| EU trade ministers are will discuss tactics on how best to respond to Trump's tariff war |

| |

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. EU trade ministers will seek today to narrow their differences over countering Donald Trump's escalating tariff war, which has ravaged global markets. With no sign that the US president might back down, the bloc may explore concessions, even as it works to finalize retaliatory steps to strengthen its hand at the negotiating table and be ready to hit back if talks fail. France has suggested one response could be regulating the use of data by big American tech platforms. But some European officials are concerned a tit-for-tat trade conflict is unavoidable. Part of the problem is that the Trump team doesn't know what it wants, EU trade chief Maros Sefcovic told envoys Friday in a closed-door meeting, we're told. After speaking with UK Prime Minister Keir Starmer, Commission President Ursula von der Leyen stressed the need to work with partners to navigate a "major turning point." And while she reaffirmed the EU's commitment to engaging in negotiations, she made clear that the bloc is ready to defend its interests. — John Ainger and Jorge Valero | |

| |

| Musk Curveball | Despite Trump's move to set a 20% tariff on imports from the EU, Elon Musk said he hopes for a "zero-tariff" system between the US and Europe that would effectively create "a free-trade zone." The remarks, in conversation with Italy's Deputy Prime Minister Matteo Salvini, show that he may be feeling the heat. Mercosur Backer | Trump's tariffs are convincing Austria to ditch its long-time opposition to a trade deal between the EU and the Mercosur bloc. That's one less opponent, but the bloc still has France and Poland to worry about, and they maintain they won't back the deal. Here's why. Defense Pool | A majority of EU member states favor inviting the UK and Canada to join the bloc's proposed €150 billion defense spending fund, we've learned. Some, mainly eastern European and Baltic nations, also want to invite the US, even amid concerns that Trumps tariffs could undermine NATO security. ECB Cuts | Expectations for ECB interest-rate cuts are rising as investors and analysts assessing the fallout from US tariffs conclude that the outcome for inflation will be more benign, while growth will suffer. The euro, though, is on a strong run against the dollar, defying expectations. | |

| |

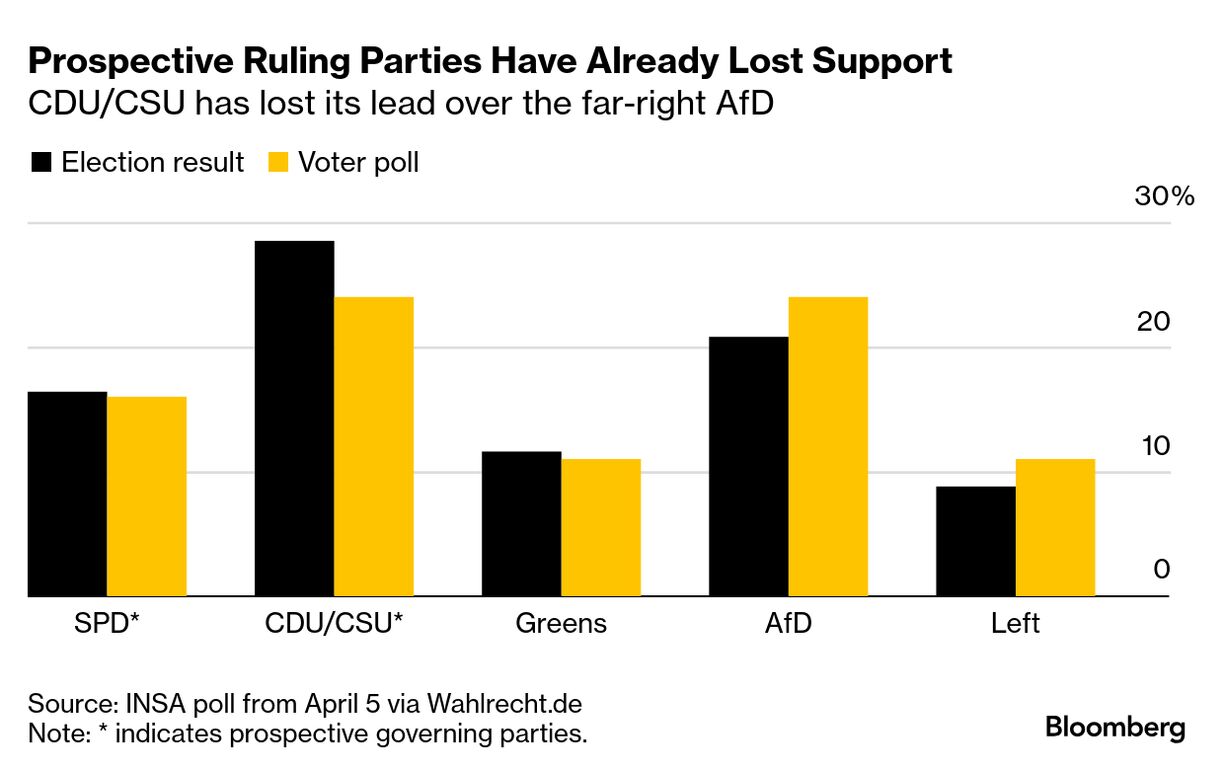

| Unlikely Spender | Chancellor-in-waiting Friedrich Merz has locked in political backing for a grand plan to ramp up investment in Germany's infrastructure and military. Now he needs to spend a trillion euros, and that's not straightforward in a country that often struggles to get things done. Right's March | France's National Rally protested in Paris yesterday over what it called the "tyranny of judges" after a court ruling barred its leader Marine Le Pen from running for president. Such a demonstration is rare from the far right and there are fears it could subject magistrates to public condemnation. Le Pen, meanwhile, told supporters she'll keep fighting the ruling. Three Graces | By the end of Trump's second term, the world could be staring at an entirely reconfigured EU, its three biggest economies ideologically shaped by three far-right women. We take you through what France's Le Pen, Germany's Alice Weidel and Italy's Giorgia Meloni have in common. And what sets them apart. Going Places | America's auto tariffs have left the sector stunned, but there's one corner of the market that's breathing a sigh of relief: classic-car traders. Thanks to a last-minute carve-out, vintage models from some of Europe's biggest brands will still be able to make the journey. | |

| |

| Germany's Merz faces the prospect of being forced into another pivot before he even takes office. His past confidence in the US is under threat as trade disruptions make a quick economic recovery even more remote. Changing geopolitics means he may have to reconsider his long-standing opposition to closer ties with China or move quickly to develop other markets for the export-dependent German economy. And his popularity is already taking a whack. | |

| |

| All times CET - 10 a.m. EU trade ministers arrive for Foreign Affairs Council meeting, with a news conference planned in the afternoon

- 10:45 a.m. EU foreign affairs chief Kaja Kallas holds news conference in Montenegro with Prime Minister Milojko Spajic; at 3:15 p.m. she presents the European Peace Facility support to armed forces in Montenegro

- EU Energy Summit in Brussels

- Commission President von der Leyen meets Norwegian premier Jonas Gahr Store

- Von der Leyen holds video conferences with industry representatives as part of steel and auto strategic dialogs

| |

| |

| |

| You received this message because you are subscribed to Bloomberg's Brussels Edition newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment