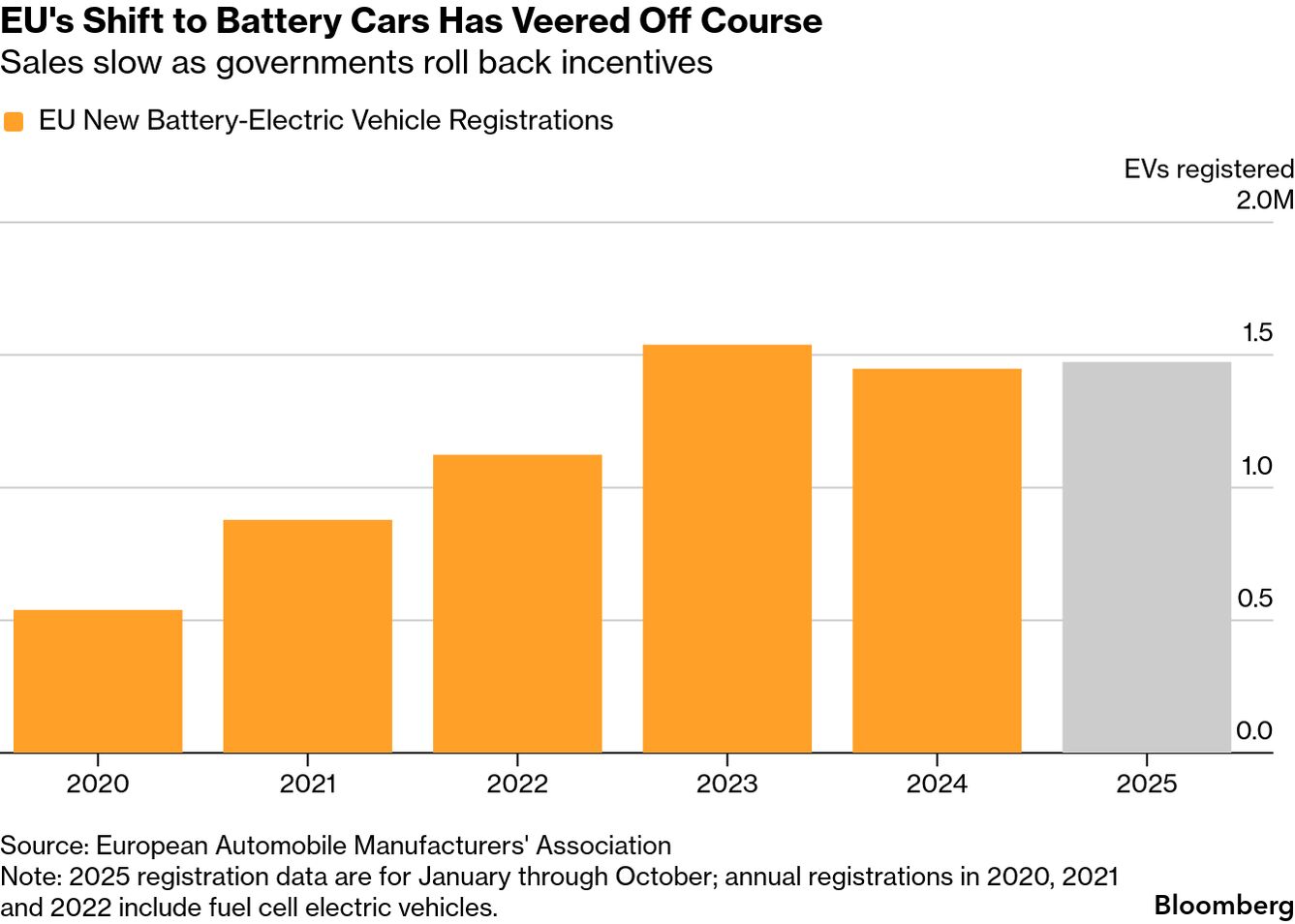

| By John Ainger, Ewa Krukowska, and Alberto Nardelli The European Union is planning a softening of emissions rules for new cars, scrapping an effective ban on combustion engines following months of pressure from the automotive industry. The proposal will allow carmakers to slow the rollout of electric vehicles in Europe and aligns the region more closely with the US where President Donald Trump is tearing up efficiency standards for cars put in place by the previous administration. The European stepback — to be unveiled later today — follows a global pullback from green policies as economic realities of major transformations set in. Mounting trade tensions with the US and China are pushing Europe to further prioritize shoring up its own industry. Although the bloc is legally bound to reach climate neutrality by 2050, governments and companies are intensifying calls for more flexibility, warning that rigid targets could jeopardize economic stability.  Employees at a Stellantis auto manufacturing plant in France Photographer: Nathan Laine/Bloomberg Under the new proposal, the European Commission will lower the requirements that would have halted sales of new gasoline and diesel-fueled cars starting in 2035, instead allowing a number of plug-in hybrids and electric vehicles with fuel-powered range extenders, according to people with knowledge of the matter. "It is a geopolitical moment and a complicated context," said Sara Aagesen, Spain's minister for the ecological transition. "The Commission itself has already introduced flexibilities in the past." Tailpipe emissions will have to be reduced by 90% by the middle of the next decade compared with the current goal of a 100% reduction, said the people, who asked not to be identified because talks on the proposal are private. The commission will set a condition that carmakers need to compensate for the additional pollution by using low-carbon or renewable fuels or locally produced green steel. "We believe that we must continue with that roadmap that was drawn up with the goal of ending the commercialization of combustion vehicles in 2035," said Aagesen, who has publicly defended the ban in the past. "It is important to meet the commitments that have been defined in order to provide stability to investors and also to citizens." The European Commission declined to comment on the proposals. But the plan is set to be adopted by EU commissioners later today and will then be discussed by the European Parliament and by member states in the EU Council. Each institution has the right to propose their own amendments and the final shape of the measure will be negotiated in the so-called trilogue talks, which will involve the parliament, the council and the commission. With automakers now gaining more time to go fully electric, environmental groups are concerned the changes create new loopholes that undermine Europe's climate ambition and leave key car manufacturers further behind China in the race to battery-powered road transport. China's car market has continued its rapid electrification and foreign brands are being muscled aside in the world's biggest car market which was once a major source of profits for Western automakers. Even in their home countries, European carmakers are facing a growing competitive threat from Chinese brands. New import tariffs thrown up by the EU offer them only limited protection. The electric-car race has become global. A third of the 39 countries reaching more than 10% of electric vehicles sold in 2025 are outside of Europe, according to energy think tank Ember. India, Mexico and Brazil have a higher share of electric vehicle sales than Japan, while electric vehicle penetration in Indonesia overtook the US this year. Globally, electric cars made up over a quarter of new car sales in 2025, up from less than 3% in 2019. Still, the prospect of an EU ban on combustion engine cars in 2035 prompted intense lobbying from Stellantis NV, Mercedes-Benz Group AG and others. Germany, home to Mercedes, Volkswagen AG and BMW AG, also pushed for changes to ease political tensions and protect jobs. Globally, automakers are struggling to make the shift profitable with Ford Motor Co. announcing it will take $19.5 billion in charges tied to a sweeping overhaul of its EV business.  A Ford F-150 Lightning Platinum electric pickup truck Photographer: Andrej Ivanov/Bloomberg The majority of the charges will come in the fourth quarter, Ford said yesterday in a statement. As part of the strategic shift, the automaker is canceling a planned electric F-Series truck, shifting production toward gas and hybrid vehicles and repurposing an EV battery plant. Ford will also convert its signature electric F-150 Lightning pickup into an extended-range hybrid vehicle. With assistance from Keith Naughton, Gabrielle Coppola, Daniel Basteiro and Alastair Marsh Read the full story on the EU's bid to soften emissions requirements for new cars, and on Ford's plans to revamp its lineup and subscribe for unlimited access to the latest developments in the electric vehicle industry. |

No comments:

Post a Comment