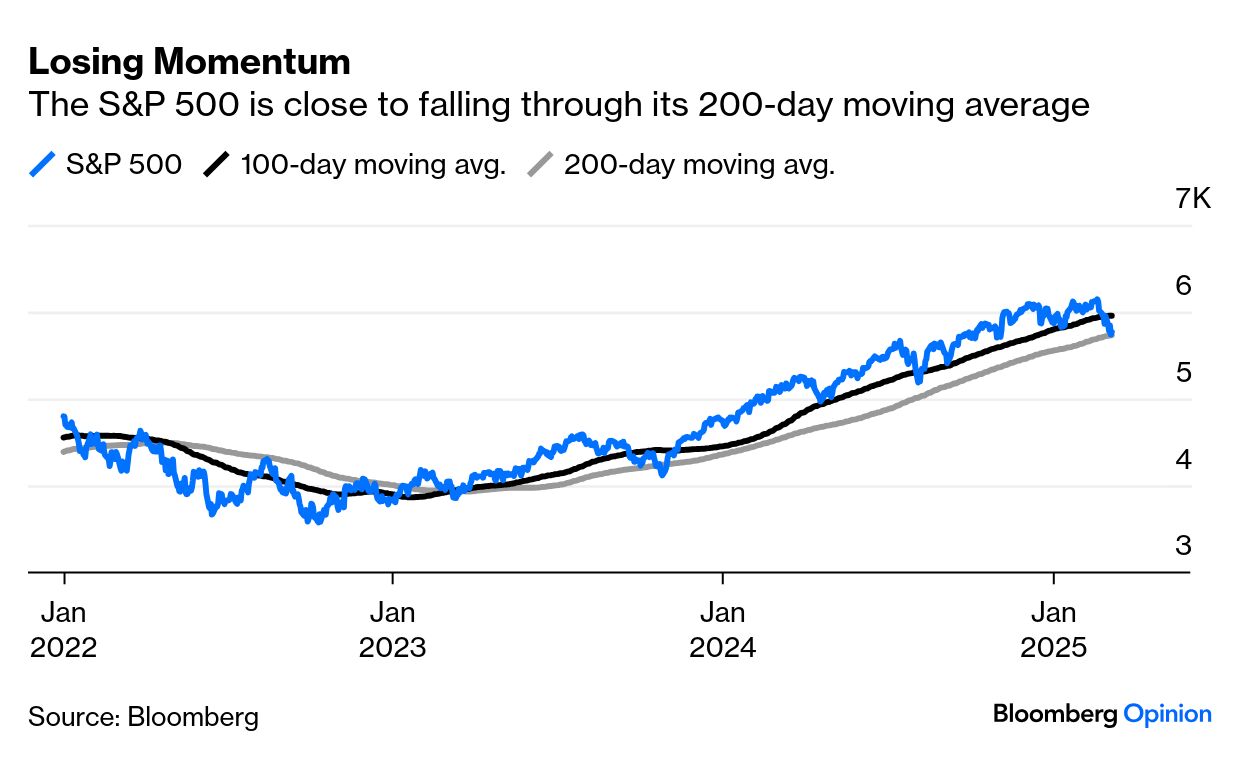

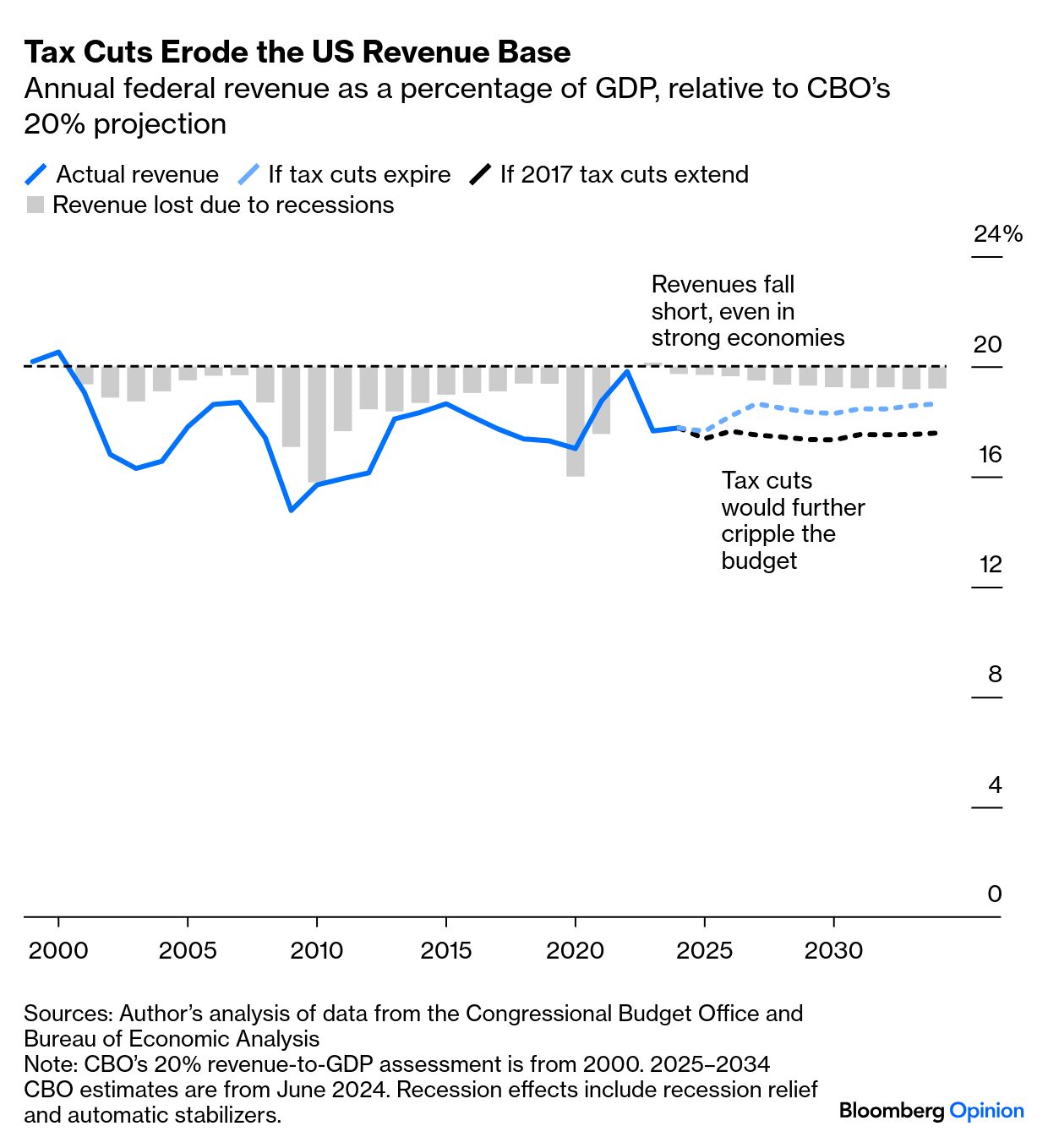

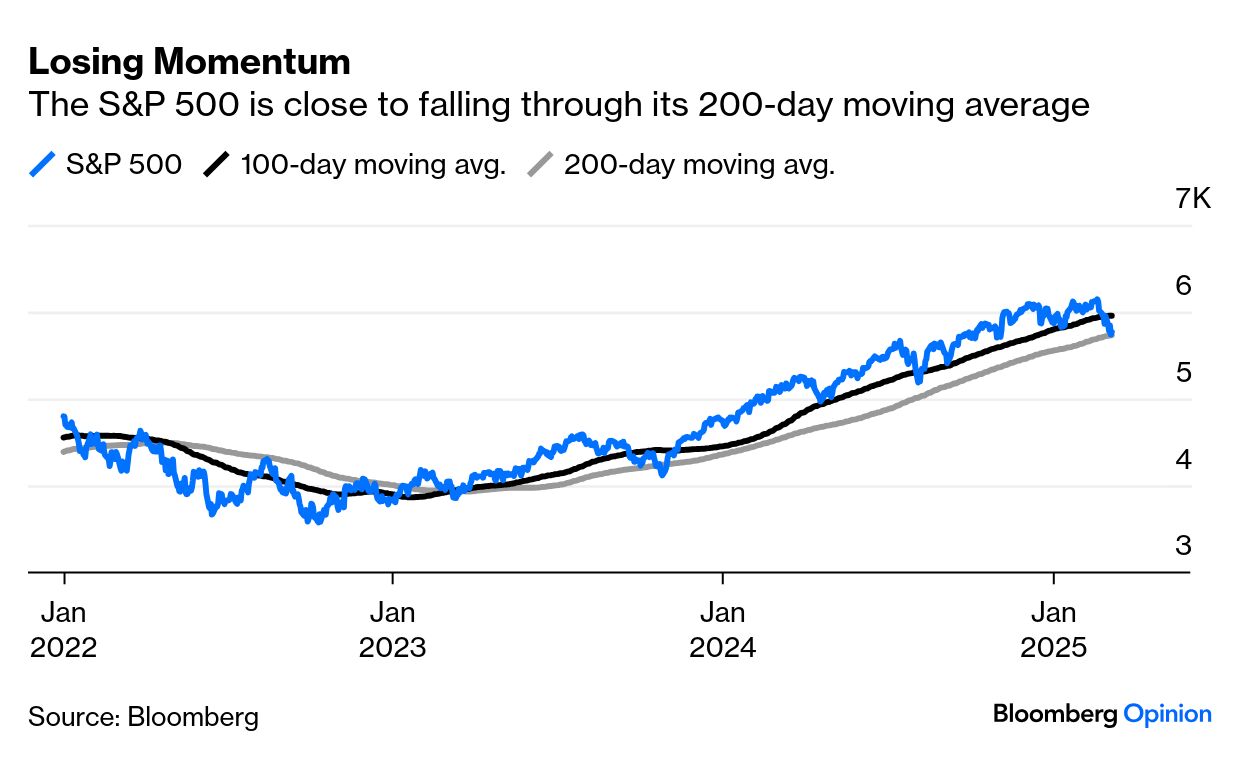

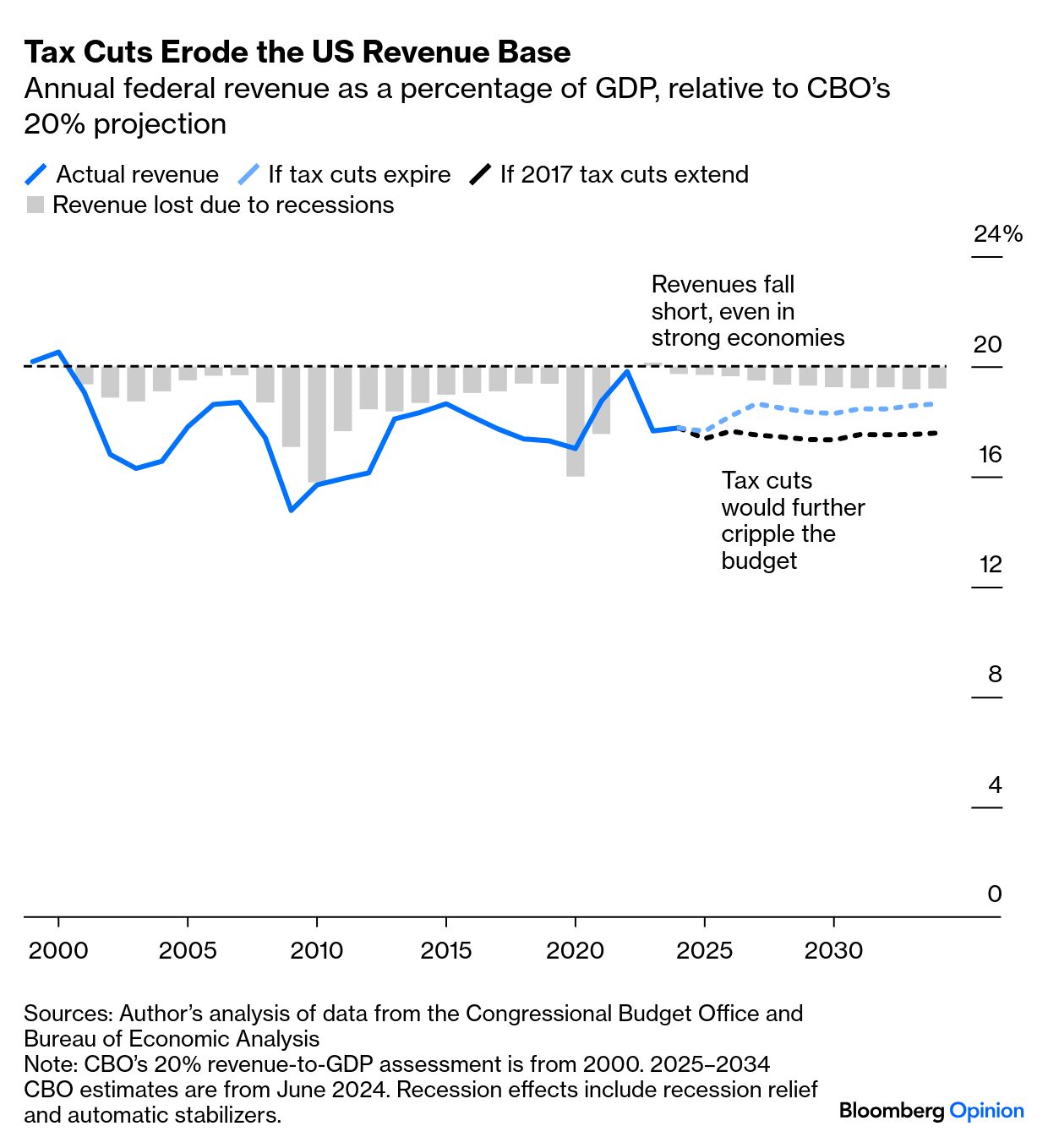

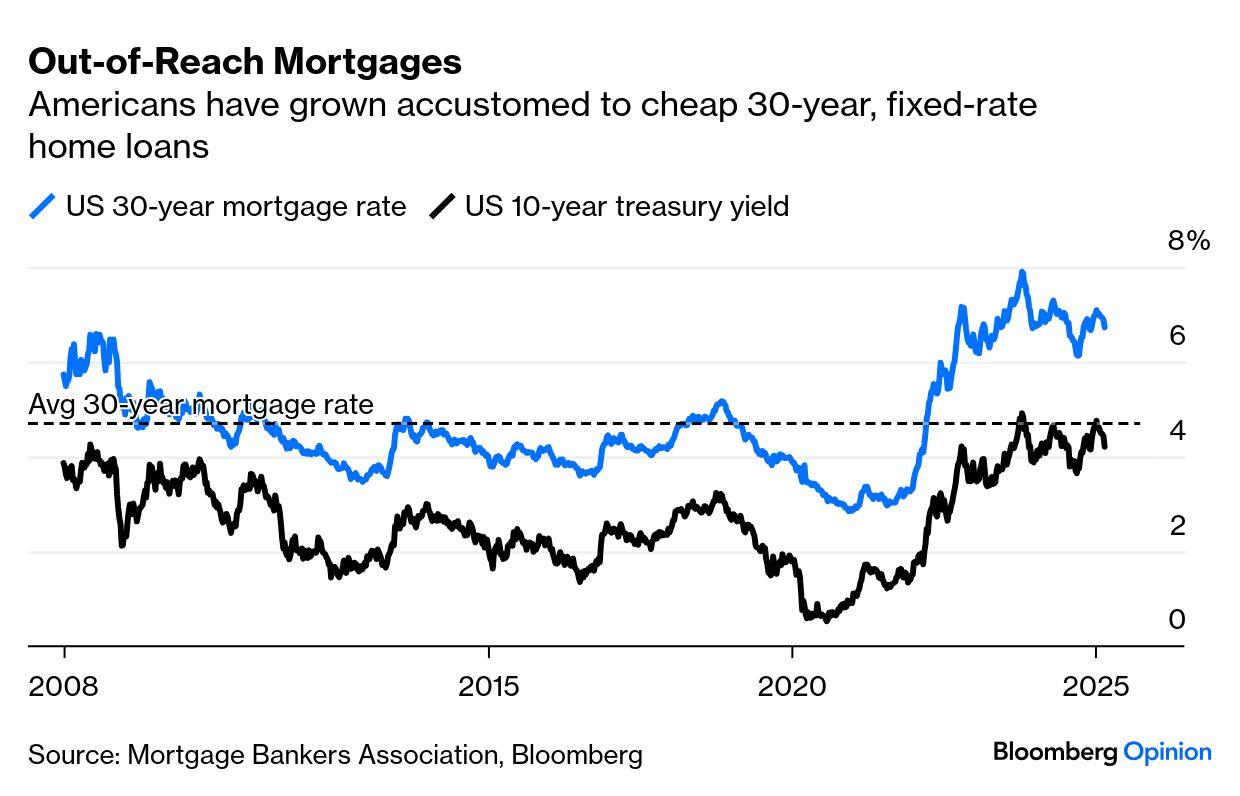

| This is Bloomberg Opinion Today, a steep market decline of Bloomberg Opinion's opinions. Sign up here. On a scale compared to the dad in The White Lotus who knows he's going to prison for money laundering, how imperiled is the US economy right now? Although consumer confidence is slumping and inflation expectations are rising, take comfort in the fact that John Authers and Richard Abbey aren't overly worried. February's jobs report provided a mixed picture of the labor market, and they say a recession is no sure thing. Still, plenty of metrics are flashing red. "Late last month, the S&P 500 plummeted through its 100-day moving average, a sign that the trend may be turning, and it's recently been flirting with the first drop below the 200-day trendline since 2023," Jonathan Levin writes. The Trump camp claims this is simply a "detox period" for the bull market. But it could easily spiral out of control: "Inertia is a powerful force, and it's far from clear that Trump will be able to halt a slump once it's demonstrably underway, even if the policy backdrop improves," he says. "Steep market declines can make consumers and businesses more cautious, and layoffs that begin as a trickle can feed upon themselves. Once a bull market is broken, it's not particularly easy to put it back together again."  Now, maybe you're thinking Trump can swoop in, save the day as a pro-growth president and turn Mr. Market's frown upside-down with a big 'ol tax cut. On paper, that sounds great. But in practice, Ernie Tedeschi says it amounts to a fiscal mess. In his new column, Ernie charts how three recessions, two wars and round after round of tax cuts dealt a blow to America's low-debt fiscal trajectory from the early aughts. Today's deficit — around $30 trillion — is beyond unsustainable, he argues, and we can't afford to carry on like this anymore: "Even a temporary tax cut will be hard to pay for. Congress and the Trump administration are contemplating a variety of different spending cuts to help offset the costs, but these are proving politically challenging."  At the same time, American homebuyers are in a world of pain. "A lack of affordability has hindered housing transactions the past two years, frustrating would-be buyers and, more recently, hammering the stocks of developers. Those waiting for popular 30-year mortgages to sink to what's considered a reasonable rate — around 5.5% by my estimation — have been repeatedly disappointed," writes Conor Sen. "The mortgage market may be ready for a fundamental reshaping in an world where sticky inflation and hefty government borrowing keep longer-term interest rates elevated." His solution? Adjustable rate mortgages, or ARMs: "A housing market where more borrowers have ARMs would be more exposed to changes in Fed policy, albeit after an initial multi-year fixed-rate period. This would give the central bank greater control over household spending at pivotal moments for the economy." Speaking of the Fed: Mohamed A. El-Erian says Chair Jerome Powell ought to reconsider how he defines price stability. "The administration of President Donald Trump is expected by some to upend the existing order and fundamentally shift the operating paradigm for companies, governments and central banks," he writes. "By rejecting any analysis of whether the 2% target remains appropriate, the Fed risks finding itself in a position similar to the UK government." Taken together, these three charts illustrate the precariousness of the economy. We're by no means barreling toward a recession, but we might be teetering on the edge of something ominous. Just don't go stealing a gun yet. Bonus Free Read: From effectively ending the war in Ukraine to setting tariffs, the president's negotiating skills are coming up short. — Tim O'Brien Do people still watch Love Is Blind?? I'll admit I've fallen off the bandwagon. But this clip of two contestants parting ways at the wedding altar is making the rounds and ooh-wee! Just watch: "They dodged a bullet!" is the overwhelming response here. But who did the dodging? Your answer will differ depending on your personal politics. Back in 2022, the cultural hive mind would have said the bride. But nowadays, the anti-woke brigade says it's the groom who averted a disaster. It illustrates how quickly the culture war has reversed under Trump. Signs are all around us that the zeitgeist is shifting in favor of conservatism. Allison Schrager says shareholder capitalism is back. Stephen L. Carter says Georgetown Law is being asked to scrub DEI from its curriculum. And on his podcast, Gavin Newsom revealed he thinks trans athletes are "deeply unfair." It all amounts to this declaration from Nia-Malika Henderson: "Woke is over." But maybe it never existed at all? In a conversation with Musa Al-Gharbi, author of We Have Never Been Woke: The Cultural Contradictions of a New Elite, Nia learned how symbolic capitalists — people in finance, consulting, HR, media and education who use knowledge to make a living — have lost the plot on community engagement. The Covid-era woke agenda illustrates that disconnect, says Musa: "You saw progressives doing stuff like focusing on renaming schools — something that just doesn't matter. If you ask parents who live in these communities what their concerns are for their kids' education, the name on the front of the building is never going be anywhere near the top of the list." It's not as if Trump is any better at addressing those concerns, though. "What are some of the first things that he prioritized?" Musa asks. "Well, we're gonna rename Mount Denali ... We're gonna change the gulf of Mexico into the Gulf of America. This is the same kind of symbolic crap that alienates voters." So, yeah! Culture wars are by all means a colossal waste of time. But so is watching Love Is Blind, and I don't think Netflix is gonna cancel that show anytime soon. |

No comments:

Post a Comment