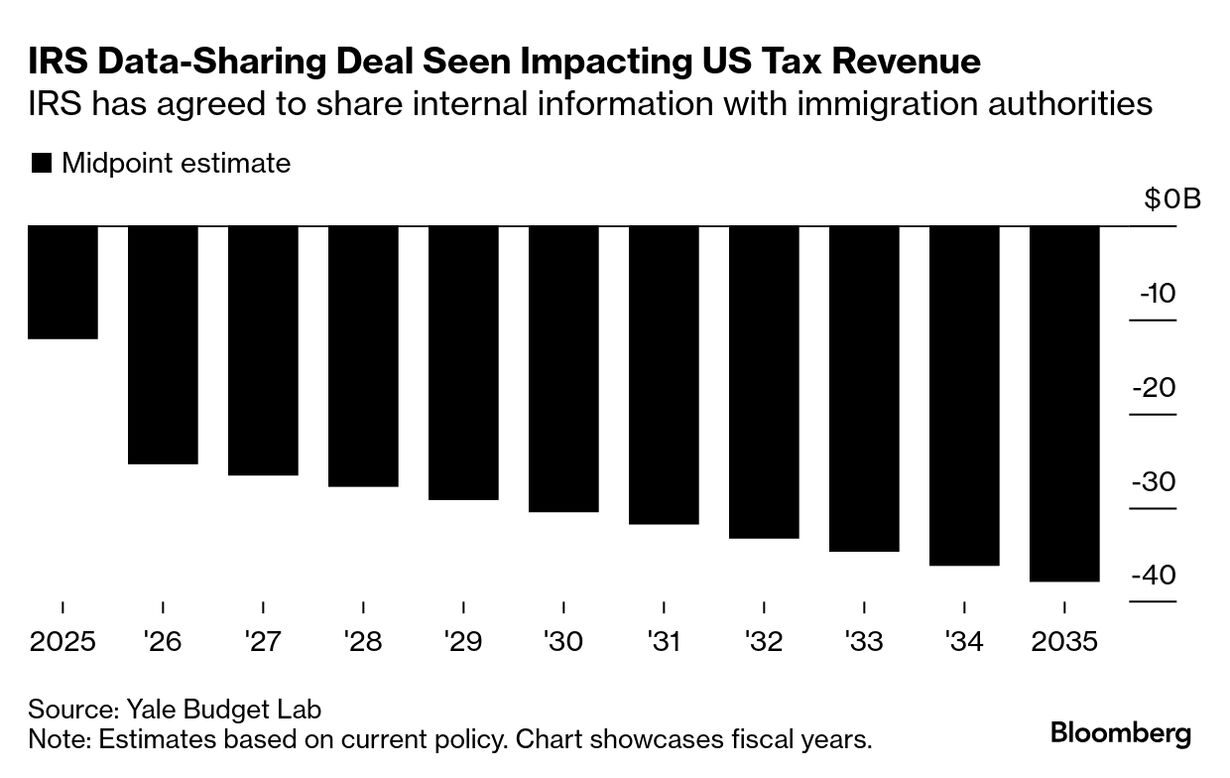

| I'm Cécile Daurat, an economics editor in the US. Today we're looking at US government revenue. Send us feedback and tips to ecodaily@bloomberg.net. And if you aren't yet signed up to receive this newsletter, you can do so here. If the US were a publicly traded company, it would probably need to issue the equivalent of a profit warning — or more accurately a deficit warning. Just as Congress is getting closer to agree on trillions of dollars in tax cuts pledged by President Donald Trump during his campaign, projections for some sources of government revenue over the coming years are coming in lower than expected. The largest shortfall by far is how much the US can expect to generate from tariffs, which Trump and his advisers are counting on to help pay for the tax cuts. Estimates keep changing with tariffs announcements rolling in on a daily, if not hourly, basis. But overall forecasters agree that tariffs will bring in a lot less than the yearly $600 billion figure that has been floated. That's in part because tariffs will likely lead to a drop in imports. Lower consumer spending and business activity as a result of trade wars would also eventually reduce revenue from taxes. A much smaller, but sizable, revenue shortfall may come from the Trump administration's crackdown on undocumented workers. The Yale Budget Lab estimates that Internal Revenue Service could lose about $26 billion in 2026 in tax collections — $313 billion over the next decade — from a recent deal giving immigration officials access to IRS tax data in order to check the immigration status of taxpayers suspected to be in the US illegally. The group said there's some uncertainty around its estimate. But it reckons that unauthorized immigrants paid $66 billion in federal taxes in 2023, with the bulk coming from payroll taxes. Many of those migrants may now think twice before filing taxes — or move to jobs in the black market. The US Treasury saw a modest pickup in customs duties last month when tariff hikes began to kick in — though not enough to make a dent in the widening fiscal deficit. The Best of Bloomberg Economics | - Japan's government has set up a taskforce on tariffs, while Vietnam held trade talks in Washington, and Mexico is looking at auto exemptions.

- Beauty, hair and personal care workers have been witnessing firsthand some of the earliest possible signs the US is tumbling into recession.

- Federal Reserve official Susan Collins says policymakers may lower interest rates later this year, but inflation could delay further cuts.

- Europe's finance ministers backed defense spending, and the European Central Bank chief, before a decision, pointed to tools available.

- Peru's central bank left rates unchanged, and so did policymakers in Kazakhstan as they warned of potential unscheduled decisions.

- Italy's new coast-to-coast high-speed rail line between Naples and Bari is a model for European Union spending.

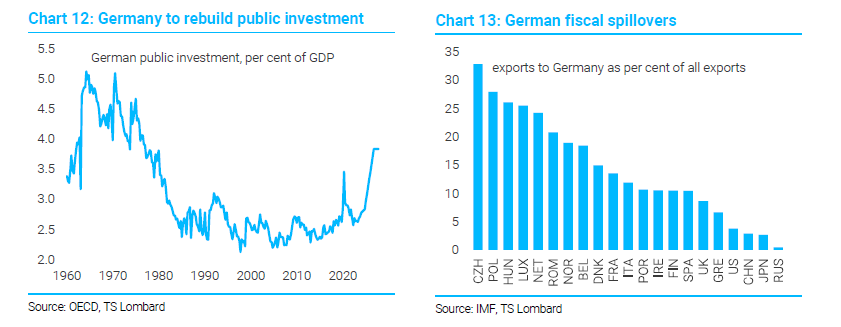

Can defense save Europe? Dario Perkins at TS Lombard thinks Germany's heavy investments in public infrastructure over the coming years and the whole of Europe looking to beef up their domestic capacity to produce military equipment will be a catalyst for growth in the medium term. But defense spending won't insulate Europe from the short-term impact of Trump's policies. Short of an immediate fiscal stimulus, central banks will need to step in by reducing interest rates to support their economies and bridge the gap, Perkins wrote in a note. "The medium-term bull case for Europe rests on European policymakers finally getting their act together," Perkins said. "We think they will. It's just a shame this is coming only in response to US policy blunders." |

No comments:

Post a Comment