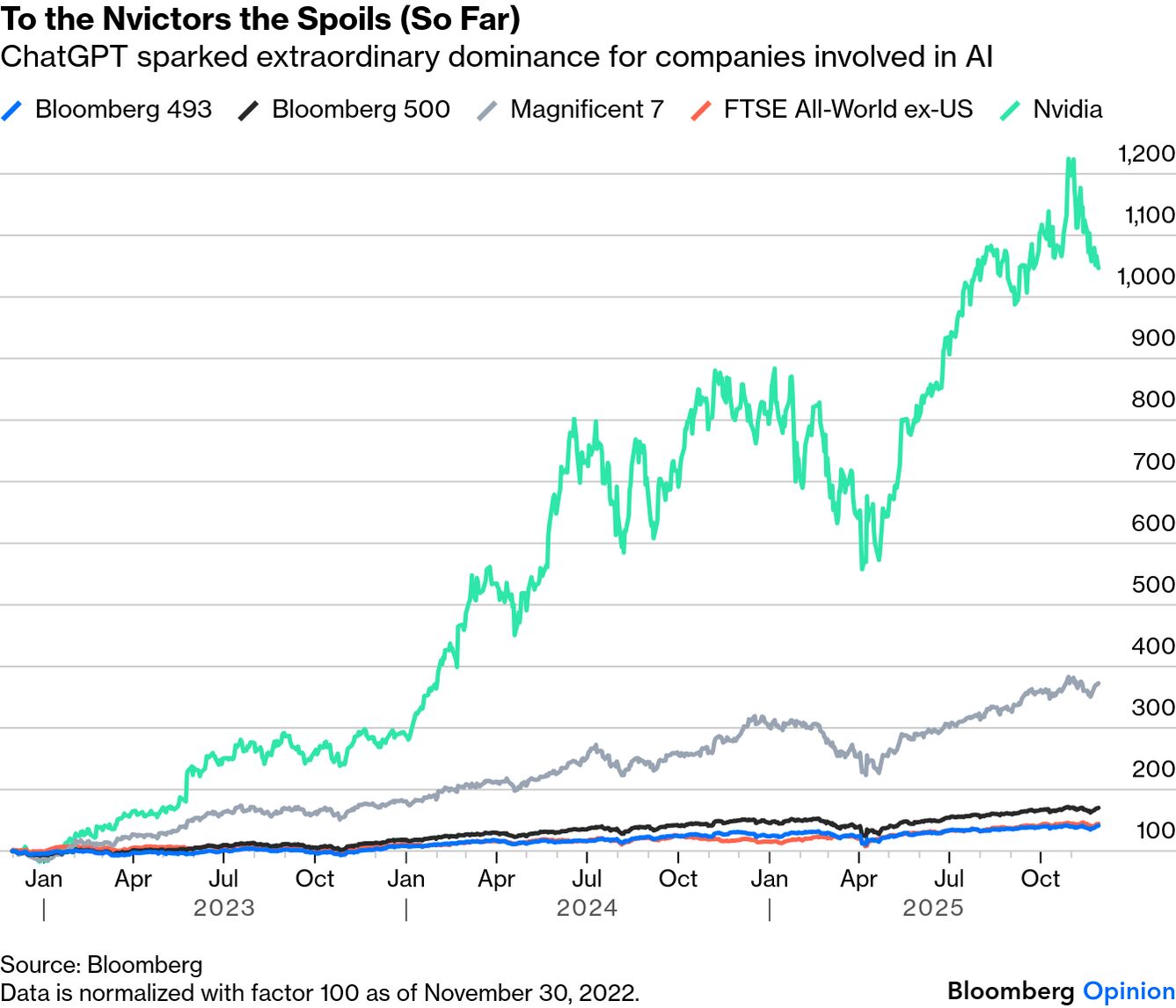

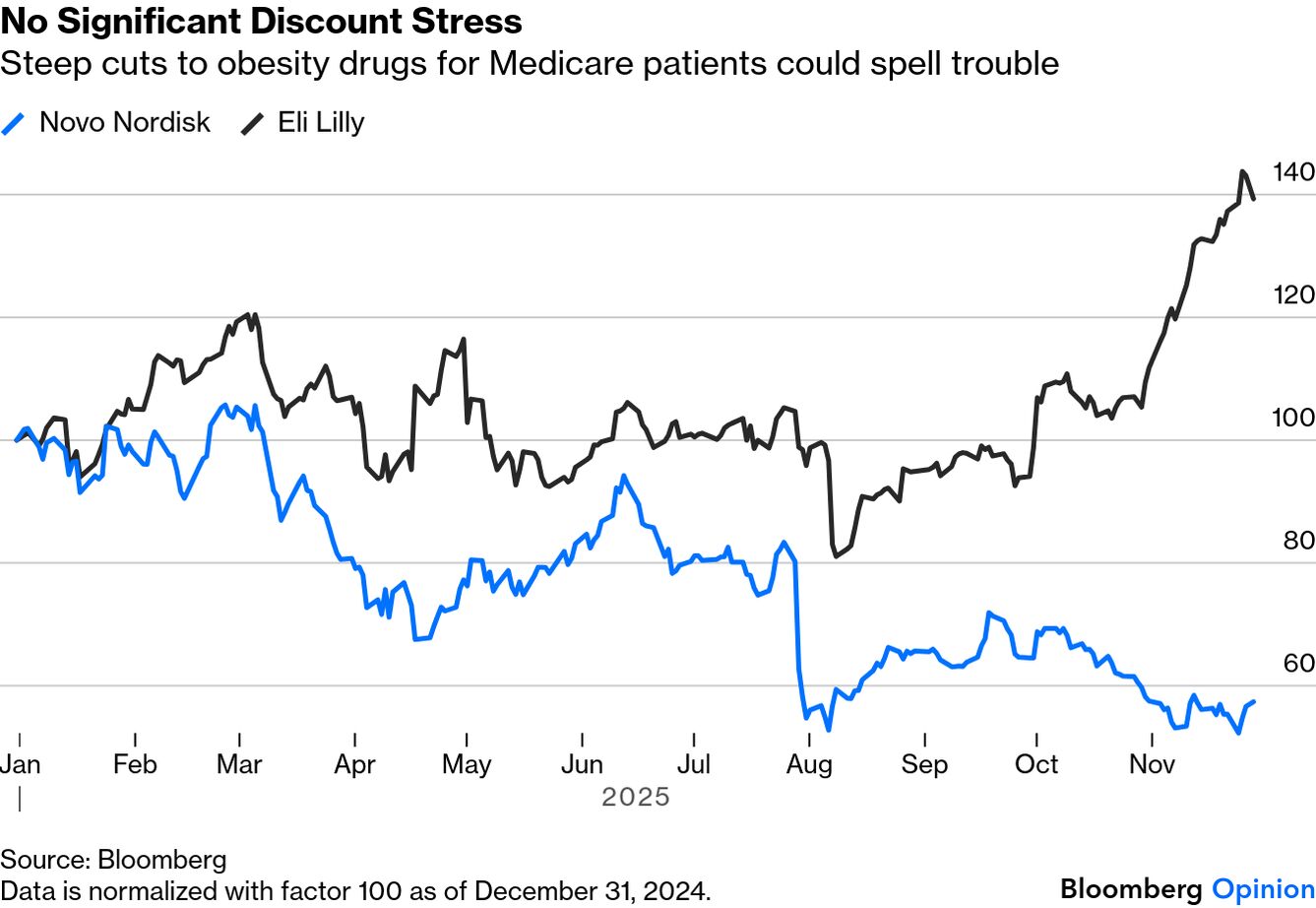

| With Thanksgiving over, thoughts turn to the issue of how to lose a few pounds. And obesity drugs have suddenly made that much more attainable, while earning big dollars for their manufacturers. It's no coincidence that the stock that has contributed most to the rise of the S&P 500 in the three years of ChatGPT — and that wasn't in the Magnificent Seven — was Eli Lilly & Co., maker of Ozempic and Mounjaro. It's gained 202% in that time, which is more than Apple Inc., Microsoft Corp., Amazon.com Inc. or Tesla Inc. But for all the talk about the enormous market for these drugs, which seems even bigger as the country stirs after a few days of enforced gluttony, the issue of cost won't go away. That hurdle just got lower with Washington's recently announced discounts on Novo Nordisk A/S's blockbuster drugs Ozempic and Wegovy for Medicare patients, the federal health insurance program for the elderly. The 71% discount may delight patients and voters alike, but drugmakers will feel the pinch unless volume growth can overcome the margin squeeze. Bloomberg Intelligence estimates that Eli Lilly and Novo Nordisk's GLP-1 obesity drug sales could fall by at least $2 billion in 2026 to $26.4 billion. Medicare's coverage, set to begin next spring, should extend eligibility to at least 10 million potential patients, which BI analysts Michael Shah and Bethan Swift argue won't be enough to offset the price cuts. The discount has barely swayed investor sentiment, with Novo Nordisk still seen as a big loser, if the stock's reaction since the announcement is anything to go by: The Danish company has endured a rough spell. Its growth prospects are heavily dependent on Ozempic (for diabetes) and Wegovy (for obesity), which both face headwinds. Shah argues these have fueled multiple guidance cuts, creating uncertainty for 2026: The company is now trading at a forward P/E that's broadly in line with large pharma peers. Yet, despite this significant derating, sentiment about the stock is unlikely to improve until we get greater visibility around compounded GLP-1s (hurting Wegovy) and the measures in place to tackle them, plus evidence of improved commercial execution.

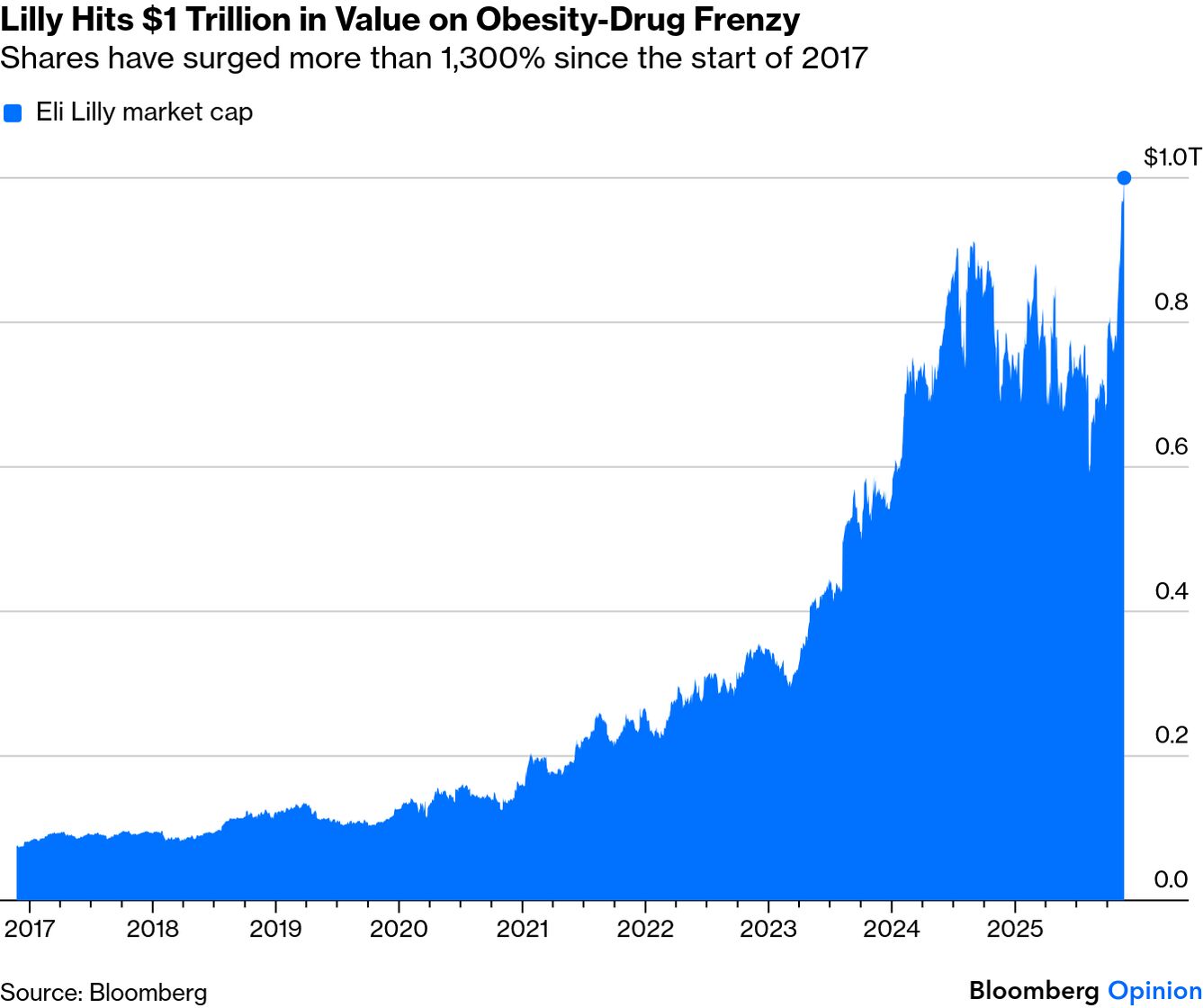

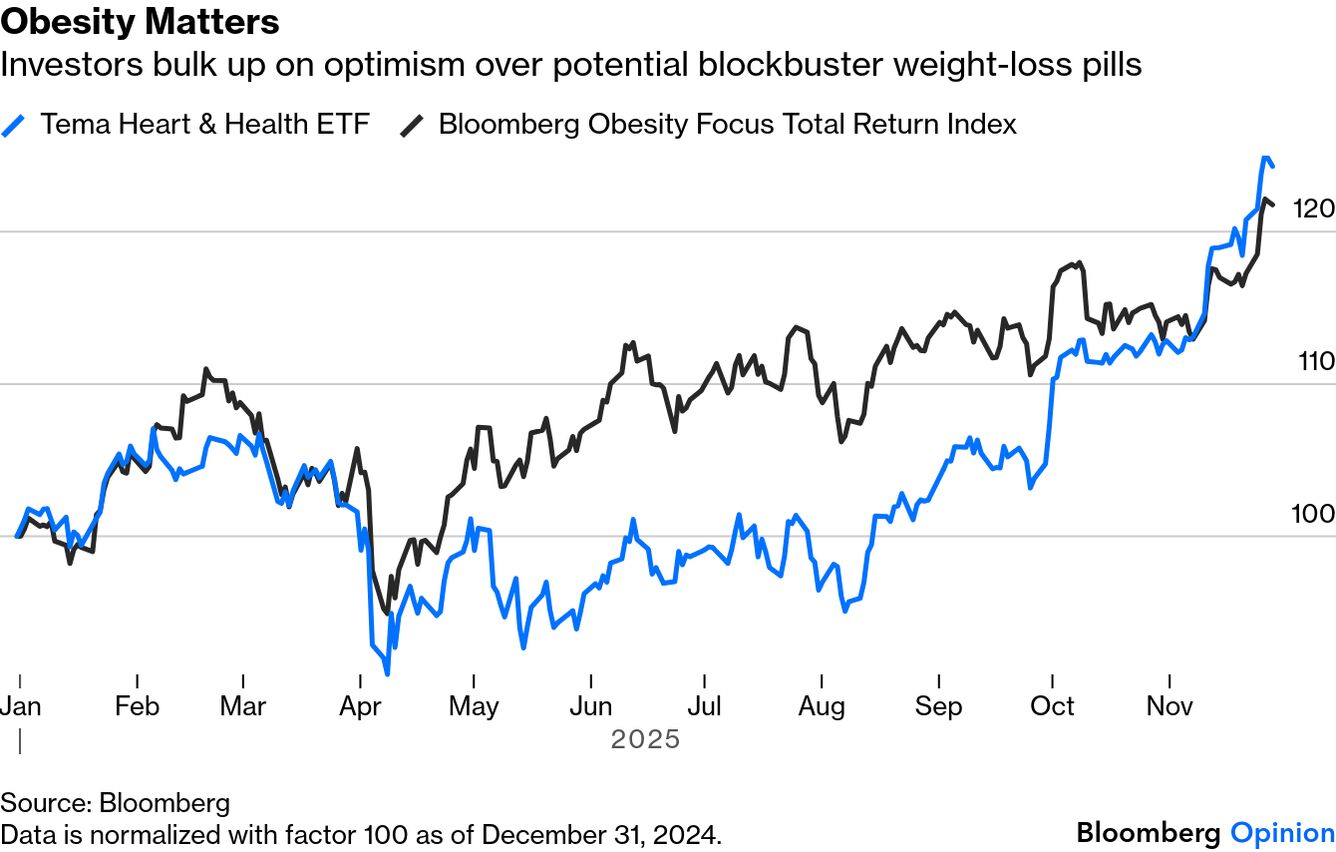

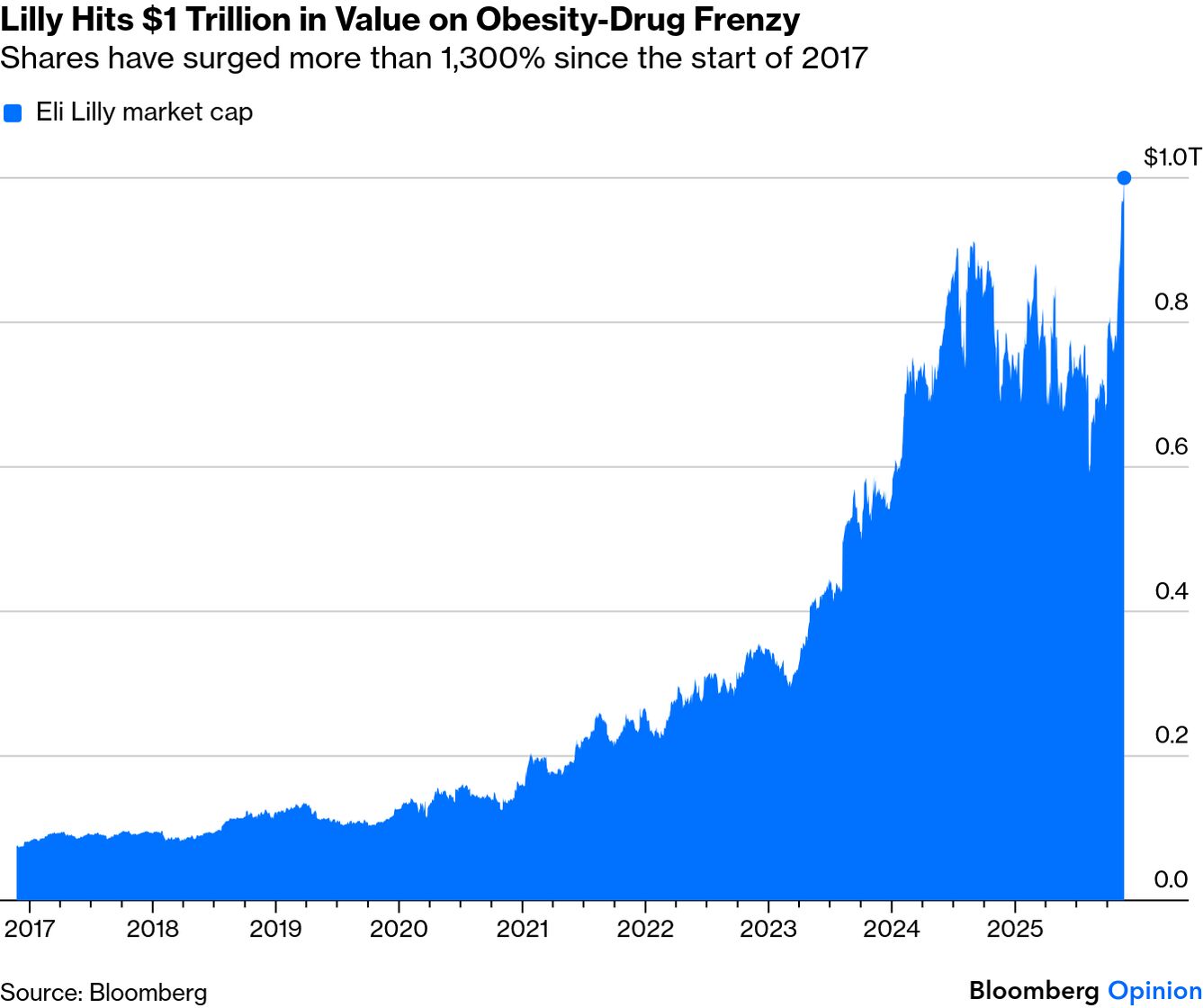

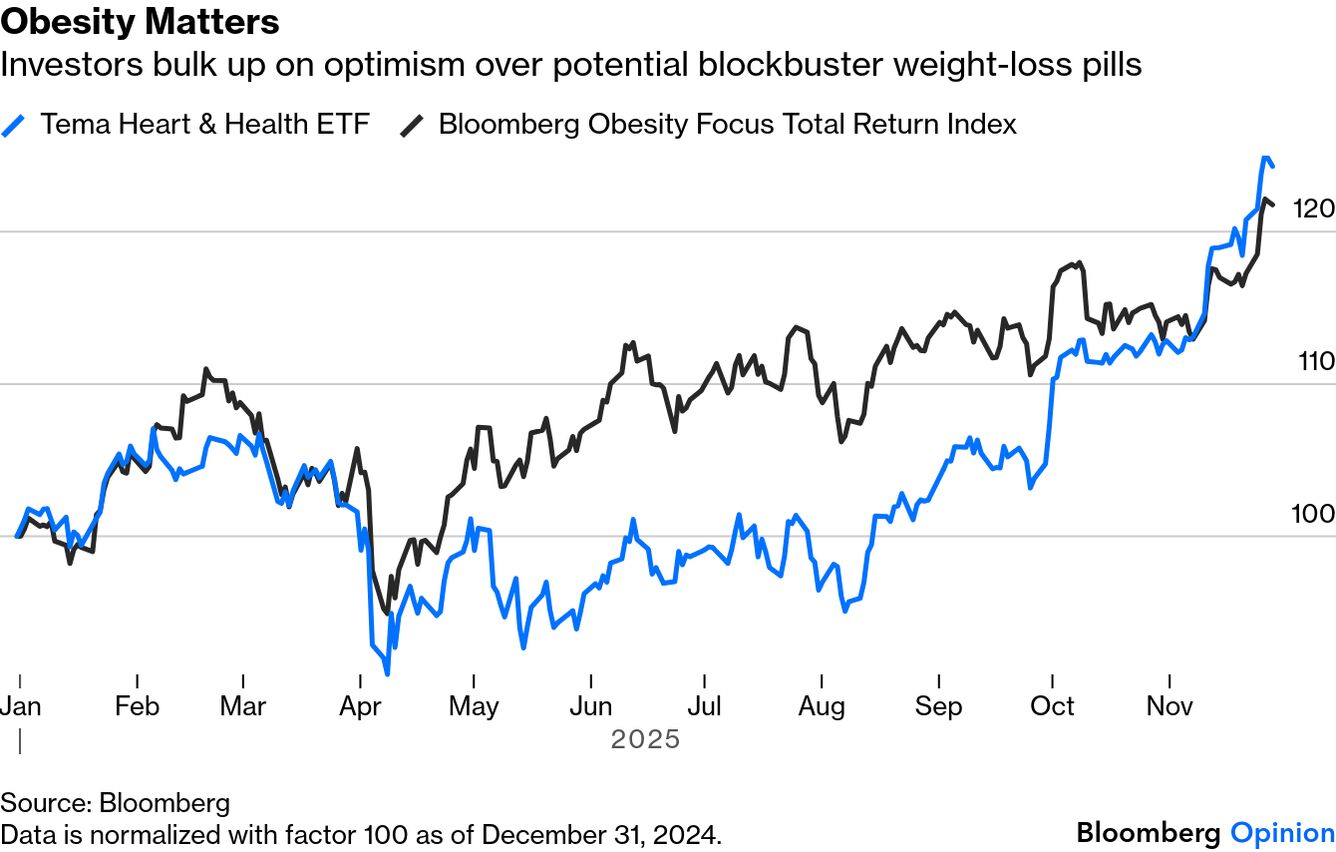

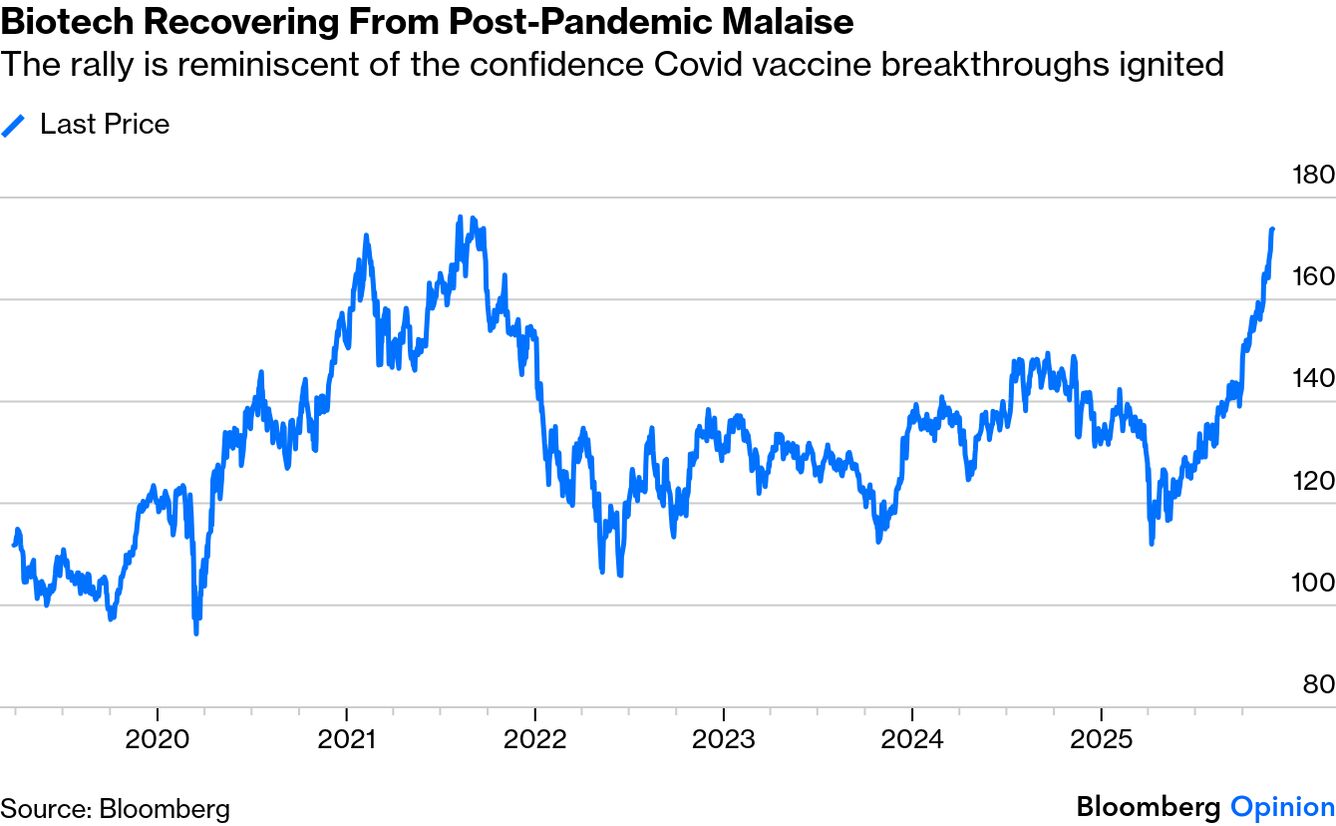

Despite both Lilly and Novo Nordisk being forced to swallow Washington's price cuts, it's Lilly's third-quarter earnings strength and its raised outlook that have investors leaning in. Expectations around the company's much-awaited weight-loss pill have helped propel it to an all-time high, making it the first health-care company to cross the $1 trillion market-cap threshold:  Ahead of a US Food and Drug Administration decision on whether to approve Lilly's oral obesity medication expected in early 2026, the firm has bulked up its supply. The elusive weight-loss pill remains the central catalyst in a market expected to reach $95 billion by 2030. Lilly's stock, up nearly 40% this year after a 32% surge in 2024, suggests investors are doubling down on the view that it will stay among the winners in the race to treat the obesity epidemic. It's running far ahead of the sector as a whole — this is how these exchange-traded funds tracking products and services related to cardiovascular and metabolic diseases, as defined by the Centers for Disease Control, have fared year-to-date:  The TEMA Heart & Health ETF, launched a year ago, is hovering around record levels. Is the optimism justified? Judging from third-quarter health-care earnings, which produced more positive surprises than any other sector, it appears so. Demand for high-cost specialty drugs, including cancer treatments, helped power strong results at distributors such as McKesson Corp., Cencora Inc., and Cardinal Health Inc.: Their performance might also conceivably stem from using AI to improve the efficiency of pharmaceutical R&D. The iShares Biotechnology ETF has surged for six straight months, its longest winning streak since 2012. It's currently on track to eclipse the all-time peak it achieved at the height of optimism for Covid vaccines: AI is already being put to work in biotech to deal with high failure rates, steep costs, and long development timelines, according to PitchBook. And so far, it's paying off. Biotechs that have baked AI into their model from the start now command nearly a 100% valuation premium to their non-AI peers: While AI tools for experimental design and clinical-trial optimization will likely continue to be integrated into drug development, the success of AI-discovered assets will be the most significant benchmark for the technology and will have the greatest impact on the biopharma business model.

A lot, of course, is riding on faith in AI as the spark for a productivity revolution. And the experience of the companies that pioneered Covid vaccines shows that it's best not to take anything for granted: in the three years of ChatGPT, Pfizer Inc. is down 38% and Moderna Inc. has lost 85% — they have the second- and fourth-largest losses of market cap in the entire S&P 500. But for now, confidence in weight-loss pills and the curative properties of AI are enough to draw the sting from the Washington Medicare deal. -- Richard Abbey |

No comments:

Post a Comment