| Bloomberg Morning Briefing Americas |

| |

| Good morning. Donald Trump weighs in on what the Federal Reserve should do next. (One guess, but it's not a surprise.) Nvidia bets big on US-made chips. And Larry Ellison has a new real-estate market in his sights. Listen to the day's top stories. | |

| Markets Snapshot | | | | Market data as of 07:20 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

| |

| |

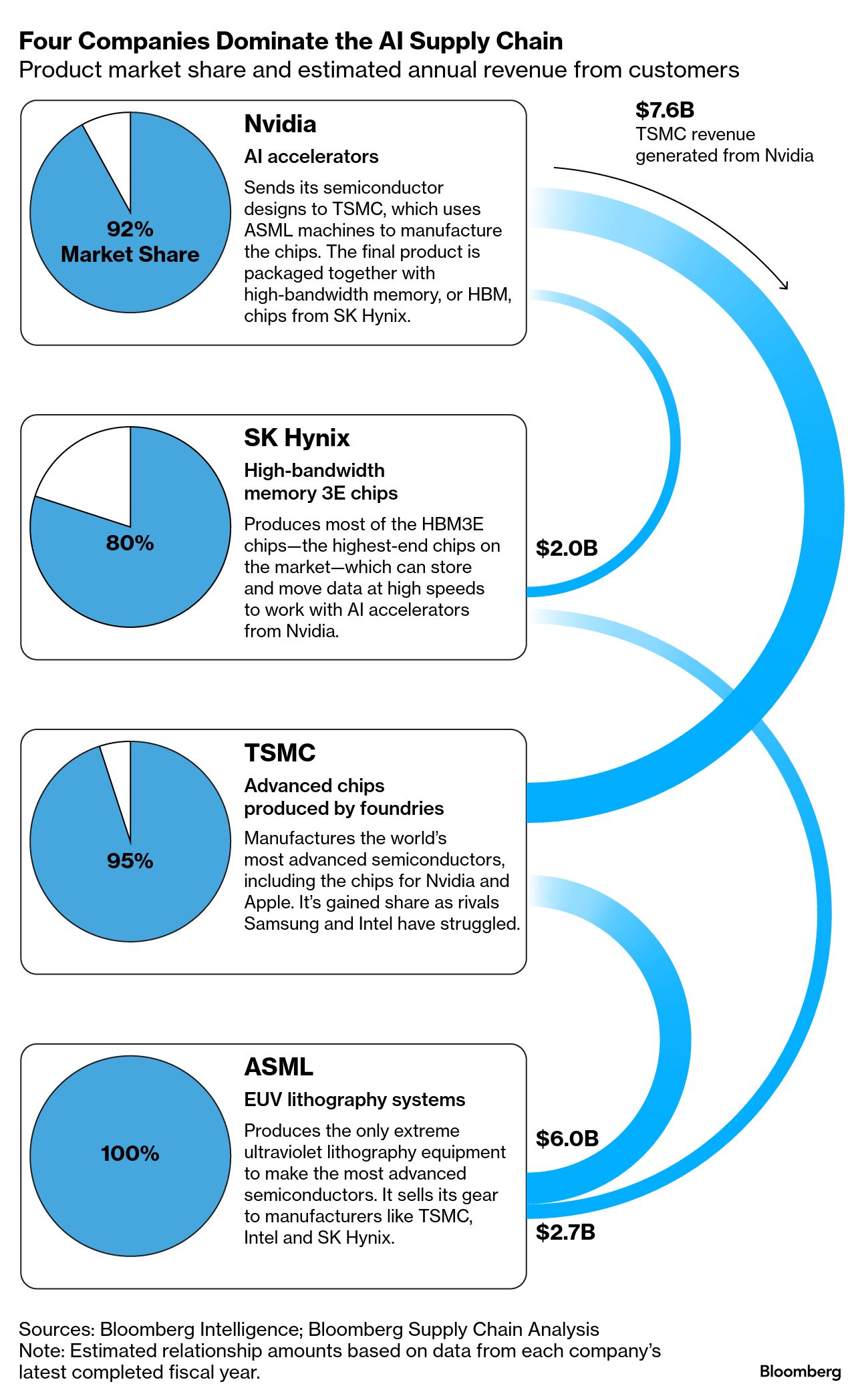

| Nvidia plans to spend several hundred billion dollars on US-made chips and electronics over the next four years, CEO Jensen Huang told the FT. Investment in US manufacturing by Taiwan's TSMC—which can produce Nvidia's latest chips—creates "a substantial step up in our supply chain resilience," Huang said. Just a few AI models will survive a domestic shakeup triggered by the advent of DeepSeek, according to Chinese entrepreneur Kai-Fu Lee. He's betting on DeepSeek, Alibaba and ByteDance in China, and on xAI, OpenAI, Google and Anthropic in the US. Elsewhere, SoftBank will buy semiconductor designer Ampere in a deal worth $6.5 billion that further broadens the firm's push into AI infrastructure. In Europe, EU leaders are meeting in Brussels today to discuss defense spending. After a phone call with Trump—which seems to have gone better than their last interaction—Ukrainian President Volodymyr Zelenskiy agreed to a proposal for a mutual halt to strikes on energy assets in the war against Russia. The US promised fresh support for Kyiv and floated American ownership of its power facilities. And breaking: Canadian Prime Minister Mark Carney is expected to call a general election for April 28, the Globe and Mail reported. He came into office only recently but is trying to capitalize on the Liberal Party's recent surge in polls. | |

Deep Dive: Larry Ellison Eyes Florida | |

The Plaza del Mar shopping plaza, which includes a Publix, in Manalapan. Photographer: Eva Marie Uzcategu Larry Ellison has spent at least $450 million in Manalapan, taking over its largest employers and fueling property demand. - The world's fifth-richest man is well-known for his property portfolio, from historic Rhode Island estates to the Hawaiian island of Lanai. But his purchases in south Florida are playing an outsize role in the area.

- Manalapan, located on a barrier island that's also home to Palm Beach, is where Ellison has bought 16-acre estate and a 309-room hotel that locals speculate he'll turn into an ultraluxury resort.

- Ellison is just the latest billionaire to make his mark in Florida, joining the likes of Jeff Bezos and Ken Griffin, who have also snatched up waterfront lots to build sprawling compounds.

| |

| |

Pan Brothers workers produce sports apparel at a facility outside Surakarta, Indonesia. Photographer: Muhammad Fadli/Bloomberg Trump's tariffs have unleashed a new "China shock," devastating jobs in emerging economies from Mexico to Indonesia as Chinese exports flood their markets. The situation is set to get worse with Trump threatening to raise levies on China even higher. | |

| Big Take Podcast |  | | | |

| |

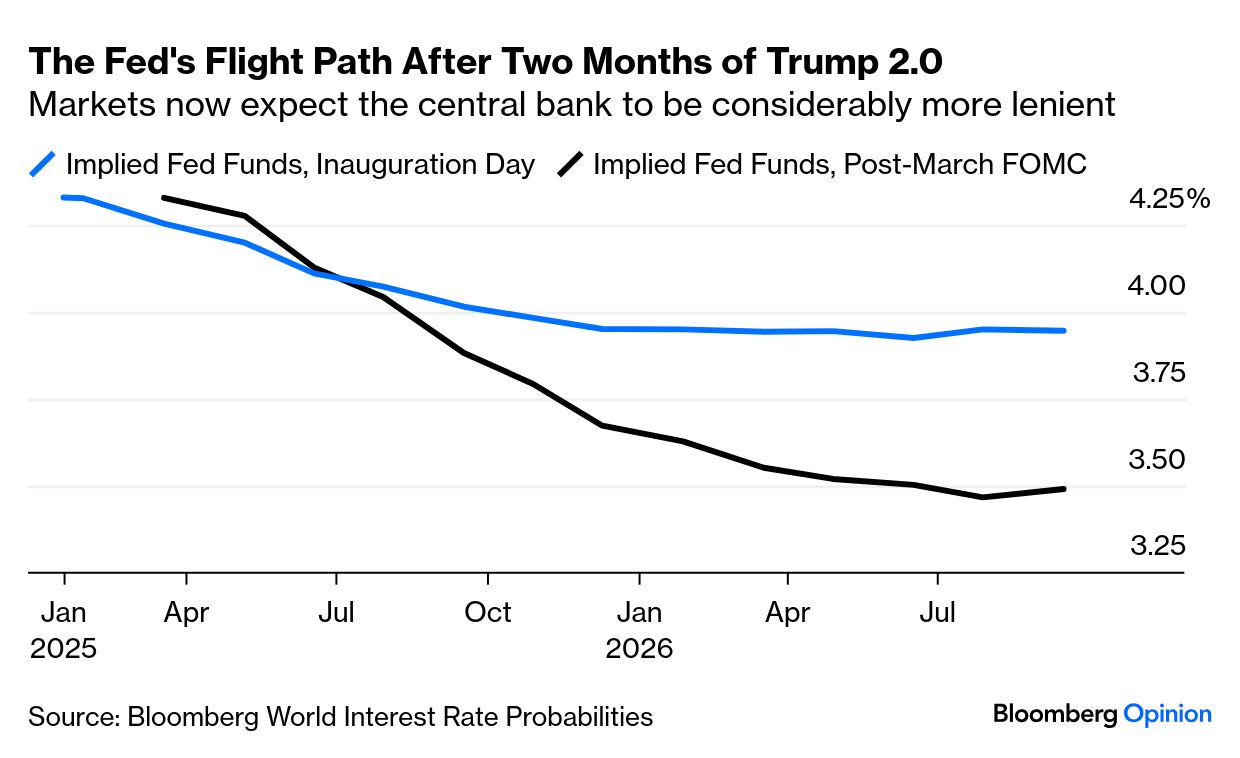

| The Fed doesn't have a clue, either—and that's OK, John Authers writes. Central bankers are honestly admitting to rising uncertainty and risks of stagflation, while implicitly promising to try not to break the economy. And Jerome Powell seemed to be giving himself maximum room for maneuver, which was wise. | |

| More Opinions |  | |  | | | |

| |

|

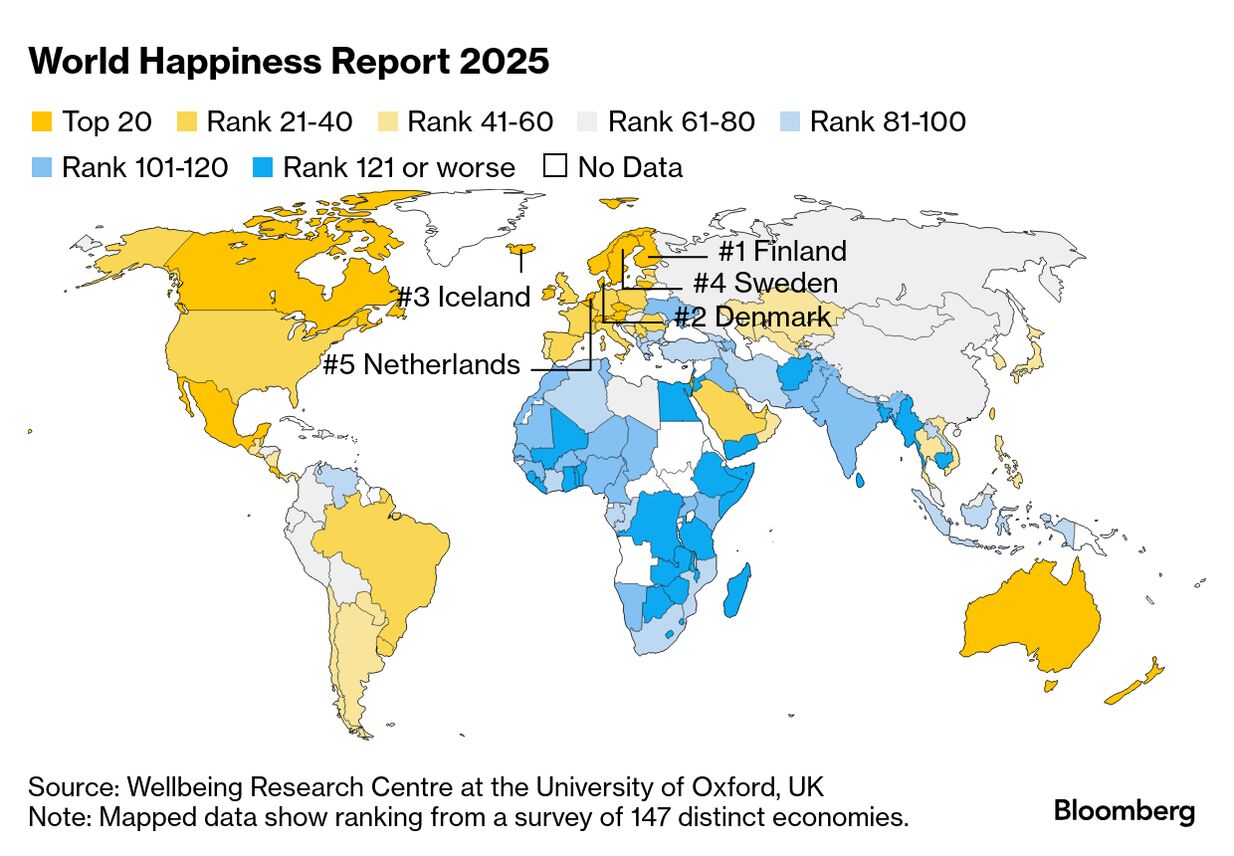

Well, this doesn't help?! The US fell to 24th place in a ranking of the world's happiest countries, its lowest-ever level. Researchers highlighted the importance of social trust and belief in others' kindness as key factors. Finland once again took the top spot.

| |

| A Couple More |  | |  | | | |

| Enjoying Morning Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: - Markets Daily for what's moving in stocks, bonds, FX and commodities

- Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Supply Lines for daily insights into supply chains and global trade

- FOIA Files for Jason Leopold's weekly newsletter uncovering government documents never seen before

Explore all newsletters at Bloomberg.com. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Morning Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment