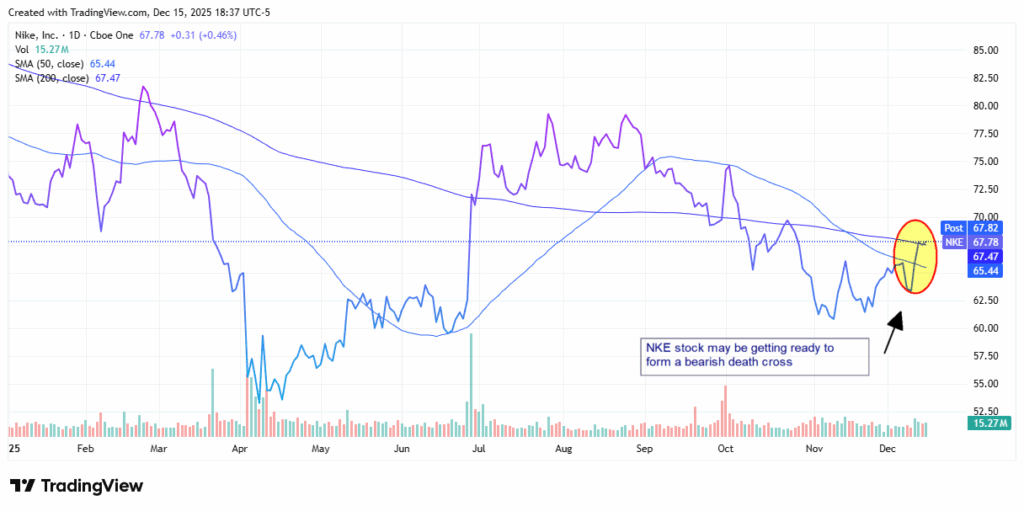

| With AI headlines heating up, BNZI stands out as a top stock investors shouldn't overlook. Banzai International (NASDAQ: BNZI) is redefining marketing technology with its AI-driven platforms that help companies grow faster through seamless integrations and mission-critical solutions across Acquisition, Engagement, and Analytics. In Q3 2025, Banzai posted $2.8 million in revenue, up 163% year-over-year, with gross margins soaring to 81.7%, demonstrating operational efficiency and rapid adoption of its offerings. Annual recurring revenue reached $11 million, reflecting a 168% increase from Q3 2024, while net losses narrowed significantly from $15.4 million to $5.9 million, signaling progress toward profitability. With over 140,000 customers and marquee clients such as Cisco, Hewlett Packard, and New York Life, BNZI proves that its AI-enhanced marketing and sales solutions are in high demand. Strategic acquisitions, including the Superblocks AI platform, strengthen BNZI's SaaS ecosystem by enabling businesses to create launch-ready, SEO-optimized websites and landing pages with ease. Leadership additions—Matt McCurdy as VP of Sales and Dean Ditto as CFO—position the company to accelerate enterprise adoption and expand its customer base further. Supported by a fortified balance sheet, debt reduction, and a new $11 million debt facility, BNZI is executing a disciplined growth strategy that combines AI innovation, customer expansion, and operational efficiency. Investors and marketers alike should watch closely as BNZI leverages technology and scale to dominate the $1.5 trillion marketing technology market. Discover why BNZI is the AI marketing tech growth story to not dismiss in 2026! Today's editorial pick for you NKE Stock May Beat, But the Growth May Already be Priced InPosted On Dec 17, 2025 by Chris Markoch Nike Inc. (NYSE: NKE) will report earnings after the market closes on December 18. NKE stock shareholders will be eyeing further gains to support the company’s recent rally of over 5%. Table of ContentsAnalysts expect the company to report earnings per share of 37.5 cents on revenue of $12.21 billion. On the top line, that would be a 4% improvement from the prior quarter. But it would be about 1% lower on a year-over-year (YoY) basis. The news is even worse on the bottom line. An EPS of 37.5 cents would be about 23% down from the prior quarter and approximately 50% YoY. That result, while expected, would call into question the company's turnaround story. Analyst Sentiment is Bullish … ExceptAnalysts have been mostly bullish on NKE stock. The consensus price target is $83.08, which would give investors an upside of 22%. And since the earnings report, several analysts have raised their price targets. However, there is one notable exception. On December 12, Citigroup downgraded NKE stock from positive to mixed. That would support the fact that the "whisper number" for Nike earnings is at 44 cents. That would still be significantly lower on a YoY basis, but it would be nearly 20% higher than the consensus estimate. However, investors should understand that the whisper number is an unofficial number that reflects investor sentiment rather than official analyst expectations. What This Earnings Report Really Needs to ShowThe key issue for Nike heading into this earnings report is not whether it can beat expectations, but how it beats and what management says about the path forward. With estimates already depressed, a modest earnings beat would not be surprising. In three out of its last four earnings reports, NKE stock has moved higher after its earnings report. That suggests a pattern of analysts offering conservative estimates that Nike has been able to exceed. However, the bar for convincing investors that Nike's turnaround is gaining traction is higher than simply clearing a low hurdle. One area investors will scrutinize closely is gross margin progress. Nike has been working through excess inventory, discounting pressure, and higher input costs for several quarters. Any improvement in margins—even incremental—would signal that pricing pressure is easing, and that Nike's cost controls are beginning to take hold. Conversely, another quarter of margin compression would reinforce concerns that the recovery is being delayed. Revenue mix will also matter. Investors want to see stabilization—or better yet, growth—in direct-to-consumer (DTC) sales, which have historically carried higher margins. Weak wholesale demand or continued softness in key regions such as North America or China could overshadow an EPS beat. Nike's ability to drive demand without relying excessively on promotions will be an important tell for whether brand strength is translating into pricing power again. Another critical component of the pre-earnings story is guidance. Even if Nike beats the consensus and the whisper number, a cautious outlook for the next quarter or fiscal year could limit upside in the stock. Management commentary around consumer demand, inventory normalization, and marketing investments will likely have more influence on the stock's reaction than the headline numbers alone. Nike Faces a Stressed Consumer and More CompetitionIt's also worth noting that Nike is operating against a challenging macro backdrop. Consumers remain price-sensitive; discretionary spending is uneven, and competition from both established brands and newer athletic labels has intensified. That environment makes it harder for Nike to deliver the kind of acceleration investors expect from a premium global brand. Taken together, this creates a setup where good news may already be anticipated, but bad or even "less good" news could be punished. In other words, Nike doesn't just need to beat—it needs to beat and raise, or at least convincingly reaffirm its turnaround timeline. That dynamic helps explain why the stock's recent rally may be vulnerable, heading into earnings. Investors positioning for a rebound are effectively betting that the worst is over. This report will either validate that belief—or expose it as premature. Is NKE Stock Priced for Perfection?NKE stock is up about 5.7% in the month ending December 15. That has established a higher level of support at around $60. That seems reasonable since, for much of this year, the stock has been trading at five-year lows. No matter what concerns you may have about Nike, that didn't seem justified. Or was it? Earnings growth has been negative YoY for the last four quarters, and even if the whisper number is accurate, it will be negative YoY this quarter, and likely for at least a quarter or two to come. That's one reason to be concerned. Another has to do with the potential of a death cross pattern. This is when a short-term moving average (typically the 50-day) crosses below a longer-term moving average (typically the 200-day).  Of course, if Nike outperforms, the stock could spike higher. Still, this doesn't appear to be a time to go long on NKE stock. A better "option," if you're comfortable with trading options would be to buy the 12/26/2025 $67 call and sell the $70 call (a 1:1 ratio). This structure benefits from a bullish reaction to earnings while capping risk to the net debit and partially offsetting high implied volatility by selling the further out-of-the-money (OTM) strike. You'll want to ensure to position size the spread so that the maximum debit at risk fits within your event-risk allocation for a single earnings trade. You'll also want to ensure you have an exit plan. Many traders close spreads the morning after earnings to avoid a rapid time/volume crush and post-event drift. This is especially important when using elevated implied volatility (IV) expirations. This message is a PAID ADVERTISEMENT for Banzai International, Inc (NASDAQ: BNZI) from Sideways Frequency. StockEarnings, Inc. has received a fixed fee of $7000 from Sideways Frequency for multiple Dedicated Email Sends, Newsletter Sponsorships and SMS Sends between Dec 18, 2025 and Dec 24, 2025. Other than the compensation received for this advertisement sent to subscribers, StockEarnings and its principals are not affiliated with either Banzai International, Inc (NASDAQ: BNZI) or Sideways Frequency. StockEarnings and its principals do not own any of the stocks mentioned in this email or in the article that this email links to. Neither StockEarnings nor its principals are FINRA-registered broker-dealers or investment advisers. The content of this email should not be taken as advice, an endorsement, or a recommendation from StockEarnings to buy or sell any security. StockEarnings has not evaluated the accuracy of any claims made in this advertisement. StockEarnings recommends that investors do their own independent research and consult with a qualified investment professional before buying or selling any security. Investing is inherently risky. Past-performance is not indicative of future results. Please see the disclaimer regarding Banzai International, Inc (NASDAQ: BNZI) on Huge Alerts website for additional information about the relationship between Sideways Frequency and Banzai International, Inc (NASDAQ: BNZI). StockEarnings, Inc |

Thursday, December 18, 2025

📈 BNZI Posts Record Q3 Revenue – See What’s Driving It

Subscribe to:

Post Comments (Atom)

The Holiday Airdrop is here 🎁 25k $ALICE up for grabs!

Incredible news and updates about everything happening in our beloved archipelago🌸 ...

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment