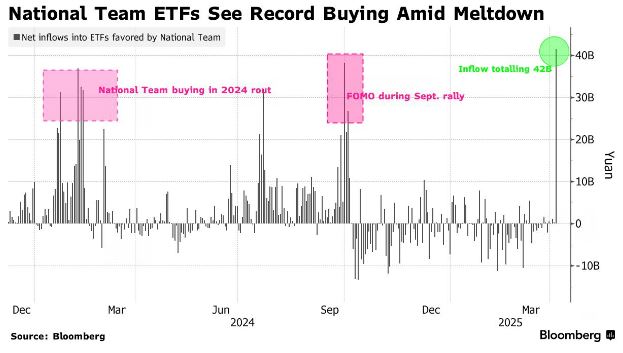

| Hi, this is Allen Wan in Shanghai, where it has become crystal clear to anyone with a pulse that China and the US are embarking on another costly trade war. One stark difference between the two sides seems to be public support. In short, China has it. The Trump administration, less so. The most high-profile sign that the US was not entirely on board with President Donald Trump's strategy was Wall Street titans like JPMorgan Chase CEO Jamie Dimon and Bill Ackman, founder of Pershing Square, raising questions about those sweeping duties that Trump levied on nations around the world on "Liberation Day." Read about the reprieve prompted by the rich here and about Ackman's shifting views of Trump here.  Trump supporter Bill Ackman warned of economic consequences. Photographer: Jeenah Moon/Bloomberg The US was risking "a self-induced, economic nuclear winter," was how Ackman, a Trump supporter, has put it. That remark summed up the dark feelings many people suddenly had about the future. The worries grew as stocks slumped badly and predictions about a recession landed. Adding to Trump's headaches, protests had earlier broken out around the US against efforts by him and Elon Musk to shrink government and over perceived attacks on civil rights. Eventually, Trump made a U-turn on tariffing the world, prompting relief and a big rally in equities that has since faded. Read about the rethink and what happens in 90 days here. There was less cheer in China because Trump left in place duties on the nation's exports. Read an essay on the trade war no one wants here. While the levies are prompting concern about the Asian nation's economic outlook, the Chinese government seems to enjoy pretty broad support for its trade war strategy, which boils down to a pledge to "fight to the end." "We are not angry so far, more liking seeing it as a joke," Li Chong, the 35-year-old head of logistics at a gaming company in Shanghai, said of the tariff onslaught. People "have confidence that the Chinese government has ways to promote domestic demand" to help limit the damage, Li said. Meng, a female entrepreneur in her 30s who is trying to start an e-commerce business targeting the overseas market, said that because Trump angered many countries, "China is not alone and I don't know what China could do otherwise." "Obviously we can see who is acting crazy this time around," said Meng, who declined to give her full name to maintain her privacy. This kind of solidarity could also be found on Chinese social media. In a comment that got thousands of likes, one person wrote that "at this point we must be tough. If we back down, we will be beaten up even more." There's a lot of reasons for the mood of quiet defiance to the US that will serve as a potent backstop for Chinese officials in the trade fight. Read more about the split here. Undergirding it all is more than a dash of patriotism. Chinese diplomats have cast Trump's moves as aimed at "containing" the people's right to build a better version of their country. That's also the line they use when the US does things like trying to stop advanced tech from going to China. Those same diplomats sounded fairly convincing when they argued that most countries were, like China, really peeved at those steep, sweeping tariffs that Trump slapped on both friend and foe. And China got some timely verbal support from Spanish Prime Minister Pedro Sanchez, who said just before a trip to the country that Europe should review its relationship with Beijing. Another reason that the Chinese public is siding with its leaders so far is they've seen how the government stepped in to help out stock investors before a selloff got nearly as bad as it did in the US. Chinese shares tumbled to start the week but state-linked funds known as the national team snapped up assets. That was one of many ways the fraying nerves of investors were soothed, including companies buying back their own stock, activity that tends to support prices. Finally, there's the strong belief in China right now that the government has the means, including via big stimulus, to at least prevent the worst-case scenario from happening. A decision by top leaders to gather this week so they could discuss support for housing, consumer spending and more at least sends the message that officialdom is on top of the situation and ready to send in the cavalry if needed. State media has also weighed in, signaling policymakers are prepared to help with moves like rate cuts or slashing the amount of funds banks must hold in reserve to keep money flowing around the financial system. People in China and elsewhere know that the trade tussle with the US is going to take some time to play out. For one thing, they remember that the combat over commerce in Trump's first term lasted nearly two years from opening shot to peace treaty. Then there's the likelihood that Trump's latest hardball tactics will just make China dig in its heels, Jennifer Welch, the chief geoeconomics analyst for Bloomberg Economics, wrote this week. "They guard their pride, drive a hard bargain and play the long game," said Welch, who once served on the White House's national security team. Given talks between the two sides would appear to be a long way off, the Chinese government can take solace in the fact its own people are on its side – for now. What We're Reading, Listening to and Watching: To devalue or not to devalue? That's the question many observers are asking about China and its currency as it looks for the right weapons in the trade fight with the US. Speculation is growing that Beijing is willing to allow the yuan to depreciate much further after the managed currency hit record lows this week in the offshore market. Global banks are divided on how far Xi's government is willing to go. Jefferies says it may decide to "go big," predicting a slide of as much as 30%, while Wells Fargo sees the risk of a 15% drop over a two-month period. Mizuho is more conservative, suggesting authorities will likely guide the yuan slightly weaker to 7.5 per dollar. While it would make sense for China to continue to guide the currency lower as it did much of the week in reaction to Trump's tariffs, the tactic comes with risks. A weaker yuan makes exports cheaper, but could also spur capital flight. China posted record outflows of foreign investment last year and that trend could continue as investors exit in the search for better alternatives. That could hurt an economy struggling to stop a deflationary spiral and a property market meltdown. Moreover, it provides fodder for the Trump administration to label China a currency manipulator, something the US did during his first term. Scott Bessent, the Treasury chief, this week urged China not to devalue the yuan. Hence Beijing needs to tread carefully. Xi has a vision to raise the yuan's status as a "powerful currency" that is stable enough to play an important role in global trade. Allowing the renminbi to weaken dramatically undercuts his ambition to make it a reserve currency and alternative to the dollar. It could also spur devaluations across Asia, where many countries are facing their own tariff risks. Xi will want the cooperation of those markets as his nation looks for alternatives to the US. Just as important, a weaker yuan makes imported goods more expensive, undermining Xi's plans to make consumer spending a bigger driver for the world's second-biggest economy and encourage foreign businesses to invest. "A large yuan depreciation would be too unsettling for markets and China's trading partners, and we do not see that outcome as likely," said Wei Liang Chang, a strategist with DBS Bank. "China could see a need to maintain goodwill with trading partners, amid an increasingly fragmented global trading system." |

No comments:

Post a Comment