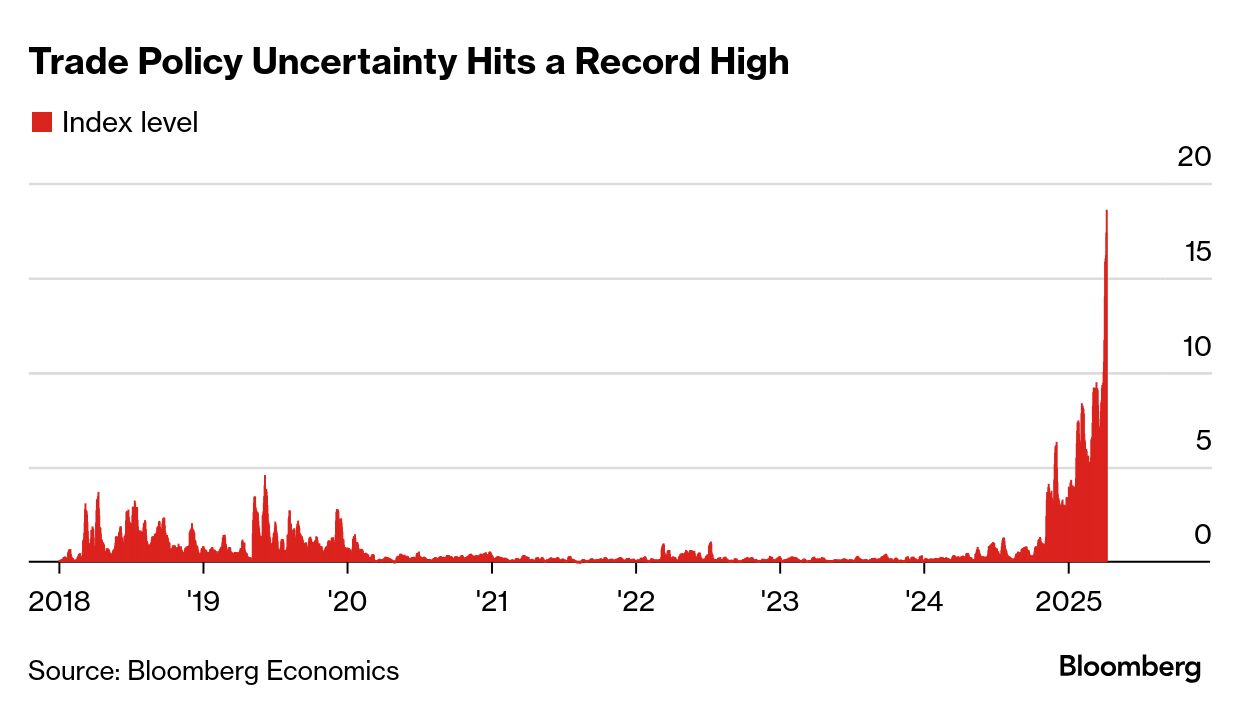

| President Donald Trump's reversal of higher tariffs for many key trading partners Wednesday eased a sense of dread in financial markets but did little to address the cluelessness hanging over businesses wondering what abrupt change will come next. "Whipsaw movements in country tariff rates will do nothing to reduce already record levels of trade-policy uncertainty," Bloomberg Economics economists Rana Sajedi, Maeva Cousin and Tom Orlik wrote in an analysis after the pause was announced. "Trump appears to consider uncertainty a positive for negotiations. For businesses and markets, it's a drag." Trumponomics Podcast: Will Trump's Tariff War Permanently Damage America? They noted that even after the temporary reprieve, the average US tariff rate is still rising to 24%, up almost 22 percentage points since Trump started his second term. Their research is featured in a Bloomberg story today about the sand in the gears of the global economy thanks to trade uncertainty. Meanwhile, Trump walloped Chinese imports with an even higher tariff — 125%. Beijing sounded willing to negotiate but not under such duress. Before Trump's now-delayed reciprocal tariffs were to take effect, there was a broader paralysis hitting global supply chains. Haas Automation, the largest machine tool builder in the western world, said earlier this week it was reducing production and eliminating overtime for the 1,700 workers at its manufacturing plant north of Los Angeles because of a "dramatic decrease in demand for our machine tools from both domestic and foreign customers." Bloomberg Tracker: Every Trump Tariff and Its Economic Effect "The 'wait and see' approach is one that is now playing out across millions of shipments scheduled each month," said Kyle Henderson, Vizion's CEO. Related Reading: —Brendan Murray in London Bloomberg's tariff tracker follows all the twists and turns of global trade wars. Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment