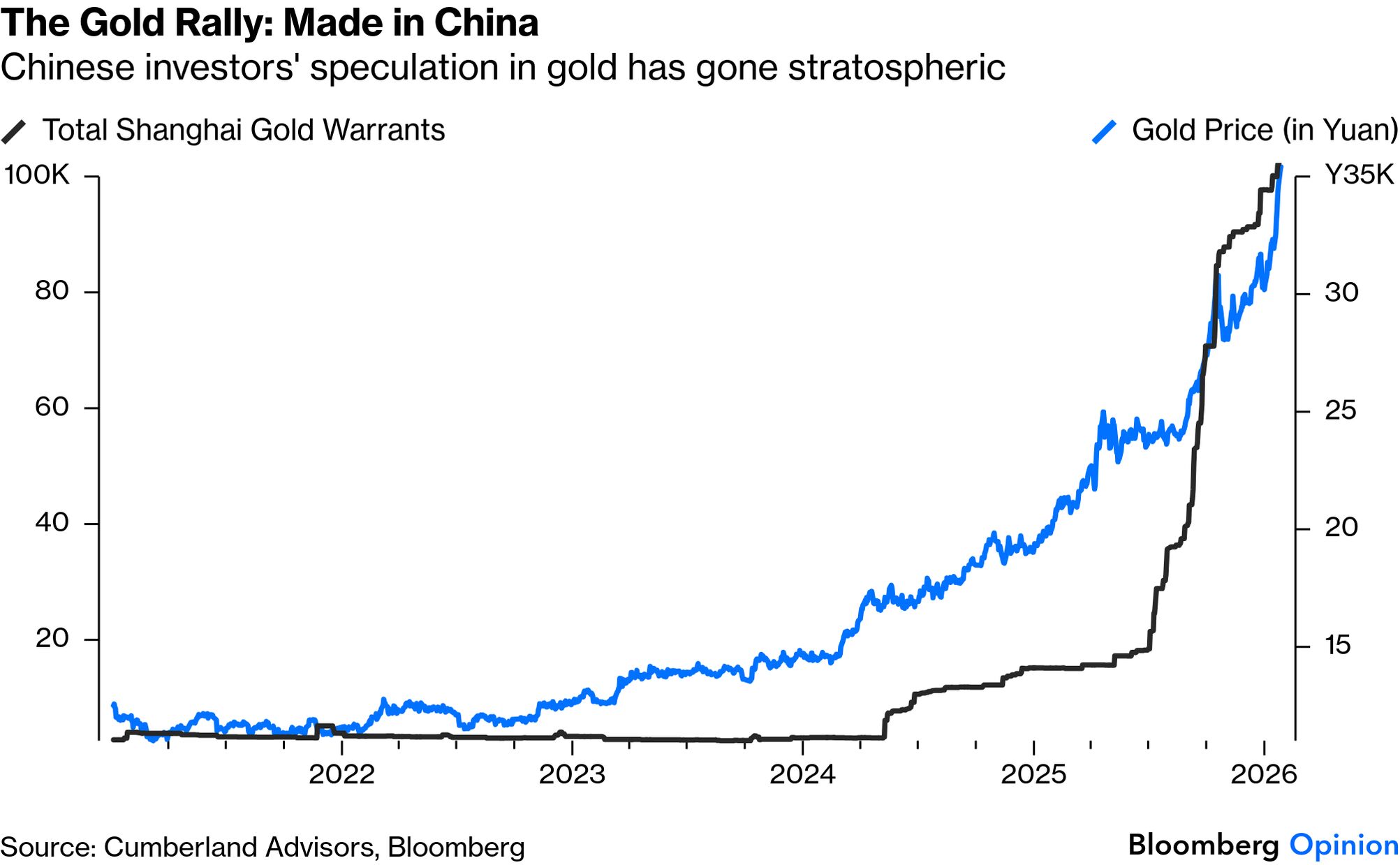

The ructions in the Japanese yen have also fed primarily into the dollar's weakness as, critically, has the surging gold price. The underlying trends are as Charles Morris of Byte Tree in London puts it: "Not macroeconomic, but geopolitical." It's Made in China... The dollar weakness is notable but not enough to drive gold that high, and rates/inflation are stable. Gold is going up because China is buying, and the same goes for silver.

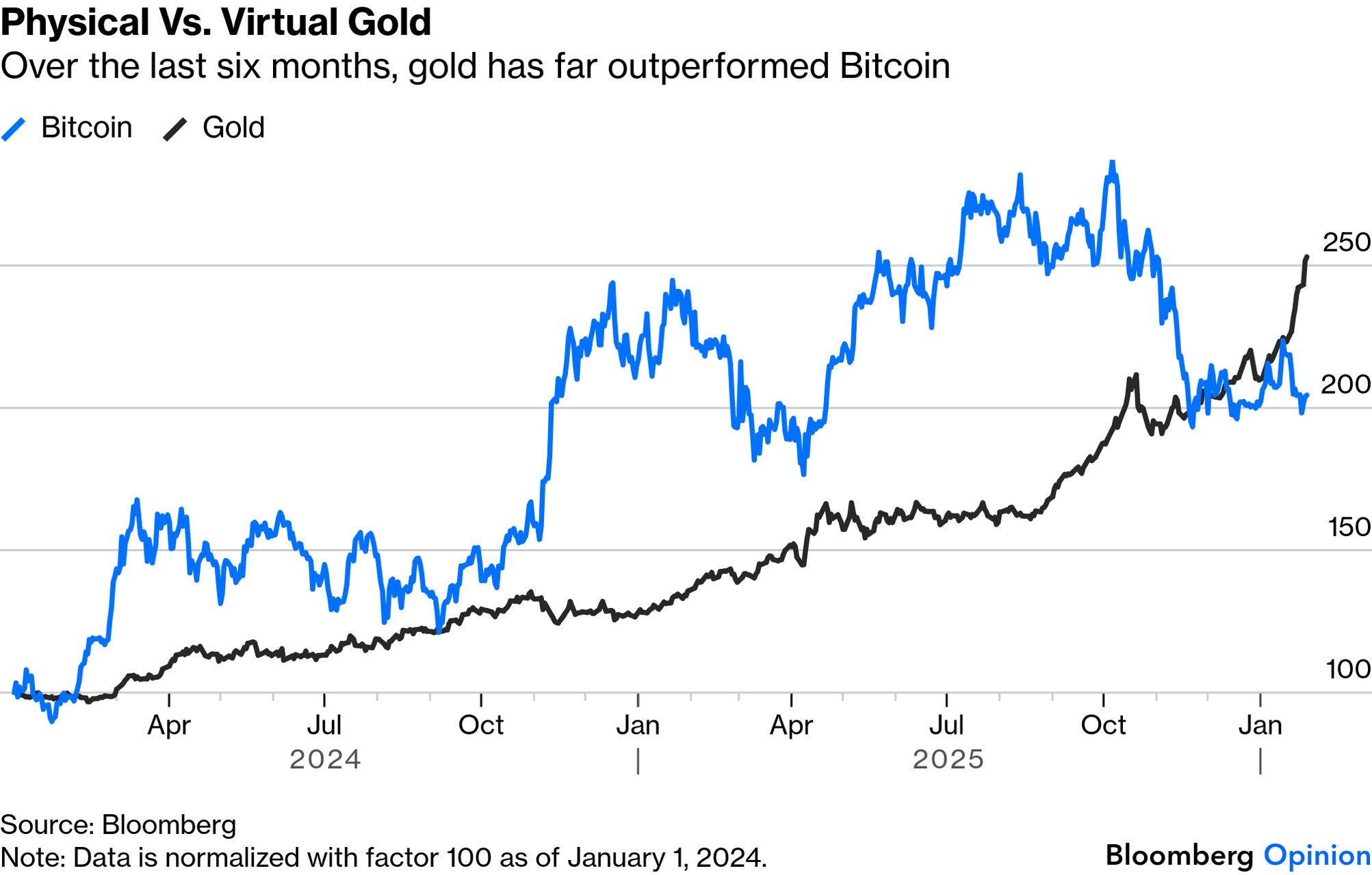

In the last two years, China has become the world's marginal buyer of gold, and therefore the price setter. David Kotok of Cumberland Advisors points out that Chinese appetite for gold is local, and that Shanghai's alternative to the SWIFT payment network, known as CIPS, is growing fast and is now used by 30 countries. As he describes it, CIPS is the backdrop to "the Shanghai gold hoard," while each Chinese warrant is a claim on physical gold in one of the hoards. The surge in the gold price has overlapped with a massive increase in holdings of these warrants: Why is CIPS driving the market? Kotok argues that "American behavior is chasing market agents away from the SWIFT system." They go to Shanghai and use Chinese gold warrants as a vehicle instead. He lists advantages that include no futures contracts, tokens, or security with the exchange, and that it's "not visible to geopolitical western prying eyes." This has also had a fascinating impact on Bitcoin, an asset that should directly profit, like gold, from any loss of confidence in the dollar. That hasn't happened, and gold and Bitcoin have diverged. Michael Howell of Global Liquidity Indexes argues that this divergence can also ultimately be traced to China, and is rooted in the way the country has come to take a very different place in the economic and liquidity cycle than America. The US is in a classic late cycle, with the Fed soon likely to stop cutting, while China still has no option but to pump liquidity into the system: In the past year, the [People's Bank of China] has injected around US$1.1 trillion into Chinese money markets: We suspect China will be forced to inject a similar amount this year in order to begin to address her overwhelming debt burden. In short, China's sky-high debt/liquidity needs to fall.

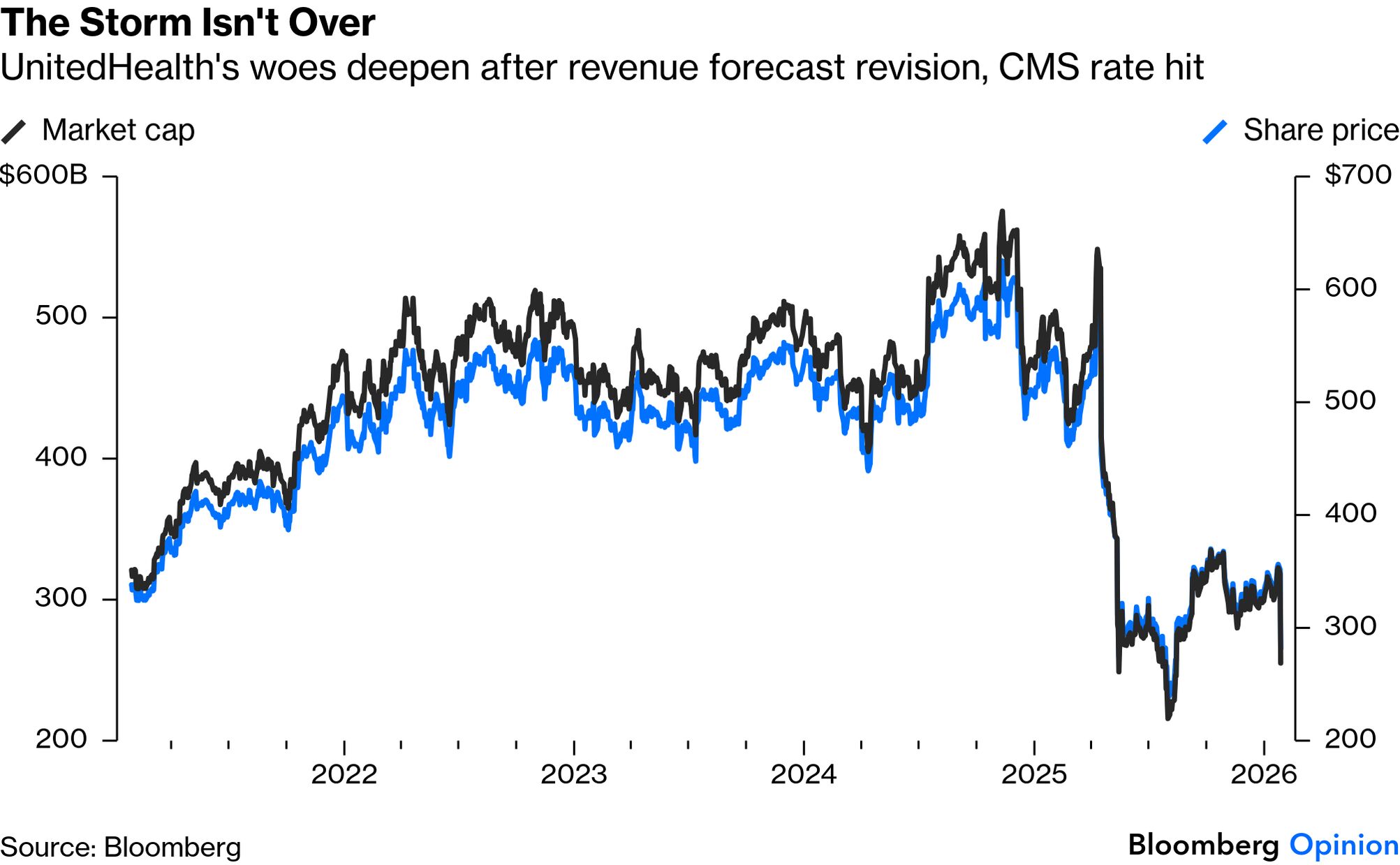

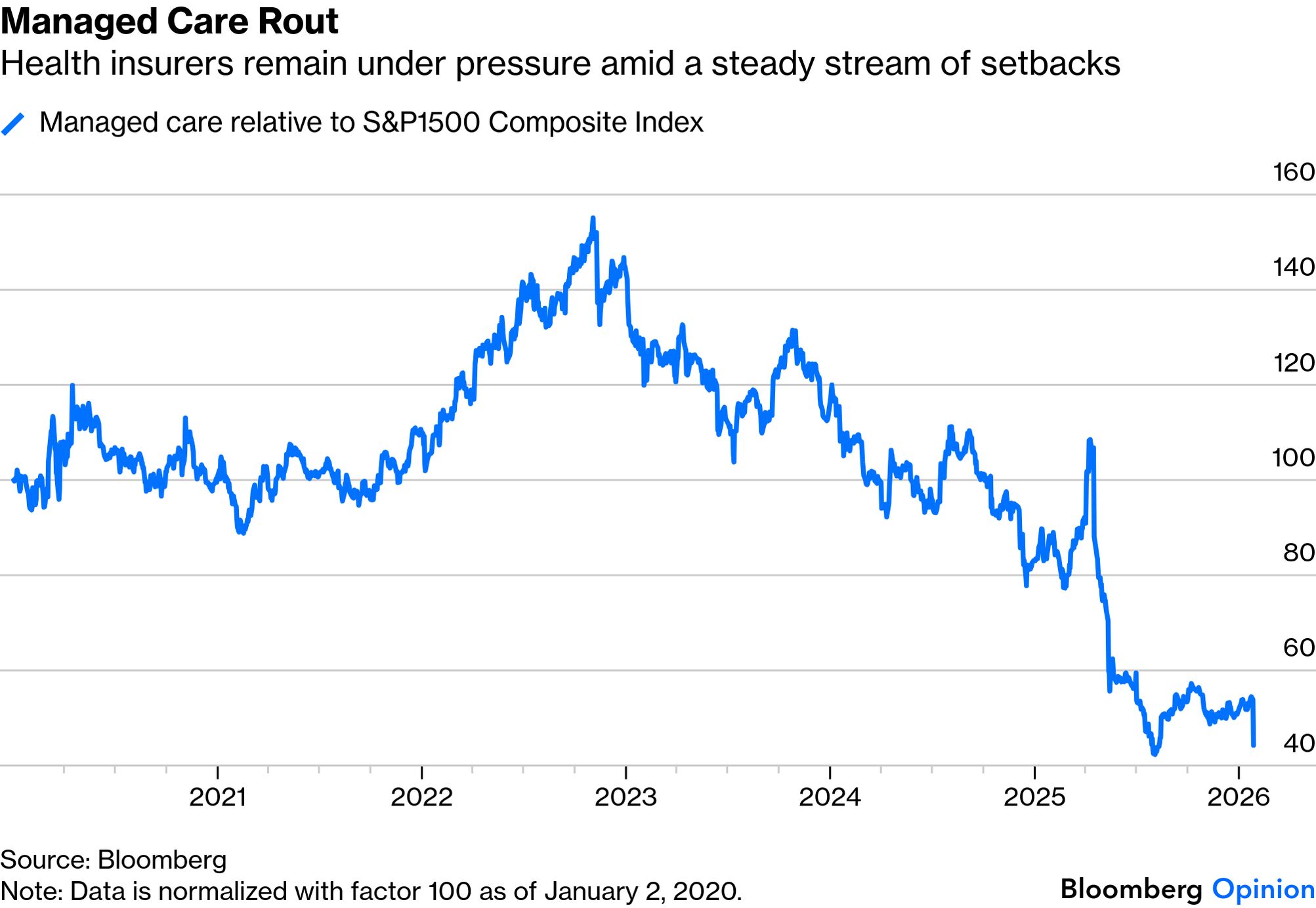

In the US, liquidity finds its way to risk assets, like the S&P 500 and particularly Bitcoin. In China's much less-developed financial system, it heads for gold. The net result is dollar devaluation and gold hoarding, which Kotok describes as repeating history from previous lurches toward protectionism by the US. The difference this time is that the system of Shanghai gold warrants and the chance to settle on the blockchain allows prices to move "in seconds, not weeks or months or years." The obvious risk is a swift and disorderly fall. Mansoor Mohi-Uddin of the Bank of Singapore points out that with the Fed biased toward rate cuts, and an administration that favors a weaker dollar and is inclined to intervene directly with allies like Japan, fundamentals weigh against the dollar. "If US investors join global investors in diversifying, then the dollar risks a more disorderly decline. US fund managers have over $130 trillion of assets but only 11% of equity holdings in foreign markets." While this state of affairs holds, the demand for safe haven hedges like gold, or the Swiss franc or Singaporean dollar, will be difficult to stop. They look almost like money for nothing. The blizzard that engulfed the US over the weekend may have passed, but at UnitedHealth Group's Minnesota headquarters, the storm is far from over. Late Monday, a White House proposal to hold payments to private Medicare plans flat next year sent the company's stock plunging in after-hours trading. Hours later, the company forecast revenue would fall this year in the first annual contraction for more than three decades. Overall, UnitedHealth's revenue for 2026 will be greater than $439 billion, representing a 2% decline from 2025 and short of analyst estimates. It's another blow to efforts to investor confidence after the tumultuous year that followed the slaying of its chief executive, Brian Thompson. The impact on the stock felt like a hot knife going through butter, plunging by almost 20%. That cut more than $64 billion off UnitedHealth's market cap: The pain spread across managed care stocks as the proposal from the Centers for Medicare and Medicaid Services (CMS) deflated investors' anticipation of a 6% increase in payments next year. CVS Health Corp. and Elevance Health Inc. fell more than 10%. The sector continued a three-year pattern of massively underperforming the index: This was only the latest blow to investors who had been betting on a rebound and demonstrated the depth of political risks when investing in health care. Markets had previously anticipated that Trump 2.0 would be more favorable for health insurers with private Medicare plans. To quote Jared Holz of Mizuho Securities USA, "The recovery trade we now believe will pause for a while." The latest developments, he says, clearly change the earnings calculus for both UnitedHealth and its peers. This could force the industry to continue to reduce benefits to better match revenue. That in turn could re-enter the political calculus as health insurance cutbacks would be both visible and unpopular. UnitedHealth's fourth-quarter results showed adjusted earnings per share just a penny above the average estimate by analysts. Its medical-loss ratio, a closely watched gauge of care expenses, came in slightly worse than Wall Street expectations. Morningstar's Julie Utterback counsels against despair. She points out that Medicare repayment-rate guidance isn't typically finalized until April, meaning the flat 2027 increase may yet rise. If anything, CMS has already foreshadowed a potential 2.5% increase from this initial draft due to expected billing trends not yet included. All is not yet lost. Beyond UnitedHealth's shock revenue forecast, there were signs of resilience. Its 2026 profit outlook was even slightly ahead of Wall Street expectations. Bloomberg Intelligence's Glen Losev argues that the results showed margin improvement across its operating units and that earnings growth could still exceed the projected 8.6% gain for the year, even if revenue tightens. Massive political risk, however, will persist. For now, investors must wait until April to see how the CMS proposals pan out. Any adjustment would be welcome; if Medicare-repayment rates hold steady, then much of that should already have been priced in after this week's shock. —Richard Abbey |

No comments:

Post a Comment