| Bloomberg Evening Briefing Americas |

| |

| Prime Minister Narendra Modi confirmed part of an agreement posted on social media by Donald Trump in which the US president said he will lower US tariffs on Indian goods to 18%. The new figure—which mean tariffs for many Indian goods will drop from 50%—offers significant relief for New Delhi, which has sought for months to negotiate a lower rate with Washington. Trump said India agreed to stop buying Russian oil as part of the accord, but Modi didn't confirm that term. Trump made a similar claim in October, but Indian refiners continued to buy crude from Moscow. India ships almost a fifth of its total exports to the US and Trump's tariffs amounted to the highest rate on products from any major trading partner. The bulk of Trump's global tariffs, however, have been ruled illegal by a US federal appeals court, which stayed its ruling pending a decision by the US Supreme Court. That ruling could come as soon as this month. —Natasha Solo-Lyons and David E. Rovella | |

What You Need to Know Today | |

| China banned concealed door handles on electric vehicles, the first country in the world to outlaw a design popularized by Tesla that is now facing global regulatory scrutiny due to a spate of deadly incidents. Cars sold in China will be required to have mechanical release both on the inside and outside, according to new safety rules issued by the Ministry of Industry and Information Technology on Monday. The ruling will take effect on Jan. 1, 2027, the ministry said. Models that have already been approved by the regulator and are in the final stages of launching in China have until January 2029 to change their designs. The news follows several high-profile incidents, including two fiery Xiaomi Corp. EV crashes in China where power failures were suspected to have prevented doors from opening, leaving people—unable to escape or be rescued–to die. While the new regulations will only impact EVs sold in China, the country's influence on the global automotive industry means it could resonate elsewhere. Tesla's doors are already the target of a safety probe in the US, while European regulators are looking to impose rules of their own. | |

| |

|

| The Trump Administration again blamed a government shutdown as it announced it won't release a jobs report as scheduled. The January report from the Bureau of Labor Statistics, which is to include highly anticipated revisions to annual employment, is expected to show previous job growth was notably weaker than initially reported. Another data revision last summer caused Trump to fire the director of the BLS, a move that has triggered growing concern over the credibility of government data in the face of increasing political pressure from the White House. | |

| |

|

| Elon Musk's SpaceX has acquired xAI in a deal that encompasses the billionaire's increasingly costly ambitions to dominate artificial intelligence and space exploration. The deal, which gives the combined company a valuation of $1.25 trillion, was announced to employees in a memo on Monday, Bloomberg News reported earlier. The firm is expected to price the shares at $526.59 each, according to people familiar with the matter, asking not to be identified as the information isn't public. The deal brings together two of the largest closely held companies in the world. XAI raised funds at a $230 billion valuation in January, while SpaceX was set to go ahead with a share sale in December at a valuation of about $800 billion, Bloomberg reported. | |

| |

|

| Crypto's latest downturn looks different on the surface. This time there are no spectacular scandals, no bankrupt exchanges and no regulatory crackdown. Yet for the industry's biggest trading platforms, the damage is starting to look uncomfortably familiar. Bitcoin is down more than 35% since an October crash from record highs. But for exchanges like Coinbase Global, Gemini Space Station and Bullish, the hit has been far steeper. Trading volumes—the core engine of their business—are plunging, dragging share prices down 40% to almost 60% over the past three months and forcing analysts to slash expectations. | |

|

| Not only was National Intelligence Director Tulsi Gabbard at the scene of the Trump administration's extraordinary raid on a Democratic-leaning Georgia county's election center last week, but the New York Times reports she put FBI agents on a call with Trump himself, during which he gave them a "pep talk." | |

| |

|

| Democrats worry the Republican Party's unprecedented campaign to redraw Congressional districts mid-decade, increase restrictions on voting and push courts to end longstanding voter rights protections mean the midterms are no sure thing. But then there's the cash advantage. Trump has said the "only thing" he worries about is losing Republican control of Congress in the November elections. The latest campaign finance filings show he's built an unprecedented war chest to help keep that from happening. Trump's political committees and the Republican National Committee amassed $483 million through the end of December, according to documents filed with the Federal Election Commission. That's nearly triple the $167 million collectively held by the Democratic National Committee and its Senate and House party committees and super PACs. The haul comes from tapping Trump's wealthiest donors with events like "MAGA Inc. dinners" at his Florida and New Jersey resorts as well as relentless appeals via text and email to small-dollar contributors who constitute his far-right base.  OpenAI President and co-founder Greg Brockman gave Trump's super-PAC $25 million. Photographer: Bridget Bennett/Bloomberg | |

|

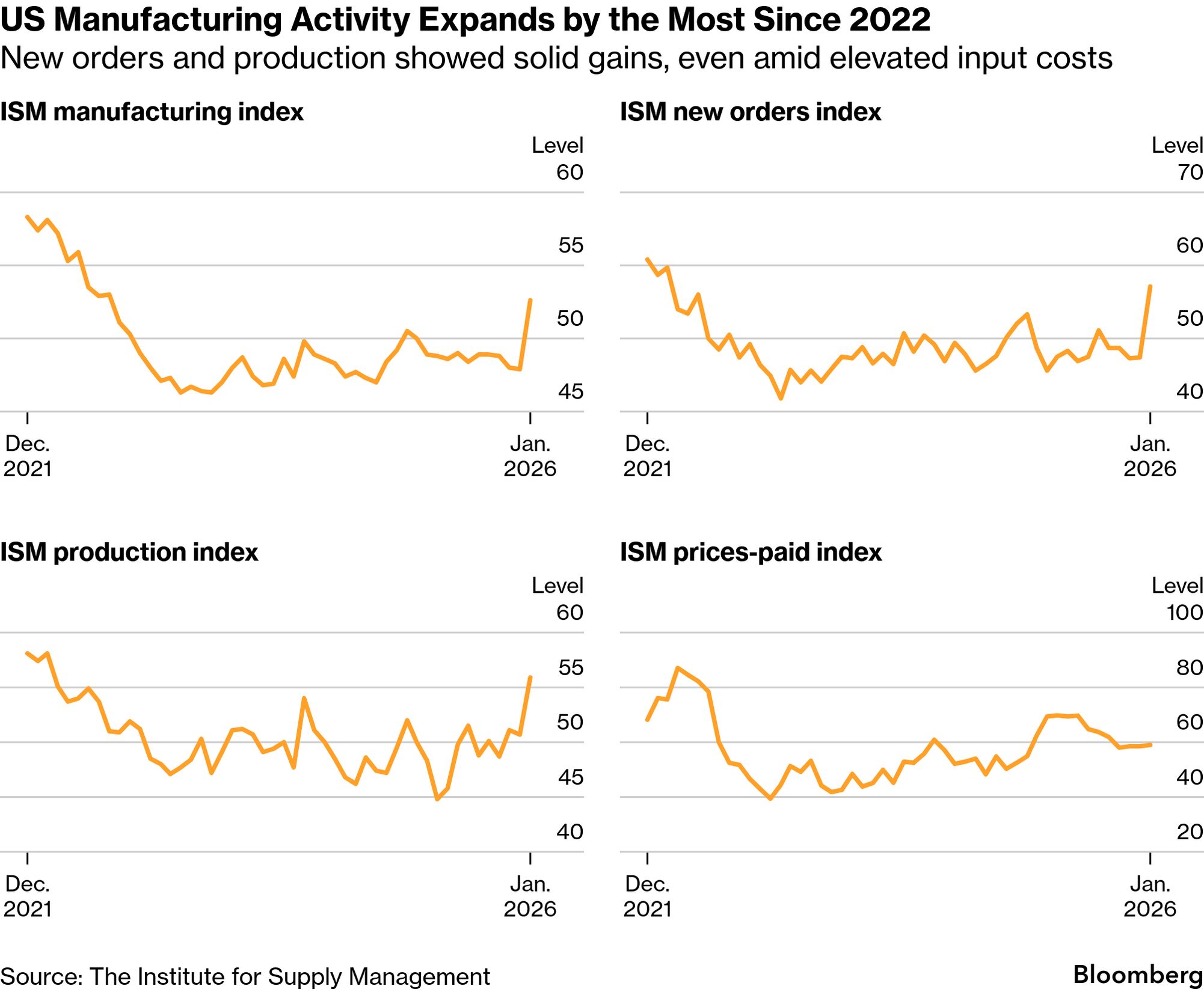

| US manufacturing activity unexpectedly expanded in January at the fastest pace since 2022, according to the Institute for Supply Management, a non-governmental supply management association. The groups's manufacturing index rose to 52.6 from 47.9, according to data released Monday. Readings greater than 50 indicate expansion, and the latest figure topped all projections in a Bloomberg survey of economists. The strength in demand reflected in part a decline in a measure of customer inventories, which contracted by the most since mid-2022. Lean customer stockpiles have the potential of providing more of a tailwind for factory orders and production in the coming months. | |

| New Year Sale: Save 60% on your first year

Enjoy unlimited access to Bloomberg.com and the Bloomberg app, plus market tools, expert analysis, live updates and more. Offer ends soon. | | | | | | |

What You'll Need to Know Tomorrow | |

| |

| |

| |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| |

Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment