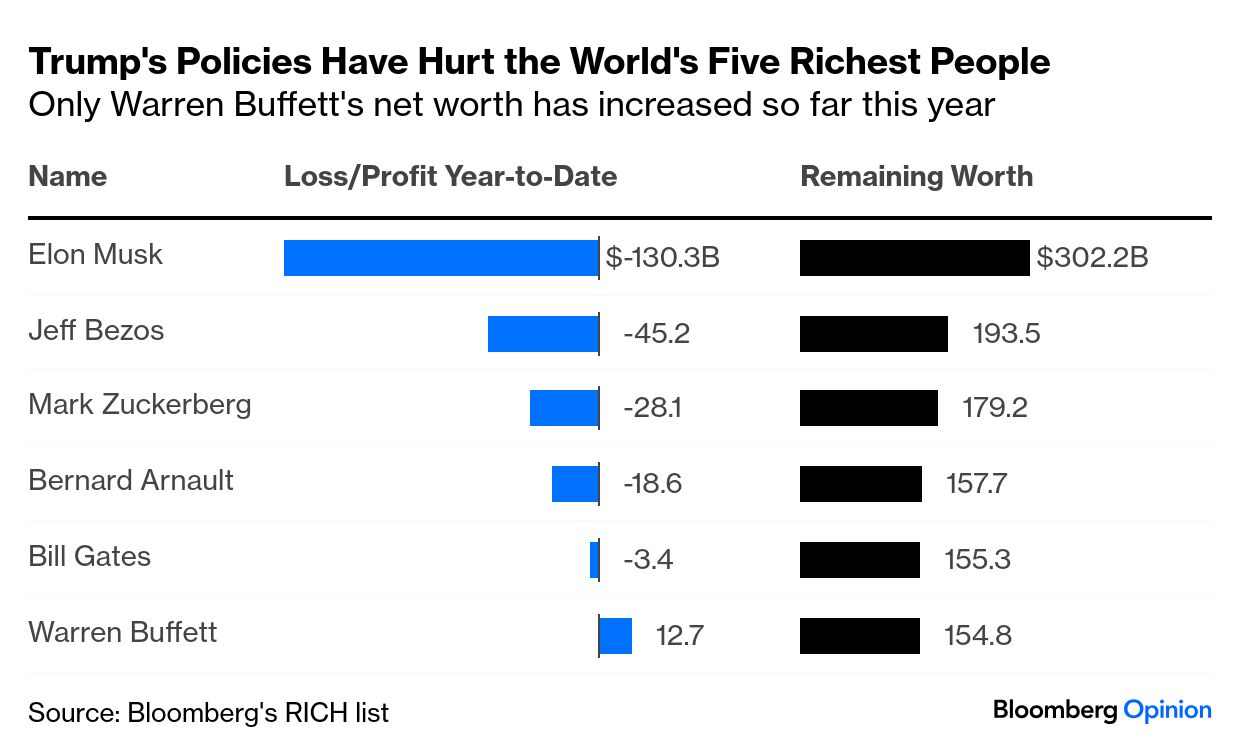

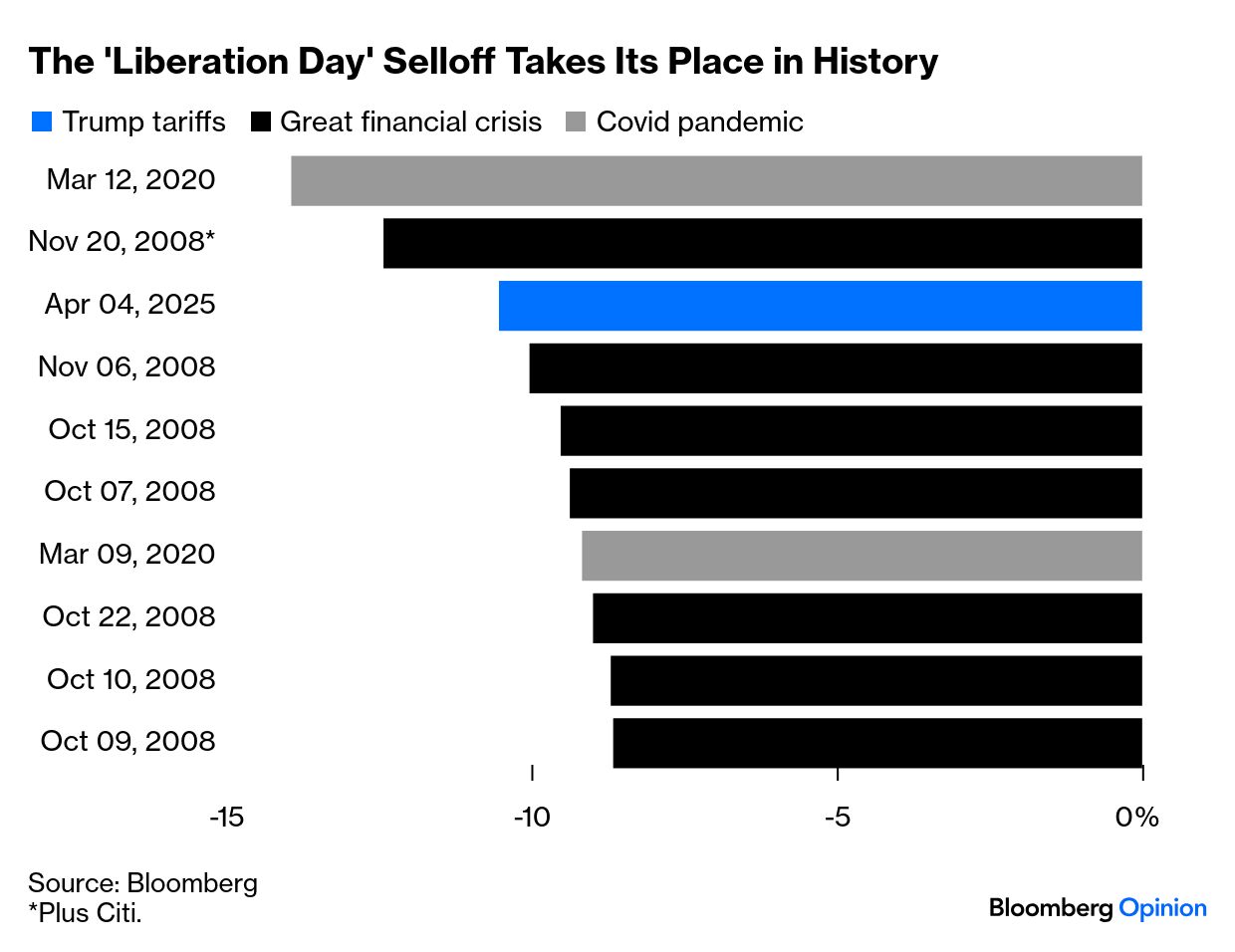

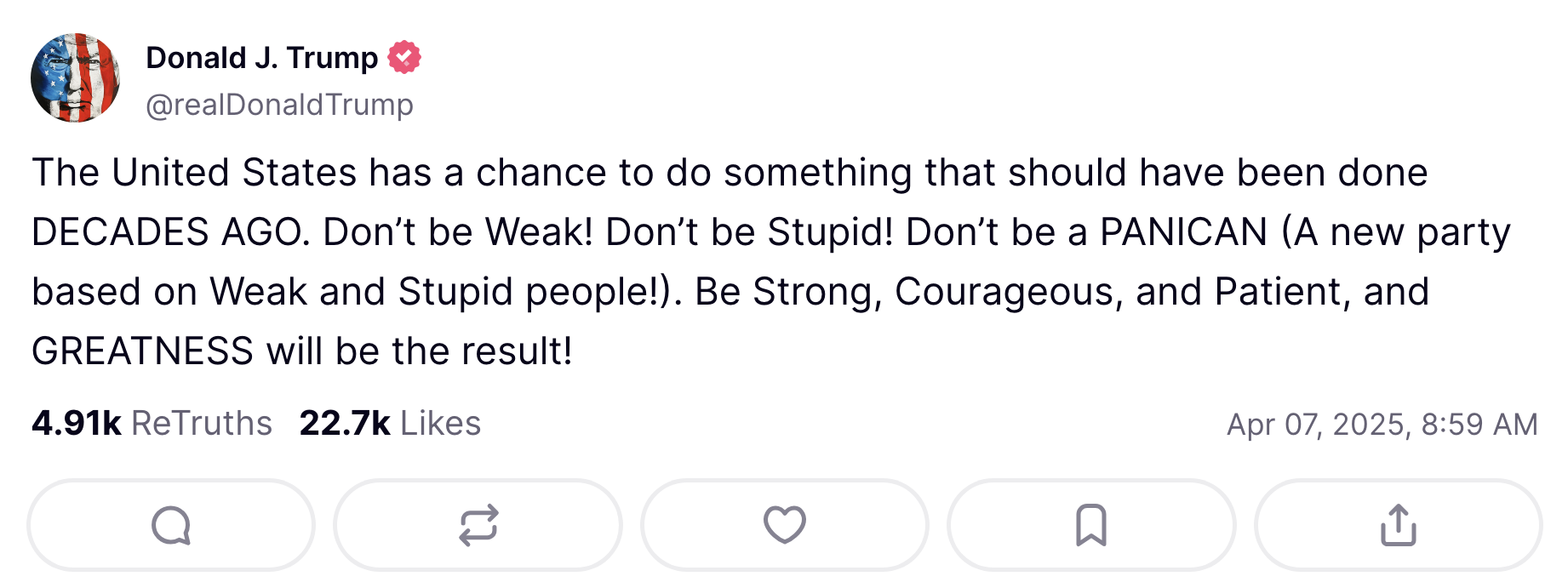

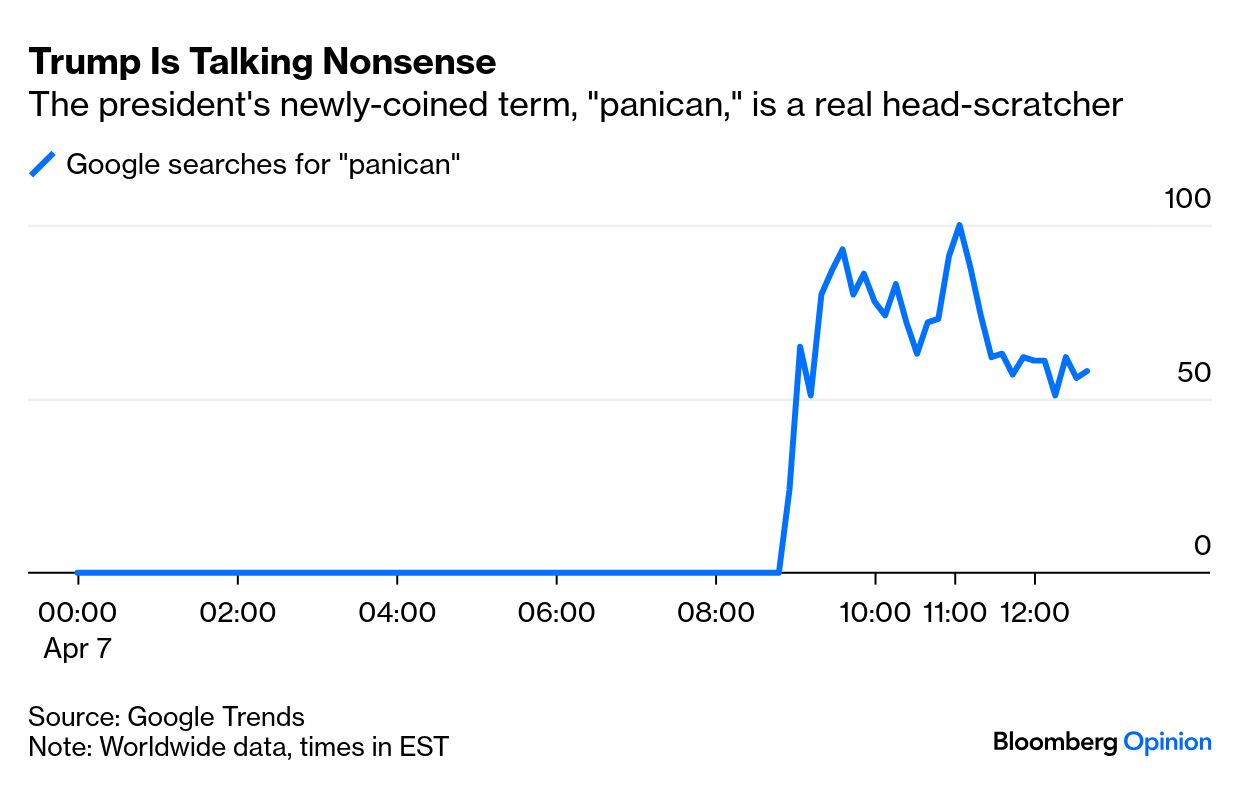

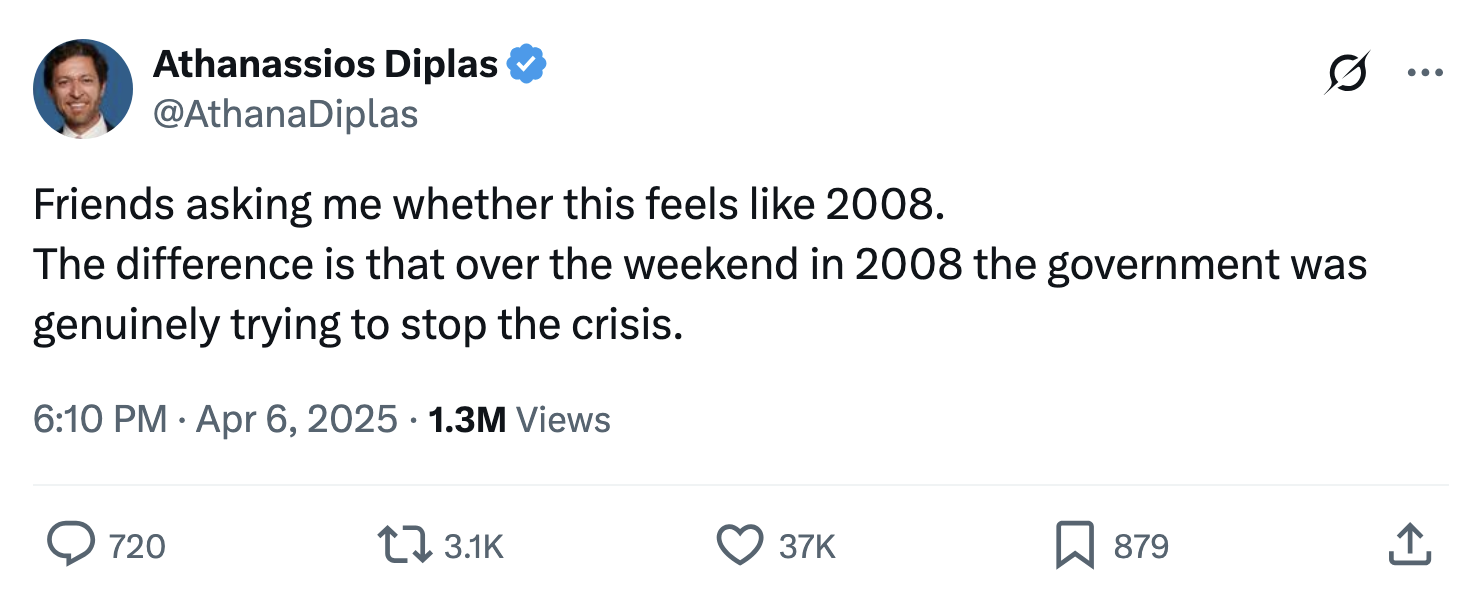

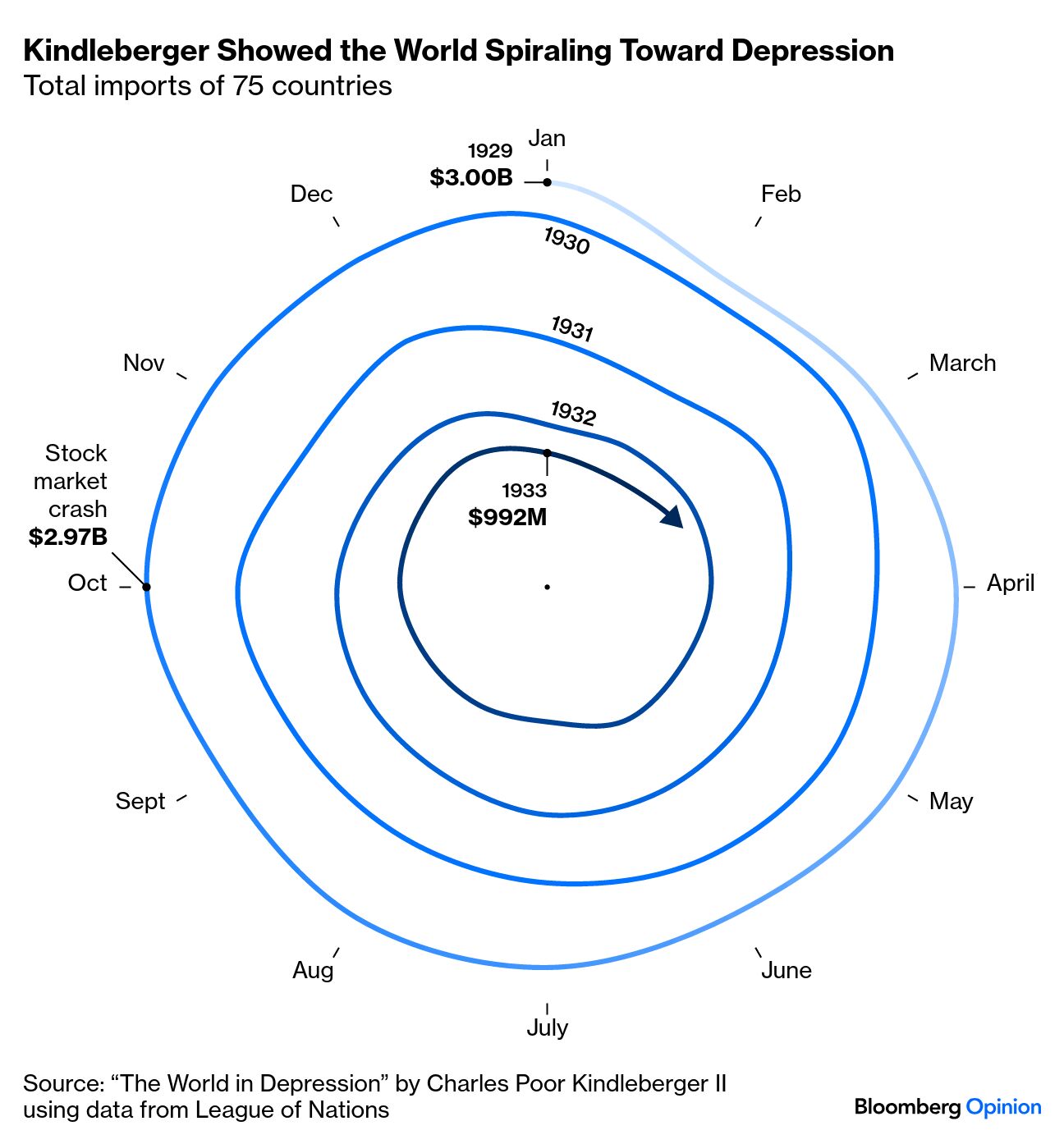

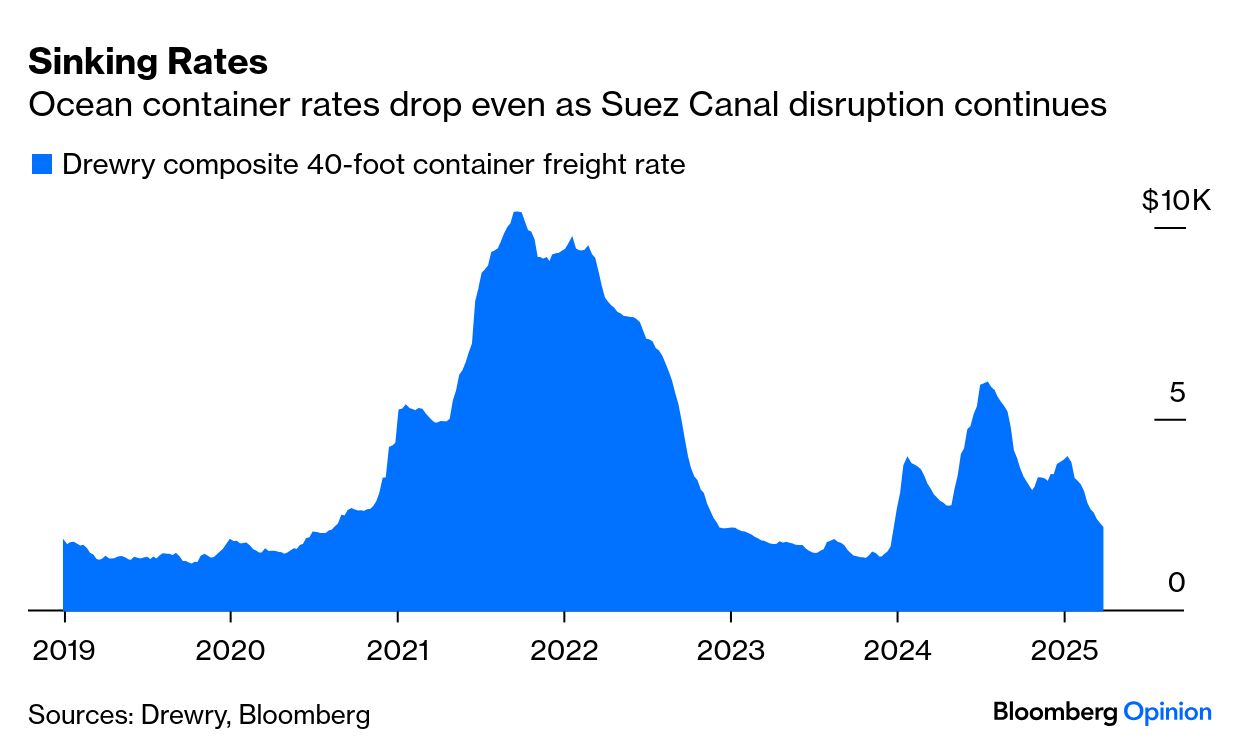

| Sometimes it takes multiple mental leaps to understand Gen Z's latest slang. Like, who would know that "she just turned 19 in Poland" means "she is serving" without the context that in Poland, that's the age you take a test to see if you're fit to serve in the military? Nobody! Nobody at all. Other times, though, the latest and greatest lingo requires no explanation at all: You're tariffed!!! Perhaps this is the sequel to calling the comeback of anything — flash mobs, urban lumberjacks, Justin-Selena drama — a "recession indicator." I can't say I'm surprised to hear that trade war uncertainty has seeped its way into Gen Z's lexicon — Andrea Felsted says consumer confidence was already slipping prior to President Donald Trump's reckless tariffs — but it's still depressing to see. Americans spent the weekend panic-buying iPhones, hoarding turnips, sharing assembly line memes, taking to the streets and watching a season finale that felt a bit too on-the-nose for a country on the brink of a bear market. Even Pershing Square's Bill Ackman "crashed out" (yet another recent addition to Gen Z's vernacular). In a post on X, he did a complete 180 on his previously ironclad MAGA stance, saying Trump risks launching "economic nuclear war on every country in the world." It's an embarrassingly late come-to-Jesus moment for Wall Street, which up until last week was mostly still using magical thinking to rationalize Trump's second term. I say mostly because 94-year-old Warren Buffett was never exactly bullish on Trump, and now he's laughing all the way to the bank: "The inclusion of several billionaires in [Trump's] administration instilled confidence he'd do little to jeopardize their stock market portfolios," writes Chris Bryant. That was clearly a misguided judgement: "The corporate executives, hedge fund managers and venture capitalists who embraced Trump are thus experiencing something resembling the five stages of grief: denial, anger, bargaining, depression and acceptance." As for Wall Street's new reality, Bill Dudley, former president of the Federal Reserve Bank of New York, says stagflation is now the best-case scenario. "More likely, the US will end up in a full-blown recession accompanied by higher inflation," he warns. John Authers echoes his sentiment, saying Trump's attack on globalization amounts to a fiscal earthquake that will live in infamy for decades to come: What's Trump have to say about all this? Well, in between playing putt-putt in Miami and rubbing elbows with the LA Dodgers, the president likened his tariffs to medicine. But there's not enough sugar in the world to make his trade policies go down easily, argues Tim O'Brien: "Anyone hoping that Trump will soon see the light and reverse course might want to reconsider the force of nature that they're dealing with. He has been insulated from the consequences of his own actions his entire life and appears to care very little about the economic sinkhole he just created." To give you an idea of just how callous the president is acting, this is his best advice for people who can't afford eggs, let alone housing: Don't be a PANICAN, huh? I don't think you can be that if you have no idea what it means: Is this a combination of "panicked + Republican"? Maybe "Pangolin + pelican"? Or is it yet another instance of covfefe word salad? The world may never know, but we really ought to leave the coining of new terms to Gen Z. Bonus Tariff Reading: The thing about having a market meltdown of historically bad proportions is that people are gonna compare it to, well, history: Although such comparisons are often imperfect, the past provides a lens that's hard not to look through during a brutal stock selloff. Today, you saw a lot of tweets and articles mentioning Black Monday in 1987, which is valid considering this happened. But Clive Crook rewinds the clock even further than that in his latest column: "Taking a sledgehammer to trade imposes a supply shock like the oil-price spikes of the 1970s," he writes. "In such circumstances, monetary policy must choose between supporting output and suppressing inflation. It can't do both." Others see similarities to the Great Depression. When I made that quip about Kit Kittredge last week, I'll admit that I was semi-joking in a ha-ha, I really hope this isn't true sort of way. But now it's looking like I wasn't too far off. Paul J. Davies says the Kindleberger Spiral, "a wonky, awkwardly scaled spiderweb showing the collapse of global trade from 1929 to 1933, accelerating after the Smoot-Hawley Tariff Act was passed by the US Congress in June 1930" — is back in vogue: Yet he says the chart "is less a schematic than an entry point into a more complex story. The tariffs didn't cause the Great Depression — but the work of the economist behind the spiral still has a serious warning for today. It is all about America's role in the world." Read the whole thing. |

No comments:

Post a Comment