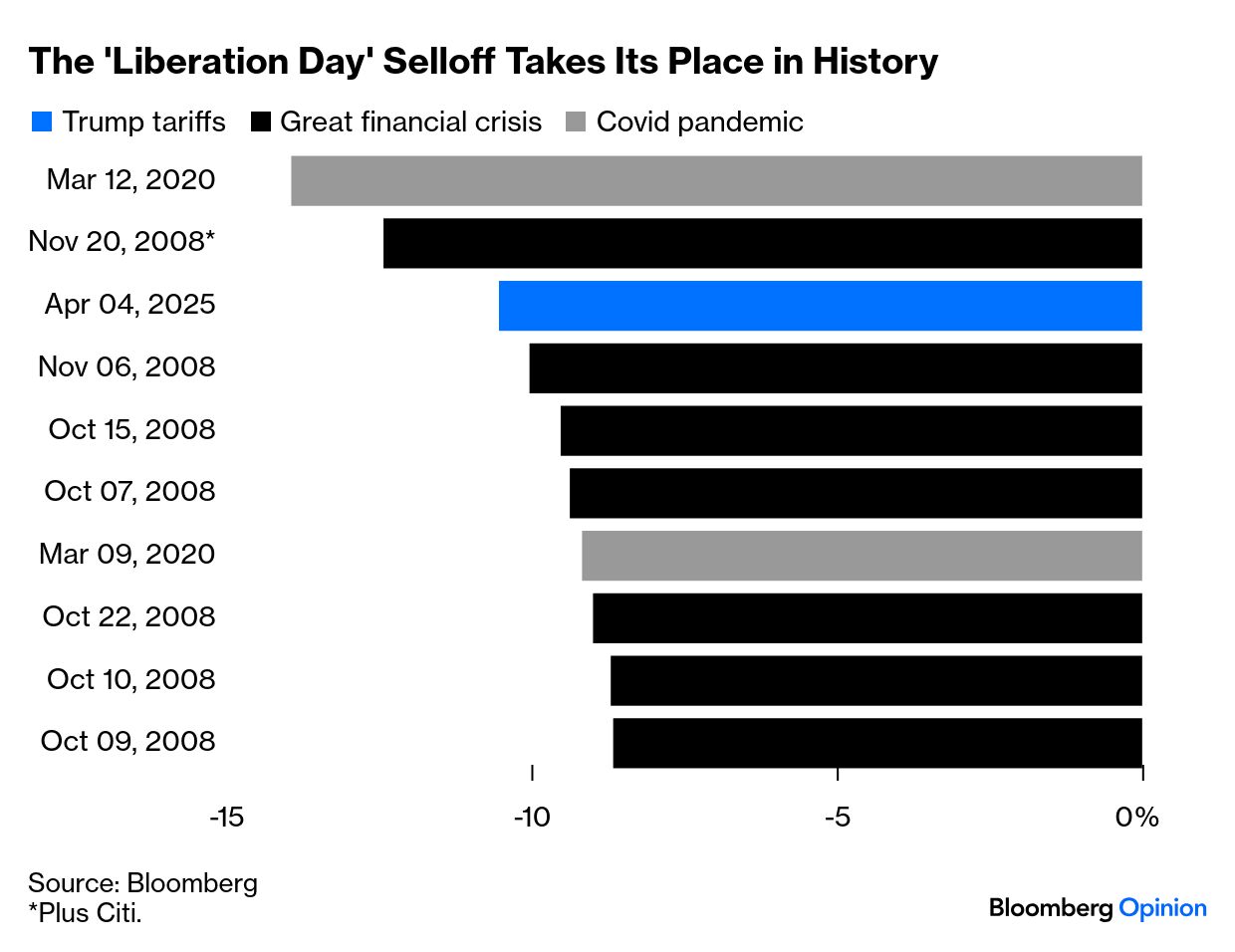

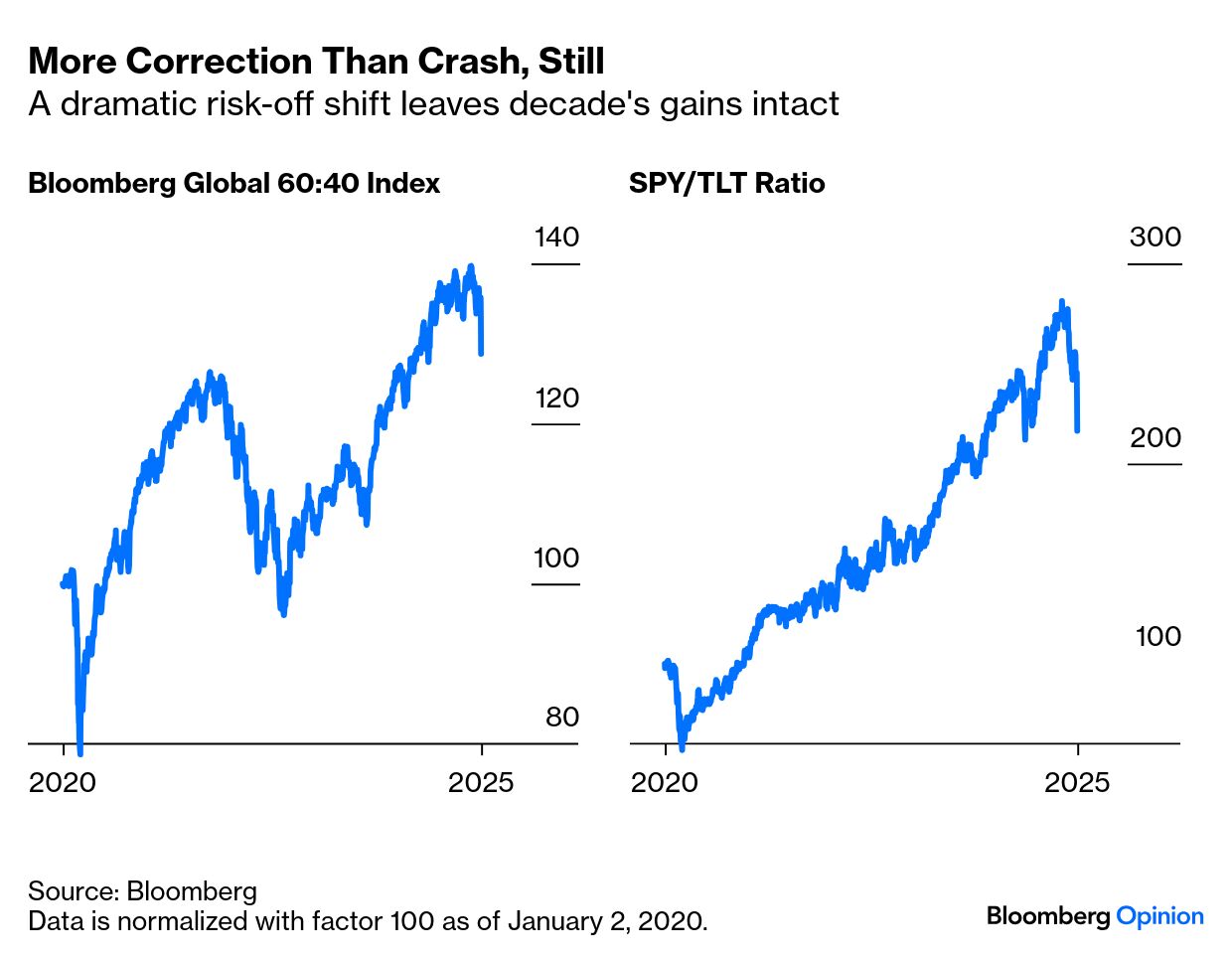

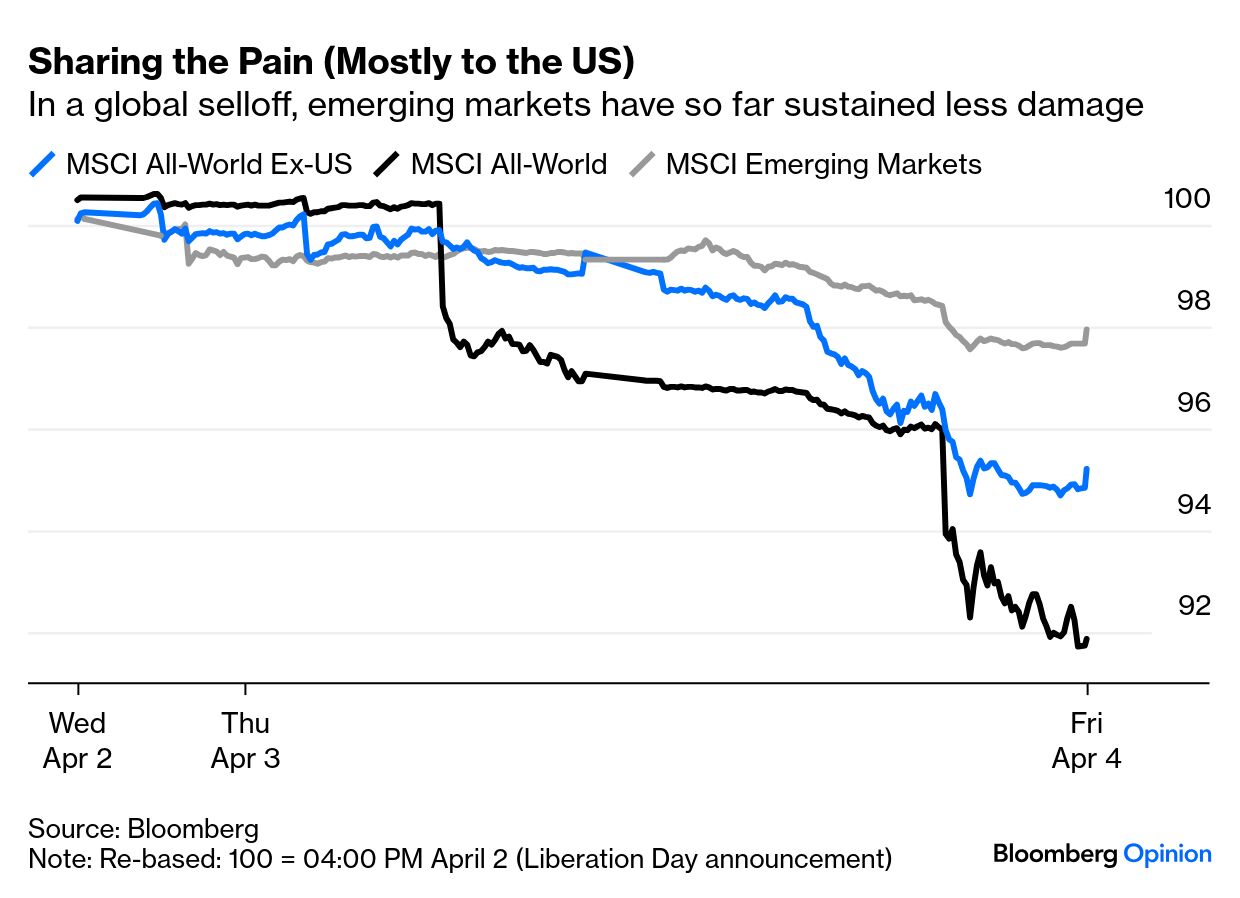

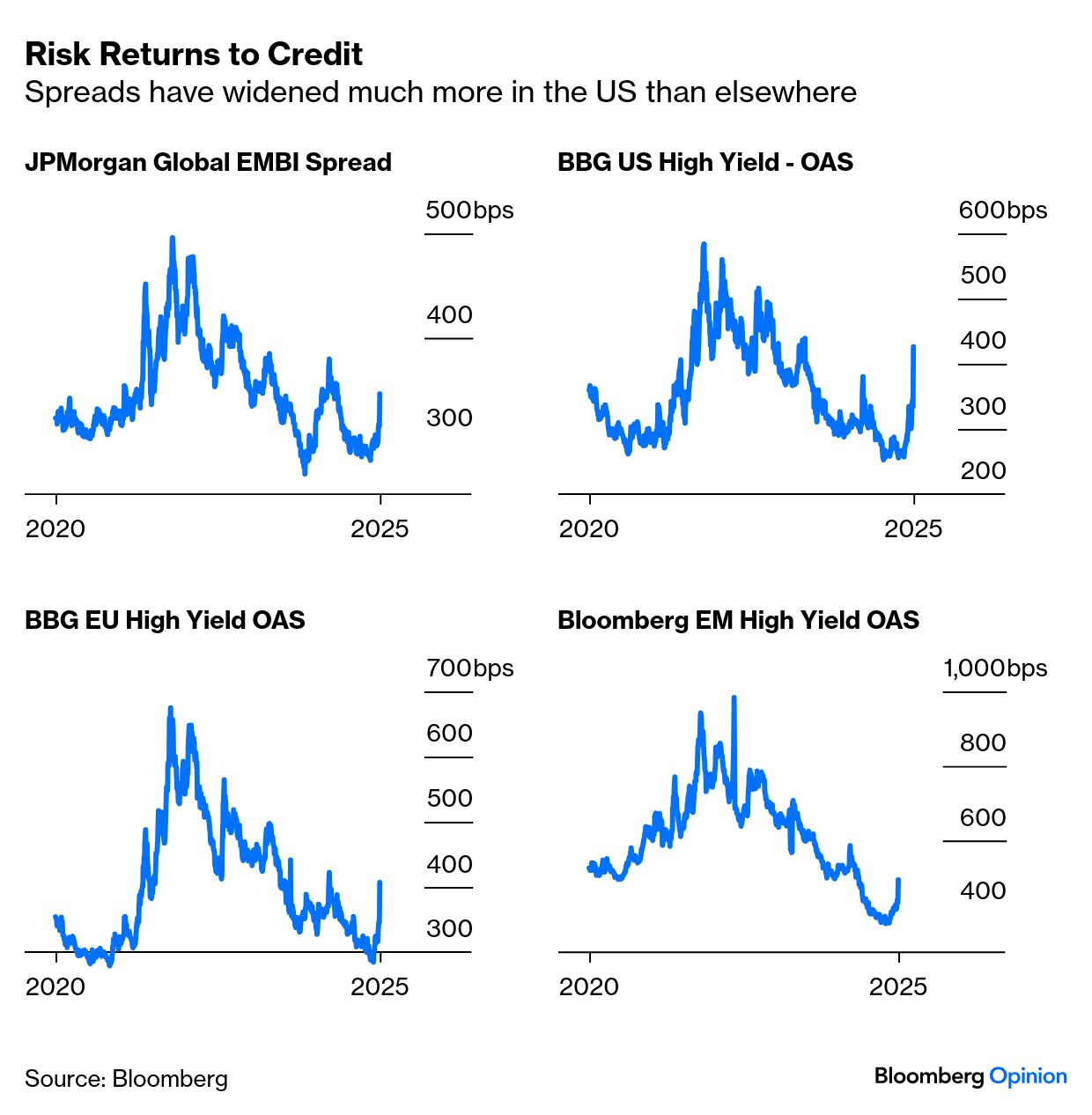

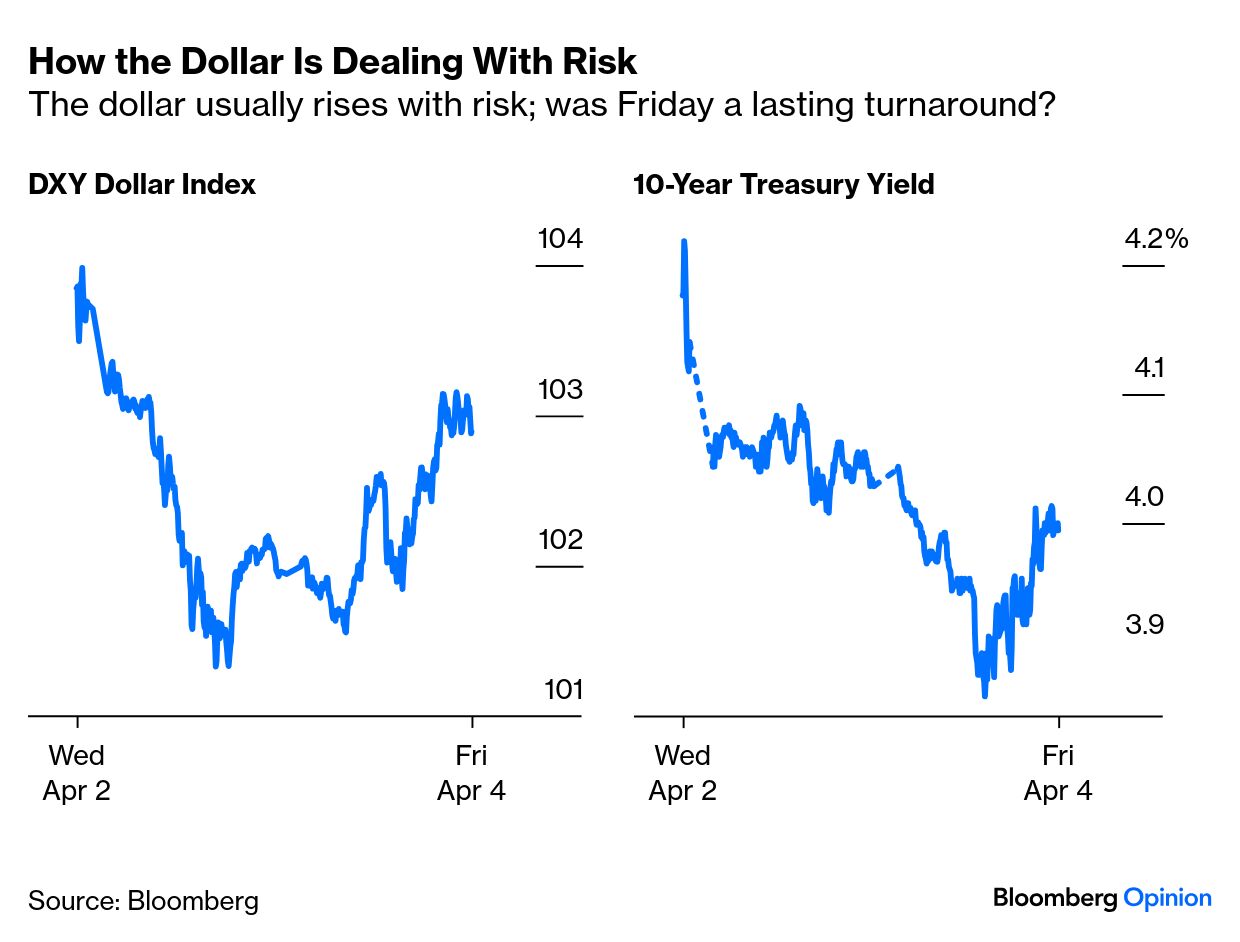

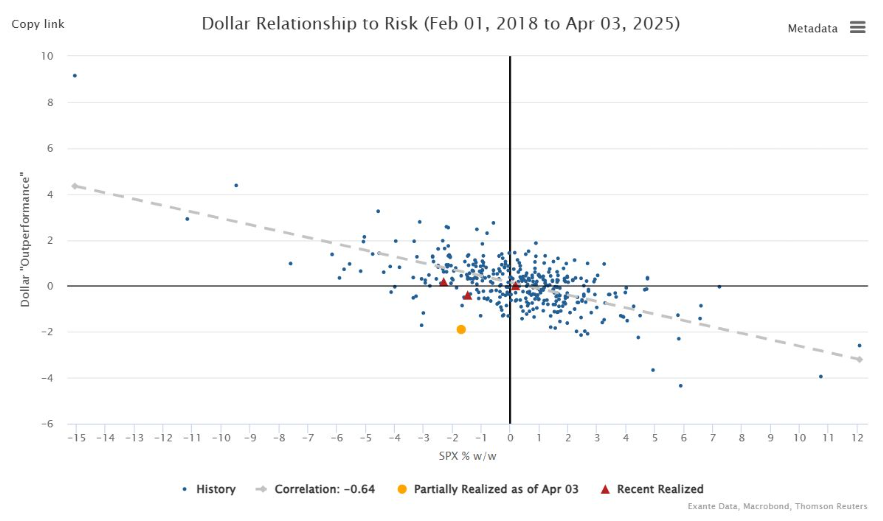

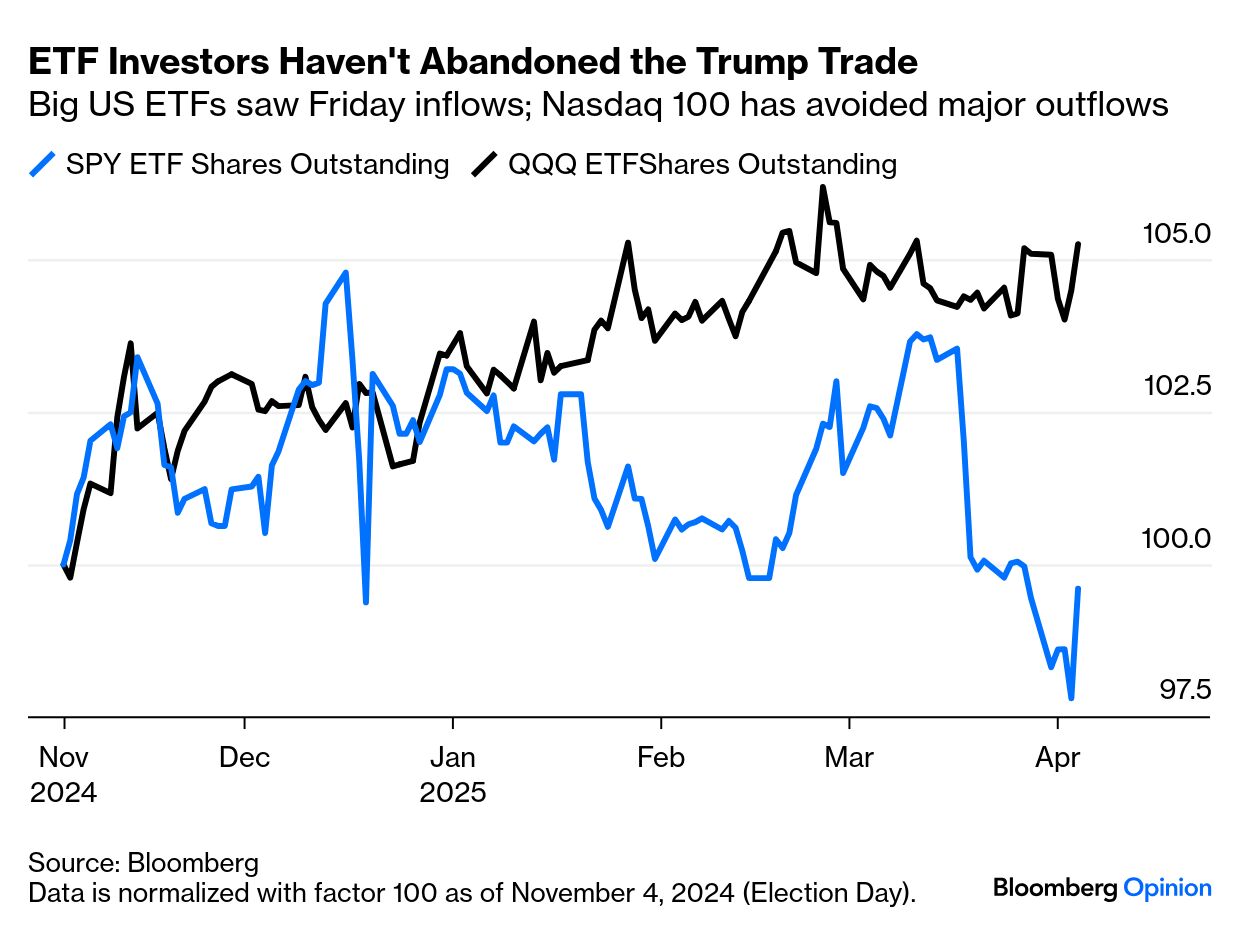

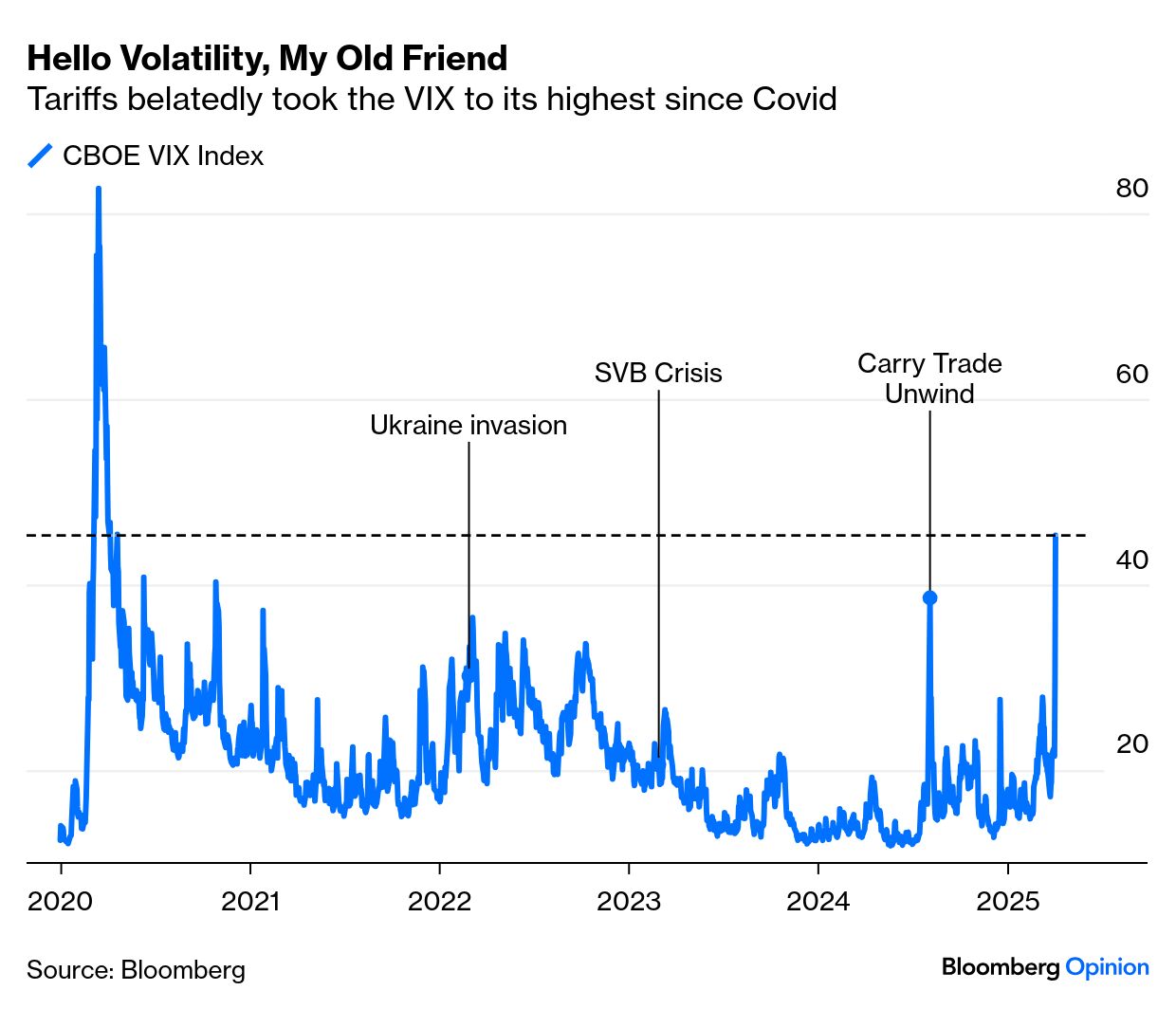

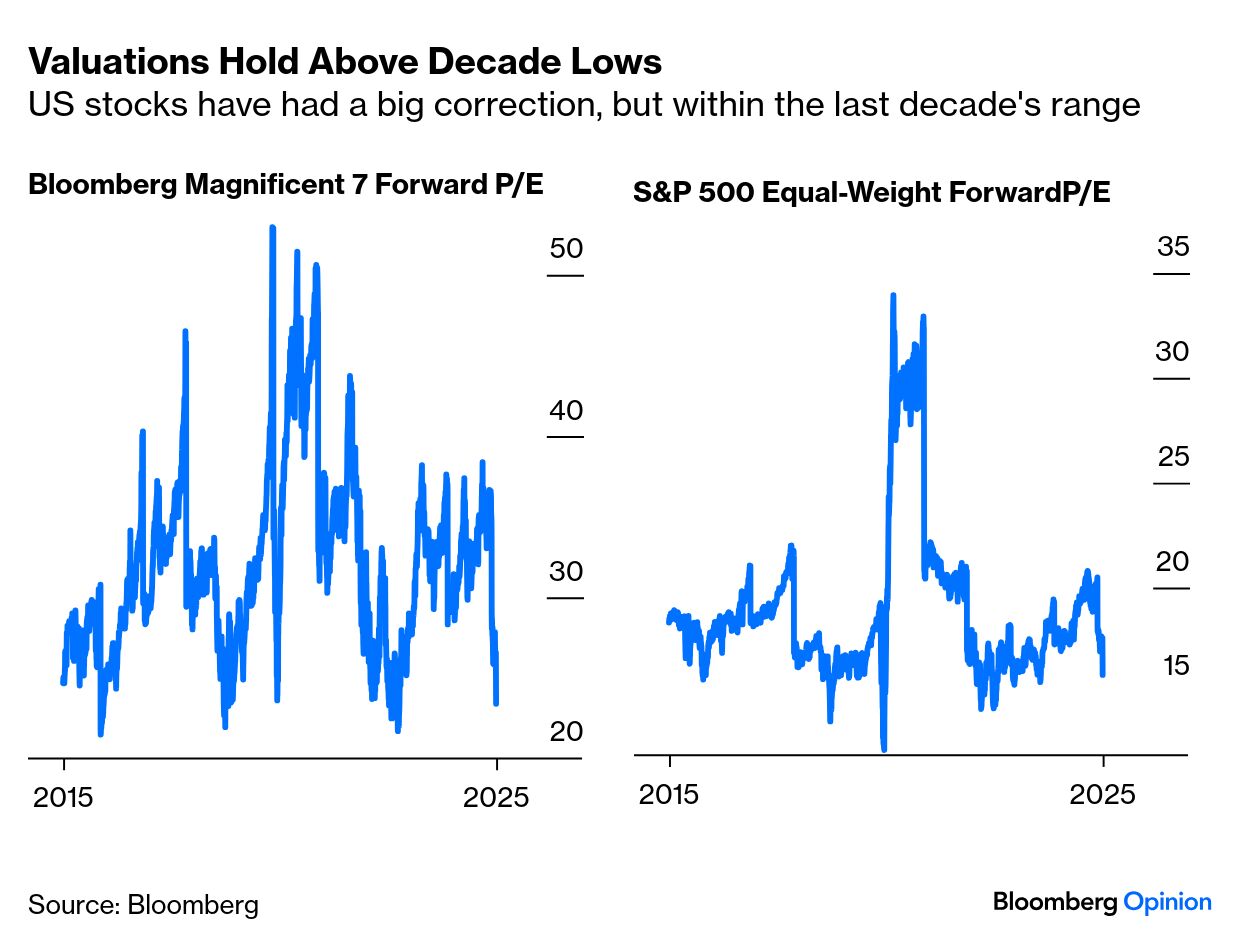

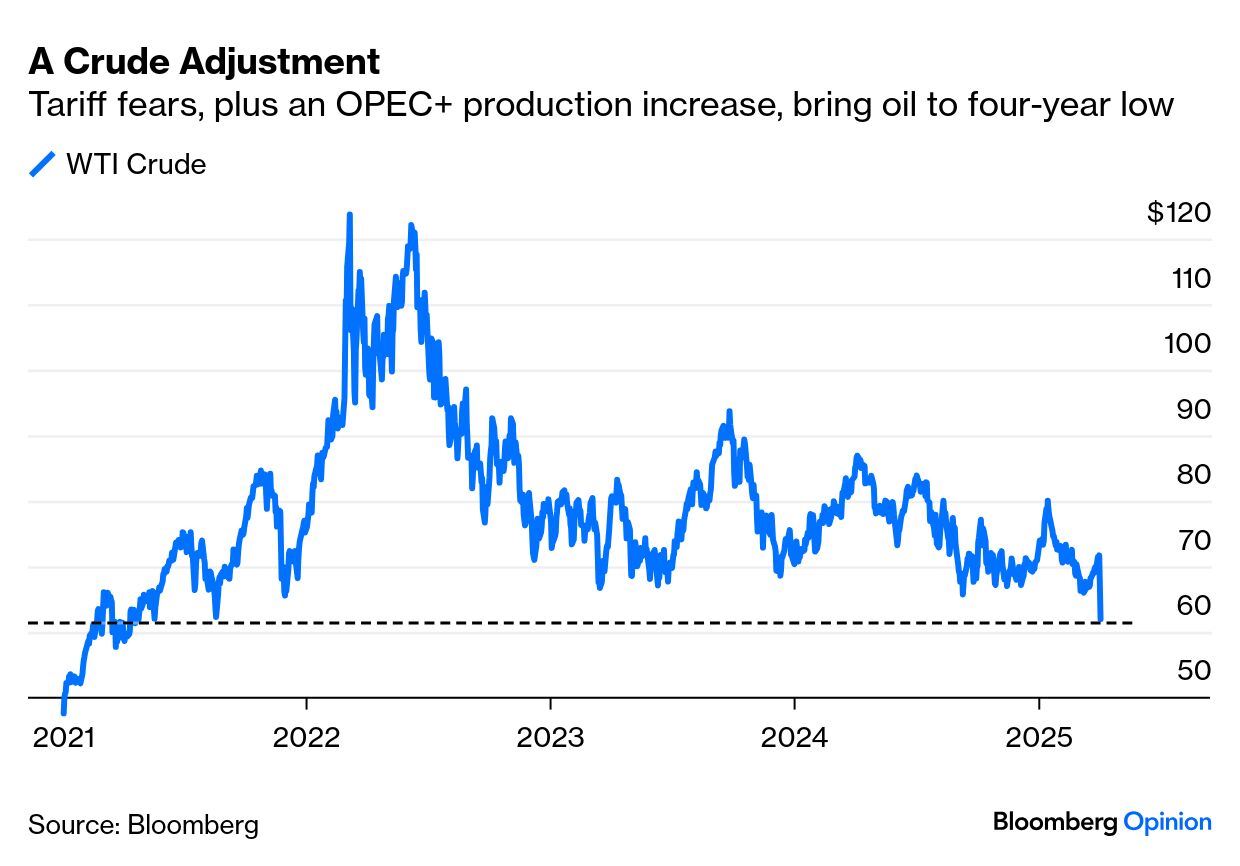

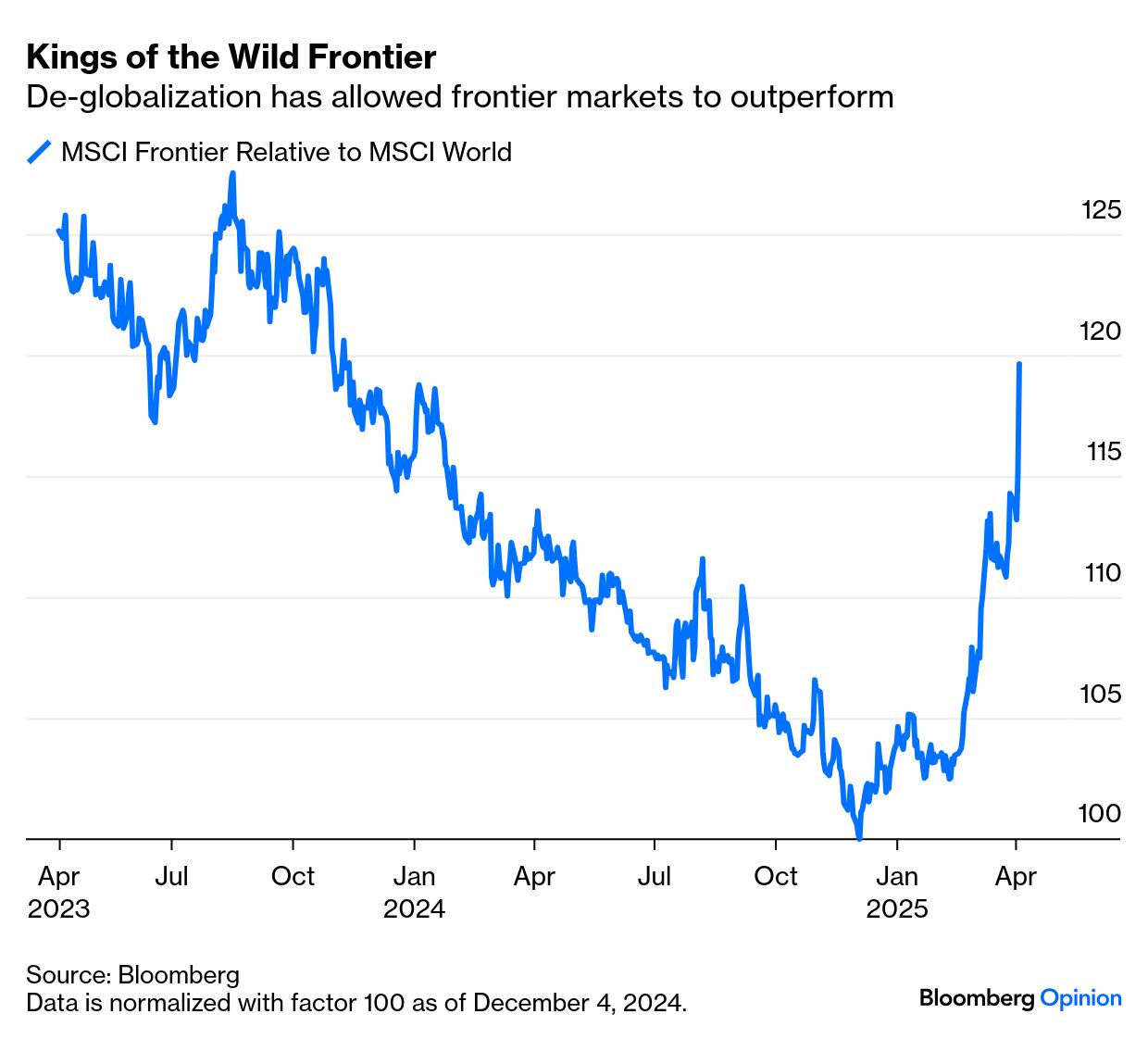

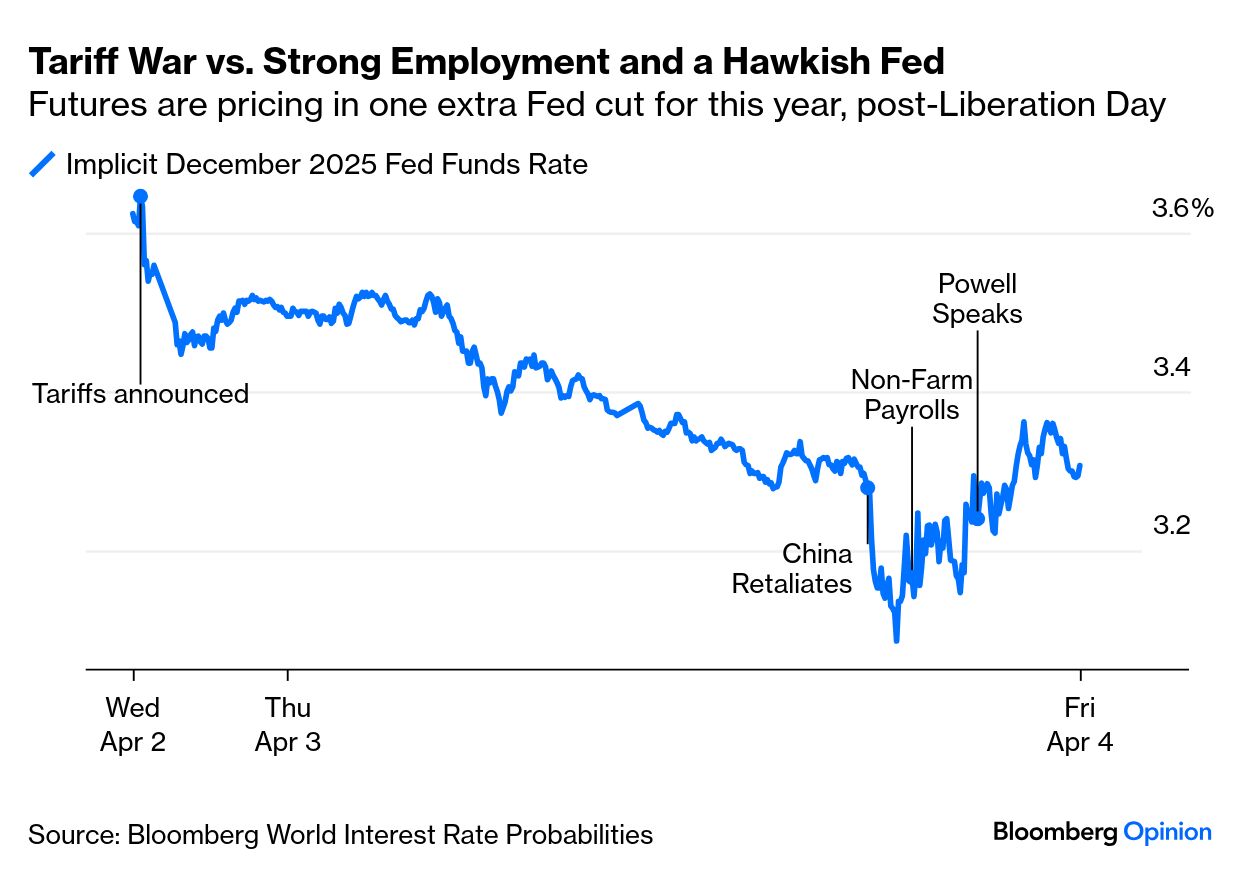

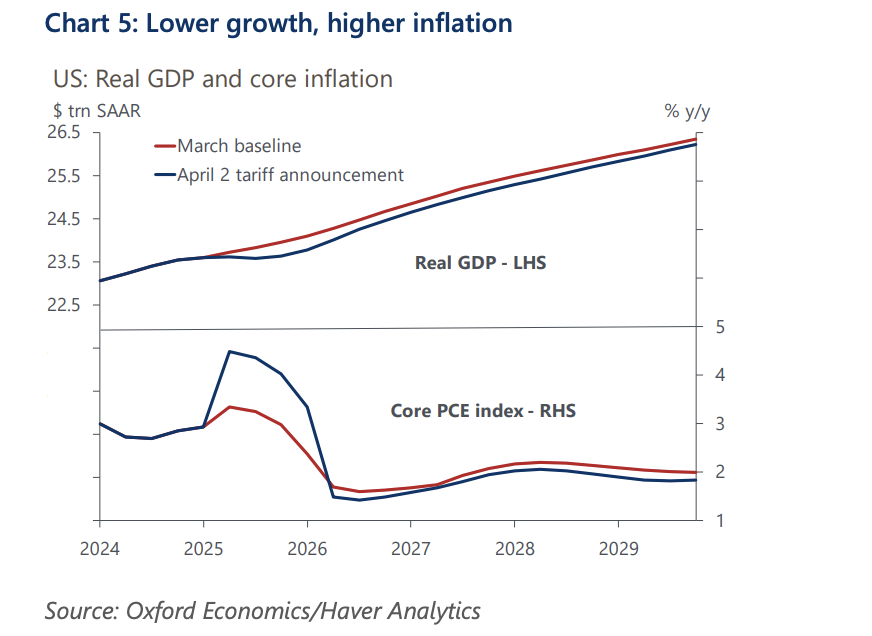

| Global markets underwent a seismic response to last Wednesday's announcement of sweeping tariffs by the US. As we brace for inevitable aftershocks in the days ahead — and with Hong Kong stocks down 10% at the time of writing in New York — here are the main details of the earthquake to date, in chart form. First, the fact that the selloff on Friday was as severe as Thursday's is unusual. It showed little interest in rethinking. It was the only third time this decade that the S&P 500 shed more than 10% in two days. These are the index's 10 greatest two-day selloffs in this century. Liberation Day falls behind only the worst moments of the Global Financial Crisis and the Covid lockdowns: The brunt was born by the biggest tech groups, which were worth the most in the first place. That led to spectacular losses in terms of market cap. Apple Inc., particularly exposed to transpacific commerce given its operations in China, was worth almost $4 trillion at the height of the "Trump Trade" over the Christmas break. It's now worth less than $3 trillion. All of last year's gains have been canceled out: If the 4.8% fall in S&P 500 futures at the Asian opening isn't reversed, then it's on course for its worst three-day selloff since the Black Monday crash of October 1987. But it's important not to overstate this. The market has swung away from a position that looked extreme. A 60/40 index (the classic 60% equities 40% bonds allocation) is the lowest in six months, but no worse than that. Similarly, stocks relative to bonds, as proxied by the popular SPY and TLT exchange-traded funds, have lost a lot of ground, but have held on to most of their post-pandemic gains. Retirement funds haven't been wiped out. Keep this in proportion; while remembering that there's also plenty of room below for this to go much further: Stock investors are convinced so far that this will damage the US more than the rest of the world. Emerging markets, recipients of some of the most extreme tariffs, have been comparatively unscathed since last Wednesday: In credit, spreads have widened sharply, suggesting a revival in recession risk. Again, emerging markets, which had been on a bad run, do not seem that badly affected to date. The rise in US high-yield spreads leaves risk far below the levels topped in 2022, but it's plainly very significant: The risk of an imminent financial accident may reside chiefly in credit. Companies are highly levered and have been surviving on generous rates they negotiated in the zero-rates environment of 2021. Any dislocation now raises serious risks. The most important issue concerns the dollar. It has been taken as a given over the last few months that US tariffs would mean a stronger dollar. Markets attempt to counteract the impact of the levies, as tariffs should mean higher inflation which would mean higher rates. Whenever risk spikes, investors take refuge in the US, even if it's the epicenter of the problem. But not this time. The dollar tanked on Thursday, even as money poured into Treasuries. Friday (when there were some big US macro developments that we deal with below) saw the dollar recover a bit, while Treasury yields rose — but this is a very important development to monitor. To give a sense of how unusual Thursday was, this chart from Exante Research maps the dollar's performance against moves in the S&P 500 over the last seven years. Thursday is marked in yellow — it was a very big outlier. If that's because confidence in the US and its assets is truly shaking, that is a very big deal: Is it fair to call this a catharsis, or revulsion trade? It doesn't look like that yet. Plenty of people tried to pick the bottom as the market fell on Friday, with big net purchases of ETFs tracking the S&P 500 and Nasdaq 100. Sentiment hasn't been wiped out: That said, volatility — as defined by the CBOE VIX index derived from options prices — has at last spiked to its highest since the worst of the Covid lockdowns. It had stayed calm for months, and this is a clear sign that investors really didn't think that Trump would go this far on tariffs: As for valuations, they've come down a lot, but remain just above their lows for the last decade. If this is a true paradigm shift, there could be much further to go — particularly if the forward earnings estimates that these valuations are based on have to be cut to account for tariffs. But so far, this selloff presents more as a classic correction of an overvalued market: Another critical development came in the oil market, fueled by a combination of growing recession fears and the decision by the OPEC+ cartel to increase supply. In early Asian trading, West Texas Intermediate crude dropped below $60 per barrel for the first time in four years. This is good news for an administration trying to show that it can contain inflation: Cheaper oil does, however, stand in the way of boosting production in the US, as it's hard to justify drilling at these low prices. Shares in drilling companies and exploration groups suffered the worst post-Liberation Day selloff: The strongest chink of light last week came from the performance of frontier stock markets, which do not yet qualify to be classified as emerging. Since the Trump Trade peaked over the Christmas period, the MSCI Frontier index has beaten its World index of developed world stocks by 20%: Since Wednesday's announcement, Bloomberg lists nine stock markets around the world that have gained, led by Ghana and Pakistan. There may well be aftershocks ahead, but for now the frontier market-shave skirted the worst damage from the attack on globalization. |

No comments:

Post a Comment