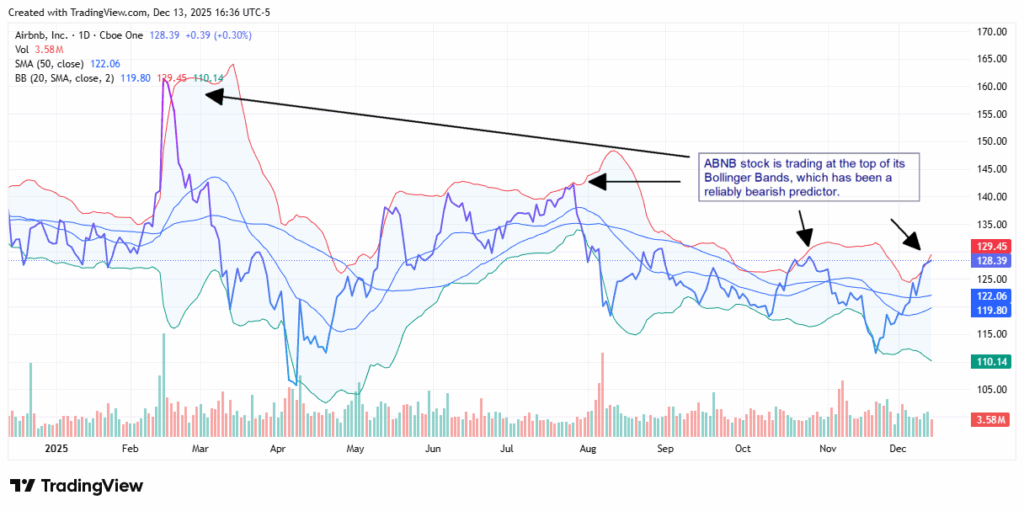

| Silver has roared back into the spotlight after briefly touching or exceeding $65 per ounce in mid-December 2025, marking one of the strongest precious-metal rallies in decades. Kootenay Silver Inc. (OTC: KOOYF) is emerging as a standout high-grade silver explorer at a time when silver prices have surged to record highs. The company's flagship 100%-owned Columba Silver Project in Chihuahua, Mexico already hosts a robust NI 43-101 resource of 54.1 million ounces of silver, and management believes the system is far from fully defined. With silver now outperforming gold and analysts projecting prices as high as $100 per ounce by 2026, Kootenay offers powerful leverage to a strengthening silver market. KOOYF is currently executing a fully funded 50,000-meter drill program using two active rigs, focused entirely on expanding the Columba resource and unlocking new high-grade zones. Past drilling has delivered exceptional intercepts, including 9.7 meters of 1,746 g/t silver and multiple intervals above 600 g/t, confirming the project's elite grade profile. Backed by respected resource investors such as Eric Sprott, and led by an experienced management team, Kootenay is advancing toward a potential Preliminary Economic Assessment (PEA)—a milestone that could significantly revalue the company as silver's bull market accelerates. Today's editorial pick for you ABNB Stock: More Clarity Needed Before Booking This StockPosted On Dec 15, 2025 by Chris Markoch Airbnb (NASDAQ: ABNB) presents investors with the dilemma that comes when a stock and its story don't align. ANBN stock appears to have some upside, but there are reasons to believe that upside may be more limited. ABNB stock has a consensus Hold rating, and I believe that's a fair way to look at the stock. Table of ContentsAirbnb continues to see strong bookings, aided by new reservation features and artificial intelligence (AI) tools. The company has also reversed the negative trend in year-over-year (YoY) revenue growth and has an impressive free cash flow (FCF) margin. And with the stock trading at a price-to-earnings (P/E) ratio around 30x, the stock's valuation is in line with the S&P 500. In fact, ABNB stock trades at a slight discount to the NASDAQ exchange as well as its historic average. On the other hand, concerns linger about the state of the consumer and the broader economy. Those results didn't show up in the company's November earnings report. But those concerns linger as the employment picture for 2026 remains cloudy, which should make investors take the recent booking news with a grain of salt. Airbnb Remains Under ConstructionIn early 2024, Airbnb chief executive officer (CEO), Brian Chesky, told shareholders that the company was "under construction." It was a good problem to have. The company had been growing too fast as the shift to remote work, along with the great relocation, delivered a significant boost to revenue and earnings. However, that growth wasn't sustainable. The company's business model doesn't lend itself to having a moat, and new competitors were quick to enter the market. That meant declining occupancy and slower growth. The company also faced accusations that it was driving up rent in urban areas. Part of Airbnb's reconstruction has come from a renewed focus on experiences. This was an initiative the company put aside in 2020 as travel was limited. But at a time when rental spaces are becoming increasingly commoditized, offering exclusive, live, or curated features could drive higher growth. Airbnb is forecasting $1 billion in new revenue and $10 billion in experience bookings by 2030. The company has also developed new tools that provide a more flexible cancellation policy, as well as new AI tools to serve as a concierge similar to that of Booking Holdings (NASDAQ: BKNG). This is in response to consumer complaints about the friction in the company's reservation/cancellation policy. With that in mind, it's interesting to note that two of the key architects of Airbnb's digital transformation have left the company. I get it. People switch jobs for any number of reasons. However, it stands to reason that the departures may indicate a renovation that does not deliver the return on investment (ROI) that investors expect. The Consumer: Bookings and Revenue Are Not the SameThe company cited these tools as a key reason for its elevated bookings in future quarters. However, it's important to note that bookings don't turn into revenue until the stay is complete. That's not to say that travelers will cancel, but removing friction and allowing cancellations closer to the reservation date can cut both ways, particularly at a time when many consumers are uncertain about their employment status or questioning every element of their budget. ABNB stock bulls may push back and say that you can't assume travelers will cancel. And even if they do, it may not be at a high percentage. That's fair. But it's enough of a question that I may want to wait to understand the nature of the risk. It may also explain why analysts have mixed sentiment on ABNB stock. Consider this. If ABNB was objectively overvalued in 2023, then it may be fairly valued even as revenue and earnings have begun to turn around. Technical Indicators Support a Cautious ApproachAfter a 5.2% run-up in the last month, ABNB stock looks closer to a short-term exhaustion point than a clean bullish breakout. Here are two reasons: First, the stock price is pressing into the upper Bollinger Band after the sharp rebound off its November lows. At several points this year, this pattern has preceded mean reversions instead of a sustained acceleration of the trend. This is also confirmed by the width between the bands, which is not expanding rapidly; this suggests improving momentum, but not the type you'd expect in a breakout.  You can also see a Hold stance supported by the moving averages. The 50- and 200-day simple moving averages (SMAs) are converging just above the stock's current price. The stock has spent much of the year chopping around these averages, further arguing for a stock that's range-bound, not one in a strong uptrend.  ABNB Stock: Should and Will Are Different WordsThe fundamentals of ABNB stock suggest the stock "should" move higher. The technical case doesn't seem as certain. However, if the company continues to deliver strong numbers, it's easy to make a technical case. But neither fundamental nor technical analysis accounts for investor sentiment. ABNB has been rangebound for the past three and a half years. And the stock has been in a predominantly bearish trend in the last 18 months. Investors can fall in love with the idea that this time is different. It's usually not. The long-term thesis for Airbnb still seems strong. But without more consumer certainty, investors would be better off holding off on buying ABNB stock. This message is a PAID ADVERTISEMENT for Kootenay Silver Inc (TSXV: KTN | OTCQX: KOOYF) from Sideways Frequency. StockEarnings, Inc. has received a fixed fee of $7000 from Sideways Frequency for multiple Dedicated Email Sends, Newsletter Sponsorships and SMS Sends between Dec 16, 2025 and Dec 22, 2025. Other than the compensation received for this advertisement sent to subscribers, StockEarnings and its principals are not affiliated with either Kootenay Silver Inc (TSXV: KTN | OTCQX: KOOYF) or Sideways Frequency. StockEarnings and its principals do not own any of the stocks mentioned in this email or in the article that this email links to. Neither StockEarnings nor its principals are FINRA-registered broker-dealers or investment advisers. The content of this email should not be taken as advice, an endorsement, or a recommendation from StockEarnings to buy or sell any security. StockEarnings has not evaluated the accuracy of any claims made in this advertisement. StockEarnings recommends that investors do their own independent research and consult with a qualified investment professional before buying or selling any security. Investing is inherently risky. Past-performance is not indicative of future results. Please see the disclaimer regarding Kootenay Silver Inc (TSXV: KTN | OTCQX: KOOYF) on Huge Alerts website for additional information about the relationship between Sideways Frequency and Kootenay Silver Inc (TSXV: KTN | OTCQX: KOOYF). StockEarnings, Inc |

Tuesday, December 16, 2025

🚀 Silver Hits $65 — And a High-Grade Explorer Is Just Getting Started!

Subscribe to:

Post Comments (Atom)

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment