| Bloomberg Morning Briefing Americas |

| |

| Good morning. 'Warrior dividends' are headed for US service members. BP gets a female CEO, a first for Big Oil. And Texas is where the US is at in its 250th year. Listen to the day's top stories. — Angela Cullen | |

| Markets Snapshot | | | | Market data as of 07:14 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

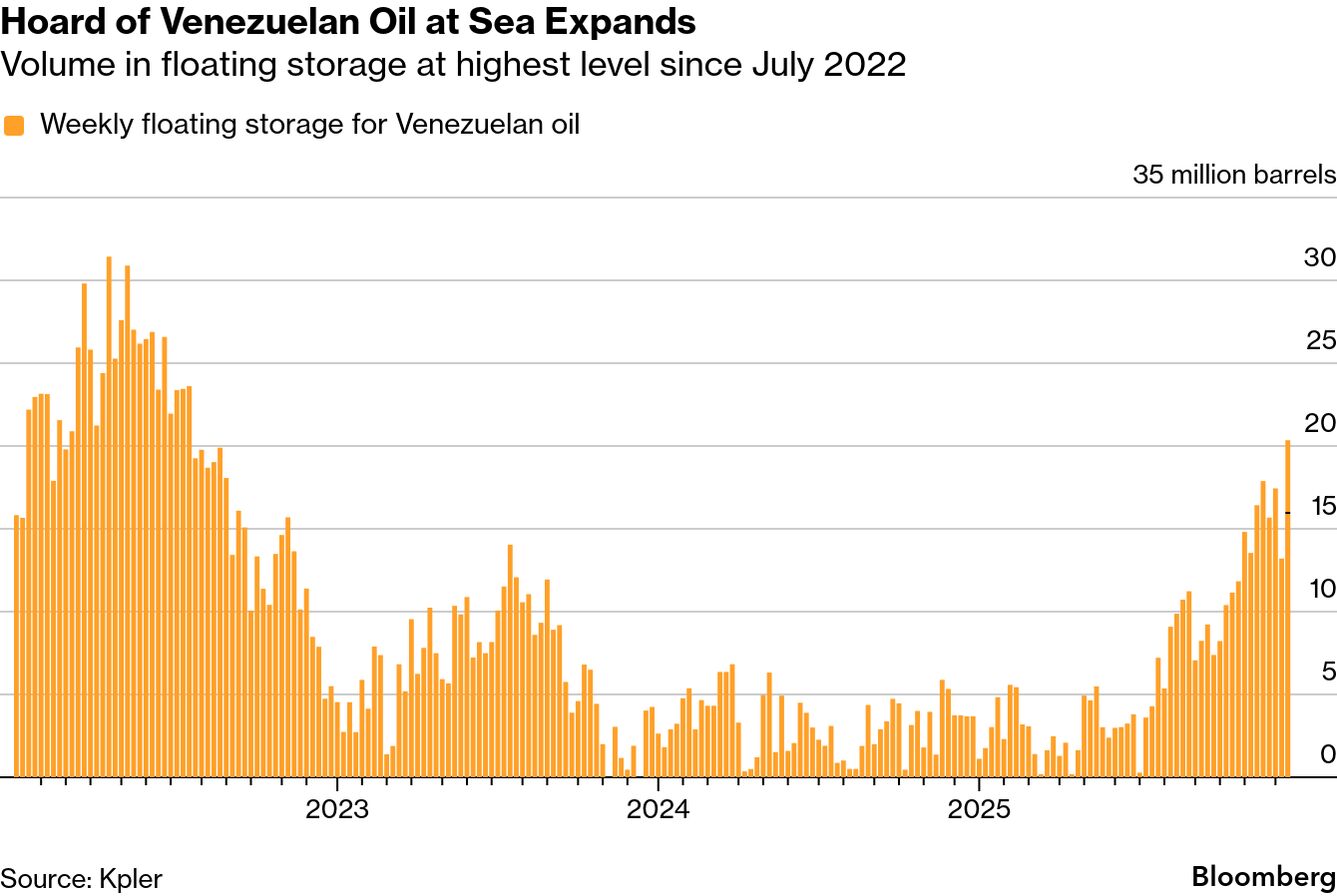

| Checks in the mail. Donald Trump said "warrior dividends" of $1,776 are headed to 1.45 million service members, as he sought to reassure Americans worried about rising living costs. That debate will get fresh impetus later today with the first US CPI data in nearly two months. Trump also said he'll soon name a new Fed chair—one backing lower rates—and unveil "some of the most aggressive housing reform plans in American history." The US approved an arms package for Taiwan worth up to $11 billion, one of its largest ever, in a move unlikely to sit well with China, which views it as a breakaway province. Beijing, meanwhile, sided with Venezuela after Trump ordered a blockade of sanctioned oil tankers moving in and out of the country, denouncing the move as "unilateral bullying." A hoard of Venezuelan crude sitting on tankers at sea may give Chinese refiners a short-term buffer if tensions escalate. BP tapped Meg O'Neill as its new CEO, making her Big Oil's first female chief. The industry veteran—who spent two decades at Exxon and most recently ran Woodside Energy—takes the helm in April. Pressure is rising for a turnaround at BP, and O'Neill's appointment signals more than a leadership change—it's a bet on a course correction back in favor of fossil fuels. | |

| |

| |

| Bitcoin's most entrenched investors are still cashing out though—and the pressure is starting to show. More than two months after the token hit a record high above $126,000, Bitcoin has fallen nearly 30% and is struggling to find support. One reason: its long-time holders haven't stopped selling. Coins held for years are being divested at some of the fastest rates in recent memory. | |

Deep Dive: Hasbro's 'Magic' Growth Potion | |

Exodus, one of Hasbro's big video-game bets, has been in development since 2019 Photographer: Hasbro Game on. As traditional toy and game sales slow, Hasbro has unlocked a powerful growth engine in fantasy worlds and digital realms. Role-playing hits like Dungeons & Dragons, trading card games like Magic: The Gathering, and an expanding slate of digital and video games are driving momentum. - Tariffs on imports from China have squeezed margins across the US toy and games industry, and Hasbro estimates a $60 million hit to its net profit in 2025. Finance chief Gina Goetter says the company is diversifying its manufacturing base to counteract these headwinds.

- CFOs like Goetter are increasingly central to shaping big-picture corporate strategy and, since joining Hasbro in 2023, she's moved quickly—cutting costs and streamlining operations. Watch our full interview here.

| |

| |

Ivana Krajcinovic photographed at her home in Alameda, CA. Photographer: Nate Ryan Cancer capitalism. Hundreds of US hospitals are marking up old cancer treatments—in some cases hundreds of times what Medicare pays. "They do it because they can get away with it," said one health care delivery exec. Check out our full series of stories on how the hunt for profit can harm cancer patients. | |

| Big Take Podcast |  | | | |

| |

| |

| More Opinions |  | |  | | | |

| Our daily word puzzle with a plot twist. Today's clue is: Pricey diamond export from Japan Play now! | |

| |

Stockyards rodeo Photographer: Manoo Sirivelu for Bloomberg Businessweek All y'all. To understand America in 2026, go to Texas. From tech billionaires and FIFA crowds, to rodeos and roadside antiques, the Lone Star State captures the forces shaping the US in its 250th year. If California is the country's future, Texas is where we are now. | |

| A Couple More |  | |  | | | |

| Bloomberg Invest: Join the world's most influential investors and financial leaders in New York on March 3-4. This flagship event examines how AI disruption, geopolitical uncertainty, shifting central bank policy and the convergence of public and private markets are reshaping global finance. Learn more here. | |

| Enjoying Morning Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: - Markets Daily for what's moving in stocks, bonds, FX and commodities

- Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Supply Lines for daily insights into supply chains and global trade

- FOIA Files for Jason Leopold's weekly newsletter uncovering government documents never seen before

Explore all newsletters at Bloomberg.com. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Morning Briefing Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment